China Compound Feed Market Size, Share, By Type (Poultry Feed, Swine Feed, Ruminant Feed, And Aquaculture Feed), By Ingredient (Cereals & Grains, Oilseeds & Meals, Additives, And Vitamins & Minerals), By Form (Pellets, Mash, And Extruded), And China Compound Feed Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesChina Compound Feed Market Size Insights Forecasts to 2035

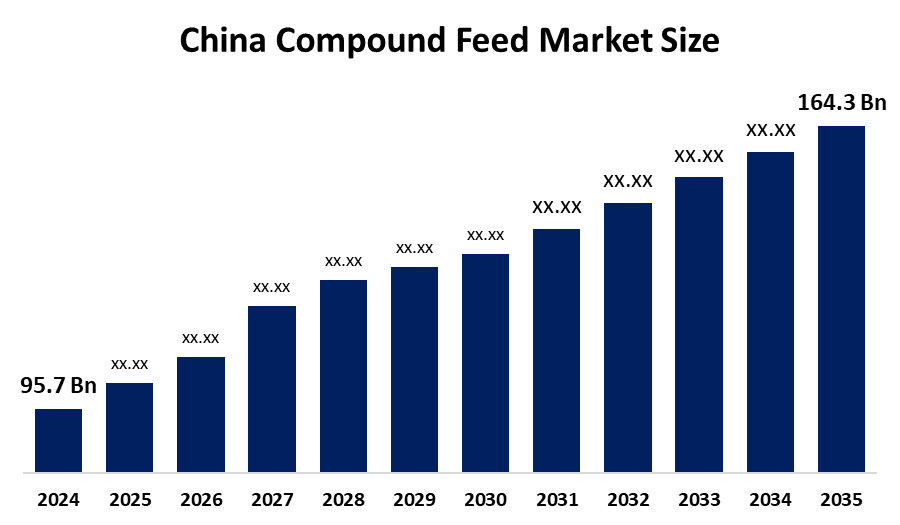

- China Compound Feed Market Size 2024: USD 95.7 Bn

- China Compound Feed Market Size 2035: USD 164.3 Bn

- China Compound Feed Market Size CAGR 2024: 5.04%

- China Compound Feed Market Size Segments: Type, Ingredient, and Form

Get more details on this report -

China Compound Feed Market Size consists of complements of animal feed, that is, nutritionally balanced formulations made up of combinations of grain, protein, vitamin, and mineral ingredients designed to help maintain and enhance the growth and health of poultry, livestock, aquaculture and other farmed animals. Compounded animal feeds represent an important upstream sector of the larger livestock and aquaculture sectors by taking raw materials from the agricultural sector to produce efficient animal production systems. China's compound feed industry has a similar role to play within China's agricultural economy as a key supplier of feed products used to feed livestock both in China and worldwide. Additionally, China is currently one of the largest producers and consumers of animal feed globally.

The Compound Feeds in China are backed by government support, including the long-term strategy of China to modernize agriculture and achieve food security by 2035. The strategy focuses on self-sufficiency and stability of food supply through increased investment into improvements in agricultural productivity, by promoting modern feed formulation, efficient farming systems, and the application of biotechnologies in agriculture. In 2023, China's total industrial feed output reached more than 315 million metric tons; thus, highlights the large scale of this type of output as well as its ability to support both livestock production and food security.

As technology advances, Chinese Compound Feed providers are now using automated feed-manufacturing processes along with the creation of precise nutritional formulations levelled according to species and growth stages, as well as exploring alternative proteins which may include using insects or fermentation as an alternative source for protein and improve feed efficiency; while reducing the overall cost of feed and providing an improved nutrient profile, creating a sustainable and competitive advantage in the marketplace.

China Compound Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 95.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.04% |

| 2035 Value Projection: | 164.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Ingredient |

| Companies covered:: | New Hope Group, Wen’s Foodstuff Group, CP Group, Haid Group, Tongwei Group, Zhengda International Group, Wellhope Agri-Tech, Shandong Backbone Group, Cargill Inc., Archer Daniels Midland, Nutreco N.V., Alltech Inc., Evonik Industries AG, BASF, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Compound Feed Market Size:

The China Compound Feed Market Size is driven by the growing population, rising disposable income and urbanization, increasing farm participation in growing livestock through use of dairy and beef, and focused modernization agendas will continue to support demand for higher quality feeds.

The China Compound Feed Market Size is restrained by the volatility in raw material prices, stringent regulatory requirements for feed safety and quality, and susceptibility of livestock industries to disease outbreaks, and environmental concerns associated with intensive animal farming.

The future of China Compound Feed Market Size is bright and promising, with versatile opportunities emerging from the creation of environmentally-friendly and efficient feed products provides opportunities for the implementation of more exacting nutritional methods, with the opportunity expanding into various niche markets like organic and value-added ingredients for pets and aquaculture. Also, government regulations that encourage reducing reliance upon foreign feed raw materials and investing in the research and development of local feed materials offer potential areas of growth and increased market share.

Market Segmentation

The China Compound Feed Market Size share is classified into type, ingredient, and form.

By Type:

The China Compound Feed Market Size is divided by type into poultry feed, swine feed, ruminant feed, and aquaculture feed. Among these, the swine feed segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High meat consumption, industrialization of livestock production, government initiatives and regulations, and urbanization with increase in disposable incomes all contribute to the swine feed segment's largest share and higher spending on compound feed when compared to other type.

By Ingredient:

The China Compound Feed Market Size is divided by ingredient into cereals & grains, oilseeds & meals, additives, and vitamins & minerals). Among these, the cereals & grains segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cereals & grains segment dominates because of high abundance energy source, cost effectiveness, versatility, and crucial role in high demand feeds for pigs and poultry with massive meat consumption in China.

By Form:

The China Compound Feed Market Size is divided by form into pellets, mash, and extruded. Among these, the mash segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cost efficiency, nutritional balance with consistent mixture, prevents selective feeding leading to better overall nutrition all contribute to the mash segment's largest share and higher spending on compound feed when compared to other form.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Compound Feed Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Compound Feed Market Size:

- New Hope Group

- Wen’s Foodstuff Group

- CP Group

- Haid Group

- Tongwei Group

- Zhengda International Group

- Wellhope Agri-Tech

- Shandong Backbone Group

- Cargill Inc.

- Archer Daniels Midland

- Nutreco N.V.

- Alltech Inc.

- Evonik Industries AG

- BASF

- Others

Recent Developments in China Compound Feed Market Size:

In November 2025, Louis Dreyfus Company opened a new speciality feed protein production line in Tianjin, China. The facility, LDC’sm first investment in commercial-scale speciality feed protein production, initially focuses on fermented soybean meal with a 60,000 tonnes/year capacity.

In July 2025, Corbion secured multiple regulatory approvals from China’s General Administration of Customs, allowing the introduction of its algae-derived omega-3DHA products into China’s animal nutrition markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Compound Feed Market Size based on the below-mentioned segments:

China Compound Feed Market Size, By Type

- Poultry Feed

- Swine Feed

- Ruminant Feed

- Aquaculture Feed

China Compound Feed Market Size, By Ingredient

- Cereals & Grains

- Oilseeds & Meals

- Additives

- Vitamins & Minerals

China Compound Feed Market Size, By Form

- Pellets

- Mash

- Extruded

Frequently Asked Questions (FAQ)

-

What is the China Compound Feed Market Size ?China Compound Feed Market Size is expected to grow from USD 95.7 billion in 2024 to USD 164.3 billion by 2035, growing at a CAGR of 5.04% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing domestic demand for animal protein, rising incomes and urbanization, increasing industrialization of livestock farming, and policies aimed at modernizing agriculture, and expansion of aquaculture and poultry industries also contributes to sustained demand for high-quality compound feeds.

-

What factors restrain the China Compound Feed Market Size?Constraints include the volatility in raw material prices, stringent regulatory requirements for feed safety and quality, and susceptibility of livestock industries to disease outbreaks, and environmental concerns associated with intensive animal farming.

-

How is the market segmented by type?The market is segmented into poultry feed, swine feed, ruminant feed, and aquaculture feed.

-

Who are the key players in the China Compound Feed Market Size?Key companies include New Hope Group, Wen’s Foodstuff Group, CP Group, Haid Group, Tongwei Group, Zhengda International Group, Wellhope Agri-Tech, Shandong Backbone Group, Cargill Inc., Archer Daniels Midland, Nutreco N.V., Alltech Inc., Evonik Industries AG, BASF, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

-

What is the China Compound Feed Market Size ?China Compound Feed Market Size is expected to grow from USD 95.7 billion in 2024 to USD 164.3 billion by 2035, growing at a CAGR of 5.04% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing domestic demand for animal protein, rising incomes and urbanization, increasing industrialization of livestock farming, and policies aimed at modernizing agriculture, and expansion of aquaculture and poultry industries also contributes to sustained demand for high-quality compound feeds.

-

What factors restrain the China Compound Feed Market Size?Constraints include the volatility in raw material prices, stringent regulatory requirements for feed safety and quality, and susceptibility of livestock industries to disease outbreaks, and environmental concerns associated with intensive animal farming.

-

How is the market segmented by type?The market is segmented into poultry feed, swine feed, ruminant feed, and aquaculture feed.

-

Who are the key players in the China Compound Feed Market Size?Key companies include New Hope Group, Wen’s Foodstuff Group, CP Group, Haid Group, Tongwei Group, Zhengda International Group, Wellhope Agri-Tech, Shandong Backbone Group, Cargill Inc., Archer Daniels Midland, Nutreco N.V., Alltech Inc., Evonik Industries AG, BASF, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?