China Pharmaceuticals Market Size, Share, By Type (Drugs and Vaccines), By Disease Indication (Oncology, Diabetes, Infectious, Cardiovascular, Neurology & Psychiatry, Respiratory, Renal, Obesity, Autoimmune, Ophthalmic, Gastrointestinal, Dermatology, Hematology/Blood, Liver/Hepatology, Genetic, Hormonal/Endocrine, Women’s Health, Reproductive, & Allergies), China Pharmaceuticals Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Pharmaceuticals Market Size Insights Forecasts to 2035

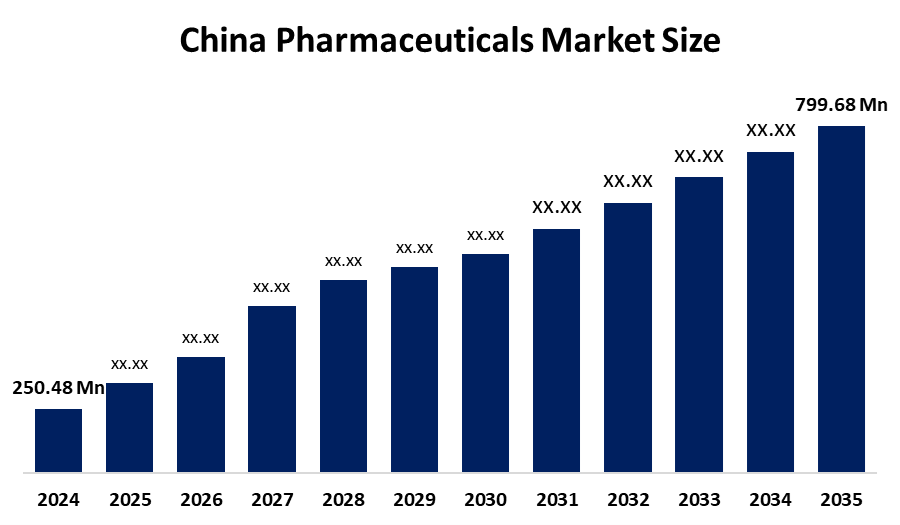

- China Pharmaceuticals Market Size 2024: USD 250.48 Bn

- China Pharmaceuticals Market Size 2035: USD 799.63 Bn

- China Pharmaceuticals Market Size CAGR 2024: 11.13%

- China Pharmaceuticals Market Size Segments: Type and Disease Indication

Get more details on this report -

The China Pharmaceuticals Market Size is the vast and rapidly growing sector for the drugs in China, which is covering generics, innovative therapies, and the APIs, shifting from basic manufacturing to the high tech R&D, it is characterised by the massive patient demand, also the government price control and the intense competition between domestic giants and the global firms driven by the unmet health needs and the policy reforms. In addition, the China’s pharmaceutical market is a dynamic landscape, blending its strength in the bulk drug production with the strategic innovations all under a unique regulatory and economic framework.

According to government data, China's Basic Medical Insurance (BMI) system, which is supervised by the National Healthcare Security Administration (NHSA), would cover around 95% of the population (more than 1.3 billion people) by 2023. Cost control is driven by national volume-based procurement (VBP) and the National Reimbursable Medication List (NRDL), which have drastically reduced medication costs and shaped China's pharmaceutical sector.

The China Pharmaceuticals Market Size offers huge growth driven by rising chronic diseases, aging population, and tech like AI & precision medicine, creating opportunities in innovative drugs and TCM integration, with a shift towards higher value manufacturing and the global partnership. The key area includes complex treatments for cancer issues, robust R&D pipelines, and leveraging AI for the drugs discovery, all supported by government focus on innovation despite cost pressures. Rapid growth in areas like oncology are driven by the gene sequencing AI, and big data for tailored treatments.

China Pharmaceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 250.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.13% |

| 2035 Value Projection: | 799.63 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Disease Indication |

| Companies covered:: | Jiangsu Hengrui Medicine, CSPC Pharmaceutical Group, Qilu Pharmaceutical, Yangtze River Pharmaceutical, Pientzehuang Pharmaceutical, Chongqing Zhifei Biological Products, BeiGene, Fosun Pharma, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Pharmaceuticals Market

The China Pharmaceuticals Market Size is driven by a massive, aging population needing care, strong government support, the funding policies, a surge in R&D innovations, a shift to high value therapies and also a vast patient pools making clinical trials efficient, all transforming it from the generics to a global innovation hub. The rapidly growing elderly segment boost the demand for the chronic diseases treatments. Increased in the disposable incomes which allows more spending on healthcare and the premium drugs. China is now moving from being just a generic manufacturer to a global leader in pharmaceutical innovation, and attracting massive investment and becoming a key source of new therapies.

The China Pharmaceuticals Market Size faces restrain like intense government price control, intellectual property issues, fragmented regulations, quality concern, the talent gaps, and the geopolitical tensions, alongside a reliance on imports for key areas, all pressuring domestic innovations and profitability despite of huge market potential.

The future of China's pharmaceutical sector looks positive, thanks to fast innovation, supporting government reforms, and rising healthcare demand. Biologics and biosimilar, AI-enabled drug discovery, the expedited clinical trial approvals, the real-world evidence acceptance, and digital health integration all are creating new growth potential. In addition, the advances in smart manufacturing, big data analytics, and precision medicine are enhancing R&D efficiency, regulatory compliance, and patient access across China's growing pharmaceutical ecosystem.

Market Segmentation

The China Pharmaceuticals Market Size share is classified into type and disease indication.

By Type

The China Pharmaceuticals Market Size is divided by type into drugs and vaccines. Among these, the vaccine segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Several reasons contribute to the segment's growth, including increased government attention on vaccine development and distribution, expanding research and introduction of novel and sophisticated vaccines, and an increase in viral illness prevalence across the country.

By Disease Indication

The China Pharmaceuticals Market Size is divided by disease indication into diabetes, oncology, infectious, neurology & psychiatry, cardiovascular, respiratory, obesity, renal, ophthalmic, autoimmune, gastrointestinal, dermatology, liver/hepatology, hematology/blood, genetic, women’s health, hormonal/endocrine, reproductive, allergies, and others. Among these, the infection segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment's growth is being driven by an increase in the number of infectious disease outbreaks in China, as well as an increase in the number of authorized products.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China pharmaceuticals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Pharmaceuticals Market

- Jiangsu Hengrui Medicine

- CSPC Pharmaceutical Group

- Qilu Pharmaceutical

- Yangtze River Pharmaceutical

- Pientzehuang Pharmaceutical

- Chongqing Zhifei Biological Products

- BeiGene

- Fosun Pharma

- Others

Recent Developments in China Pharmaceuticals Market

In January 2025, Santen expanded China’s pharmaceutical market with the launch of Verkazia (ciclosporin) for severe childhood vernal keratoconjunctivitis (VKC), addressing high unmet pediatric ophthalmology needs under China’s evolving specialty treatment landscape.

In March 2024, China’s pharmaceutical market saw rising rare-disease drug approvals driven by supportive NMPA policies, with rare disease therapies forming a significant share of new approvals and increased regulatory focus on paediatric medicines to address unmet clinical needs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Pharmaceuticals market based on the below-mentioned segments:

China Pharmaceuticals Market, By Type

- Drugs

- Vaccines

China Pharmaceuticals Market, By Disease Indication

- Oncology

- Diabetes

- Infectious

- Cardiovascular

- Neurology & Psychiatry

- Respiratory

- Autoimmune

- Ophthalmic

- Gastrointestinal

- Others

Frequently Asked Questions (FAQ)

-

What is the China pharmaceuticals market size?China Pharmaceuticals Market is expected to grow from USD 250.48 billion in 2024 to USD 799.63 billion by 2035, growing at a CAGR of 11.13% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by a massive, aging population needing care, strong government support, the funding policies, a surge in R&D innovations, a shift to high value therapies and also a vast patient pools making clinical trials efficient, all transforming it from the generics to a global innovation hub.

-

What factors restrain the China pharmaceuticals market?Constraints include the intense government price control, intellectual property issues, fragmented regulations, quality concern, the talent gaps, and the geopolitical tensions, alongside a reliance on imports for key areas, all pressuring domestic innovations and profitability despite of huge market potential.

-

How is the market segmented by type?The market is segmented into drugs and vaccines.

-

Who are the key players in the China Pharmaceuticals market?Key companies include Jiangsu Hengrui Medicine, CSPC Pharmaceutical Group, Qilu Pharmaceutical, Yangtze River Pharmaceutical, Pientzehuang Pharmaceutical, Chongqing Zhifei Biological Products, BeiGene, Fosun Pharma.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?