China Defense Electronics Market Size, Share, By Vertical (Navigation, Communication, and Display, Electronic Warfare, Optronics, Radars, and C4ISR), By Electronic Warfare (Jammers, Self-protection EW Suites, Directed Energy Weapons, Directional Infrared Countermeasures, Antennas, IR Missile Warning Systems, & Others), China Defense Electronics Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseChina Defense Electronics Market Size Insights and Forecast to 2035

-

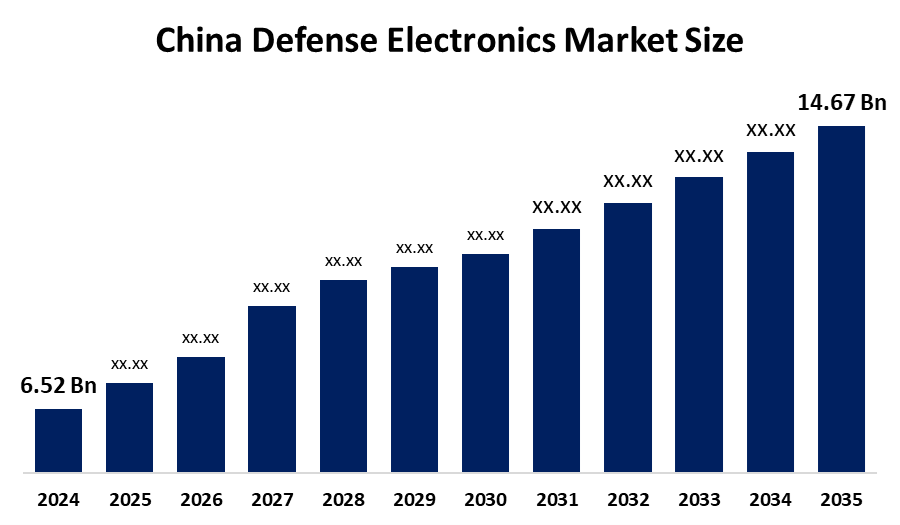

China Defense Electronics Market Size 2024: USD 6.52 Bn

- China Defense Electronics Market Size 2035: USD 14.67 Bn

- China Defense Electronics Market Size CAGR 2024: 7.65%

- China Defense Electronics Market Size Segments: Vertical and Electronic Warfare

Get more details on this report -

The China Defense Electronics Market Size comprises advanced electronic systems developed for military applications and is driven by strong civil–military integration and substantial government investment. Key focus areas include AI-powered radars, electronic warfare (EW), unmanned aerial vehicles (UAVs), smart C4ISR systems, cyber defense solutions, and directed-energy weapons deployed across land, sea, air, and space platforms. The market emphasizes technological self-reliance and the enhancement of advanced military capabilities.

China’s Defense Electronics Market Size is rapidly evolving, supplying high-technology electronic components and systems that are essential for modernizing its armed forces. The market strongly prioritizes indigenous innovation and the integration of civilian technological advancements into military applications.

China’s Military-Civil Fusion (MCF) strategy is a national policy that integrates civilian industries, universities, and private technology firms into defense research, development, and manufacturing. China invests more than 2.6% of its GDP in R&D, and its defense budget is expected to exceed USD 230 billion by 2024, promoting the development of dual-use technologies. Under the MCF framework, thousands of private enterprises and research institutions contribute to military innovation, creating a hybrid defense industrial system that combines centralized state oversight with market-driven efficiency and faster technology commercialization.

The China Defense Electronics Market Size presents significant future opportunities in AI-driven autonomous systems such as robotic platforms and drones, advanced electronic warfare systems for jamming and protection, C4ISR technologies, intelligence, surveillance, and reconnaissance (ISR) systems, as well as space-based technologies. These opportunities are driven by rising defense expenditure, increasing geopolitical tensions, and a strong focus on indigenous innovation in sensors, cyber capabilities, and integrated systems for naval, aerial, and ground platforms.

China Defense Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 6.52 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.65% |

| 2035 Value Projection: | 14.67 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Vertical, By Electronic Warfare |

| Companies covered:: | China Electronics Technology Group Corporation (CETC), Aviation Industry Corporation of China (AVIC), China Aerospace Science & Industry Corporation (CASIC), China Aerospace Science & Technology Corporation (CASC), China National Electronics Import & Export Corporation (CEIEC), Hesai Technology Co., Ltd., Goertek Inc., Zhejiang Dahua Technology Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Defense Electronics Market

The China Defense Electronics Market Size is driven by the massive government investments in military modernization, rising geopolitical tension, strategic goals to become a world-class force, and rapid tech adoption like AI for advanced radar, EW, cyber and autonomous systems aiming for network centric warfare capabilities. China’s sustained the significant budget growth fuels demand for cutting edge electronics aiming to transform the PLA into the high tech force. Protecting the increasingly connected military networks from the cyber-attacks spurs demand for the advanced cybersecurity solutions.

The China Defense Electronics Market Size is restrained by the international export restrictions, supply chin vulnerabilities for the high end components, and challenges regarding the perceived quality and reliability of its military products in the global market. The increasing use of interconnected digital infrastructure in defense systems heighten the risk of the cyber-attacks, Ensuring the security of these sensitive networks from potential breaches is a critical and ongoing challenge

China's defense electronics sector has a bright future because of its military modernization, information, and military-civil fusion. Secure communications, AI-driven signal processing, radar systems, and electronic warfare are all seeing growth prospects. In order to fulfil changing national defense and security objectives, the integration of technologies like AI, 5G, sophisticated sensors, and quantum communication will improve interoperability, reinforce system intelligence, and increase operational efficiency.

Market Segmentation

The China Defense Electronics Market Size share is classified into vertical and electronic warfare.

By Vertical

The China Defense Electronics Market Size is divided by vertical into navigation, communication, and display, electronic warfare, optronics, radars, and C4ISR. Among these, the navigation and communication segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is expanding because of increasing government investment, particularly in display technologies. Additionally, the demand for sophisticated military systems, such as better communication capabilities and real-time decision-making, helped to drive segment expansion.

By Electronic warfare

The China Defense Electronics Market Size is divided by electronic warfare into jammers, self-protection EW suites, directed energy weapons, directional infrared countermeasures, antennas, IR missile warning systems, & others. Among these, the Self-protection EW Suites segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to the need to protect military assets from evolving threats, and supported by significant investments in technical innovation.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China defense electronics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Defense Electronics Market

- China Electronics Technology Group Corporation (CETC)

- Aviation Industry Corporation of China (AVIC)

- China Aerospace Science & Industry Corporation (CASIC)

- China Aerospace Science & Technology Corporation (CASC)

- China National Electronics Import & Export Corporation (CEIEC)

- Hesai Technology Co., Ltd.

- Goertek Inc.

- Zhejiang Dahua Technology Co., Ltd.

Recent Developments in China Defense Electronics Market

In September 2025, China used a major military parade to unveil a range of new weaponry, including advanced anti-aircraft missile systems (HQ-20, HQ-22A, HQ-29), hypersonic anti-ship missiles, underwater drones, and numerous AI-equipped drones and laser weapons for anti-drone defense.

In September 2025: The FK-3000 anti-drone system underscores rising demand for advanced radar, sensors, fire-control systems, electronic targeting, and counter-UAV technologies driven by modern military requirements.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China defense electronics market based on the below-mentioned segments:

China Defense Electronics Market, By Vertical

- Navigation

- Communication and Display

- Electronic Warfare

- Optronics

- Radars

- C4ISR

China Defense Electronics Market, By Electronic Distribution

- Jammers

- Self-protection EW Suites

- Directed Energy Weapons

- Directional Infrared Countermeasures

- Antennas

- IR Missile Warning Systems

- Others

Frequently Asked Questions (FAQ)

-

What is the China Defense Electronics market size?China defense electronics Market is expected to grow from USD 6.52 billion in 2024 to USD 14.67 billion by 2035, growing at a CAGR of 7.65% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the massive government investments in military modernization, rising geopolitical tension, strategic goals to become a world-class force, and rapid tech adoption like AI for advanced radar, EW, cyber and autonomous systems aiming for network centric warfare capabilities.

-

What factors restrain the China Defense Electronics market?Constraints include the international export restrictions, supply chin vulnerabilities for the high end components, and challenges regarding the perceived quality and reliability of its military products in the global market.

-

How is the market segmented by vertical?The market is segmented into navigation, communication and display, electronic warfare, optronics, radars, C4ISR.

-

Who are the key players in the China Defense Electronics market?Key companies include China Electronics Technology Group Corporation (CETC), Aviation Industry Corporation of China (AVIC), China Aerospace Science & Industry Corporation (CASIC), China Aerospace Science & Technology Corporation (CASC), China National Electronics Import & Export Corporation (CEIEC), Hesai Technology Co., Ltd., Goertek Inc., Zhejiang Dahua Technology Co., Ltd.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?