China ESG Investing Market Size, Share, By Type (Impact Investing, Sustainable Funds, Green Bonds, ESG Integration, and Others), By Investor Type (Corporate, Institutional, and Retail), By Application (Integrated ESG, Environmental, Social, and Governance), and China ESG Investing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialChina ESG Investing Market Insights Forecasts to 2035

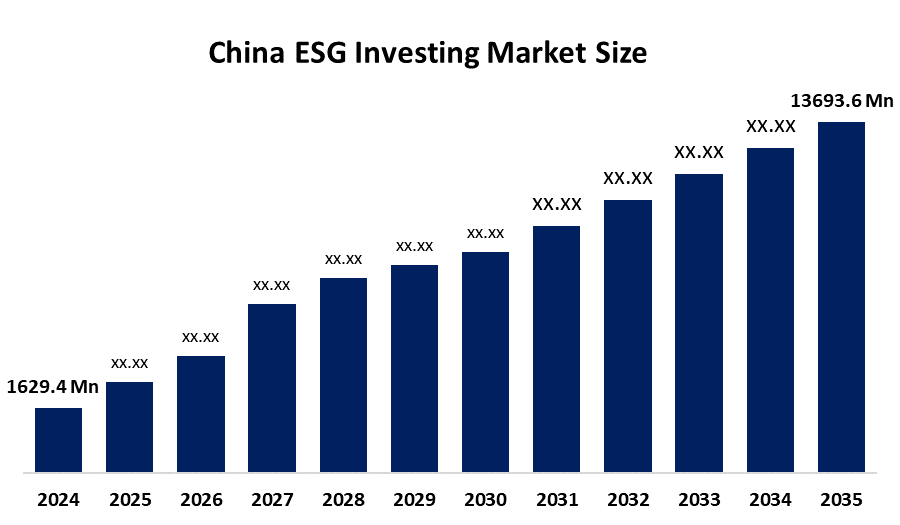

- China ESG Investing Market Size 2024: USD 1629.4 Mn

- China ESG Investing Market Size 2035: USD 13693.6 Mn

- China ESG Investing Market CAGR: 21.35%

- China ESG Investing Market Segments: Type, Investor Type, and Application

Get more details on this report -

In China ESG investing market, the incorporation of Environmental, Social, and Governance (ESG) principles into investment strategies has become increasingly popular in recent years. To advance national priorities, such as the "dual carbon" targets of peaking carbon emissions by 2030 and reaching carbon neutrality by 2060, which President Xi Jinping pledged during the general debate of the 75th session of the United Nations General Assembly in 2020, Chinese policymakers and financial institutions have come to recognize the importance of mobilizing capital in line with ESG objectives.

Government initiatives have a significant impact on the China ESG investment sector. In line with national dual-carbon targets (carbon peak by 2030, neutrality by 2060), policymakers, such as the PBOC and CSRC, support green finance, ESG transparency, and sustainable investment products. ESG integration is strengthened across industries, and policies such as the Green Finance Support Project standardize green projects.

Technologies such as AI, big data, blockchain, and satellite-based carbon monitoring are examples of technological developments that improve the accuracy, transparency, and predictive analytics of ESG data. These projects and advancements promote trustworthy ESG reporting, wise investment choices, and capital flow alignment with China's sustainability goals.

Market Dynamics of the China ESG Investing Market:

The China ESG investing market is driven by government initiatives supporting dual-carbon objectives, ESG disclosure, and green finance. Demand for sustainable investments is fueled by growing investor awareness. AI, big data, blockchain, and real-time emissions monitoring are examples of technological innovations that improve the accuracy and risk evaluation of ESG data. Attractive investment opportunities are created by global ESG alignment and the expansion of low-carbon, sustainable, and renewable industries.

Despite these, there are many obstacles to overcome, such as inconsistent disclosure requirements, a short-termist market, and low participant understanding of ESG. High agency conflicts about ESG ratings, a high percentage of retail investors (around 50%), and the long-term nature of ESG returns at odds with investment behaviour are some of the main obstacles.

China’s ESG investing market presents significant growth opportunities across sectors and financial products. Growth of green finance, which includes green bonds, ESG funds, and loans tied to sustainability. High-return investment opportunities are provided by low-carbon technology, energy efficiency, and renewable energy. Market openness is improved by required ESG disclosures and increased regulatory backing. Additional chances for capital inflow are offered by cross-border partnerships and adherence to international ESG norms. As China pursues its dual-carbon and sustainability objectives, the market is generally expected to grow sustainably.

China ESG Investing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1629.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 21.35% |

| 2035 Value Projection: | USD 13693.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | CITIC Securities, China Galaxy Securities, Guotai Junan Securities, Industrial and Commercial Bank of China, China Construction Bank, Sungrow, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China ESG investing market share is classified into type, investor type, and application.

By Type:

Based on type, the China ESG investing market is categorized into impact investing, sustainable funds, green bonds, ESG integration, and others. Among these, the ESG integration segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The broad use of ESG criteria in institutional portfolios, regulatory support for ethical investing, and asset managers' increasing awareness of incorporating environmental, social, and governance considerations into conventional financial analysis are the main drivers of this dominance.

By Investor Type:

On the basis of investor type, the China ESG investing market is divided into corporate, institutional, and retail. Among these, the institutional segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Strong involvement from pension funds, insurance companies, and asset management businesses, as well as favourable government policies, a growing regulatory emphasis on sustainable finance, and the increasing incorporation of ESG factors into long-term investment plans, are all credited with this expansion.

By Application:

The China ESG investing market is classified by application into integrated ESG, environmental, social, and governance. Among these, the integrated ESG segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is fueled by the growing maturity of China's sustainable finance ecosystem, regulatory guidance, and investors' and asset managers' preference for a comprehensive ESG approach that concurrently integrates environmental, social, and governance factors into investment decision-making.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China ESG investing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China ESG Investing Market:

- CITIC Securities

- China Galaxy Securities

- Guotai Junan Securities

- Industrial and Commercial Bank of China

- China Construction Bank

- Sungrow

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China ESG investing market based on the following segments:

China ESG Investing Market, By Type

- Impact Investing

- Sustainable Funds

- Green Bonds

- ESG Integration

- Others

China ESG Investing Market, By Investor Type

- Corporate

- Institutional

- Retail

China ESG Investing Market, By Application

- Integrated ESG

- Environmental

- Social

- Governance

Frequently Asked Questions (FAQ)

-

1.Which type segment dominates the China ESG investing market?ESG Integration held the largest market share in 2024 due to widespread institutional adoption, regulatory support, and asset managers’ focus on ESG criteria.

-

2.Which investor type is the largest?Institutional investors accounted for the largest share in 2024, supported by pension funds, insurance companies, and government-backed sustainable investment policies.

-

3.What drives the China ESG investing market?Key drivers include government initiatives supporting dual-carbon goals, growing investor awareness, technological innovations (AI, big data, blockchain, emissions monitoring), and opportunities in low-carbon and renewable industries.

-

4.What are the challenges in the China ESG investing market?Base Year: 2024 Historical Data: 2020-2023 Category: Banking and Financial Report Title: China ESG Investing Market The China ESG Investing Market is Expected to Grow from USD 1629.4 Million in 2024 to USD 13693.6 Million by 2035, Growing at a CAGR of 21.35% during the forecast period 2025-2035. China ESG Investing Market Size, Share, By Type (Impact Investing, Sustainable Funds, Green Bonds, ESG Integration, and Others), By Investor Type (Corporate, Institutional, and Retail), By Application (Integrated ESG, Environmental, Social, and Governance), and China ESG Investing Market Insights, Industry Trend, Forecasts to 2035. China ESG Investing Market Insights Forecasts to 2035 • China ESG Investing Market Size 2024: USD 1629.4 Mn • China ESG Investing Market Size 2035: USD 13693.6 Mn • China ESG Investing Market CAGR: 21.35% • China ESG Investing Market Segments: Type, Investor Type, and Application In China ESG investing market, the incorporation of Environmental, Social, and Governance (ESG) principles into investment strategies has become increasingly popular in recent years. To advance national priorities, such as the "dual carbon" targets of peaking carbon emissions by 2030 and reaching carbon neutrality by 2060, which President Xi Jinping pledged during the general debate of the 75th session of the United Nations General Assembly in 2020, Chinese policymakers and financial institutions have come to recognize the importance of mobilizing capital in line with ESG objectives. Government initiatives have a significant impact on the China ESG investment sector. In line with national dual-carbon targets (carbon peak by 2030, neutrality by 2060), policymakers, such as the PBOC and CSRC, support green finance, ESG transparency, and sustainable investment products. ESG integration is strengthened across industries, and policies such as the Green Finance Support Project standardize green projects. Technologies such as AI, big data, blockchain, and satellite-based carbon monitoring are examples of technological developments that improve the accuracy, transparency, and predictive analytics of ESG data. These projects and advancements promote trustworthy ESG reporting, wise investment choices, and capital flow alignment with China's sustainability goals. Market Dynamics of the China ESG Investing Market: The China ESG investing market is driven by government initiatives supporting dual-carbon objectives, ESG disclosure, and green finance. Demand for sustainable investments is fueled by growing investor awareness. AI, big data, blockchain, and real-time emissions monitoring are examples of technological innovations that improve the accuracy and risk evaluation of ESG data. Attractive investment opportunities are created by global ESG alignment and the expansion of low-carbon, sustainable, and renewable industries. Despite these, there are many obstacles to overcome, such as inconsistent disclosure requirements, a short-termist market, and low participant understanding of ESG. High agency conflicts about ESG ratings, a high percentage of retail investors (around 50%), and the long-term nature of ESG returns at odds with investment behaviour are some of the main obstacles. China’s ESG investing market presents significant growth opportunities across sectors and financial products. Growth of green finance, which includes green bonds, ESG funds, and loans tied to sustainability. High-return investment opportunities are provided by low-carbon technology, energy efficiency, and renewable energy. Market openness is improved by required ESG disclosures and increased regulatory backing. Additional chances for capital inflow are offered by cross-border partnerships and adherence to international ESG norms. As China pursues its dual-carbon and sustainability objectives, the market is generally expected to grow sustainably. Market Segmentation The China ESG investing market share is classified into type, investor type, and application. By Type: Based on type, the China ESG investing market is categorized into impact investing, sustainable funds, green bonds, ESG integration, and others. Among these, the ESG integration segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The broad use of ESG criteria in institutional portfolios, regulatory support for ethical investing, and asset managers' increasing awareness of incorporating environmental, social, and governance considerations into conventional financial analysis are the main drivers of this dominance. By Investor Type: On the basis of investor type, the China ESG investing market is divided into corporate, institutional, and retail. Among these, the institutional segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Strong involvement from pension funds, insurance companies, and asset management businesses, as well as favourable government policies, a growing regulatory emphasis on sustainable finance, and the increasing incorporation of ESG factors into long-term investment plans, are all credited with this expansion. By Application: The China ESG investing market is classified by application into integrated ESG, environmental, social, and governance. Among these, the integrated ESG segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is fueled by the growing maturity of China's sustainable finance ecosystem, regulatory guidance, and investors' and asset managers' preference for a comprehensive ESG approach that concurrently integrates environmental, social, and governance factors into investment decision-making. Competitive Analysis: The report offers the appropriate analysis of the key organisations/companies involved within the China ESG investing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Top Key Companies in the China ESG Investing Market: • CITIC Securities • China Galaxy Securities • Guotai Junan Securities • Industrial and Commercial Bank of China • China Construction Bank • Sungrow • Others Key Target Audience Market Players Investors End-users Government Authorities Consulting and Research Firm Venture capitalists Value-Added Resellers (VARs) Market Segment This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China ESG investing market based on the following segments: China ESG Investing Market, By Type • Impact Investing • Sustainable Funds • Green Bonds • ESG Integration • Others China ESG Investing Market, By Investor Type • Corporate • Institutional • Retail China ESG Investing Market, By Application • Integrated ESG • Environmental • Social • Governance FAQ 1. Which type segment dominates the China ESG investing market? ESG Integration held the largest market share in 2024 due to widespread institutional adoption, regulatory support, and asset managers’ focus on ESG criteria. 2. Which investor type is the largest? Institutional investors accounted for the largest share in 2024, supported by pension funds, insurance companies, and government-backed sustainable investment policies. 3. What drives the China ESG investing market? Key drivers include government initiatives supporting dual-carbon goals, growing investor awareness, technological innovations (AI, big data, blockchain, emissions monitoring), and opportunities in low-carbon and renewable industries. 4. What are the challenges in the China ESG investing market? Challenges include inconsistent ESG disclosure, a short-termist market, low ESG awareness, agency conflicts in ESG ratings, and a high proportion of retail investors (~50%) with differing investment horizons.

Need help to buy this report?