China Digital Payment Market Size, Share, By Type (Mobile Wallet Payments, QR Code-Based payments NFC and Contactless Cards Payments, Online Card Payments, Bank Transfer, Digital Currency Payments, and Other), By Technology (Mobile Apps, Hosted Payment Gateways, API-Based Payment Integration, Contactless Payment Technologies, and Other), By End Use Application (Retail, Food & Beverage, Transportation, Utilities, Government and Public Services, Healthcare, and Others), and China Digital Payment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialChina Digital Payment Market Insights Forecasts to 2035

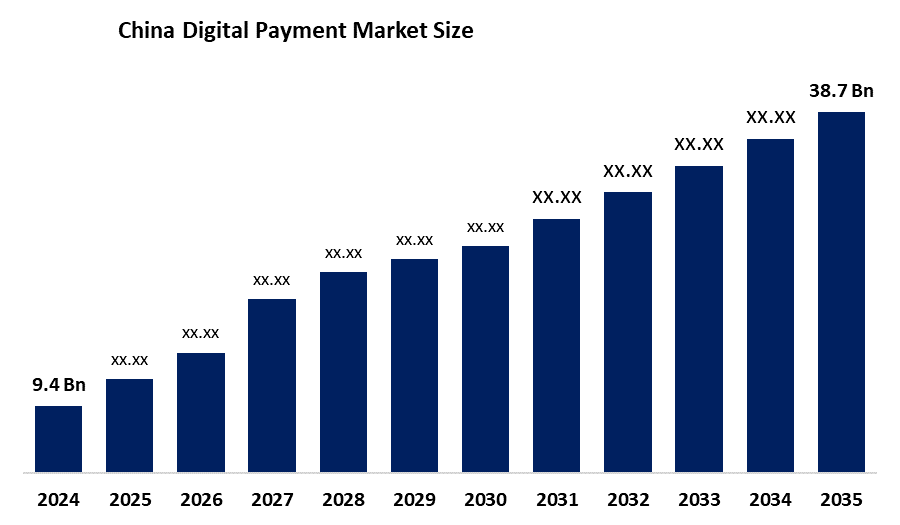

- China Digital Payment Market Size 2024: USD 9.4 Billion

- China Digital Payment Market Size 2035: USD 38.7 Billion

- China Digital Payment Market CAGR: 13.73%

- China Digital Payment Market Segments: Type, Technology, and End Use Application

Get more details on this report -

The electronic payment systems that allow cashless transactions via mobile wallets, QR code-based payments, NFC and contactless cards, online card payments, bank transfers, and digital currency platforms make up the Chinese digital payment market. With a high smartphone penetration rate, a strong internet infrastructure, and broad acceptance of mobile payments in public services, retail, transit, food and beverage, and healthcare, China is a global leader in digital payments. Regularly, consumer and commercial transactions now heavily rely on digital payments.

By enacting laws that support system security, payment standardization, and financial inclusion, the Chinese government actively encourages digital payments. The People's Bank of China's introduction of the digital yuan (e-CNY), which aims to increase transaction efficiency, strengthen regulatory control, and lessen reliance on cash, is a significant project.

The market is further strengthened by technological developments, such as blockchain-based security, biometric authentication, AI-driven fraud detection, and API-based payment interfaces, which provide quicker, safer, and more seamless payment experiences across sectors.

Market Dynamics of the China Digital Payment Market:

The fast expansion of e-commerce and mobile commerce, the widespread use of smartphones, and consumers' strong preference for cashless transactions are the main factors driving the Chinese digital payment sector. Digital payments are now an essential aspect of everyday life due to the widespread use of mobile wallets like Alipay and WeChat Pay as well as the broad acceptance of QR codes in retail, transportation, and services. Additionally, the introduction of the digital yuan (e-CNY) and proactive government actions supporting digital financial infrastructure continue to accelerate industry expansion.

However, the China digital payment market faces certain restraints. Regulatory scrutiny and compliance requirements for third-party payment providers can limit operational flexibility, especially for smaller firms. Concerns about data privacy and cybersecurity continue to be major obstacles since increased transaction volumes raise the risk of fraud and system vulnerabilities. Furthermore, a highly concentrated industry has resulted from fierce competition among well-established platforms, making it challenging for new players to capture a sizable portion of the market.

The China digital payment market offers significant prospects in spite of these difficulties. There is unrealized potential due to the increasing use of digital payments in rural and lower-tier cities. Another significant growth channel is the expansion of cross-border payment systems to facilitate international trade and tourism. Furthermore, it is anticipated that new use cases and long-term growth will be sustained by developments in technologies like blockchain, AI, and biometrics as well as deeper integration of digital payments into public services, healthcare, and smart cities.

China Digital Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.4 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 13.73% |

| 2035 Value Projection: | USD 38.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Ant Group (Alipay), Tencent Holdings, China UnionPay, JD Digits (JD Pay), LianLian DigiTech, Meituan Pay, Baidu Wallet, PDD Payments, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China Digital Payment Market share is classified into type, technology, and end use application.

By Type:

On the basis of type, the China digital payment market is categorized into mobile wallet payments, qr code-based payments NFC and contactless cards payments, online card payments, bank transfer, digital currency payments, and other. Among these, the mobile wallet payments segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. The extensive use of systems like WeChat Pay and Alipay, high smartphone penetration, smooth integration with online and physical shopping, and a strong customer preference for quick, safe, and cashless transactions are the main factors driving this dominance.

By Technology:

Based on technology, the China digital payment market is divided into mobile apps, hosted payment gateways, API-based payment integration, contactless payment technologies, and others. Among these, the mobile apps segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The extensive usage of mobile payment super-apps like WeChat Pay and Alipay, deep integration with e-commerce, retail, transit, and lifestyle services, and high smartphone penetration in urban and semi-urban areas are all factors contributing to this leadership.

By End Use Application:

The China digital payment market is classified by end-use application into retail, food & beverage, transportation, utilities, government and public services, healthcare, and others. Among these, the retail segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The ubiquitous usage of mobile wallets and QR-code payments in everyday consumer transactions, the quick expansion of e-commerce, and the widespread adoption of digital payments across online and offline retail channels all contribute to this domination.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China digital payment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Digital Payment Market:

- Ant Group (Alipay)

- Tencent Holdings

- China UnionPay

- JD Digits (JD Pay)

- LianLian DigiTech

- Meituan Pay

- Baidu Wallet

- PDD Payments

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China digital payment market based on the following segments:

China Digital Payment Market, By Type

- Mobile Wallet Payments

- QR Code-Based payments

- NFC and Contactless Cards Payment

- Online Card Payments

- Bank Transfer

- Digital Currency Payments

- Other

China Digital Payment Market, By Technology

- Mobile Apps

- Hosted Payment Gateways

- API-Based Payment Integration

- Contactless Payment Technologies

- Other Technologies

China Digital Payment Market, By End Use Application

- Retail

- Food & Beverage

- Transportation

- Utilities

- Government and Public Services

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

1.What is the China Digital Payment Market?The China digital payment market includes electronic systems enabling cashless transactions through mobile wallets, QR code-based payments, NFC/contactless cards, online card payments, bank transfers, and digital currencies. It is widely used across retail, transportation, e-commerce, food & beverage, healthcare, and public services.

-

2.Which payment type dominates the market?Mobile wallet payments held the largest share in 2024 due to high adoption of Alipay and WeChat Pay, smartphone penetration, and ease of use in online and offline transactions.

-

3.Which technology leads the market?Mobile apps dominate, thanks to super-app integration, deep e-commerce connectivity, and high smartphone usage in urban and semi-urban areas.

-

4.Which end-use application has the largest share?The retail segment led in 2024, driven by the growth of e-commerce and widespread QR-code and mobile wallet adoption.

-

5.Who are the leading companies in China’s digital payment market?Ant Group (Alipay), Tencent Holdings (WeChat Pay), China UnionPay, JD Digits (JD Pay), LianLian DigiTech, Meituan Pay, Baidu Wallet, PDD Payments, and others.

Need help to buy this report?