China Dairy Alternatives Market Size, Share By Product (Milk, Yogurt, Cheese, and Ice Cream), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores), China Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesChina Dairy Alternatives Market Size Insights Forecasts to 2035

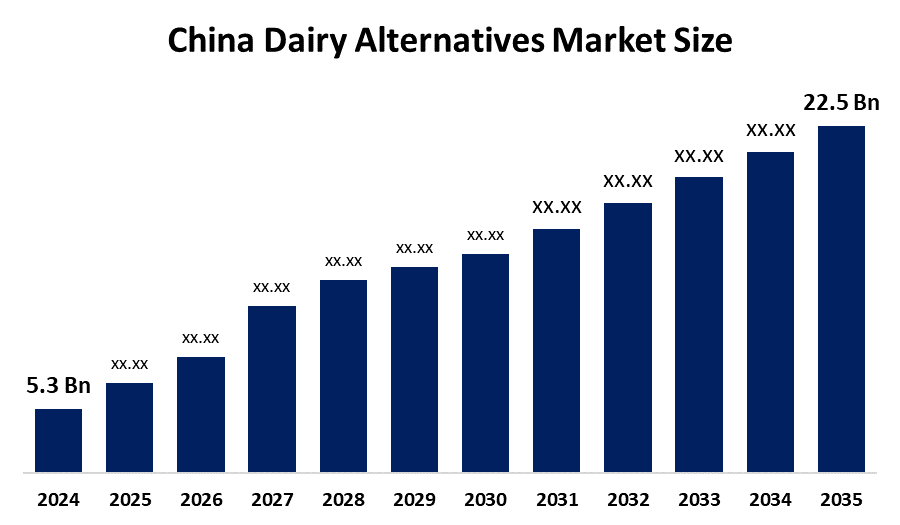

- China Dairy Alternatives Market Size 2024: USD 5.3 Bn

- China Dairy Alternatives Market Size 2035: USD 22.5 Bn

- China Dairy Alternatives Market CAGR 2024: 14.05%

- China Dairy Alternatives Market Segments: Product and Distribution Channels

Get more details on this report -

The China Dairy Alternatives Market Size is a rapidly expanding sector, which is covering the plant based milks, yoghurt, cheese, ice cream and the functional beverages which is driven by the rising health awareness, lactose intolerance, sustainability concern, and the growing disposable incomes. The market is marked by the continuous product innovation, growing foodservice partnerships, and fierce rivalry between domestic and foreign companies. This is convenient, high-quality, and fortified plant-based goods, these goods are becoming more and more popular due to urbanization, changing eating patterns, and widespread e-commerce. In addition, China’s dairy alternatives landscape blends strong manufacturing capabilities and cold-chain logistics with advances in clean-label formulations, localized flavors, and nutrition-focused innovation within an evolving regulatory and consumer environment.

The Healthy China 2030 initiative promotes improved nutrition and public health awareness across China. Although it supports overall dietary quality rather than specific products, it indirectly drives the dairy alternatives market, as health-conscious consumers increasingly choose plant-based options to manage lactose intolerance and support preventive wellness lifestyles.

The China dairy alternatives market is witnessing the rapid growth which is driven by the rising health and the nutrition awareness, also the urbanization and the higher disposable incomes. There is a rise in consumption due to the advancements in the plant based milk, cheese, ready to-drink drinks and the functional meals. The product safety and the freshness are improved the technological advancements in supply chain tracking, the quality monitoring and also the cold chain monitoring, and the cold chain logistics. E-commerce and modern retail channels improve accessibility, while government regulations and import facilitation support market expansion. Rising demand for smoothies, bakery inclusions, and health-oriented products further fuels the growth of China’s dairy alternatives sector.

Market Dynamics of the China Dairy Alternatives Market

The China dairy alternatives market is driven by the expanding distribution networks, also the government support through import facilitation and food safety regulations, and the growing urban consumer demand for nutritious, convenient, and the premium products. Spending on the premium plant-based milks, yogurts, cheeses, and functional beverages is nowadays encouraged by the rising disposable incomes. The technology advancements in supply chain tracking, e-commerce platforms, and cold-chain logistics, dairy alternatives are increasingly popular for the high-value market. The demand is further increased by the rising health consciousness, understanding of lactose sensitivity, and interest in sustainable diets. China is becoming a major global market for dairy substitutes which is drawing investment in both fresh and processed plant-based goods as well as foreign suppliers and local start-ups’.

The China dairy alternatives market faces challenges such as strict import regulations, compliance with food safety and quality standards, seasonal supply limitations for certain plant-based ingredients, high logistics and cold-chain costs, and reliance on imports from a few key countries. These factors pressure profit margins and consistent product availability, despite strong growth potential and rising consumer demand for plant-based and functional dairy alternatives.

The future of China’s dairy alternatives market looks promising and bright, which is driven by rising health-conscious consumption, urbanization, and the sustainability awareness. The product freshness and quality are improving thanks to advancements in cold-chain logistics, supply chain digitalization, also smart storage, and the quality monitoring. Furthermore, in China's quickly developing dairy alternatives ecosystem, e-commerce platforms, data-driven demand forecasting, novel plant-based milks, yogurts, cheeses, functional beverages, and value-added processing are increasing market access, improving efficiency, and generating new growth opportunities. Long-term market potential is further strengthened by rising interest in lactose-free goods, sustainable packaging, and customized nutrition.

Market Segmentation

The China dairy alternatives market share is classified into product and distribution channels.

By Product

The China dairy alternatives market is divided by product into milk, yogurt, cheese, and ice cream. Among these, the milk segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to deep cultural familiarity with soy milk, versatility in daily use, widespread availability, and strong demand from lactose-intolerant consumers.

By Distribution Channels

The China dairy alternatives market is divided by distribution channels into supermarket & hypermarkets, convenience stores. Among these, the supermarket & hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because this are large retail establishments that can stock a vast array of domestic and international dairy alternatives, catering to diverse consumer preferences and dietary needs.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China Dairy Alternatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Dairy Alternatives Market

- Danone S.A

- Nestlé S.A

- Oatly Group AB

- Blue Diamond Growers

- Vitasoy International Holdings Ltd

- Hebei Yangyuan Zhihui Beverage Co. Ltd

- Coconut Palm Group Co. Ltd

- Dali Foods Group Co. Ltd

- Inner Mongolia Yili Industrial Group Co. Ltd

- Mengniu Dairy Company Limited

- Others

Recent Developments in China Dairy Alternatives Market

In July 2023, Sweden-based Veg of Lund partnered with China’s Haofood to introduce its potato-based milk alternative DUG, including Original, Unsweetened, and Barista variants, strengthening product innovation within China’s fast-growing dairy alternatives market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insight has segmented the China dairy alternatives market based on the below-mentioned segments:

China Dairy Alternatives Market, By Product

- Milk

- Yogurt

- Cheese

- Ice Cream

China Dairy Alternatives Market, By Distribution Channels

- Supermarket & Hypermarkets

- Convenience Stores.

Frequently Asked Questions (FAQ)

-

Q: What is the China dairy alternatives market size?A: China dairy alternatives market is expected to grow from USD 5.3 billion in 2024 to USD 22.5 million by 2035, growing at a CAGR of 14.05% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by expanding distribution networks, also the government support through import facilitation and food safety regulations, and the growing urban consumer demand for nutritious, convenient, and the premium products.

-

Q: What factors restrain the China dairy alternatives market?A: Constraints include the strict import regulations, compliance with food safety and quality standards, seasonal supply limitations for certain plant-based ingredients, high logistics and cold-chain costs, and reliance on imports from a few key countries.

-

Q: How is the market segmented by product?A: The market is segmented into milk, yogurt, cheese, and ice cream.

-

Q: Who are the key players in the China dairy alternatives market?A: Key companies include Danone S.A., Nestlé S.A., Oatly Group AB, Blue Diamond Growers, Vitasoy International Holdings Ltd, Hebei Yangyuan Zhihui Beverage Co. Ltd, Coconut Palm Group Co. Ltd, Dali Foods Group Co. Ltd, Inner Mongolia Yili Industrial Group Co. Ltd, Mengniu Dairy Company Limited., Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?