China Digital Signature Market Size, Share, and COVID-19 Impact Analysis, By Offering (Public Cloud Software, Software License, and Software Maintenance), By End Use (Legal Services, BFSI, Healthcare, Real Estate, Education, Manufacturing, and Cross-Border Trade), China Digital Signature Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyChina Digital Signature Market Insights Forecasts to 2035

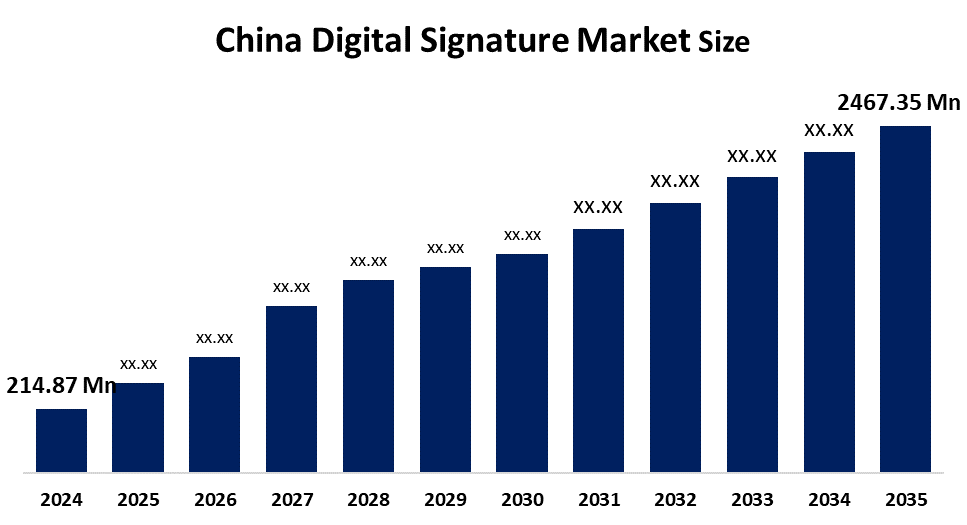

- The China Digital Signature Market Size Was Estimated at USD 214.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 24.84% from 2025 to 2035

- The China Digital Signature Market Size is Expected to Reach 2467.35 USD Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The China digital signature Market is anticipated to reach USD 2467.35 Million by 2035, Growing at a CAGR of 24.84% from 2025 to 2035. The market growth is driven by massive government digital transformation, rising cyber threats necessitating improved security, rapid expansion in the BFSI and healthcare sectors, and technological advances such as AI and Blockchain for trust all pushing for paperless, safe, and efficient digital processes, despite hurdles such as standards gaps.

Market Overview

China digital signature market involves using the cryptography to secure the electronic transactions, while providing legally recognized verification for authenticity and the integrity, booming with the mobile payment integration and the e-commerce, driven by the digital transformation and the regulation, covering the software and the services for securing the document workflows, approvals and the identity verification across the sector like the finance, government and the retail. These market provides the technology and the services that apply cryptographic methods to create secure, legally, valid electronic signatures, enabling businesses and the individuals to conduct the digital transactions and manage the electronic records with the verified authenticity and integrity, especially within the digital ecosystem.

The China’s digital signature market is booming with huge opportunities in integrating blockchain for the security, cloud based scalable solution, and the advanced features like WhatsApp delivery for improved experience, expecting the rapid growth. The key opportunities lie in secure BFSI transaction, enhancing patient record in the healthcare, supporting the online contracts in e-commerce and securing the government communications.

Report Coverage

This research report categorises the market for the China digital signature market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China digital signature market recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China digital signature market.

China Digital Signature Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 214.87 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 24.84% |

| 2035 Value Projection: | USD 2467.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Offering, By End Use |

| Companies covered:: | Tencent E-Sign, Da Hong Qian, Ai Qian, Yun Qian Zhang, FaDaDa (Shenzhen FaDaDa Network Technology Co., Ltd.), eSign (Hangzhou Tiangu Information Technology Co., Ltd.), Qiyue Suo (Shanghai Genyan Network Technology Co. Ltd.), Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The China’s digital signature market is driven by the robust government support and the favourable legal frameworks, rapid digital transformation across various industries, and the integration of advanced technologies like AI and the blockchain. A widespread shift towards digital workflow across the numerous sectors is fuelling the demand for the secure and efficient authentication solutions. Businesses aims to achieve paperless operations, it also improves the improves the customer experience and streamline the processes to save time and the cost. The rising incidence of cyberattacks and the data breaches has increased the demand for robust security measures. Digital signatures with their use of encryption identity verification and tamper proof audits trails address this concern effectively. The digital signatures offer a better user experience by enabling remote signing from any location and the device reducing the document turnaround time, automating back end process. Sectors such as banking, financial services, and insurance (BFSI) and healthcare are increasingly adopting digital solutions to improve efficiency, fraud prevention, and customer experience.

Restraining Factors

China’s digital signature market faces restrain like the preferences for traditional wet signatures, lack of unified technical standards causing interoperability issues, the cost barrier of the SMEs and the security concern despite advanced encryption, alongside the need for deeper awareness and stronger regularity clarity for the foreign services. While inherently secure, risks like private key theft identity theft and the potential provider breaches the erode user trust, slowing the adoption, especially among the tech savvy users.

Market Segmentation

The China Digital Signature Market share is classified into offerings and end use.

- The public cloud software dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Digital Signature market is divided by offerings into public cloud software, software license, and software maintenance. Among these, public cloud software dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Accordingly, it pays as you go pricing strategy appeals to SMEs and startups. This concept allows firms to swiftly offer services from any remote location. Furthermore, public cloud software is compatible with a variety of technologies, including AI, block chain, and big data analytics, and it supports mobile-first techniques, which allow for remote signing via applications and browsers.

- The BFSI segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China Digital Signature market is segmented by end use into legal services, BFSI, healthcare, real estate, education, manufacturing, and cross-border trade. Among these, the BFSI segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. It is due to the banking institutions are increasingly using cloud-hosted electronic signature technologies due to their cheaper initial costs, rapid feature updates, and seamless scalability. These platforms assist decrease paperwork, speed up transaction times, and lower operational costs, which is critical for the BFSI sector's ability to handle a significant volume of agreements.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China digital signature market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tencent E-Sign

- Da Hong Qian

- Ai Qian

- Yun Qian Zhang

- FaDaDa (Shenzhen FaDaDa Network Technology Co., Ltd.)

- eSign (Hangzhou Tiangu Information Technology Co., Ltd.)

- Qiyue Suo (Shanghai Genyan Network Technology Co. Ltd.)

- Others

Recent Developments:

In June 2025, Contract Lock’s electronic signature solution was implemented at Northeast Normal University, enabling localized digital transformation, supporting national secret cryptographic algorithms, strengthening compliance, data security, auditability, and accelerating adoption of electronic signatures across administration.

In July 2024, Kingdee Cloud and FaDaDa jointly launched the Starry Sky Flagship Edition, an integrated electronic signature solution supporting finance, healthcare, manufacturing, and other industries, strengthening compliant digital contract management across China’s enterprise market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China digital signature market based on the below-mentioned segments:

China Digital Signature Market, By Offering

- Public Cloud Software

- Software License

- Software Maintenance

China Digital Signature Market, By End Use

- legal services

- BFSI

- Healthcare

- Real estate

- Education

- Manufacturing

- Cross-border trade.

Frequently Asked Questions (FAQ)

-

Q: What is the China digital signature market size?A: Market is expected to grow from USD 214.87 million in 2024 to USD 2467.35 million by 2035, growing at a CAGR of 24.84% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by massive government digital transformation, rising cyber threats necessitating improved security, rapid expansion in the BFSI and healthcare sectors, and technological advances such as AI and Blockchain for trust; all pushing for paperless, safe, and efficient digital processes, despite hurdles such as standards gaps.

-

Q: What factors restrain the China digital signature market?A: Constraints like the preferences for traditional wet signatures, lack of unified technical standards causing interoperability issues, the cost barrier of the SMEs and the security concern despite advanced encryption, alongside the need for deeper awareness and stronger regularity clarity for the foreign services.

-

Q: How is the market segmented by end use?A: The market is segmented into legal services, BFSI, healthcare, real estate, education, manufacturing, and cross-border trade.

-

Q: Who are the key players in the China digital signature market?A: Key companies eSign (Hangzhou Tiangu Information Technology Co., Ltd.), Qiyue Suo (Shanghai Genyan Network Technology Co. Ltd.), Shang Shang Qian (BestSign), Hangzhou Shangshangqian Network Technology Co., Ltd, FaDaDa, Tencent E-Sign, Da Hong Qian, Ai Qian, Yun Qian Zhang

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?