China Plastic Recycling Market Size, Share, By Source (Bottles, Non-Bottle Rigid Plastics, And Flexible Plastics), By End Use (Packaging, Construction, Automotive, Textiles, Electronics, And Consumer Goods), And China Plastic Recycling Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsChina Plastic Recycling Market Insights Forecasts to 2035

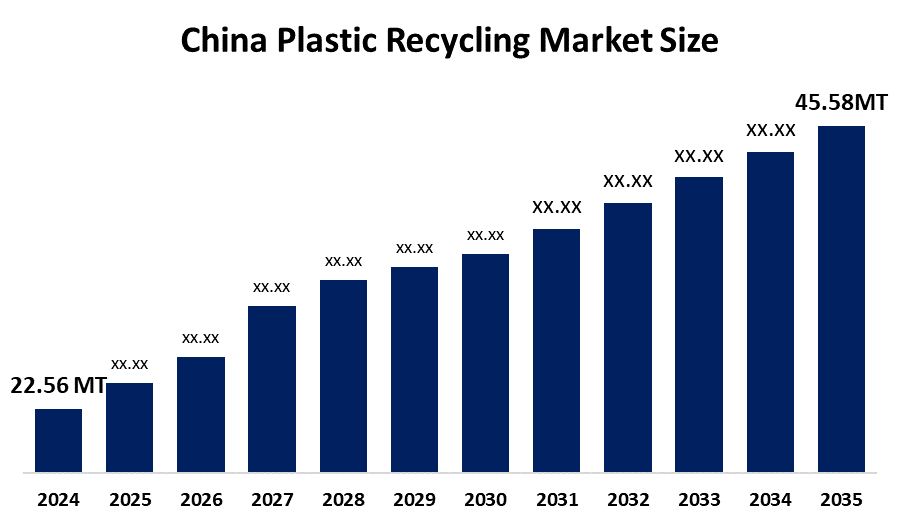

- China Plastic Recycling Market Size 2024: 22.56 Million Tonnes

- China Plastic Recycling Market Size 2035: 45.58 Million Tonnes

- China Plastic Recycling Market CAGR 2024: 6.6%

- China Plastic Recycling Market Segments: Source and End Use

Get more details on this report -

The China plastic recycling market is composed generally of activities related to collecting, sorting, processing and reusing consumer and industrial plastic waste to recover material that can be used again in the manufacture of products, and thereby reducing reliance on virgin plastics and resulting pollution of the environment through the landfill and by incinerating it. China's volume of both producing and consuming plastic has made it a large player globally with large amounts of plastic waste resulting in the development of government and industry to formalize or develop recycling infrastructure to handle the material generated in China.

The plastic recycling in China are backed by government support, including the China’s waste import ban and Operation National Sword, a policy that, starting in 2018, restricted the import of most foreign plastic waste with stringent contamination thresholds and effectively ended China’s role as the world’s largest importer of scrap plastics. China’s plastic waste recycling rate is expected to rise significantly, with forecasts indicating domestic recycled plastic processing could approach 8000 × 10(4) tonnes and recycling efficiency improvements by 2025, as the country pushes to transition toward higher reuse levels and reduce landfill dependency.

As technology advances, Chinese plastic recycling providers are now using innovations in processing include advanced mechanical and chemical recycling methods, such as catalytic depolymerisation, solvent purification, digital sorting technologies, and material recovery facilities using advanced technology to recover recyclable materials. These innovations help to produce plastics that can be used in applications with a higher market value than traditional methods and to produce feedstock for the pet food industry that has similar or improved quality characteristics to virgin feedstock.

China Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 22.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.6% |

| 2035 Value Projection: | 45.58 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Source ,By End Use |

| Companies covered:: | GEM Co., Ltd., Veolia Environment SA, Zhejiang Boretech Environmental Group Ltd., Suez SA, Beijing Enterprises Environment Group Ltd., Tus-Sound Environmental Holdings Ltd., Capital Environment Holdings Ltd., Zhangjiagang Retech Machinery, POLYSTAR Machinery, Wiscon Envirotech Inc., Guangzhou Valuda Group Co., Ltd., Shandong Fangda Renewable Resources Co., Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Plastic Recycling Market:

The China plastic recycling market is driven by the strict environmental regulations and plastic pollution controls, increasing corporate and consumer pressures for sustainable packaging, rising industrial demand for cost-competitive recycled resins, supportive government incentives that promote recycling infrastructure development, technology adoption in advanced mechanical and chemical recycling processes, expansion of waste-to-resource hubs, and increased digitalisation and automation to improve efficiency further propel the market growth.

The China plastic recycling market is restrained by the technical complexity, high initial costs, limited recycling infrastructure in rural and less developed regions, challenges in achieving high-quality outputs for certain materials, and economic competition from low-cost virgin plastics.

The future of China plastic recycling market is bright and promising, with versatile opportunities emerging from the development of chemical recycling and value-added uses for recycled plastic products combined with the establishment of waste-to-resource hubs and industrial clusters, increased digitalization and automation to increase efficiency, and improved collaboration between brands, waste-management companies, and government programs to strengthen supply chains of recycled materials will support the ongoing innovation and commercial growth of the recycled plastic market in the context of China’s ambitions for a circular economy.

Market Segmentation

The China plastic recycling market share is classified into source and end use.

By Source:

The China plastic recycling market is divided by source into bottles, non-bottle rigid plastics, and flexible plastics. Among these, the conventional recycling technologies segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High volume of PET waste generation, highly efficient, established informal collection network, and strong demand for recycled PET in textile manufacturing all contribute to the bottles segment's largest share and higher spending on plastic recycling when compared to other source.

By End Use:

The China plastic recycling market is divided by end use into packaging, construction, automotive, textiles, electronics, and consumer goods. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of high volume of single-use plastics from the food sectors, growth in e-commerce platforms, strict government regulations, and growing consumer demand for sustainable and circular packaging solutions in China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China plastic recycling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Plastic Recycling Market:

- GEM Co., Ltd.

- Veolia Environment SA

- Zhejiang Boretech Environmental Group Ltd.

- Suez SA

- Beijing Enterprises Environment Group Ltd.

- Tus-Sound Environmental Holdings Ltd.

- Capital Environment Holdings Ltd.

- Zhangjiagang Retech Machinery

- POLYSTAR Machinery

- Wiscon Envirotech Inc.

- Guangzhou Valuda Group Co., Ltd.

- Shandong Fangda Renewable Resources Co., Ltd.

- Others

Recent Developments in China Plastic Recycling Market:

In December 2025, SK Chemicals & Kelinle formed a joint venture to build a “Feedstock Innovation Center” in Shaanxi Province, designed to convert hard-to-recycle textile waste and PET bottle crushing residues into raw materials for chemical recycling. Operations are expected to commence in the second half of 2026.

In July 2025, a Chandigarh-based start-up announced the launch of its patented Generation VI chemical recycling technology. This technology converts hard-to-recycle, contaminated plastics into food-grade polymers and sustainable fuels.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China plastic recycling market based on the below-mentioned segments

China Plastic Recycling Market, By Source

- Bottles

- Non-Bottles Rigid Plastics

- Flexible Plastics

China Plastic Recycling Market, By End Use

- Packaging

- Construction

- Automotive

- Textiles

- Electronics

- Consumer Goods

Frequently Asked Questions (FAQ)

-

Q: What is the China plastic recycling market size?A: China plastic recycling market is expected to grow from 22.56 million tonnes in 2024 to 45.58 million tonnes by 2035, growing at a CAGR of 6.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strict environmental regulations and plastic pollution controls, increasing corporate and consumer pressures for sustainable packaging, rising industrial demand for cost-competitive recycled resins, supportive government incentives that promote recycling infrastructure development, technology adoption in advanced mechanical and chemical recycling processes, expansion of waste-to-resource hubs, and increased digitalisation and automation to improve efficiency further propel the market growth.

-

Q: What factors restrain the China plastic recycling market?A: Constraints include the technical complexity, high initial costs, limited recycling infrastructure in rural and less developed regions, challenges in achieving high-quality outputs for certain materials, and economic competition from low-cost virgin plastics.

-

Q: How is the market segmented by source?A: The market is segmented into bottles, non-bottle rigid plastics, and flexible plastics.

-

Q: Who are the key players in the China plastic recycling market?A: Key companies include GEM Co., Ltd., Veolia Environment SA, Zhejiang Boretech Environmental Group Ltd., Suez SA, Beijing Enterprises Environment Group Ltd., Tus-Sound Environmental Holdings Ltd., Capital Environment Holdings Ltd., Zhangjiagang Retech Machinery, POLYSTAR Machinery, Wiscon Envirotech Inc., Guangzhou Valuda Group Co., Ltd., Shandong Fangda Renewable Resources Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?