China Industrial Robot Market Size, Share, and COVID-19 Impact Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), China Industrial Robot Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentChina Industrial Robot Market Insights Forecasts to 2035

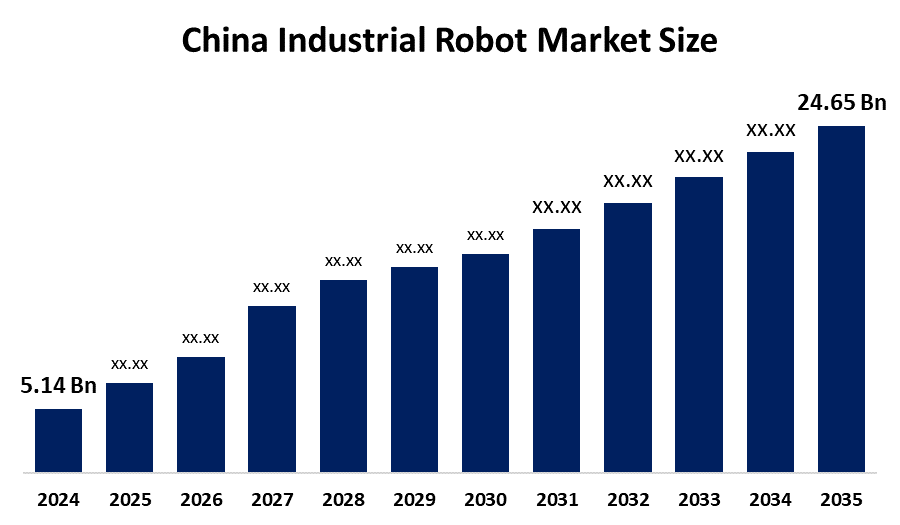

- The China Industrial Robot Market Size Was Estimated at 5.14 USD Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.3% from 2025 to 2035

- The China Industrial Robot Market Size is Expected to Reach 24.65 USD Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The China Industrial Robot Market Size is anticipated to reach USD 24.65 billion by 2035, growing at a CAGR of 15.3% from 2025 to 2035. The market growth is driven by government initiatives, economic incentives, and strong demand from important industries such as automotive (particularly EVs) and electronics are driving automation for efficiency, quality, and maintaining global competitiveness in advanced manufacturing.

Market Overview

The China Industrial Robot Market Size refers to the design, manufacturing, sales and the deployment of the automated programmable machines for the tasks in the Chinese factories which is driven by rising labour costs, government support for the smart manufacturing and high demand from the key sectors like automotive, electronics and metal to boost the productivity, efficiency and the quality in the complex industrial settings. This market offers a huge future opportunities driven by the government push for the smart manufacturing, tech integration with the strong growth in automotive electronics, Automation is crucial to offset the rising wages and an aging population, increasing the adoption of robots across the country. China leads global robot’s installation with the potential for continued high growing sector.

Government initiatives, subsidies, and rising EV and electronics production are accelerating automation in China. The country installed over 290,000 industrial robots in 2023, achieving a robot density of 470 per 10,000 workers, boosting efficiency and global manufacturing competitiveness.

Report Coverage

This research report categorises the market for the China Industrial Robot Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China industrial robot market recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China industrial robot market.

China Industrial Robot Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.14 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 15.3% |

| 2035 Value Projection: | USD 24.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Robot Type, By Application |

| Companies covered:: | Shanghai Step Electric Corporation, HGZN Group, Borunte Robot Co Ltd, ABB, EVS Tech Co Ltd, Siasun Robot Automation Co Ltd, Estun Automation, Efort Intelligent Equipment Co Ltd, Jaka Robotics, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

China’s Industrial Robot Market Size is driven by the rising of the labor costs, government support via initiatives like the made in China to shift the smart growing manufacturing, growing consumer demand, and technological advancement in the IoT, this all is leading to increased automation for efficiency, productivity, and global competitiveness, especially in the electronics, automotive and healthcare. Aging population and rising wages make automation essential to offset labor shortages and rescue operational cost in labor intensive industry. More advanced robotics solutions are needed because the digital transformation of production places a strong emphasis on automation, connection, and human-robot collaboration. Robots provide accuracy, speed, and reliability, resulting in more efficient processes and superior tailored goods. China is now the world's largest market for industrial robots due to the increasing adoption of these devices by Chinese firms.

Restraining Factors

The Key restraining factors for China’s Industrial Robots Market Size include high initial investments and the maintenance costs, making them unaffordable for many SMEs, jobs displacement concern due to china’s large labour force and the need for skilled talent for the complex integration and operations, despite overall rapid growth driven by the electronics or the automotive demand.

Market Segmentation

The China Industrial Robot Market share is classified into robot type and application.

- The articulated segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Industrial Robot Market Size is divided by robot type into articulated, scara, cylindrical, linear, parallel, and others. Among these, the articulated segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to the exceptional versatility, flexibility, and precision, which makes them suitable for a wide range of applications across various key industries.

- The material handling segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China Industrial Robot Market Size is segmented by application into pick and place, welding & soldering, material handling, assembling, cutting & processing, and others. Among these, the material handling segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Due to enormous demand for automating general manufacturing, e-commerce, and logistics due to labour shortages, growing labour costs, and the need for quicker, more effective operations in industries like consumer products, electronics, and automobiles.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Industrial Robot Market Size along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shanghai Step Electric Corporation

- HGZN Group

- Borunte Robot Co Ltd

- ABB

- EVS Tech Co Ltd

- Siasun Robot Automation Co Ltd

- Estun Automation

- Efort Intelligent Equipment Co Ltd

- Jaka Robotics

- Others

Recent Developments:

In September 2024, China installed a record 295,000 industrial robots, representing 54% of global installations, while its operational robot stock surpassed two million units, reinforcing China’s leadership in the global industrial robot and advanced manufacturing market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Industrial Robot market based on the below-mentioned segments:

China Industrial Robot Market, By Robot Type

- Articulated

- SCARA

- Cylindrical

- Linear

- Parallel

- Others

China Industrial Robot Market, By Application

- Pick and Place

- Welding & Soldering

- Material Handling

- Assembling

- Cutting & Processing

- Others

Frequently Asked Questions (FAQ)

-

What is the China industrial robot market size?Market is expected to grow from USD 5.14 billion in 2024 to USD 24.65 billion by 2035, growing at a CAGR of 15.3% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by government initiatives, economic incentives, and strong demand from important industries such as automotive (particularly EVs) and electronics are driving automation for efficiency, quality, and maintaining global competitiveness in advanced manufacturing.

-

What factors restrain the China industrial robot market?Constraints include high initial investments and the maintenance costs, making them unaffordable for many SMEs, jobs displacement concern due to china’s large labour force and the need for skilled talent for the complex integration and operations, despite overall rapid growth driven by the electronics or the automotive demand.

-

How is the market segmented by application?The market is segmented into Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, Others.

-

Who are the key players in the China industrial robot market?Key companies include Shanghai Step Electric Corporation, HGZN Group, Borunte Robot Co Ltd, ABB, EVS Tech Co Ltd, Siasun Robot Automation Co Ltd, Estun Automation, Efort Intelligent Equipment Co Ltd, Jaka Robotics, Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?