China Liquefied Petroleum Gas Market Size, Share, By Application (Residential, Commercial, Chemical, Industrial, Autogas, Refinery, and Others), By Source (Road Transportation, Ship, Railways, Pipelines, Bobtail Tankers, and Large Road Tankers), and China Liquefied Petroleum Gas Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerChina Liquefied Petroleum Gas Market Insights Forecasts to 2035

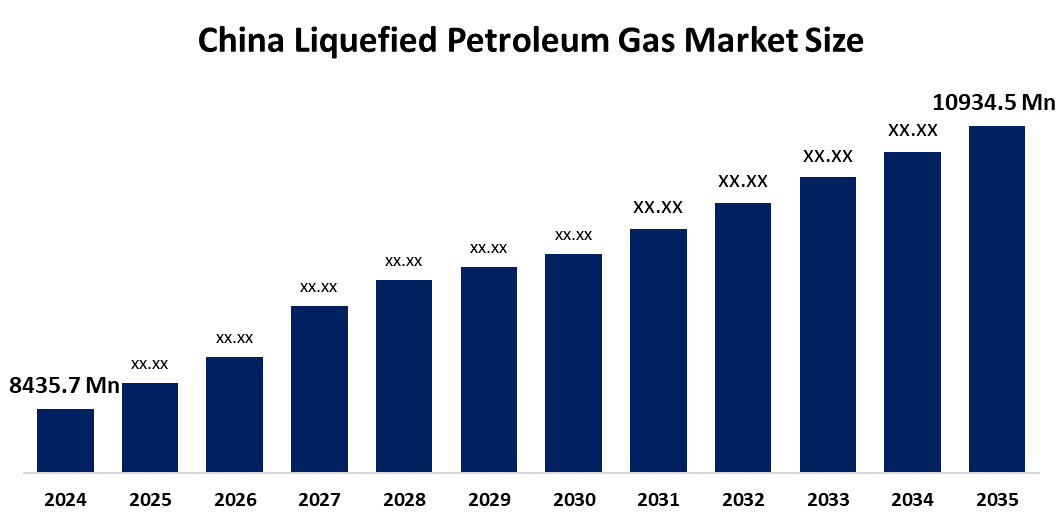

- China Liquefied Petroleum Gas Market Size 2024: USD 8435.7 Million

- China Liquefied Petroleum Gas Market Size 2035: USD 10934.5 Million

- China Liquefied Petroleum Gas Market CAGR: 2.39%

- China Liquefied Petroleum Gas Market Segments: Application and Source

Get more details on this report -

Liquefied petroleum gas used for automotive, commercial, industrial, and residential purposes makes up the China LPG market. LPG, a blend of propane and butane, is prized as a clean-burning substitute for coal and conventional fuels. It is utilized for industrial activities, cooking, heating, and car autogas. Growing urbanization, higher disposable incomes, and the development of LPG distribution infrastructure such as pipelines, cylinder networks, and bottled LPG—are the main drivers of market expansion. Adoption of LPG in homes and businesses is also influenced by rising environmental consciousness and the need for greener energy sources.

The Chinese government supports LPG as part of its clean energy transition and pollution reduction strategies. Policies under programs like the “Coal-to-Gas” substitution initiative encourage households and industries to replace coal with cleaner LPG. Subsidies, safety regulations, and incentives for infrastructure expansion including storage, bottling, and distribution facilities—aim to ensure reliable supply and safety standards. Promotion of LPG as an autogas alternative also aligns with national efforts to reduce vehicular.

Innovations in technology concentrate on leak detection systems, effective distribution, and secure storage. IoT-enabled pipeline and storage tank monitoring, automated refilling systems, and high-pressure LPG cylinders are examples of innovations. Better burner efficiency and combustion technologies increase energy use in industrial applications. Large-scale adoption and operating efficiency throughout China are supported by new advancements in integrated supply chain management and LPG autogas infrastructure.

China Liquefied Petroleum Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8435.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.39 % |

| 2035 Value Projection: | USD 10934.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Application, By Source |

| Companies covered:: | China Petroleum & Chemical Corporation, PetroChina Company Limited, China Gas Holdings Ltd, CNOOC Limited, Donghua Energy, Xinao Energy, Joyoung Gas, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Liquefied Petroleum Gas Market:

Growing energy demand, particularly in the commercial, industrial, and residential sectors, is driving the LPG market in China. Because LPG burns cleaner than coal and other fossil fuels, it is widely utilized for cooking, heating, and industrial processes, complementing China's environmental objectives. Fuel consumption is increased by growing infrastructure for LPG distribution and storage, fast urbanization, and rising disposable incomes. LPG use is being accelerated by government programs encouraging the use of cleaner fuels in homes and businesses in place of coal. Additionally, as the nation investigates greener transportation fuels, LPG's position in auto gas (LPG-powered automobiles) is gaining pace.

LPG is a petroleum-derived product; price volatility associated with changes in the price of crude oil around the world limits market expansion. Complete market penetration is hampered by infrastructure constraints in remote areas, such as storage, transportation, and bottling facilities. LPG handling, storage, and distribution present additional obstacles due to safety concerns and regulatory compliance constraints.

There are opportunities for LPG auto gas network extension, household bottled LPG supply, and electrification replacement initiatives in rural and semi-urban areas. Safety and operational effectiveness are improved by technological advancements in leak detection systems, storage, and transportation. Long-term market expansion in China is also possible due to the growth of eco-friendly LPG applications for clean cooking solutions and industrial operations.

Market Segmentation

The China liquefied petroleum gas market share is classified into application and source.

By Application

The market is categorized by application into residential, commercial, chemical, industrial, autogas, refinery, and others. Among these, the industrial segment held the majority market share in 2024 and is predicted to grow at a remarkable rate. The widespread use of energy and gas-based solutions in manufacturing, power generation, metals, cement, food processing, and other heavy industries is what propels the industrial segment's supremacy. Demand from this sector has dramatically expanded due to rapid industrialization, infrastructure development, and manufacturing capacity expansion.

By Source

This market is divided by source into road transportation, ship, railways, pipelines, bobtail tankers, and large road tankers. Among these, the road transportation segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Road transportation is the most popular last-mile delivery method due to its flexibility, wide distribution network, and capacity to service both urban and rural locations.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China liquefied petroleum gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Liquefied Petroleum Gas Market:

- China Petroleum & Chemical Corporation

- PetroChina Company Limited

- China Gas Holdings Ltd

- CNOOC Limited

- Donghua Energy

- Xinao Energy

- Joyoung Gas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China liquefied petroleum gas market based on the following segments:

China Liquefied Petroleum Gas Market, By Application

- Residential

- Commercial

- Chemical

- Industrial

- Autogas

- Refinery

- Others

China Liquefied Petroleum Gas Market, By Source

- Transportation

- Ship

- Railways

- Pipelines

- Bobtail Tankers

- Large Road Tankers

Frequently Asked Questions (FAQ)

-

1. What is the projected market size by 2035?The market is expected to reach USD 10,934.5 million by 2035, growing from USD 8,435.7 million in 2024.

-

2. What is the expected CAGR during the forecast period?The China LPG Market is projected to grow at a CAGR of 2.39% from 2025 to 2035.

-

3. Which application segment dominates the market?The industrial segment held the largest share in 2024 due to extensive LPG use in manufacturing, power generation, metals, cement, and food processing industries.

-

4. Which source segment accounts for the largest market share?Road transportation dominated in 2024 as the preferred last-mile delivery method, offering flexibility and wide coverage across urban and rural areas.

Need help to buy this report?