China Convenience Stores Market Size, Share, By Store Type (Traditional, Forecourt, and Chain Stores), By Product (Foodservice, Packaged Food, Beverages, and Tobacco), By Channel (In-Store, Online Click-And-Collect), and China Convenience Stores Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsChina Convenience Stores Market Insights Forecasts to 2035

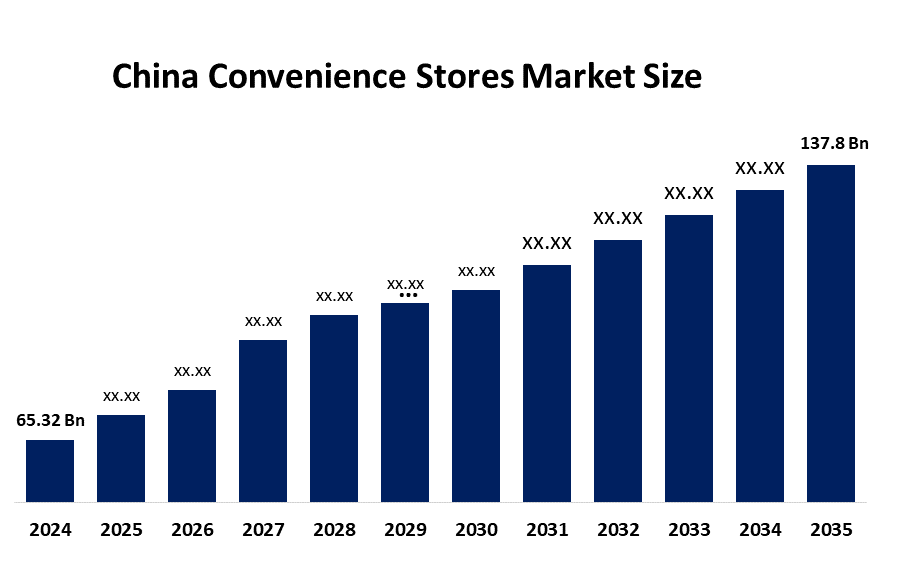

- China Convenience Stores Market Size 2024: USD 65.32 Billion

- China Convenience Stores Market Size 2035: USD 137.8 Billion

- China Convenience Stores Market CAGR: 7.02%

- China Convenience Stores Market Segments: Store Type, Product, and Channel

Get more details on this report -

China’s convenience store market continues to expand rapidly, with increasing store counts and retail sales as operators adapt to evolving consumer demand for fresh food, quick service, and multi-channel retail experiences. To capitalize on urban consumption growth and increasing digital engagement, major chains are concentrating on "store + online" instant retail models and extended service formats, including 24-hour operations. The majority of new net additions are driven by large operators, and store openings and sales growth continue to be important indicators of market strength.

This evolution is actively supported by government policy. As part of China's urban planning and "15 minute community life circle" policy, national and provincial programs support community-level retail, including smart and unmanned convenience stores, as part of the infrastructure for urban consumption. To improve retail management and customer experience, regulatory support under the "14th Five Year Plan" places a strong emphasis on digital transformation, non-contact services, standardized and green development, and the integration of contemporary technologies like the Internet of Things (IoT), big data, and mobile payments.

The main force behind industry transformation is technological advancement. Efficiency and customer convenience are increased by digital and AI-enabled tools, such as cloud-based labor and inventory systems, intelligent logistics, and contactless payment. Precision merchandising and omnichannel expansion are made possible by unmanned retail formats and data-driven customer insights, which assist retailers in differentiating their products in a cutthroat market.

Market Dynamics of the China Convenience Stores Market:

Rapid urbanization, changing customer lifestyles, and rising disposable incomes that favour quick, accessible retail formats are all contributing to the strong growth of China's convenience store industry. Along with the acceptance of digital payments and connection with e-commerce platforms, the growth of shop networks, particularly in metropolitan and lower-tier cities, improves customer convenience and expands market reach. Efficiency and consumer satisfaction are further enhanced by technological innovation, such as AI-enabled inventory management and instant retail services. Demand is being reinforced by consumers' growing desire for fresh, ready-to-eat foods, health-conscious goods, and extended service formats, including round-the-clock operations.

The market is constrained by a number of factors, though. Profit margins are squeezed by high operating and rental costs, and price pressure is increased by fierce competition from both traditional retail and internet channels. Expansion initiatives and steady product availability may be hampered by regional regulatory obstacles and supply chain complexity. Price sensitivity among consumers may reduce discretionary spending at convenience stores, particularly during economic downturns.

Partnerships in e-commerce, network development into semi-urban and rural markets, and product innovation present significant prospects. Adoption of omnichannel shopping and strategic partnerships with delivery platforms can open up new revenue sources. Additionally, incorporating community initiatives and utilizing private-label goods can boost brand differentiation and loyalty.

China Convenience Stores Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 65.32 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.02% |

| 2035 Value Projection: | USD 137.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Store Type, By Product |

| Companies covered:: | 7-Eleven China, Lawson China, FamilyMart China, Alibaba’s Hema, Bingobox, Meiyijia Convenience Store, Easy Joy (Sinopec Group), PetroChina uSmile, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China convenience stores market share is classified into store type, product, and channel

By Store Type:

On the basis of store type, the China convenience store market is categorized into traditional, forecourt, and chain stores. Among these, the chain stores segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. Due to effective supply chain management, standardized processes, and high brand recognition. Their extensive product assortments, 24/7 availability, and quick urban expansion draw large crowds. Additionally, during the course of the forecast period, steady growth is supported by the integration of digital payments, loyalty programs, and ready-to-eat options.

By Product:

Based on product, the China convenience stores market is divided into foodservice, packaged food, beverages, and tobacco. Among these, the foodservice segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is influenced by urban consumers' growing desire for fresh snacks, ready-to-eat meals, and on-the-go food options. This market is heavily supported by busy lives, long workdays, and a growing need for quick eating options.

By Channel:

The China convenience stores market is classified by channel into in-store and online click-and-collect. Among these, the in-store channel segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main reason for this dominance is substantial foot traffic in residential and urban locations, high impulse buying, and instant product availability. For short meals, drinks, and everyday necessities, customers still prefer to visit stores. Convenience stores are widely available, and their extended operating hours contribute to the segment's promising growth prospects.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China convenience stores market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Convenience Stores Market:

- 7-Eleven China

- Lawson China

- FamilyMart China

- Alibaba’s Hema

- Bingobox

- Meiyijia Convenience Store

- Easy Joy (Sinopec Group)

- PetroChina uSmile

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China convenience stores market based on the following segments:

China Convenience Stores Market, By Store Type

- Traditional

- Forecourt

- Chain Stores

China Convenience Stores Market, By Product

- Foodservice

- Packaged Food

- Beverages

- Tobacco

China Convenience Stores Market, By Channel

- In-Store

- Online Click-And-Collect

Frequently Asked Questions (FAQ)

-

1.What is the projected market size of the China convenience stores market by 2035?The market is projected to grow from USD 65.32 billion in 2024 to USD 137.8 billion by 2035, registering a CAGR of 7.02% during the forecast period (2025–2035).

-

2.What are the key growth drivers of the China convenience stores market?Key drivers include rapid urbanization, changing consumer lifestyles, increasing disposable incomes, digital payment adoption, and integration with e-commerce and instant retail platforms.

-

3.What challenges does the China convenience store market face?Major challenges include high rental and operating costs, intense competition, supply-chain complexities, regulatory variations, and consumer price sensitivity.

-

4.What opportunities exist in the China convenience stores market?Opportunities lie in omnichannel retailing, expansion into semi-urban and rural areas, private-label products, smart/unmanned stores, and partnerships with online delivery platforms.

-

5.Who are the key players in the China convenience stores market?Key players include 7-Eleven China, Lawson China, FamilyMart China, Alibaba’s Hema, Meiyijia, Easy Joy (Sinopec), PetroChina uSmile, Bingobox, and others.

Need help to buy this report?