China Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Insulins, Oral Anti-Diabetes, Non-Insulin Injectable Drugs, and Combination Drugs), By Diabetes Type (Type-1 and Type-2 Diabetes), By Drug Origin (Branded Drugs and Generic/Biosimilar Drugs), and China Diabetes Drugs Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareChina Diabetes Drugs Market Size Insights Forecasts to 2035

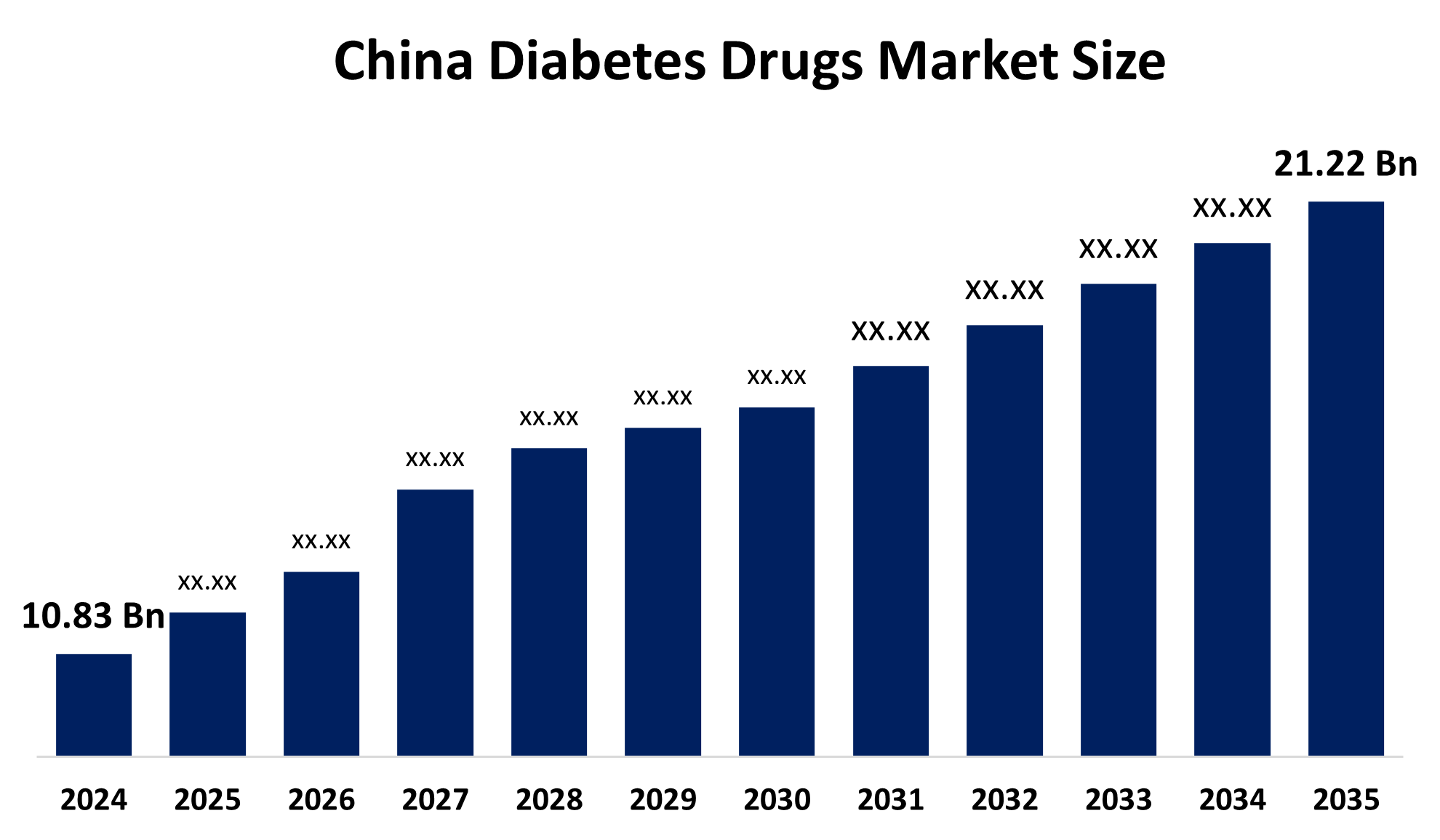

- China Diabetes Drugs Market Size Was Estimated at USD 10.83 billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.31% from 2025 to 2035

- China Diabetes Drugs Market Size is Expected to Reach USD 21.22 billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, China Diabetes Drugs Market Size is Anticipated to Reach USD 21.22 Billion by 2035, Growing at a CAGR of 6.31% from 2025 to 2035. China diabetes drug market is driven by factors such as an aging population, increasing obesity rates, earlier disease onset, growing adoption of GLP-1 and dual-agonist therapies, expansion of digital prescription channels, strong venture funding, a robust biosimilar pipeline, and investment from multinational companies.

Market Overview

The China Diabetes Drugs Market Size represents the commercial activity related to diabetes medications, encompassing the sale and use of pharmaceutical treatments for diabetes across China. Diabetes drugs in China are used for the treatment and ongoing management of diabetes, including Type 1, Type 2, and gestational diabetes. These medications help control blood sugar levels, support insulin function, and lower the risk of diabetes-related complications. The Chinese diabetes drugs market is driven by an aging population, rising obesity, earlier onset, uptake of GLP-1 & dual-agonists, digital prescription trends, venture funding, biosimilar pipeline, and multinational investment.

Key opportunities in the diabetes market include the growing patient population due to aging and lifestyle changes. Next-generation therapies like GLP-1 and dual-agonists offer room for expansion. Government reimbursement and NRDL updates create better market access. Local manufacturing and biosimilars allow cost-efficient product launches. Digital health platforms and strategic partnerships provide new distribution and collaboration channels.

Government initiatives/policies like government reimbursement reforms, Late 2024 (effective Jan 1, 2025), China added 90 new drugs to the NRDL (including drugs for chronic diseases like diabetes), part of the annual update to broaden coverage. In Dec 2025 (effective Jan 1, 2026) Another major update added 114 new medicines to the NRDL and introduced the first Commercial Insurance Innovative Drug List, further expanding reimbursement access for innovative therapies. The regulatory framework has been shifting in the mid-2020s (especially 2025–2026) to emphasize speedier approval pathways for innovative drugs, traceability, and local innovation. This includes requirements for local regulatory representatives and enhanced regulatory tracking of reimbursements, which can benefit domestically developed products.

Report Coverage

This research report categorizes the market for China Diabetes Drugs Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing China diabetes drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of China diabetes drugs market.

China Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.83 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.31% |

| 2035 Value Projection: | USD 21.22 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Drug Class, By Diabetes Type |

| Companies covered:: | Eli Lilly, Sanofi, Novo Nordisk, Gan & Lee, Tonghua Dongbao, Sanofi, Pfizer, Merck & co., Boehringer Ingelheim and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The China Diabetes Drugs Market Size is driven by the rapid rise in diabetes prevalence and earlier onset of the disease, which is increasing demand for treatments across all segments. Expansion of NRDL listings and volume-based procurement is improving drug accessibility and encouraging higher consumption. The launch of GLP-1 and Tirzepatide therapies, along with domestic biosimilars, is stimulating treatment adoption and intensifying competition. Changes in distribution, such as the shift of prescriptions from hospitals to retail under the dual-invoice policy, are expanding market reach, while internet hospitals and e-pharmacy platforms are enhancing patient adherence and access. Additionally, venture and private equity investment in peptide CDMO capacity is strengthening domestic manufacturing capabilities, supporting supply growth to meet rising demand.

Restraining Factors

The diabetes drug market is restrained by margin pressures due to repeated NRDL price reductions, growing regulatory scrutiny over the long-term safety of GLP-1 therapies, supply chain challenges for injectable-grade peptides, and physician reluctance to adopt newer drug classes in lower-tier cities.

Market Segmentation

The China diabetes drugs market share is classified into drug class, diabetes type, and drug origin.

- The non-insulin injectable segment accounted for the highest growth share market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China Diabetes Drugs Market Size is segmented by drug class into insulins, oral anti-diabetics, non-insulin injectable drugs, combination drugs. Among these, the non-insulin injectable accounted for the highest growth share market in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment includes GLP-1 receptor agonists and dual-agonists like tirzepatide, which are growing rapidly due to their ability to lower blood glucose, aid weight loss, and reduce cardiovascular risk. Non-insulin injectables are preferred for Type 2 diabetes when oral drugs are insufficient, offering a convenient alternative to insulin. Growth is supported by increased awareness, NRDL reimbursement updates, and strong pipeline activity, making this one of the fastest-growing areas in China’s diabetes drug market.

- The type-2 segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Diabetes Drugs Market Size is segmented by diabetes type into type-1 and type-2. Among these, the type-2 dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. reflecting the high prevalence of Type 2 diabetes in China. The large patient base, increasing disease awareness, and expanding access to modern therapies continue to drive growth in this segment. Type 2 therapies account for the majority of prescriptions, making them the primary focus for both domestic and multinational pharmaceutical companies operating in the region.

- The generic/biosimilar drugs segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China Diabetes Drugs Market Size is segmented by drug origin into branded drugs and generic/biosimilar drugs. Among these, generic/biosimilar drugs held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The generic/biosimilar drugs segment is growing rapidly in China’s diabetes market due to patent expirations on key drugs, aggressive launches by domestic players, and significant price advantages over branded therapies. Short supply chains and NRDL inclusion boost reliability and prescriber confidence, while increasing clinician and patient acceptance drives adoption. As a result, generic/biosimilars are expanding their market presence even as branded drugs defend share through innovation and device improvements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China Diabetes Drugs Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi

- Eli Lilly

- Novo Nordisk

- Gan & Lee

- Tonghua Dongbao

- Sanofi

- Pfizer

- Merck & co.

- Boehringer Ingelheim

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2025, Shanghai Yinnuo Pharmaceutical Technology received NMPA approval for Isu-Paglutide α, a long-acting GLP-1 agonist designed to help control blood glucose in patients with Type 2 diabetes, highlighting the growing adoption of next-generation therapies.

- In January 2025, CSPC Ouyi Pharmaceutical received NMPA approval for Prusogliptin Tablets after a 623-day review. This marks the introduction of a new Class 1 small-molecule drug in China’s diabetes market, expanding oral treatment options for patients. Around the same time, Shanghai Yinnuo Pharmaceutical Technology obtained NMPA approval for Isu-Paglutide α, a long-acting GLP-1 agonist for controlling blood glucose in Type 2 diabetes.

- In May 2024, Eli Lilly launched Mounjaro (tirzepatide) nationally at CNY 1,758 per box; while this product is not yet covered by public insurance, its introduction underscores the increasing presence of innovative combination therapies in the Chinese market. Collectively, these approvals and launches indicate strong momentum for both domestic and multinational companies to capture opportunities in China’s rapidly evolving diabetes treatment landscape.

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented China Diabetes Drugs Market Size based on the below-mentioned segments:

China Diabetes Drugs Market, By Drug Class

- Insulins

- Oral Anti-Diabetics

- Non-Insulin Injectable Drugs

- Combination Drugs

China Diabetes Drugs Market, By Diabetes Type

- Type-1 Diabetes

- Type-2 Diabetes

China Diabetes Drugs Market, By Drug Origin

- Branded drugs

- Generic /Biosimilar drugs

Frequently Asked Questions (FAQ)

-

Q. What is the current and projected size of the China diabetes drugs market?A: The market was valued at USD 10.83 billion in 2024 and is projected to reach USD 21.22 billion by 2035, growing at a CAGR of 6.31% during 2025–2035.

-

Q. What factors are driving growth in the China diabetes drugs market?A: Market growth is driven by an aging population, rising obesity, earlier disease onset, increasing adoption of GLP-1 and dual-agonist therapies, expansion of digital prescriptions, strong venture funding, a growing biosimilar pipeline, and multinational company investments.

-

Q. Why are non-insulin injectables gaining rapid adoption in China?A: These drugs offer effective blood glucose control, support weight loss, reduce cardiovascular risk, and are preferred when oral therapies are insufficient, providing a convenient alternative to insulin.

-

Q. What are the major challenges restraining the market?A: Market restraints include price pressure from NRDL cuts, safety scrutiny of long-term GLP-1 use, injectable peptide supply-chain challenges, and slower adoption of new drugs in lower-tier cities.

-

Q. Which companies are key players in the China diabetes drugs market?A: Major players include Eli Lilly, Novo Nordisk, Sanofi, Gan & Lee, Tonghua Dongbao, Pfizer, Merck & Co., and Boehringer Ingelheim, among others.

Need help to buy this report?