China Core Banking Software Market Size, Share, By Deployment (Saas/Hosted, Licensed), By Banking Type (Large Banks, Midsize Banks, Small Banks, Community Banks and Credit Unions), By End-User (Retail Banking, Treasury, Corporate Banking, Wealth Management), China Core Banking Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialChina Core Banking Software Market Insights Forecasts to 2035

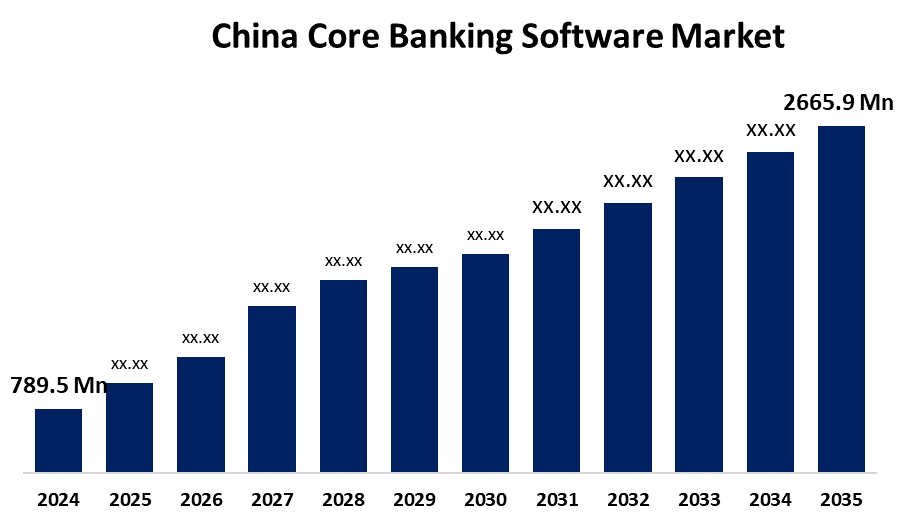

- China Core Banking Software Market Size 2024: USD 789.5 Million

- China Core Banking Software Market Size 2035: USD 2665.9 Million

- China Core Banking Software Market CAGR 2024: 11.7%

- China Core Banking Software Market Segments: By Deployment, By Banking Type, and By End-User

Get more details on this report -

The China core banking software refers to the systems that facilitate all day-to-day operations related to dealing with banks, such as processing deposits, loans, accounts, payments, and customer data, and which serve as the foundation upon which China's banking system operates; that is, all banks in China use these systems for both consumer and corporate transactions.

As China's banking sector becomes fully digital, core banking software will see increased demand for flexible and scalable solutions that can handle ever-increasing transaction volumes via mobile banking, digital payment methods such as Alipay and WeChat Pay, and the integration of Fintech into existing architecture. The major companies in China's core banking software business are regional suppliers who developed performance-driven, cloud-based solutions designed explicitly to meet the needs of China's unique size and regulatory environment.

The core banking software market in China is regulated by a number of regulatory authorities, including the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC). These authorities impose certain business standards that are required to help establish data protection, data security, cybersecurity, interoperability, and compliance with national business practices for Chinese banks. Furthermore, the government has committed to providing opportunities for digital economy development, encouraging greater financial inclusion, encouraging self-reliance in technology use, and providing funding to promote a sustained long-term growth trend in China's core banking software market.

China Core Banking Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 789.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.7% |

| 2035 Value Projection: | 2665.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Deployment, By Banking Type, By End-User |

| Companies covered:: | Shenzhen Sunline Tech Co., Ltd., Hundsun Technologies Inc., Yonyou Network Technology Co., Ltd., iSoftStone Information Technology Group, Neusoft Corporation, Tencent Cloud Financial Services, Huawei Cloud |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Core Banking Software Market:

The China core banking software market is expanding rapidly as banks migrate to digital banking. More mobile and internet transactions are pressuring banks to replace outdated systems that can't manage big volumes, real-time processing, or current features. The government's support for fintech, digital payments, and the digital yuan encourages banks to invest in modern, scalable core banking platforms. Demand is increasing for cloud-based systems, AI integration, and open banking solutions, particularly through collaborations with local technology suppliers.

However, the market faces challenges by strict data security, privacy, and compliance regulations drive up costs and slow down system updates. Replacing outdated banking systems is costly, challenging, and time-consuming. There is a lack of qualified experts in cloud and AI technologies, and fierce competition from regional suppliers weakens pricing power. Major cities have greater adoption rates, whereas rural areas lag due to poor infrastructure.

There are Chinese government policies that promote digital banking, fintech innovation and financial inclusiveness from the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA), amongst others, to the current core banking software market. The infrastructure supporting real-time payments with the use of e-CNY is being improved by PBOC driven by projects, such as Piloting of Digitalized Yuan(s) and embracing a demand for rapid deployment for e-CNY Digitalized Yuan Terrain. Moreover, policies encouraging banks to rely upon local and safe technologies have encouraged banks to utilize local core banking systems which provide for cloud computing, data localization and self-sufficient technologies.

Growth opportunities include wider cloud/SaaS adoption, AI-driven analytics for risk and personalisation, expansion into smaller banks and rural areas, integration with digital yuan ecosystems, and continued innovation in scalable, secure platforms.

Market Segmentation

The China Core Banking Software Market share is classified into deployment, banking type, and end-user.

By Development:

The China core banking software market is segmented into SaaS/Hosted and Licensed. SaaS/Hosted models are growing the fastest, driven by exceptional scalability to manage surging transaction volumes, significantly lower initial capital investment, rapid deployment timelines, automatic continuous upgrades without service interruptions, and seamless integration with fintech APIs, open banking platforms, and digital ecosystems.

By Banking Type:

The China core banking software market is divided by banking type into large banks, midsize banks, small banks, community banks, and credit unions. Midsize banks is experiencing the strongest growth, as they actively pursue digital catch-up to remain competitive with larger institutions, leverage more flexible and cost-effective SaaS solutions, and encounter fewer barriers during system migration compared to massive legacy overhauls in large banks.

By End-User:

The China core banking software market is segmented by end-user into retail banking, treasury, corporate banking, and wealth management. Corporate banking is growing the most rapidly, supported by accelerating digitisation of business operations, rising demand for integrated treasury management solutions, supply-chain financing tools, efficient B2B payment platforms, and the expanding role of digital channels in corporate and trade finance activities across China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Core Banking Software Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Core Banking Software Market:

- Shenzhen Sunline Tech Co., Ltd.

- Hundsun Technologies Inc.

- Yonyou Network Technology Co., Ltd.

- iSoftStone Information Technology Group

- Neusoft Corporation

- Tencent Cloud Financial Services

- Huawei Cloud

Recent Developments in China Core Banking Software Market:

In March 2024: Shenzhen Sunline Tech Co., Ltd. and Huawei Cloud jointly unveiled a new distributed core banking solution designed to offer scalable, high-performance core systems for Chinese banks, deepening their technology partnership.

In March 2025, At the Huawei China Partner Conference 2025, Sunline launched an AI-Powered Core Banking Requirement Analysis Solution developed with Huawei Ascend and DeepSeek to improve core system requirement analysis and speed up response to market needs.

In September 2025, Industrial Bank Co., Ltd., China Academy of Information and Communications Technology (CAICT), and Huawei jointly released the “Financial Intelligent Application Collaboration Guideline” standard draft to support integrated, secure intelligent financial systems.

In November 2025, Huawei Cloud Stack was reported to have retained the largest market share in China’s financial private cloud infrastructure, reinforcing its role as key cloud support for banks’ core system modernization.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Sperical Insigts has segmented the China Core Banking Software Market based on the below-mentioned segments

China Core Banking Software Market, By Deployment

- SaaS/Hosted

- Licensed

China Core Banking Software Market, By Banking Type

- Large Banks

- Midsize Banks

- Small Banks

- Community Banks and Credit Unions

China Core Banking Software Market, By End-User

- Retail Banking

- Treasury

- Corporate Banking

- Wealth Management

Frequently Asked Questions (FAQ)

-

1. What is the current size of the China Core Banking Software Market?The market was approximately USD 789.5 million in 2024 and is expected to reach around USD 2665.9 million by 2035.

-

2. What is the growth rate of the China Core Banking Software Market during the forecast period?It is projected to grow at a CAGR of about 11.7% during 2025–2035.

-

3. What does the China Core Banking Software Market include?It includes software platforms that manage core banking operations like deposits, loans, accounts, and transactions for banks across China.

-

4. Which deployment model is growing fastest in the China Core Banking Software Market?SaaS/hosted models, due to flexibility, cost savings, and quick scalability.

-

5. What are the key factors driving the growth of the China Core Banking Software Market?Digital transformation, mobile banking surge, government fintech support, and legacy system upgrades.

-

6. What are the major challenges faced by the China Core Banking Software Market?Regulatory compliance, migration complexities, cybersecurity risks, and competition.

Need help to buy this report?