China Extractable and Leachable Testing Services Market Size, Share, By Product (Container Closure Systems, Drug Delivery Systems, Single-use Systems, and Others), By Application (Parenteral Drug Products, Orally Inhaled and Nasal Drug Products, and Ophthalmic), and China Extractable and Leachable Testing Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Extractable and Leachable Testing Services Market Insights Forecasts to 2035

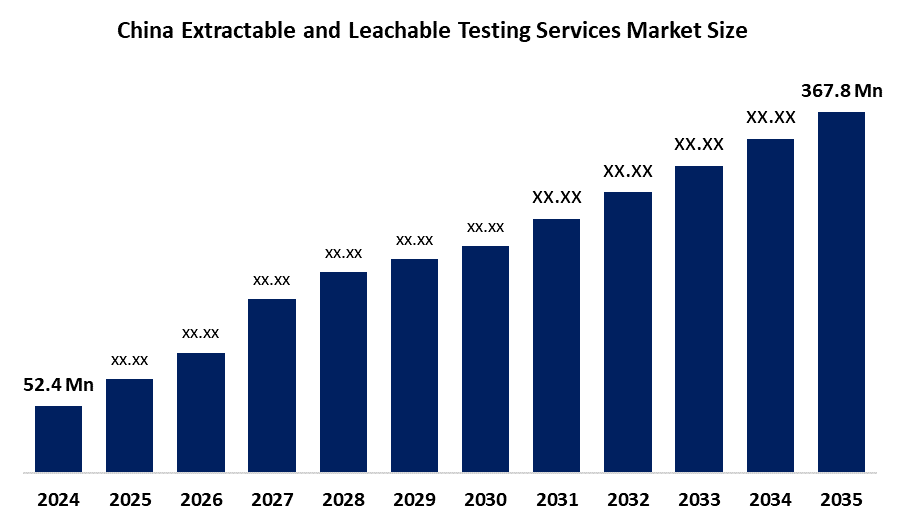

- China Extractable and Leachable Testing Services Market Size 2024: USD 52.4 Million

- China Extractable and Leachable Testing Services Market Size 2035: USD 367.8 Million

- China Extractable and Leachable Testing Services Market CAGR: 19.38%

- China Extractable and Leachable Testing Services Market Segments: Product and Application

Get more details on this report -

The Extractable and Leachable Testing Service examines chemicals that may seep into the product from things like packaging, medications, or medical equipment. The market for extractable and leachable testing services in China is growing quickly due to increased production of pharmaceuticals and medical devices as well as stricter laws to guarantee compliance with regulations and safety. In China, demand for specialized analytical services has expanded due to the necessity of comprehensive E&L testing, particularly in complex formulations, packaging components, and combination items. To achieve quality standards, local producers are developing capabilities or outsourcing to skilled labs.

China's regulatory bodies, headed by the National Medical Products Administration (NMPA), are strengthening safety and quality standards for pharmaceuticals, biologics, and medical devices, increasing the need for thorough E&L testing before approvals. By aligning with international pharmacopeia recommendations, these standards encourage domestic companies to implement globally recognized testing procedures. Advanced analytical testing is encouraged by the government's emphasis on product safety and compliance.

E&L testing skills are being greatly improved by technological advancements. While automation, high-throughput screening, and AI-based data analytics simplify workflows and predictive risk assessments, advanced LC-MS and GC-MS techniques increase detection sensitivity for trace pollutants. These developments facilitate compliance with strict regulatory requirements and enable laboratories to produce results more quickly and accurately.

Market Dynamics of the China Extractable and Leachable Testing Services Market:

The National Medical Products Administration (NMPA) enforces strict regulations to protect the safety of drugs and medical devices, which is the main driver of the extractable and leachable (E&L) testing services market in China. The rapid growth of biologics, biosimilars, and complex injectable formulations entails high-risk materials and container closing mechanisms, which has raised the necessity for thorough E&L investigations. The demand for expert E&L testing services is also being greatly increased by China's growing pharmaceutical and medical device industrial base, as well as the growing trend of outsourcing specialist analytical testing.

The industry has confronted obstacles, including high testing costs brought on by the demand for sophisticated analytical tools like high-resolution mass spectrometry, GC-MS, and LC-MS. Market adoption may be further slowed by the scarcity of qualified analysts and complicated, constantly changing regulations, especially for small and mid-sized manufacturers.

Technological developments such as automation, AI-based data interpretation, and high-throughput testing platforms present significant prospects. It is anticipated that China's E&L testing ecosystem would be strengthened and new growth opportunities will be created by growing government support for quality compliance, greater R&D investments, and strategic partnerships between domestic and foreign testing laboratories.

China Extractable and Leachable Testing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 19.38% |

| 2035 Value Projection: | USD 367.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Eurofins Scientific, Intertek Group plc, SGS S.A., WuXi AppTec Co., Ltd., Sotera Health / Nelson Laboratories, Merck KGaA, West Pharmaceutical Services, Inc., Pacific Biolabs, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China Extractable and Leachable Testing Services Market share is classified into product and application.

By Product:

On the basis of product, the China extractable and leachable testing services market is categorized into container closure systems, drug delivery systems, single-use systems, and others. Among these, the container closure systems segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. Driven by the extensive use of packaging components in pharmaceutical manufacturing, as well as strict regulatory constraints.

By Application:

Based on application, the China extractable and leachable testing services market is divided into parenteral drug products, orally inhaled and nasal drug products, and ophthalmic. Among these, the parenteral drug products segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Strict regulatory requirements for injectable formulations, the high risk of direct bloodstream administration, and the increasing production of biologics and complex injectables that necessitate extensive extractable and leachable testing are the main factors driving the dominance of parenteral drug products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China extractable and leachable testing services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Extractable and Leachable Testing Services Market:

- Eurofins Scientific

- Intertek Group plc

- SGS S.A.

- WuXi AppTec Co., Ltd.

- Sotera Health / Nelson Laboratories

- Merck KGaA

- West Pharmaceutical Services, Inc.

- Pacific Biolabs

- Others

Recent Developments in the China Extractable and Leachable Testing Services Market:

- In January 2025, to expedite biologics development with improved regulatory alignment and turnaround efficiency, Wuxi AppTec Co. Ltd. introduces a new integrated extractables and leachables testing platform.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China extractable and leachable testing services market based on the following segments:

China Extractable and Leachable Testing Services Market, By Product

- Container Closure Systems

- Drug Delivery Systems

- Single-use Systems

- Others

China Extractable and Leachable Testing Services Market, By Application

- Parenteral Drug Products

- Orally Inhaled and Nasal Drug Products

- Ophthalmic

Frequently Asked Questions (FAQ)

-

1.What is the China Extractable and Leachable (E&L) Testing Services Market?The China E&L testing services market focuses on analytical testing that identifies chemicals that may migrate from packaging materials, drug delivery systems, or medical devices into pharmaceutical products, ensuring safety, quality, and regulatory compliance.

-

2.What was the market size in 2024, and what is the forecast for 2035?The market was valued at USD 52.4 million in 2024 and is projected to reach USD 367.8 million by 2035, growing at a CAGR of 19.38% during 2025–2035.

-

3.What are the key drivers of market growth?Growth is driven by strict NMPA regulations, rising production of biologics and complex injectable drugs, expansion of China’s pharmaceutical and medical device industries, and increased outsourcing of specialized analytical testing services.

-

4.Which product segment dominated the market in 2024?Container closure systems held the largest market share in 2024 due to their widespread use in pharmaceutical packaging and stringent regulatory scrutiny.

-

5.Which application segment leads the market?Parenteral drug products dominated the market, driven by strict safety requirements for injectables, high patient risk, and increasing biologics production.

-

6.What are the major restraints affecting the market?High testing costs, the need for advanced analytical equipment, limited skilled professionals, and complex regulatory requirements can hinder market growth.

Need help to buy this report?