China Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Management Devices (Insulin Pumps, Insulin Syringes, Infusion Sets, Insulin Cartridges, Disposable Pens, and Insulin Jet Injectors) and By Monitoring Devices (Self-Monitoring Blood Glucose and Continuous Glucose Monitoring), and China Diabetes Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareChina Diabetes Devices Market Size Insights Forecasts to 2035

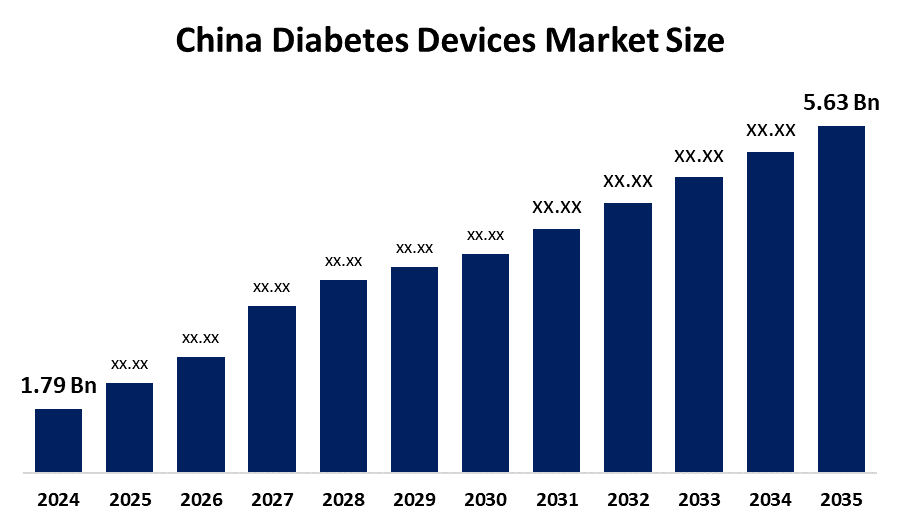

- China Diabetes Devices Market Size 2024: USD 1.79 Bn

- China Diabetes Devices Market Size 2035: USD 5.63 Bn

- China Diabetes Devices Market CAGR 2024: 10.98%

- China Diabetes Devices Market Segments: Type and Distribution Channel

Get more details on this report -

The China Diabetes Devices Market Size is rapidly growing segment and is driven by the growing prevalence of diabetes and rising patient awareness across urban and rural populations. The market is characterized by the strong competition between domestic manufacturers offering cost-effective solutions and the global companies introducing advanced, tech-enabled devices. Supportive government initiatives, reimbursement policies, and regulatory reforms are further encouraging adoption and innovation all things considered, the market creates a dynamic and quickly evolving environment for diabetes treatment by fusing China's industrial know-how with cutting-edge technologies like artificial intelligence and cloud-based monitoring.

China’s Healthy China 2030 strategy includes a 2024–2030 diabetes prevention and control action, targeting increased screening, awareness, and standardized management of diabetes at the primary care level to reduce disease burden and improve health outcomes by 2030, reflecting national priority on noncommunicable disease prevention and control.

The China diabetes device market is growing steadily, which is driven by the rising prevalence of diabetes, an aging population, and the increasing health awareness, this all are supported by the national initiatives such as Healthy China 2030. The growth opportunities span for blood glucose monitoring systems, continuous glucose monitors, insulin delivery devices, and digital diabetes management platforms. The industry is moving toward the higher-value, also the technology-driven solutions, and big-data-based disease management systems. The rapid adoption of gene-informed care, mobile health apps, and cloud-connected devices is improving personalized diabetes management, while government support for innovation, domestic manufacturing, and primary care expansion continues to drive market growth despite pricing and reimbursement pressures.

Market Dynamics of the China Diabetes Devices Market

The China diabetes devices market is driven by a large and rapidly aging population with rising diabetes prevalence, expanding reimbursement coverage, and strengthening primary healthcare infrastructure. There is increase in the healthcare spending and the disposable incomes are driving up the adoption of the sophisticated glucose monitoring devices, insulin pumps and the digital diabetes management options. This diabetes device market is moving towards the high values, the technology driven products like the continuous glucose monitoring and the connected platforms. This market is supported by the vast patient base that enables the rapid product validation and the localization, now China is attracting strong domestic and global investments and emerging as a key innovations and the manufacturing hub for the next generation diabetes device.

The China diabetes devices market faces restraints such as strong pricing pressure from centralized procurement, reimbursement limitations for advanced devices, and intense competition from low-cost domestic manufacturers. In addition, reliance on imported core components, intellectual property risks, and geopolitical tensions affecting medical technology supply chains continue to pressure profitability and slow innovation, despite the market’s large patient base and long-term growth potential.

The future of China’s diabetes devices market appears highly positive and bright, which is driven by rapid technological innovation, expanding healthcare demand, and the supportive reforms in medical device regulation and reimbursement. There are advanced glucose monitoring systems, continuous glucose monitors, smart insulin pumps, and AI-enabled data analytics are creating new growth opportunities. Faster device approvals, increased acceptance of real-world evidence, and connection with digital health systems all help to improve market access and clinical uptake. Furthermore, advancements in smart manufacturing, cloud connection, big data analytics, and personalized diabetes treatment are improving product quality, supply chain efficiency, and patient outcomes throughout China's developing diabetes care ecosystem.

Market Segmentation

The China diabetes devices market share is classified into type and distribution Channels.

By Type

The China diabetes devices market is divided by type into BGM devices, insulin delivery devices. Among these, the insulin delivery devices systems segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their convenience, portability, and ease of use, which significantly enhances patient compliance with treatment regimens.

By Distribution Channel

The China diabetes devices market is divided by distribution into hospital pharmacies, retail pharmacies. Among these, the hospital pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because hospital pharmacies serve as the primary access points for most patients receiving diabetes care and treatment in China's healthcare system.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China diabetes devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Diabetes Devices Market

- Ascensia Diabetes Care Holdings AG

- Novo Nordisk A/S

- AstraZeneca

- Sanofi

- Abbott

- F. Hoffmann-La Roche Ltd

- Medtronic

- Dexcom, Inc.

- BD

- Others

Recent Developments in China Diabetes Devices Market

In January 2024, Trinity Biotech and Bayer signed a letter of intent to launch a low-cost CGM biosensor device in China, marking a significant step in expanding advanced glucose monitoring solutions in the Chinese diabetes device market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China diabetes devices market based on the below-mentioned segments:

China Diabetes Devices Market, By Type

- BGM Devices

- Insulin Delivery Devices

China Diabetes Devices Market, Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies.

Frequently Asked Questions (FAQ)

-

Q: What is the China diabetes devices market size?A: China diabetes devices market is expected to grow from USD 1.79 billion in 2024 to USD 5.63 billion by 2035, growing at a CAGR of 10.98% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a large and rapidly aging population with rising diabetes prevalence, expanding reimbursement coverage, and strengthening primary healthcare infrastructure.

-

Q: What factors restrain the China diabetes devices market?A: Constraints include the strong pricing pressure from centralized procurement, reimbursement limitations for advanced devices, and intense competition from low-cost domestic manufacturers.

-

Q: How is the market segmented by type?A: The market is segmented into BGM devices, insulin delivery devices.

-

Q: Who are the key players in the China diabetes devices market?A: Key companies include Ascensia Diabetes Care Holdings AG, Novo Nordisk A/S, AstraZeneca, Sanofi, Abbott, F. Hoffmann-La Roche Ltd, Medtronic, Dexcom, Inc., BD, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?