China Medical Device Market Size, Share, By Type (Orthopaedic Devices, Cardiovascular Devices, Diagnostic Imaging, In-vitro Diagnostic, Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, and Others), By End-user (Hospitals & ASC’s, Clinics, and Others), China Medical Device Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Medical Device Market Insights Forecasts to 2035

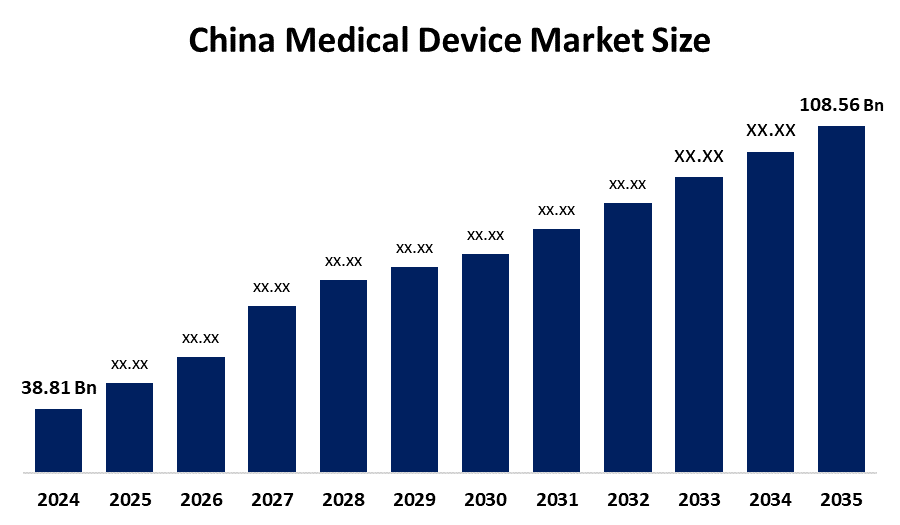

- China Medical Device Market Size 2024: USD 38.81 Bn

- China Medical Device Market Size 2035: USD 108.56 Bn

- China Medical Device Market CAGR 2024: 9.8%

- China Medical Device Market Segments: Type and End-User

Get more details on this report -

The China Medical Device Market Size refers to the vast sector encompassing the instruments, equipment, software, reagent, and consumables used for preventing, diagnosing, treating the diseases. Monitoring health, and life support, driven by the aging population, rising incomes, and the tech advancements, making the China the world second largest healthcare market. This market defines the medical devices as article used for diseases diagnosis, prevention or functional compensation relying on the rather than primarily pharmacological ones.

China’s National Volume-Based Procurement (VBP) program, led by the National Healthcare Security Administration, has reshaped the Medical Device Market Size by centralized bulk purchasing. Government data shows coronary stent prices fell by over 90%, while hip and knee joint implants dropped around 80%, favouring large-scale suppliers and intensifying price competition across China’s medical device sector.

In order to increase trial efficiency, expedite patient recruitment, and improve data quality, medical device clinical trial support providers in China are rapidly utilizing wearable technology, telemedicine, electronic data capture, and artificial intelligence. In addition to the facilitating real-time monitoring and remote data collection, this expanding hybrid and decentralized clinical trial paradigm increases patient access throughout China's large geographic area. Providers are now successfully implement adaptive clinical trial designs for medical devices in China, to enhance the post-market surveillance, and better comply with NMPA regulatory criteria by utilizing advanced analytics, predictive modelling, and real-world evidence.

China Medical Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 38.81 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 9.8% |

| 2035 Value Projection: | USD 108.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End-user |

| Companies covered:: | Siemens Healthineers AG, Stryker, Abbott, BD, Medtronic, Johnson & Johnson Services, Inc., Koninklijke Philips N.V, Hoffmann-La Roche Ltd, Boston Scientific Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Medical Device Market:

The China Medical Device Market Size is driven by an aging population, rising incomes, the strong government support for the healthcare upgrades technological leaps, and increased chronic diseases prevalence, is driving demand for the high end imports and domestic innovation, leading to growth and significant investments. A rapidly aging population increases the need for devices addressing age related condition like diabetes, cardiovascular issues, and the mobility challenges. A growing affluent, middle class seeks higher quality healthcare now which is boosting spending on advanced devices and the personalized care.

The China Medical Device Market Size is restrained by intense local competition and the price wars, stringent/lengthy NMPA regulations, reliance on foreign tech for high end parts challenges in reimbursement, geopolitical uncertainties, and slow tech transfer from research, demanding localized strategies for foreign firms.

The future of the Medical Device Market Size is bright and promising, it is motivated by the new prospects from digital health integration, real-world evidence generation, AI-assisted patient recruitment, and decentralized and hybrid clinical trials. The predictive analytics, connected wearables, and e-clinical platforms are being used to improve patient engagement, optimize trial efficiency, and assist compliance with changing regulatory requirements. They are also speeding up the innovation and the market access for cutting-edge medical products.

Market Segmentation

The China Medical Device Market share is classified into type and end-user.

By Type:

The China Medical Device Market Size is divided by type into orthopaedic devices, cardiovascular devices, diagnostic imaging, in-vitro diagnostic, minimally invasive surgery devices, wound management, diabetes care device. Among these, the in-vitro diagnostic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of increasing the number of in-vitro diagnostics (IVDs) across various settings, including clinical laboratories, hospitals, and even at home in China. In response, key players are expanding their distribution networks for in-vitro diagnostics in the country, thereby increasing device penetration.

By End-User:

The China Medical Device Market Size is divided by end-user into hospitals & clinics, pharmaceutical & medical device manufacturers, and others. Among these, the hospitals & clinics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because venues provide a variety of services under one roof, giving patients greater accessibility, savings, and time savings. Furthermore, it is anticipated that the growth of foreign hospitals in China would increase the need for sophisticated medical equipment in these environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Medical Device Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Medical Device Market:

- Siemens Healthineers AG

- Stryker

- Abbott

- BD

- Medtronic

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V

- Hoffmann-La Roche Ltd

- Boston Scientific Corporation

- Others

Recent Developments in China Medical Device Market:

In February 2025, China’s National Medical Products Administration (NMPA) reported that 65 innovative medical devices were approved in 2024, most of them domestically developed, underscoring strong regulatory support and accelerating innovation in China’s medical device market.

In July 2025, Ypsomed received NMPA approval in China for Mazdutide, a first-in-class dual GCG/GLP-1 receptor agonist, delivered via the YpsoMate 1.0 autoinjector, highlighting innovation in China’s pharmaceutical and drug-delivery device market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China Medical Device Market Size based on the below-mentioned segments:

China Medical Device Market, By Type

- Orthopaedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- In-vitro Diagnostic

- Minimally Invasive Surgery Devices

- Wound Management

- Diabetes Care Devices

- Others

China Medical Device Market, By End-User

- Hospitals & ASC's

- Clinics

- Others

Frequently Asked Questions (FAQ)

-

What is the China medical device market size?China Medical Device Market is expected to grow from USD 38.81 billion in 2024 to USD 108.56 billion by 2035, growing at a CAGR of 9.8% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by an aging population, rising incomes, the strong government support for the healthcare upgrades technological leaps, and increased chronic diseases prevalence, is driving demand for the high end imports and domestic innovation, leading to growth and significant investments.

-

What factors restrain the China medical device market?Constraints include by intense local competition and the price wars, stringent/lengthy NMPA regulations, reliance on foreign tech for high end- parts challenges in reimbursement, geopolitical uncertainties, and slow tech transfer from research, demanding localized strategies for foreign firms.

-

How is the market segmented by type?The market is segmented into orthopaedic devices, cardiovascular devices, diagnostic imaging, in-vitro diagnostic, minimally invasive surgery devices, wound management, diabetes care devices, and others.

-

Who are the key players in the China medical device market?Key companies include Siemens Healthineers AG, Stryker, Abbott, BD, Medtronic, Johnson & Johnson Services, Inc, Koninklijke Philips N.V, Hoffmann-La Roche Ltd, Boston Scientific Corporation, Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?