China Cell Therapy Raw Materials Market Size, Share, By Product (Media, Sera, Cell Culture, Supplements, Antibodies, Reagents & Buffers, Others), By End Use (Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs, Others), China Cell Therapy Raw Materials Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Cell Therapy Raw Materials Market Size Insights Forecasts to 2035

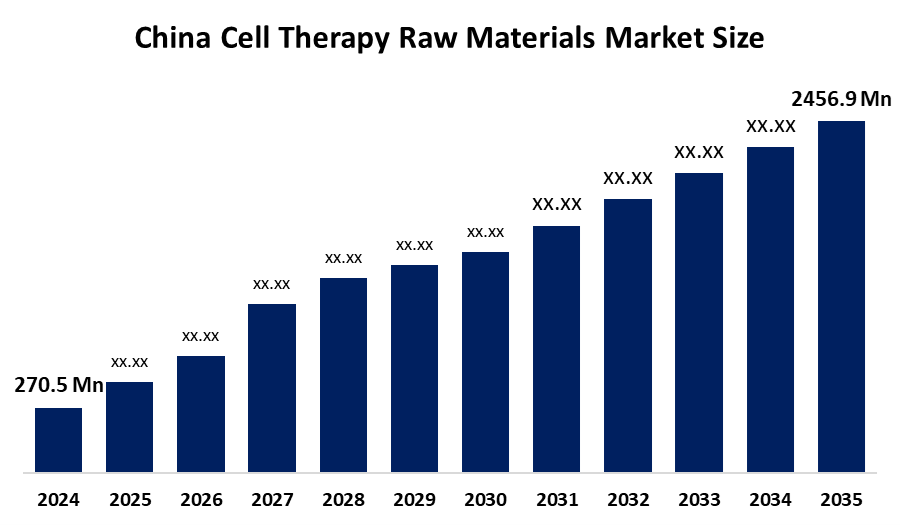

- China Cell Therapy Raw Materials Market Size 2024: USD 270.5 Mn

- China Cell Therapy Raw Materials Market Size 2035: USD 2456.9 Mn

- China Cell Therapy Raw Materials Market Size CAGR 2024: 22.21%

- China Cell Therapy Raw Materials Market Size Segments: Product and End Use

Get more details on this report -

The China Cell Therapy Raw Materials Market Size is a rapidly booming sector, this covers cell culture media, reagents, consumables for bioprocessing, and specialty biomaterials, transitioning from low-value imports to high-value, domestically produced goods. Growing demand from CAR-T, stem cell, and gene therapy developers, robust government backing, and fierce rivalry between local suppliers and international companies motivated by innovation policies and unmet therapeutic needs are its defining characteristics. In addition, China’s market blends its strengths in large-scale bio manufacturing, regulatory advancements, and collaborations, creating a dynamic ecosystem for scalable, high-quality cell therapy raw material production.

China’s National Medical Products Administration (NMPA) has implemented expedited regulatory pathways such as Priority Review, Breakthrough Therapy Designation, and Conditional Approval, which are applied to Advanced Therapy Medicinal Products (ATMPs) including cell therapies, to accelerate review and approvals. These pathways are part of NMPA’s regulatory reforms to shorten approval timelines and support innovative therapies in China.

The China Cell Therapy Raw Materials Market Size offers significant growth which is driven by rising demand for CAR-T, stem cell, and gene therapies, an aging population, and the technological advancements such as AI-enabled process optimization and automated bio manufacturing. This creates the various opportunities in high-quality cell culture media, reagents, and the bioprocessing consumables, with a shift toward locally manufactured, high-value materials and global collaborations. The key areas include scalable production for oncology and regenerative therapies, robust supply chains for critical raw materials, and the leveraging data analytics for process standardization, all supported by the government initiatives promoting innovation, streamlined approvals, and digital integration despite cost pressures.

China Cell Therapy Raw Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 270.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.21% |

| 2035 Value Projection: | 2456.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, ACROBiosystems, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Cell Therapy Raw Materials Market Size

The China Cell Therapy Raw Materials Market Size is driven by the booming the demand for CAR-T, stem cell, and gene therapies, strong government support, favorable funding policies, and an expanding local manufacturing ecosystem, all transforming it from a reliance on imports to a global innovation hub. The need for premium cell culture medium, reagents, and bioprocessing consumables is increased by the quickly expanding biotech and regenerative medicine industries. There is a rise in the investments and increasing adoption of advanced therapies allow companies to scale production and innovate, positioning China as a key source of critical raw materials for both domestic and international cell therapy development.

The China Cell Therapy Raw Materials Market Size faces restraints such as intense price competition, intellectual property challenges, fragmented regulatory standards, and quality concerns. Dependence on imported high-end reagents and biomaterials, talent shortages in advanced bioprocessing, and geopolitical tensions further pressure domestic growth and innovation, despite the market’s significant long-term potential.

The future of China’s cell therapy raw materials market looks very bright and promising, which is driven by the rapid technological advancements, supportive government policies, and the rising demand for CAR-T, stem cell, and gene therapies. While AI-enabled process optimization, digital integration, and the automation improves the efficiency of manufacturing and quality, scalable production is made possible by high-quality cell culture medium, reagents, and bioprocessing consumables. Additionally, regulatory reforms, streamlined approval pathways, and increasing domestic capabilities are strengthening supply chains and expanding access, creating significant growth opportunities across China’s evolving cell therapy ecosystem.

Market Segmentation

The China Cell Therapy Raw Materials Market Size share is classified into product and end use.

By Product

The China Cell Therapy Raw Materials Market Size is divided by product into media, sera, cell culture, supplements, antibodies, reagents & buffers, others. Among these, the cell culture, supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their critical role in cell survival, growth, differentiation, and functionality, fueling the increasing demand for advanced therapies like CAR-T and personalized medicine.

By End Use

The China Cell Therapy Raw Materials Market Size is divided by end use into biopharmaceutical & pharmaceutical companies, Cros & Cmos, others. Among these, the biopharmaceutical & pharmaceutical companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Driven by massive investments in R&D, clinical trials, and commercializing new therapies like CAR-T.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China Cell Therapy Raw Materials Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Cell Therapy Raw Materials Market Size

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Sartorius AG

- ACROBiosystems

- Others

Recent Developments in China Cell Therapy Raw Materials Market Size

In December 2025, Lonza’s TheraPEAK™ T-VIVO, a chemically defined, serum-free, and animal-component-free medium, was widely adopted for CAR-T cell production. It supports consistent and scalable manufacturing while meeting regulatory standards in China’s cell therapy raw materials market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Cell Therapy Raw Materials Market Size based on the below-mentioned segments:

China Cell Therapy Raw Materials Market Size, By Product

- Media, Sera

- Cell Culture

- Supplements

- Antibodies

- Reagents & Buffers

- Others.

China Cell Therapy Raw Materials Market Size, By End Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Others

Frequently Asked Questions (FAQ)

-

What is the China Cell Therapy Raw Materials Market Size?China Cell Therapy Raw Materials Market Size is expected to grow from USD 270.5 million in 2024 to USD 2456.9 million by 2035, growing at a CAGR of 22.21% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the booming the demand for CAR-T, stem cell, and gene therapies, strong government support, favorable funding policies, and an expanding local manufacturing ecosystem.

-

What factors restrain the China Cell Therapy Raw Materials Market Size?Constraints include intense price competition, intellectual property challenges, fragmented regulatory standards, and quality concerns.

-

How is the market segmented by product?The market is segmented into media, sera, cell culture, supplements, antibodies, reagents & buffers, others.

-

Who are the key players in the China Cell Therapy Raw Materials Market Size?Key companies include Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, ACROBiosystems, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?