China Insulin Market Size, Share, By Type (Insulin Analog And Human Insulin), By Product (Rapid-Acting Insulin, Long-Acting Insulin, Combination Insulin, Biosimilar, And Others), And China Insulin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Insulin Market Size Insights Forecasts to 2035

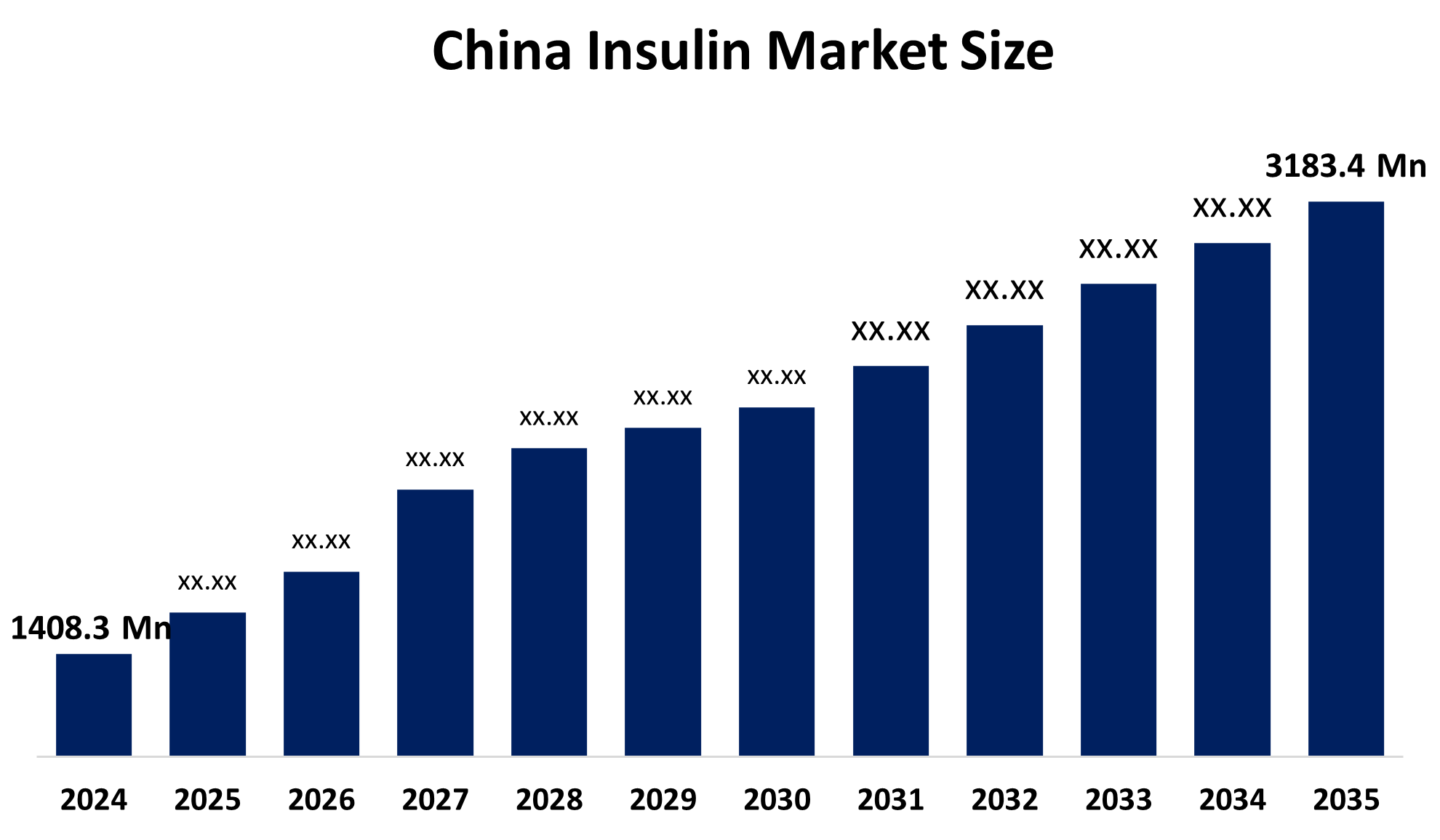

- China Insulin Market Size 2024: USD 1408.3 Mn

- China Insulin Market Size 2035: USD 3183.4 Mn

- China Insulin Market CAGR 2024: 7.7%

- China Insulin Market Segments: Type and Product

Get more details on this report -

The China Insulin Market Size encompasses all future enhancements and variations of insulin products, driven by the country's diabetes epidemic, changing treatment guidelines and improvements to the medical infrastructure within China to care for its growing diabetic population. The China market for insulin is a collection of many manufacturers that produce, distribute, market and dispense products containing human engineered insulin. The demand for this market has been solidly built on the need to treat patients with Type 1 and advanced stages of Type 2 diabetes, in which either insufficient quantities of natural produced insulin are available or the body has become resistant to the biologically active form of insulin in China.

The insulin in China is backed by government support, including the National Centralized Procurement Program, which began including insulin products in May 2022. Under this program, the National Healthcare Security Administration (NHSA) negotiates prices for commonly used insulins and purchases them in bulk for distribution through hospitals and pharmacies. This initiative has cut insulin prices by an average of around 48%, saving an estimated 9 billion Yuan annually in diabetes-related health expenditures and benefiting over 10 million patients by improving affordability and access to both second- and third-generation insulin products.

As technology advances, Chinese insulin providers are now using technologies such as digital platforms, smart pens, and CGM systems provide innovative ways to deliver insulin that enhance both patient outcomes and efficiencies of the regimen while allowing healthcare providers to remotely track their patients with data-based decisions. The Chinese pharmaceutical industry is also working towards the potential advancement of areas such as oral insulin formulations and closed loop insulin pump systems to improve glycemic levels, and lower the complications associated with diabetes.

Market Dynamics of the China Insulin Market:

The China Insulin Market Size is driven by the country’s huge and rising diabetes population, large, sustained demand for insulin therapy and allied services, government healthcare reforms and insurance coverage expansions, robust public health campaigns, improve affordability and access across urban and increasingly rural areas, lifting treatment rates, enhanced healthcare infrastructure, growing middle-class income levels, and greater awareness of diabetes management further support market expansion.

The China Insulin Market Size is restrained by the price controls and government procurement policies, significant cost pressure on manufacturers, competitive landscape among local and global players geographic imbalances persist, and slower uptake in smaller urban and rural regions.

The future of China Insulin Market Size is bright and promising, with versatile opportunities emerging from the domestic businesses by providing lower-cost alternatives to the imported biological due to this continual growth in biosimilar insulins. The rapid advancement of digital health will lead to rapid growth of innovative delivery systems like smart pens, pumps, and connected health platforms. Additionally, possibilities will increase for both global and local companies to bring innovative insulin formulations and combination therapies to the marketplace that address clinical needs and improve patient outcomes.

China Insulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1408.3 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.7% |

| 2035 Value Projection: | USD 3183.4 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Type |

| Companies covered:: | Novo Nordisk, Eli Lilly and Company, Sanofi, Gan & Lee Pharmaceuticals, Tonghua Dongbao, Biocon, Medtronic, Hengrui Medicine, CSPC Pharmaceutical Group and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The China Insulin Market share is classified into type and product.

By Type:

The China Insulin Market Size is divided by type into insulin analog and human insulin. Among these, the insulin analog segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior glucose control, reduced hypoglycaemia risk, better mimicry of natural insulin, rapidly growing diabetic population, and technological advancements all contribute to the insulin analog segment's largest share and higher spending on insulin when compared to other type.

By Product:

The China Insulin Market Size is divided by product into rapid-acting insulin, long-acting insulin, combination insulin, biosimilar, and others. Among these, the long-acting insulin segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The long-acting insulin dominates because of high prevalence of Type 2 diabetes requiring basal insulin, shift towards premium insulin analog, improved accessibility, and government-driven affordability, reducing the price of insulin.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Insulin Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Insulin Market:

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Gan & Lee Pharmaceuticals

- Tonghua Dongbao

- Biocon

- Medtronic

- Hengrui Medicine

- CSPC Pharmaceutical Group

- Others

Recent Developments in China Insulin Market:

- In September 2025, Provention Bio, Sanofi subsidiary received approval for Tzield (teplizumab), the first therapy in China to delay the onset of Stage 3 Type 1 diabetes.

- In February 2025, Novo Nordisk received approval from China’s NMPA for insulin icodec, a novel once-weekly basal insulin analog for adults with type 2 diabetes.

- In December 2024, Sanofi announced a 1 billion Yuan investment to build a new, major insulin production facility in Yizhuang, Beijing. This was their second site in Beijing and fourth in China, focused on localized production to meet high demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Insulin Market Size based on the below-mentioned segments:

China Insulin Market, By Type

- Insulin Analog

- Human Insulin

China Insulin Market, By Product

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China insulin market size?A: China insulin market is expected to grow from USD 1408.3 million in 2024 to USD 3183.4 million by 2035, growing at a CAGR of 7.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the country’s huge and rising diabetes population, large, sustained demand for insulin therapy and allied services, government healthcare reforms and insurance coverage expansions, robust public health campaigns, improve affordability and access across urban and increasingly rural areas, lifting treatment rates, enhanced healthcare infrastructure, growing middle-class income levels, and greater awareness of diabetes management further support market expansion.

-

Q: What factors restrain the China insulin market?A: Constraints include the price controls and government procurement policies, significant cost pressure on manufacturers, competitive landscape among local and global players geographic imbalances persist, and slower uptake in smaller urban and rural regions.

-

Q: How is the market segmented by type?A: The market is segmented into insulin analog and human insulin.

-

Q: Who are the key players in the China insulin market?A: Key companies include Novo Nordisk, Eli Lilly and Company, Sanofi, Gan & Lee Pharmaceuticals, Tonghua Dongbao, Biocon, Medtronic, Hengrui Medicine, CSPC Pharmaceutical Group, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?