China Cell Line Development Market Size, Share, By Products & Services (Reagents & Media, Equipment, Bioreactors, Automated Systems, Centrifuges, Storage Equipment, and Others), By Source (Mammalian Cell Line, Non-mammalian Cell Line, Insects, and Amphibians), By Type (Recombinant Cell Lines, Hybridomas, Continuous Cell Lines, and Primary Cell Lines), and China Cell Line Development Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Cell Line Development Market Insights Forecasts to 2035

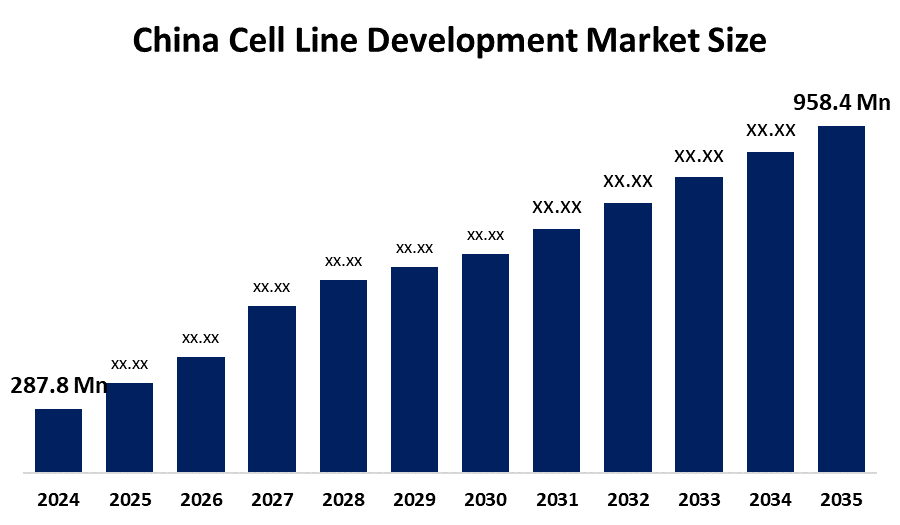

- China Cell Line Development Market Size 2024: USD 287.8 Mn

- China Cell Line Development Market Size 2035: USD 958.4 Mn

- China Cell Line Development Market CAGR: 11.56%

- China Cell Line Development Market Segments: Products and Services, Source, and Type.

Get more details on this report -

The services and technologies utilized in the development, optimization, and characterisation of stable cell lines for the manufacture of biologics, monoclonal antibodies, vaccines, recombinant proteins, and cutting-edge treatments make up the Chinese cell line development market. A crucial stage in the production of biopharmaceuticals is cell line creation, which guarantees high expression levels, product uniformity, and regulatory compliance. The market serves China's quickly growing pharmaceutical and biotechnology industries, which include both domestic producers and multinational corporations using local CDMOs and CROs.

Through programs like "Healthy China 2030" and laws encouraging biotechnology innovation, biologics self-sufficiency, and sophisticated medicine manufacturing, the Chinese government actively supports the expansion of the biopharmaceutical sector. The National Medical Products Administration (NMPA) has increased compliance with international regulatory standards, promoted innovation, and expedited biologics licensing processes. Furthermore, local cell line development skills are being strengthened by growing public and private investment in biotech parks and research infrastructure.

Technological advancements are significantly shaping the market, with increasing adoption of gene editing technologies, automation, high-throughput screening, and sophisticated cell engineering platforms. Cell line development is becoming more effective and competitive in China's biopharmaceutical ecosystem thanks to innovations in CHO cell line optimization, expression system development, and data-driven process optimization that increase productivity, shorten development times, and improve scalability.

Market Dynamics of the China Cell Line Development Market:

The biopharmaceutical industrys explosive growth, especially in the manufacturing of vaccines, biologics, and monoclonal antibodies, is the main driver of the China cell line development market. The use of advanced cell line development services is being accelerated by growing RD investments, growing demand for biosimilars, and Chinas emphasis on domestic biologics manufacturing. Pharmaceutical businesses are also being encouraged to outsource cell line creation to specialist providers by the National Medical Products Administration's NMPA favourable regulatory reforms and the growth of CRO CDMO services.

However, the market faces obstacles such as high development costs, lengthy development schedules, and the requirement for highly qualified scientific competence despite its robust expansion. Adoption may also be hampered by complicated regulatory compliance requirements and intellectual property issues, especially for small and mid-sized biotech companies.

Growing international partnerships, the increasing need for biologics and customized medications, and developments in genetic engineering, cell line optimization, and automation technologies all present significant prospects. Long-term growth prospects are further strengthened by government programs promoting biotechnology innovation and the development of biomanufacturing infrastructure.

China Cell Line Development Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 287.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.56% |

| 2035 Value Projection: | USD 958.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Source, By Type |

| Companies covered:: | Danaher,Creative BioLabs,WuXi Biologics,WuXI AppTec,Lonza Group,Thermo Fisher Scientific,Merck KGaA,Corning Incorporated,Selexis SA,Sartorius AG And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China Cell Line Development Market share is classified into products and services, source, and type.

By Products and Services:

On the basis of products and services, the China cell line development market is categorized into reagents media, equipment, bioreactors, automated systems, centrifuges, storage equipment, and others. Among these, the reagents and media segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. The recurrent nature of consumables, the growing development of biologics and biosimilars, and the growing need for optimal cell culture medium to improve cell viability and productivity are the main factors driving this dominance.

By Source:

Based on the source, the China cell line development market is divided into mammalian cell line, non-mammalian cell line, insects, and amphibians. Among these, the mammalian segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is largely due to the widespread use of mammalian cell lines, particularly CHO, HEK293, and hybridoma cells, in the creation of monoclonal antibodies, vaccines, recombinant proteins, and advanced biologics. The robust growth potential for the pharmaceutical sector is further fueled by the growing emphasis on biosimilars, cell and gene treatments, and the rise of biopharmaceutical manufacturing and CDMO services in China.

By Type:

The China cell line development market is classified by type into recombinant cell lines, hybridomas, continuous cell lines, and primary cell lines. Among these, the recombinant cell lines segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The broad application of recombinant cell lines in the massive production of hormones, vaccines, monoclonal antibodies, and other therapeutic proteins is what propels this leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China cell line development market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Cell Line Development Market:

- Danaher

- Creative BioLabs.

- WuXi Biologics

- WuXI AppTec

- Lonza Group

- Thermo Fisher Scientific

- Merck KGaA

- Corning Incorporated

- Selexis SA

- Sartorius AG

- Others

Recent Developments in the China Cell Line Development Market:

- In April 2025, with a high-yield CHO K cell line, Thermo Fisher Scientific introduced an improved integrated platform that shortened IND filing times from 13 to 9 months while increasing productivity and stability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China cell line development market based on the following segments:

China Cell Line Development Market, By Products and Services

- Reagents & Media

- Equipment

- Bioreactors

- Automated Systems

- Centrifuges

- Storage Equipment

- Others

China Cell Line Development Market, By Source

- Mammalian Cell Line

- Non-mammalian Cell Line

- Insects

- Amphibians

China Cell Line Development Market, By Type

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

Frequently Asked Questions (FAQ)

-

1. What is the base year and forecast period for the China cell line development market?The base year for the study is 2024, with historical data covering 2020–2023. The forecast period extends from 2025 to 2035.

-

2. What is the market size and growth outlook of the China cell line development market?The market was valued at USD 287.8 million in 2024 and is expected to reach USD 958.4 million by 2035, growing at a CAGR of 11.56% during the forecast period.

-

3. Which products and services segment dominates the China cell line development market?The reagents & media segment held the largest market share in 2024 due to the recurrent demand for consumables and the increasing development of biologics and biosimilars.

-

4. Which source segment leads the China cell line development market?The mammalian cell line segment dominated the market in 2024, driven by its extensive use in producing monoclonal antibodies, vaccines, recombinant proteins, and advanced biologics.

-

5. Which type of cell line accounted for the highest market share?The recombinant cell lines segment dominated the market in 2024 owing to its widespread application in large-scale production of therapeutic proteins, hormones, and vaccines.

Need help to buy this report?