China E-cigarette and Vape Market Size, Share, By Product (Disposable, Rechargeable and Modular Devices), By Distribution Channel (Online, Retail), China E-cigarette and Vape Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsChina E-cigarette and Vape Market Insights Forecasts to 2035

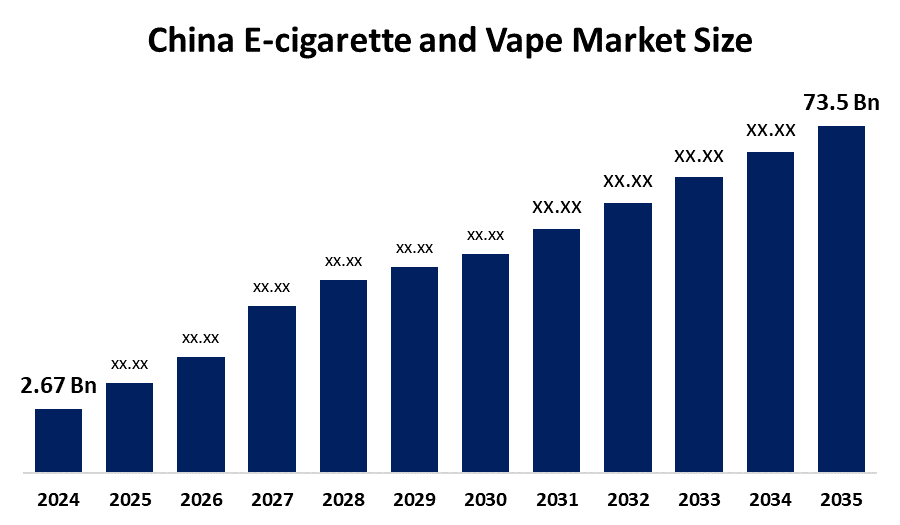

- China E-cigarette and Vape Market Size 2024: USD 2.67 Bn

- China E-cigarette and Vape Market Size 2035: USD 73.5 Bn

- China E-cigarette and Vape Market CAGR 2024: 35.17%

- China E-cigarette and Vape Market Segments: Product and Distribution Channel

Get more details on this report -

The China e-cigarette and vape market is a large, fast-evolving sector covering closed and open systems, pod devices, disposables, and atomizer components, transitioning from export-driven manufacturing to technology-enabled, regulated, and brand-led development. This market is shaped by changing consumer lifestyles, harm-reduction awareness, product innovation in temperature control and atomization, rapid cross-border e-commerce adoption, customization demand, strong global exports, tightening government regulation under the State Tobacco Monopoly Administration, sustainability initiatives, and intense competition between domestic leaders and international premium brands within a complex compliance framework.

The China e-cigarette and vape market offers strong growth which is driven by the changing consumer preferences, rising disposable incomes, urban lifestyles, and the growing demand for regulated harm-reduction alternatives. The new product innovation in the pod systems, advanced atomization, temperature control, and the compliant nicotine formulations is creating opportunities for premium, technology-driven devices. There is rapid expansion of export markets, cross-border e-commerce, and digital distribution channels, along with smart manufacturing, customization, and sustainability initiatives, is supported by evolving regulatory frameworks, despite pricing pressures, stricter compliance costs, and intense competition among domestic and international brands.

China E-Cigarette And Vape Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.67 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 35.17% |

| 2035 Value Projection: | USD 73.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product,By Distribution Channel |

| Companies covered:: | Smoore International Holdings Ltd.; ALD; Innokin; IMiracle Shenzhen Technology Co., Ltd.; Shenzhen Joyetech Electronics Co., Ltd.; RELX International; MOTI; Shenzhen Kanger Technology Co., Ltd.; Shenzhen IVPS Technology Co., Ltd.; and other key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China E-cigarette and Vape Market

The China e-cigarette and vape market is driven by the large and the urbanizing population, rising middle-class incomes, strong manufacturing capabilities, and the evolving government regulation shaping standardized industry growth. The demand for regulated, technologically advanced, and the premium vape products is rising due to the lifestyle changes, harm-reduction awareness, and the product innovation in atomization and pod systems. China is transitioning from a low-cost manufacturing base into a global hub for branded, compliant, and export-oriented e-cigarette and vape technologies, supported by rapid cross-border e-commerce, design innovation, supply-chain strength, and international market expansion, attracting sustained investment and reinforcing China’s leadership in the global vape industry.

The China e-cigarette and vape market faces restraints such as strict and evolving regulatory oversight, licensing requirements, flavor and nicotine restrictions, and high compliance costs. In addition, intense price competition, rising raw material and manufacturing expenses, intellectual property risks, export dependence, trade barriers, shifting international regulations, reputational scrutiny, and geopolitical tensions continue to impact profitability, market access, and long-term innovation despite strong global demand potential.

The future of China’s e-cigarette and vape market appears positive and promising, which is supported by continuous product innovation, regulatory standardization, and the evolving consumer lifestyles. Advanced pod systems, improved atomization technology, temperature control features, compliant nicotine formulations, and the sustainability-focused designs are creating the new growth opportunities. In addition, progress in smart manufacturing, automation, AI-assisted product design, digital quality control, cross-border e-commerce, and global distribution networks is improving production efficiency, regulatory compliance, brand differentiation, and international market access across China’s expanding e-cigarette and vape ecosystem.

Market Segmentation

The China E-cigarette and Vape Market share is classified into product and distribution channel.

By Product

The China E-cigarette and vape market is divided by product into disposable, rechargeable and modular devices. Among these, the rechargeable segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to a combination of cost-effectiveness, environmental sustainability, and a growing consumer preference for customizable features.

By Distribution Channel

The China E-cigarette and vape market is divided by distribution Channel into online, and retail. Among these, the retail segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to extensive physical presence in convenience stores and vape shops, offering instant access, product testing, and expert advice.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China E-cigarette and vape market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China E-cigarette and Vape Market

- Smoore International Holdings Ltd.

- ALD

- Innokin

- IMiracle Shenzhen Technology Co. Ltd.

- Shenzhen Joyetech Electronics Co. Ltd.

- RELX International

- MOTI

- Shenzhen Kanger Technology Co., Ltd.

- Shenzhen IVPS Technology Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China E-cigarette and vape market based on the below-mentioned segments:

China E-cigarette and Vape Market, By Product

- Disposable

- Rechargeable

- Modular Devices

China E-cigarette and Vape Market, By Distribution Channel

- Online

- Retail

Frequently Asked Questions (FAQ)

-

Q: What is the China E-cigarette and vape market size?A: China E-cigarette and vape market is expected to grow from USD 2.67 billion in 2024 to USD 73.5 billion by 2035, growing at a CAGR of 35.17% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the large and the urbanizing population, rising middle-class incomes, strong manufacturing capabilities, and the evolving government regulation shaping standardized industry growth.

-

Q: What factors restrain the China E-cigarette and vape market?A: Constraints include strict and evolving regulatory oversight, licensing requirements, flavor and nicotine restrictions, and high compliance costs.

-

Q: How is the market segmented by product?A: The market is segmented into disposable, rechargeable and modular devices.

-

Q: Who are the key players in the China E-cigarette and vape market?A: Key companies include RELX International, YOOZ, MOTI, Shenzhen Kanger Technology Co., Ltd., Shenzhen IVPS Technology Co., Ltd., Smoore International Holdings Ltd., ALD, Innokin, IMiracle Shenzhen Technology Co. Ltd., Shenzhen Joyetech Electronics Co. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?