China Citric Acid Market Size, Share, and COVID-19 Impact Analysis, By Form (Anhydrous and Liquid), By Application (Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, and Others), and China Citric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Citric Acid Market Insights Forecasts to 2035

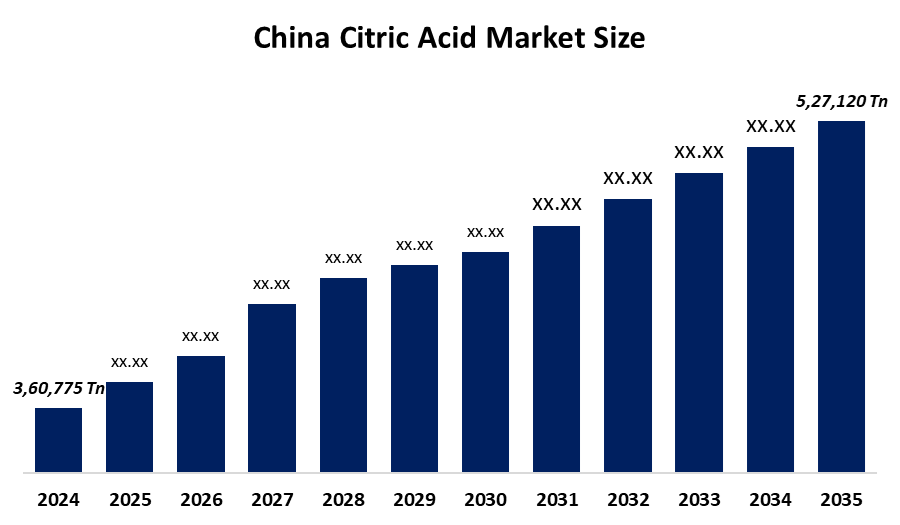

- The China Citric Acid Market Size Was Estimated at 3,60,775 Tons in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.51% from 2025 to 2035

- The China Citric Acid Market Size is Expected to Reach 5,27,120 Tons by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The China Ctric Acid Market Size is anticipated to reach 5,27,120 tons by 2035, Growing at a CAGR of 3.51% from 2025 to 2035. The China citric acid market is growing due to robust demand from the food and beverage sector, increasing pharmaceutical manufacturing, growth in the personal care industry, higher consumption of processed foods, expanding exports, and a rising preference for biodegradable and eco-friendly ingredients in cleaning and detergent products

Market Overview .

The China citric acid market refers to the production, consumption, export, and import of citric acid within China, including its use across food & beverages, pharmaceuticals, personal care, and industrial applications. In China, citric acid is widely used in food and beverages as a preservative and flavor enhancer, in pharmaceuticals as a stabilizer, in cosmetics for pH control, and in detergents and cleaners for various industrial applications. The market is driven by strong demand from the food and beverage industry, growing pharmaceutical production, an expanding personal care sector, rising processed food consumption, export growth, and increasing demand for biodegradable and eco-friendly ingredients in detergents and cleaners.

Key opportunities in the China citric acid market include expanding demand for processed and convenience foods, rising pharmaceutical and nutraceutical production, growing exports to North America and Europe, increasing use in biodegradable detergents, and technological advancements in fermentation that improve production efficiency and cost competitiveness. In December 2025, the U.S. initiated a third sunset review of antidumping and countervailing duties on citric acid from China, prompting Chinese producers to strengthen compliance and competitiveness, ultimately supporting long-term export market stability and growth.

Report Coverage

This research report categorizes the market for the China citric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China citric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China citric acid market.

China Citric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3,60,775 Ton |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.51% |

| 2035 Value Projection: | 5,27,120 Tons |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Form |

| Companies covered:: | TTCA Co., Ltd., RZBC Group Co. Ltd, COFCO Biochemical (Anhui) Co., Ltd., Anhui BBCA Biochemical Co., Ltd., Laiwu Taihe Biochemistry Co. Ltd., Huangshi Xinghua Biochemical Co., Ltd., Arshine Group Co., Ltd., GYF Biotech Ltd., Jiangsu Hongbao Bio-Chemical Co., Ltd., and Other key palyers |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The citric acid market in China is driven by growing applications in the food and beverage, pharmaceutical, and cosmetics sectors, rising consumer demand for natural preservatives and clean-label products has boosted citric acid use, especially in processed foods, beverages, and confectionery, Increasing adoption in sustainable and green chemistry applications further supports growth, massive and low-cost production, high export volumes, and surging domestic demand in the food, beverage, and pharmaceutical industries. Growth is fueled by the increased use of citric acid as a preservative, acidulant, and cleaner in household products

Restraining Factors

The China citric acid market is primarily restrained by a combination of intense international trade barriers, high raw material price volatility, and stringent environmental regulations, weak global demand, geopolitical risks, and anti- dumping duties & trade barriers.

Market Segmentation

The China citric acid market share is classified into form and application.

- The anhydrous segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China citric acid market is segmented by form into anhydrous and liquid. Among these, the anhydrous segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to its extensive utilization across the food, beverage, and pharmaceutical sectors. Its superior stability, extended shelf life, and moisture-free characteristics make it essential for a wide range of formulations, particularly in dry products, reinforcing its critical role in these industries.

- The food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China citric acid market is segmented by application into food and beverages, household detergents and cleaners, pharmaceuticals, and others. Among these, the food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the food and beverage segment represents the primary catalyst for citric acid consumption, owing to its widespread application as a preservative and flavoring agent in processed foods, confectionery, and beverages. This segment maintains market dominance driven by increasing demand for natural additives and the expanding popularity of ready-to-drink and convenience-oriented products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China citric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TTCA Co., Ltd.

- RZBC Group Co. Ltd

- COFCO Biochemical (Anhui) Co., Ltd.

- Anhui BBCA Biochemical Co., Ltd.

- Laiwu Taihe Biochemistry Co. Ltd.

- Huangshi Xinghua Biochemical Co., Ltd.

- Arshine Group Co., Ltd.

- GYF Biotech Ltd.

- Jiangsu Hongbao Bio-Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, TTCA Co., Ltd recently showcased corporate cooperation developments and industrial chain collaboration with Huaguang Group, signalling expanded capacity and supply partnerships. This strategic move aligns with the growing demand in the China citric acid market, which is both expanding domestically, driven by food, beverage, and pharmaceutical sectors and maintaining strong export potential

- In February 2025, RZBC Group Co., Ltd honoured as an Enterprise with Contribution to Economic Development and Leading Manufacturing Enterprise, reflecting strategic industry positioning and brand recognition. RZBC’s leadership in the Chinese citric acid industry is significant given the market’s high competition and export-oriented nature, where innovation, production efficiency, and supply chain integration are critical to maintaining market share both domestically and internationally.

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China citric acid market based on the below-mentioned segments:

China Citric Acid Market, By Form

- Anhydrous

- Liquid

China Citric Acid Market, By Application

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

What is the China citric acid market?The China citric acid market encompasses production, consumption, imports, and exports of citric acid, used across food & beverages, pharmaceuticals, personal care, and industrial applications like detergents and cleaners.

-

What is the projected China citric acid market size by 2035?The China citric acid market is expected to reach 5,27,120 tons by 2035, growing at a CAGR of 3.51% during 2025-2035 due to rising domestic and export demand.

-

What factors are driving growth in the China citric acid market?Growth is driven by strong demand from the food & beverage, pharmaceutical and personal care sectors, rising processed food consumption, export expansion, and eco-friendly detergent applications.

-

What factors are restraining the China citric acid market?The market is restrained by international trade barriers, raw material price volatility, stringent environmental regulations, weak global demand, geopolitical risks, and anti-dumping duties on exports.

-

What are the key opportunities in the China citric acid market?Opportunities include rising demand for processed and convenience foods, growth in pharmaceutical and nutraceutical production, expanding exports, use in biodegradable detergents, and technological advancements in fermentation, improving efficiency.

Need help to buy this report?