China Hydrogen Market Size, Share, By Production Source (Grey Hydrogen, Industrial By-Product, And Green Hydrogen), By End Use (Ammonia, Refining, Methanol, Fuel, And Others), And China Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Hydrogen Market Insights Forecasts to 2035

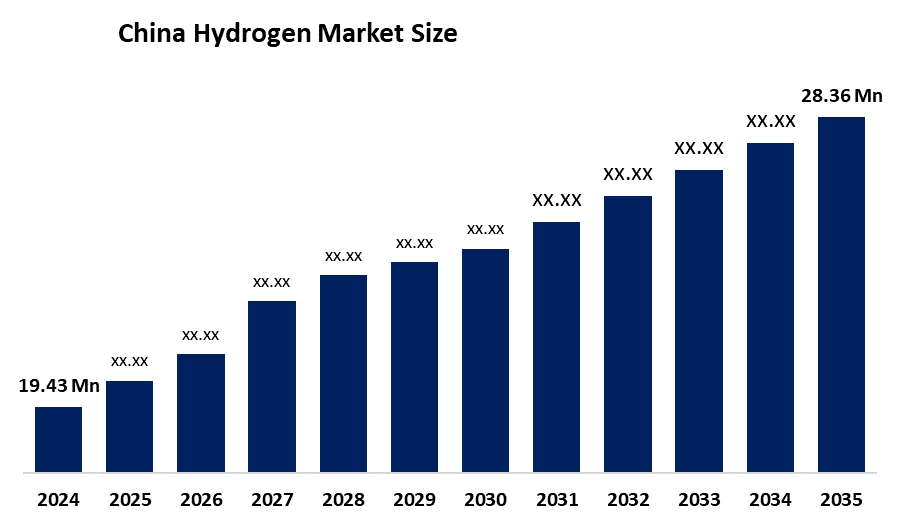

- China Hydrogen Market Size 2024: 19.43 Million Tonnes

- China Hydrogen Market Size 2035: 28.36 Million Tonnes

- China Hydrogen Market CAGR 2024: 3.5%

- China Hydrogen Market Segments: Production Source And End Use

Get more details on this report -

China hydrogen market is a growing and essential aspect of its clean energy transition that entails hydrogen production, supply, transport, and application, including as an energy source and feedstock throughout various industries, namely in transportation, industry, and electricity generation. Various applications are driving the demand for hydrogen in China, including traditional applications in the petrochemical and refining industries, as well as newer applications for hydrogen fuel-cell vehicles, industrial decarbonisation for steel-making and refining operations, as well as large-scale energy storage systems, so therefore hydrogen will play a vital role in supporting both future energy and industrial strategies in China.

The hydrogen in China are backed by government support, including the national Hydrogen Industry Development Medium and Long-Term Plan (2021-2035), which sets ambitious targets for the hydrogen value chain, deployment of hydrogen fuel cell vehicles, and integration of hydrogen into energy systems. The Country’s total hydrogen production capacity exceeded 50 million tons per year, with annual production surpassing 36.5 million tons and renewable hydrogen projects rapidly expanding with more than 600 planned and over 90 already operational collectively representing over 50% of global renewable hydrogen capacity. This underscores China’s dominant position in both traditional and clean hydrogen sectors and reflects the strong policy push to scale up production and infrastructure.

As technology advances, China’s hydrogen providers are now using various forms of hydrogen fuel cells, using high-pressure gaseous and liquid hydrogen storage and transportation systems, and advancements in fuel cell design, whereby improved fuel cell efficiency and durability for both automotive and stationary uses. In addition, research is focused on developing systems that integrate variable renewable energy sources such as wind and solar with the production of hydrogen, thus enhancing the stability of electrical grids and reducing costs associated with both generating electricity from renewable sources and using hydrogen as a fuel. In addition to being environmentally responsible, these advanced technologies will also lower costs and create additional opportunities for new uses of hydrogen.

Market Dynamics of the China Hydrogen Market:

The China hydrogen market is driven by the ambitious climate and energy goals, rising carbon peak and carbon neutrality targets, strong policy support, investment in low-carbon energy carriers, demand from heavy industry especially steel, chemicals and transportation, abundant renewable energy resources in regions, strong basis for scaling up green hydrogen production, and technological advancements in for renewable generation and hydrogen supply.

The China hydrogen market is restrained by the high-emission fossil-based hydrogen production, high initial costs, availability of low-cost renewable electricity and advanced electrolyzers, infrastructure gaps, constrain adoption in the transportation sector, and fluctuations in policy support.

The future of China hydrogen market is bright and promising, with versatile opportunities emerging from the increased production of green Hydrogen, supported by energy production policies that foster additional renewable energy technologies at declining costs, industrial users such as steel and chemical producers are being given many more opportunities for deep decarbonisation. Furthermore, as hydrogen fuel cell vehicles continue to grow in popularity across multiple verticals, this creates new supply chai opportunities and play a major role in the transition to clean energy in China.

China Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.43 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | CSSC Perry Hydrogen, LONGi Hydrogen, Sungrow Hydrogen, Sinopec, China Energy Investment Corporation, Dongfang Electric, SinoHytec, Tianneng, Horizon Fuel Cell Technologies, MinYang Smart Energy, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China Hydrogen Market share is classified into production source and end use.

By Production Source:

The China hydrogen market is divided by production source into grey hydrogen, industrial by-product and green hydrogen. Among these, the grey hydrogen segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Abundant coal resources in China, lower production costs, well established industrial infrastructure, and viable option for large scale, cost sensitive, and immediate industrial use all contribute to the grey hydrogen segment's largest share and higher spending on hydrogen when compared to other production source.

By End Use:

The China hydrogen market is divided by end use into ammonia, refining, methanol, fuel, and others. Among these, the ammonia segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The ammonia segment dominates because of leading consumption demand from agriculture and chemicals, cheap and most established production method, and accounted as a primary consumer for both conventional and green hydrogen.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Hydrogen Market:

- CSSC Perry Hydrogen

- LONGi Hydrogen

- Sungrow Hydrogen

- Sinopec

- China Energy Investment Corporation

- Dongfang Electric

- SinoHytec

- Tianneng

- Horizon Fuel Cell Technologies

- MinYang Smart Energy

- Others

Recent Developments in China Hydrogen Market:

In January 2026, Houpu Clean Energy commissioned the first green hydrogen project in Kashgar, Xinjiang, utilizing an “EPC + O” (Engineering, Procurement, Construction + Operations) model.

In December 2025, CHN Energy connected the 400 MW Rudong integrated PV-hydrogen-storage project to the grid. This includes 500 kg/day hydrogen refuelling capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China hydrogen market based on the below-mentioned segments:

China Hydrogen Market, By Production Source

- Grey Hydrogen

- Industrial By-Product

- Green Hydrogen

China Hydrogen Market, By End Use

- Ammonia

- Refining

- Methanol

- Fuel

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China hydrogen market size?A: China hydrogen market is expected to grow from 19.43 Million Tonnes in 2024 to 28.36 Million Tonnes by 2035, growing at a CAGR of 4.57% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the ambitious climate and energy goals, rising carbon peak and carbon neutrality targets, strong policy support, investment in low-carbon energy carriers, demand from heavy industry especially steel, chemicals and transportation, abundant renewable energy resources in regions, strong basis for scaling up green hydrogen production, and technological advancements in for renewable generation and hydrogen supply.

-

Q: What factors restrain the China hydrogen market?A: Constraints include the high-emission fossil-based hydrogen production, high initial costs, availability of low-cost renewable electricity and advanced electrolyzers, infrastructure gaps, constrain adoption in the transportation sector, and fluctuations in policy support.

-

Q: How is the market segmented by production source?A: The market is segmented into grey hydrogen, industrial by-product, and green hydrogen.

-

Q: Who are the key players in the China hydrogen market?A: Key companies include CSSC Perry Hydrogen, LONGi Hydrogen, Sungrow Hydrogen, Sinopec, China Energy Investment Corporation, Dongfang Electric, SinoHytec, Tianneng, Horizon Fuel Cell Technologies, MinYang Smart Energy, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?