China Linear Alpha Olefin Market Size, Share, By Type (Butene-1, Hexene-1, Octene-1, And Others), By End Use (Polyethylene, Polyalphaolefins, Oxo Alcohols, And Others), And China Linear Alpha Olefin Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsChina Linear Alpha Olefin Market Insights Forecasts to 2035

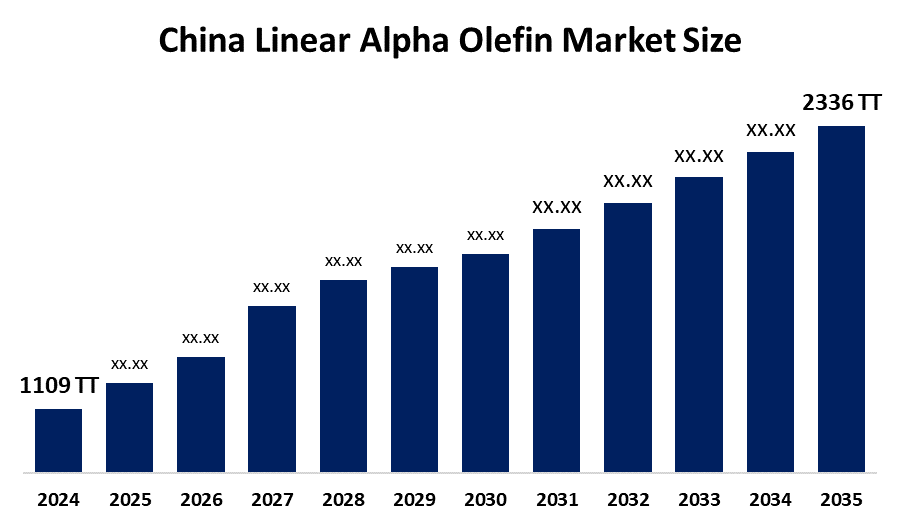

- China Linear Alpha Olefin Market 2024: 1109 Thousand Tonnes

- China Linear Alpha Olefin Market Size 2035: 2336 Thousand Tonnes

- China Linear Alpha Olefin Market CAGR 2024: 7.01%

- China Linear Alpha Olefin Market Segments: Type and End Use

Get more details on this report -

The China linear alpha olefin (LAO) market encompasses the indigenous chemical industry for linear alpha olefins, a type of straight-chained hydrocarbon compound that contains a double bond at one end. Linear alpha olefins are essential building blocks for the production of chemicals such as polyethylene and may be used as comonomers to create polyethylene, as intermediate products for the production of synthetic lubricants, surfactants, and specialty chemicals, among many other uses, also provide greater chemical capacity than other types of hydrocarbons.

The linear alpha olefin in China is backed by government support, including the Work Plan for Stabilizing Growth in the Petrochemical and Chemical Industry (2025–2026) jointly issued by the Ministry of Industry and Information Technology and other central agencies, aims for over 5 % annual growth in added value of the petrochemical and chemical sectors including linear alpha olefin production.

As technology advances, Chinese linear alpha olefin providers are now developing new innovations for production including the use of sophisticated catalysts and advanced processes to assist in reducing the amount of carbon produced during the oligomerization process, while also considering sustainable manufacturing and reducing their environmental impact. In addition, innovations in digital technology, particularly utilizing artificial intelligence systems for process control, are enabling petrochemical producers to streamline operations, increase quality control, and improve energy efficiency creating opportunities to enhance their competitive advantage against global competition.

China Linear Alpha Olefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1109 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.01% |

| 2035 Value Projection: | 2336 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 154 |

| Segments covered: | By Type,By End Use |

| Companies covered:: | China Petrochemical Corporation, China National Petroleum Corporation, Shell plc, Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, INEOS Oligomers, Sasol Limited, SABIC, Idemitsu Kosan Co., Ltd., Qatar Chemical Company Ltd., Dow Chemical Company, Mitsui Chemicals, Inc., Evonik Industries AG, BASF SE, Mitsubishi Chemical Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Linear Alpha Olefin Market:

The China linear alpha olefin market is driven by the booming demand for plastics and advanced polymer materials, rising need for LAO comonomers in polyethylene and other polymers, rapid urbanization, rising living standards spur greater consumption of detergents and personal care products, strong government policy support for modernizing the chemical industry, increasingly exploring advanced catalyst technologies, and strengthening domestic supply chains enhances investor confidence and capacity expansion further propel the market growth.

The China linear alpha olefin market is restrained by the significant reliance on imported high-end LAO technologies, constrained domestic self-sufficiency, high production costs, volatile ethylene prices, supply chain pressures present cost challenges for manufacturers, and stringent environmental regulations.

The future of China linear alpha olefin market is bright and promising, with versatile opportunities emerging from the growing dependency on imports and an opportunity to capture more lucrative high-margin segments such as specialty chemicals and functional additives, domestic producers are actively exploring innovative catalyst technologies as well as sustainable manufacturing processes. The growth of important end-use manufacturing segments will continue to create opportunities for producing differentiated LAOs. Additionally, domestic producers will benefit from government programs that support the production of high-value chemicals, promote environmentally compliant manufacturing, and encourage the use of digital processes.

Market Segmentation

The China Linear Alpha Olefin Market share is classified into type and end use.

By Type:

The China linear alpha olefin market is divided by type into butene-1, hexene-1, octene-1, and others. Among these, the butane-1 segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High dominance in polyethylene production, cost effectiveness, established supply chain, and surge in demand for LLDPE and HDPE in packaging all contribute to the butene-1 segment's largest share and higher spending on linear alpha olefin when compared to other type.

By End Use:

The China linear alpha olefin market is divided by end use into polyethylene, polyalphaolefins, oxo alcohols, and others. Among these, the polyethylene segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The polyethylene segment dominates because of growing demand for plastic packaging, consumer goods, and automotive parts, country’s rapidly expanding economy, and well established infrastructure of linear alpha olefin market in China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China linear alpha olefin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Linear Alpha Olefin Market:

- China Petrochemical Corporation

- China National Petroleum Corporation

- Shell plc

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- INEOS Oligomers

- Sasol Limited

- SABIC

- Idemitsu Kosan Co., Ltd.

- Qatar Chemical Company Ltd.

- Dow Chemical Company

- Mitsui Chemicals, Inc.

- Evonik Industries AG

- BASF SE

- Mitsubishi Chemical Corporation

- Others

Recent Developments in China Linear Alpha Olefin Market:

In March 2025, Satellite Chemical announced that its subsidiary, Lianyungang Petrochemical, successfully commenced mass production of 1-octene at its industrial experiment facility. This was significant development in China’s domestic supply of this high- end alpha olefin.

In January 2025, CNOOC & Shell finalized the investment decision to expand their petrochemical complex in Daya Bay, Huizhou, including a third ethylene cracker with associated downstream units for producing linear alpha olefins. This project was slated for completion in 2028.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China linear alpha olefin market based on the below-mentioned segments:

China Linear Alpha Olefin Market, By Type

- Butene-1

- Hexene-1

- Octene-1

- Others

China Linear Alpha Olefin Market, By End Use

- Polyethylene

- Polyalphaolefins

- Oxo Alcohols

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China linear alpha olefin market size?A: China linear alpha olefin market is expected to grow from 1109 thousand tonnes in 2024 to 2336 thousand tonnes by 2035, growing at a CAGR of 7.01% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the booming demand for plastics and advanced polymer materials, rising need for LAO comonomers in polyethylene and other polymers, rapid urbanization, rising living standards spur greater consumption of detergents and personal care products, strong government policy support for modernizing the chemical industry, increasingly exploring advanced catalyst technologies, and strengthening domestic supply chains enhances investor confidence and capacity expansion further propel the market growth.

-

Q: What factors restrain the China linear alpha olefin market?A: Constraints include the significant reliance on imported high-end LAO technologies, constrained domestic self-sufficiency, high production costs, volatile ethylene prices, supply chain pressures present cost challenges for manufacturers, and stringent environmental regulations.

-

Q: How is the market segmented by type?A: The market is segmented into butene-1, hexene-1, octene-1, and others.

-

Q: Who are the key players in the China linear alpha olefin market?A: Key companies include China Petrochemical Corporation, China National Petroleum Corporation, Shell plc, Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, INEOS Oligomers, Sasol Limited, SABIC, Idemitsu Kosan Co., Ltd., Qatar Chemical Company Ltd., Dow Chemical Company, Mitsui Chemicals, Inc., Evonik Industries AG, BASF SE, Mitsubishi Chemical Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?