China Hydrogen Peroxide Market Size, Share, By Grade (<30%, 30%-50%, 50%-80%, And >80%), By Function (Bleaching, Oxidant, Disinfectant, And Others), And China Hydrogen Peroxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Hydrogen Peroxide Market Size Insights Forecasts to 2035

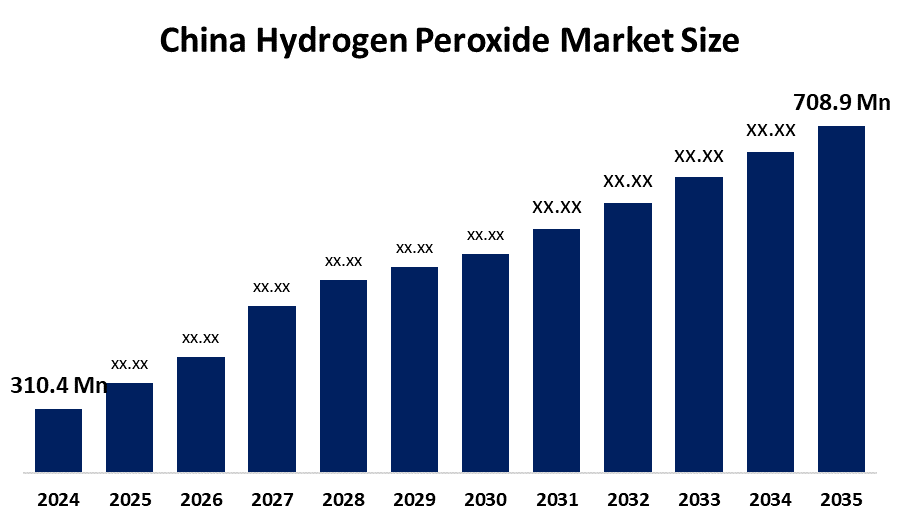

- China Hydrogen Peroxide Market Size 2024: USD 310.4 Million

- China Hydrogen Peroxide Market Size 2035: USD 708.9 Million

- China Hydrogen Peroxide Market CAGR 2024: 7.8%

- China Hydrogen Peroxide Market Segments: Grade and Function

Get more details on this report -

The China Hydrogen Peroxide Market Size consists of the areas of hydrogen peroxide production, distribution, and consumption of hydrogen peroxide, a widely used chemical compound that can be used as an oxidizer, bleaching agent, disinfectant, and intermediate to other industrial chemicals. Hydrogen peroxide in China is produced domestically and imported into China; pink paper & pulp bleaching, textiles, wastewater treatment, electronics manufacturing, food processing, and healthcare have multiple sectors where hydrogen peroxide is consumed. It is an excellent environmentally friendly oxidizer compared to many chlorine-based oxidizing agents, making hydrogen peroxide essential for both industrial and consumer applications.

The hydrogen peroxide in China are backed by government support, including the environmental and industrial policies by the National Development and Reform Commission (NDRC) and related ministries that encourage greener industrial processes and stricter pollution control. These policies promote the use of chemicals that reduce environmental impact, such as hydrogen peroxide for wastewater treatment and chlorine-free bleaching in pulp and textile industries.

As technology advances, Chinese hydrogen peroxide providers are now using higher purity grades and optimized processes for the production of ultra-pure hydrogen peroxide. Improvement in production efficiencies and energy efficiencies due to innovation of reactor design, improved catalytic activity of catalysts, and greater degrees of automation in the processes. They are also reflective of improvements made in packaging and handling technologies to enhance safety and stability during distribution and end-use phases. These trends in technology are consistent with broad trends throughout China’s chemical industry towards meeting higher purification standards, safer production practices, and environmental compliance with established standards.

Market Dynamics of the China Hydrogen Peroxide Market:

The China hydrogen peroxide market is driven by the expansion of downstream industries that use H2O2 as a key input, rapid growth in wastewater treatment, stringent environmental regulations, increased demand from textiles, electronics, and healthcare segments, heightened focus on hygiene and disinfection, demand for hydrogen peroxide-based sanitizers and sterilization solutions, and innovation in formulation and packaging further supporting overall market growth.

The China hydrogen peroxide market is restrained by the regulatory and safety concerns related to handling and storage, high compliance costs and operational challenges, volatility in raw material prices, competitive pressure from alternative bleaching and disinfectant chemicals, and fluctuating demand cycles challenges.

The future of China hydrogen peroxide market is bright and promising, with versatile opportunities emerging from the advanced sewer and industrial waste treatment market will see the application of hydrogen peroxide for advanced oxidation processes and food production hygiene growing as companies adopt safer, cleaner options to maintain compliance with food safety legislation. Conversely, the trend towards sustainability and circular production will increase the integration of hydrogen peroxide into the chemical industry, as manufacturers are moving toward offering eco-friendly chemicals. The growing use of high-purity hydrogen peroxide that meets the requirements of electronic and semiconductor manufacturers creates opportunities for other high-tech manufacturers based on China's overall desire to be a global leader in advanced manufacturing technology.

Market Segmentation

The China hydrogen peroxide market share is classified into grade and function.

By Grade:

The China hydrogen peroxide market is divided by grade into <30%, 30%-50%, 50%-80%, and >80%. Among these, the <30% segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Widespread adoption as a safe & effective disinfectant, increased hygiene awareness among consumer, versatile nature, eco-friendly agent, and widespread industrial use in bleaching all contribute to the <30% segment’s largest share and higher spending on hydrogen peroxide segment when compared to other grade.

By Function:

The China hydrogen peroxide market is divided by function into bleaching, oxidant, disinfectant, and others. Among these, the bleaching segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The bleaching segment dominates because of high demand from the pulp and paper industry for eco-friendly, high quality bleaching, and the textile industry for fabric processing, and growth in e-commerce has boosted demand for packaging paper in China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China hydrogen peroxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Hydrogen Peroxide Market:

- Solvay

- Evonik Industries AG

- Arkema

- Mitsubishi Gas Chemical Company

- Sichuan Hebang Biotechnology

- Jiangxi Liwen

- Shandong Minxiang Chemical

- Guangxi Chlor-Alkali Chemical

- Lunan Chemical

- Inner Mongolia Qinghua

- Henan Jinhe Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China hydrogen peroxide market based on the below-mentioned segments:

China Hydrogen Peroxide Market, By Grade

- <30%

- 30%-50%

- 50%-80%

- >80%

China Hydrogen Peroxide Market, By Function

- Bleaching

- Oxidant

- Disinfectant

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China hydrogen peroxide market size?A: China hydrogen peroxide market is expected to grow from USD 310.4 million in 2024 to USD 708.9 million by 2035, growing at a CAGR of 7.8% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expansion of downstream industries that use H₂O₂ as a key input, rapid growth in wastewater treatment, stringent environmental regulations, increased demand from textiles, electronics, and healthcare segments, heightened focus on hygiene and disinfection, demand for hydrogen peroxide-based sanitizers and sterilization solutions, and innovation in formulation and packaging further supporting overall market growth.

-

Q: What factors restrain the China hydrogen peroxide market?A: Constraints include the regulatory and safety concerns related to handling and storage, high compliance costs and operational challenges, volatility in raw material prices, competitive pressure from alternative bleaching and disinfectant chemicals, and fluctuating demand cycles challenges.

-

Q: How is the market segmented by grade?A: The market is segmented into <30%, 30%-50%, 50%-80%, and >80%.

-

Q: Who are the key players in the China hydrogen peroxide market?A: Key companies include Solvay, Evonik Industries AG, Arkema, Mitsubishi Gas Chemical Company, Sichuan Hebang Biotechnology, Jiangxi Liwen, Shandong Minxiang Chemical, Guangxi Chlor-Alkali Chemical, Lunan Chemical, Inner Mongolia Qinghua, Henan Jinhe Industry Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?