China Dental Implants Market Size, Share, By Type (Titanium And Zirconia), By Treatment (SLA & SLActive, Anodized Surfaces, Nano-Textured Surfaces, And Other Fixture Surface Treatments), By Implant Design (Tapered, Parallel-Walled, And Other Implant Design), By Procedure (Single-Stage And Two-Stage), And China Dental Implants Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareChina Dental Implants Market Insights Forecasts to 2035

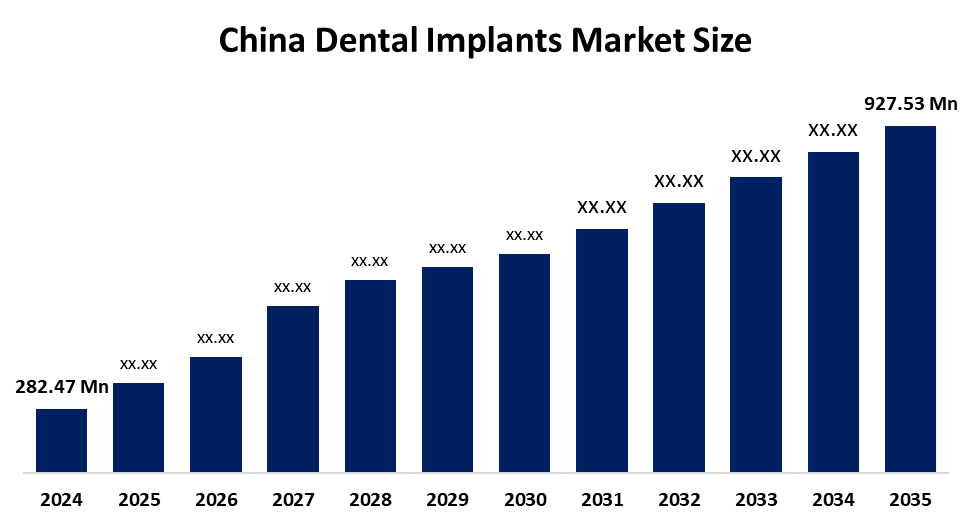

- China Dental Implants Market Size 2024: USD 282.47 Mn

- China Dental Implants Market Size 2035: USD 927.53 Mn

- China Dental Implants Market CAGR 2024: 11.41%

- China Dental Implants Market Segments: Type, Treatment, Implant Design, and Procedure

Get more details on this report -

The China dental implants market is comprised of a variety of different products and clinical treatments which replace a lost tooth by placing surgically inserted pieces on the upper part of the jawbone to support prosthetic crowns, bridges or dentures. In addition to implant parts and materials, the dental implants market also includes planning software, guiding tools and post-treatment care offered by hospitals, private dental clinics, and specialized dental companies throughout China. The increased growth in the dental implants market is driven by individuals experiencing tooth loss causing them to opt for cosmetic reasons; implants are positioned to play an integral role in the overall oral health service industry in China.

The dental implants in China are backed by government support, including the "Healthy China 2030", included oral health in their health priorities within the country, also increased access to dental services through education and improvements made to the systems regulating services and providing preventative care and management of dental diseases. The National Healthcare Security Administration has recently released new measures regulating prices for dental implant services and implementing volume based procurement to facilitate lowering costs and making them affordable.

As technology advances, Chinese dental implants providers are now using digital dentistry tools to improve precision, increase patient outcomes and reduce the length of a procedure. Advances in digital dentistry tools, such as CAD/CAM, 3D imaging, virtual surgical planning, and guided implant placement, allow more precise treatment of patients while decreasing the time required for procedures. The latest digital workflow is using a diagnostic tool for AI-assisted imaging and may also be incorporating robotic assistance into the workflow. Additionally, newly developed implant materials, such as zirconia, will provide greater durability and aesthetic appeal, helping to drive dental implant market.

China Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 282.47 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.41% |

| 2035 Value Projection: | USD 927.53 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Treatment, By Implant Design, By Procedure |

| Companies covered:: | Straumann Group, Dentsply Sirona Inc., Nobel Biocare Services AG, Osstem Implant Co., Ltd., ZimVie Inc., Dentium Co., Ltd., BioHorizons IPH, Inc., 3M Co., MegaGen Implant Co., Ltd., Bicon Dental Implants, Shandong Weigao Oethopaedic Device Co., Ltd., Guangdong Huge Dental Material Co., Ltd., Ningbo Runyes Medical Instrument Co., Ltd., Double Medical Technology Inc., Bioconcept Dental Implants, and others key vendors |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the China Dental Implants Market:

The China dental implants market is driven by the increasing amount of R&D activities in pharmaceutical and biotechnology companies, increase in the number of chronic diseases, governments support for employees with dental implants through policies of legislature, prevalent digital trial models and decentralised model in the industry, increase in AI, data analytics and e-clinical platforms to improve patient data capture.

The China dental implants market is restrained by the gaps in a specialty-trained dental workforce, limited availability of advanced implant solutions, reimbursement of dental implants, and uneven access to technology and the provision of service.

The future of China dental implants market is bright and promising, with versatile opportunities emerging from the substantial growth of dental tourism within areas provides an opportunity to attract patients from within China as well as internationally who require affordable, high quality implant treatment. Additionally, the growing trend of establishing private dental chain service into Dental Service Organizations (DSO) provides an opportunity to create consistency in the delivery of dental care, improve operational efficiencies and increase service capacity. Furthermore, with the ongoing digital transformation and advancement of AI technology, a number of additional opportunities are being created to differentiate possible dental practices from one another and increase productivity through improved diagnosis, planning and implementing treatment within China.

Market Segmentation

The China Dental Implants Market share is classified into type, treatment, implant design, and procedure.

By Type:

The China dental implants market is divided by type into titanium and zirconia. Among these, the titanium segment holds the largest revenue market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High compatibility with human tissue, minimum risk of adverse reactions, high strength and durable solution for tooth replacement, and cost effective all contribute to the titanium segment's dominance and higher spending on dental implants when compared to other type.

By Treatment:

The China dental implants market is divided by treatment into SLA and SLActive, anodized surfaces, nano-textured surfaces, and others fixture surface treatments. Among these, the SLA and SLActive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The SLA and SLActive segment dominates because of enhanced osseo-integration for implant stability and long term functionality, widely adopted by manufacturers, superior clinical outcomes, reduced risk of implant failure, and technological advancements.

By Implant Design:

The China dental implants market is divided by implant design into tapered, parallel-walled, and others implant design. Among these, the tapered segment accounted for the highest share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior primary stability during insertion, suitable for immediate procedures for faster restoration processes, and versatile design offers adaptability to varying bone structures all contribute to the titanium segment's dominance and higher spending on dental implants when compared to other implant design.

By Procedure:

The China dental implants market is divided by procedure into single-stage and two-stage. Among these, the two-stage segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The two-stage segment dominates because of clinical caution in complex cases, established and proven methodology making it the standard of care for many dental professionals, and soft tissue maturation crucial for the long-term health and aesthetics of the implant site.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China dental implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Dental Implants Market:

- Straumann Group

- Dentsply Sirona Inc.

- Nobel Biocare Services AG

- Osstem Implant Co., Ltd.

- ZimVie Inc.

- Dentium Co., Ltd.

- BioHorizons IPH, Inc.

- 3M Co.

- MegaGen Implant Co., Ltd.

- Bicon Dental Implants

- Shandong Weigao Oethopaedic Device Co., Ltd.

- Guangdong Huge Dental Material Co., Ltd.

- Ningbo Runyes Medical Instrument Co., Ltd.

- Double Medical Technology Inc.

- Bioconcept Dental Implants

- Others

Recent Developments in China Dental Implants Market:

In May 2025, Chinese startup Lunray Medical’s introduced the LUNDENT platform. This is a laser-powered dental treatment system designed for minimally invasive procedures in soft tissue surgery, periodontal care, and endodontic disinfection, which supports overall implant workflows.

In November 2024, China’s National Medical Products Administration released 34 new medical device standards covering dental materials and surgical implants, a development that guides domestic product innovation and quality.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical insights has segmented the China dental implants market based on the below-mentioned segments:

China Dental Implants Market, By Type

- Titanium

- Zirconia

China Dental Implants Market, By Treatment

- SLA and SLActive

- Anodized Surfaces

- Nano-Textured Surfaces

- Others Fixture Surface Treatments

China Dental Implants Market, By Implant Design

- Tapered

- Parallel-Walled

- Others Implant Design

China Dental Implants Market, By Procedure

- Single-Stage

- Two-Stage

Frequently Asked Questions (FAQ)

-

Q: What is the China dental implants market size?A: China dental implants Market is expected to grow from USD 282.47 million in 2024 to USD 927.53 million by 2035, growing at a CAGR of 11.41% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing amount of R&D activities in pharmaceutical and biotechnology companies, increase in the number of chronic diseases, governments support for employees with dental implants through policies of legislature, prevalent digital trial models and decentralised model in the industry, increase in AI, data analytics and e-clinical platforms to improve patient data capture.

-

Q: What factors restrain the China dental implants market?A: Constraints include the gaps in a specialty-trained dental workforce, limited availability of advanced implant solutions, reimbursement of dental implants, and uneven access to technology and the provision of service.

-

Q: How is the market segmented by implant design?A: The market is segmented into tapered, parallel-walled, and other implant design.

-

Q: Who are the key players in the China dental implants market?A: Key companies include Straumann Group, Dentsply Sirona Inc., Nobel Biocare Services AG, Osstem Implant Co., Ltd., ZimVie Inc., Dentium Co., Ltd., BioHorizons IPH, Inc., 3M Co., MegaGen Implant Co., Ltd., Bicon Dental Implants, Shandong Weigao Oethopaedic Device Co., Ltd., Guangdong Huge Dental Material Co., Ltd., Ningbo Runyes Medical Instrument Co., Ltd., Double Medical Technology Inc., Bioconcept Dental Implants, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?