China Carbon Capture Storage Market Size, Share, By Application (Power Generation, Cement, Oil and Gas, Metal Production, and Others), By Technology (Post Combustion, Industrial Process, Oxy-combustion, and Pre-combustion), and China Carbon Capture Storage Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerChina Carbon Capture Storage Market Size Insights Forecasts to 2035

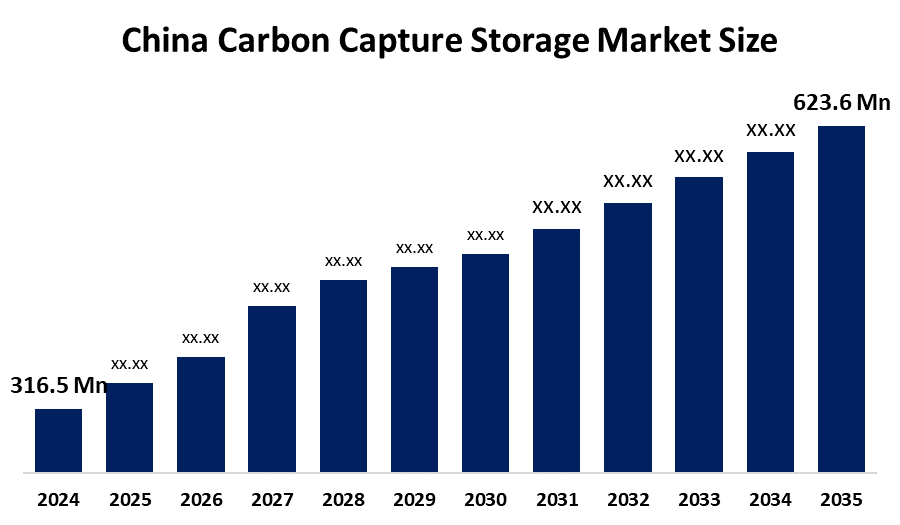

- China Carbon Capture Storage Market Size 2024: USD 316.5 Mn

- China Carbon Capture Storage Size 2035: USD 623.6 Mn

- China Carbon Capture Storage Market CAGR: 6.36%

- China Carbon Capture Storage Market Segments: Application and Technology

Get more details on this report -

Technologies and services intended to absorb carbon dioxide (CO2) emissions from industrial sources, transport them, and permanently store them underground to prevent atmospheric release are referred to as the China Carbon Capture and Storage (CCS) market. For difficult-to-abate industries including coal-fired power generation, cement, steel, chemicals, and oil refining, CCS is seen as a crucial decarbonisation strategy.

As part of its national climate plan, which is in line with the 2030 carbon peak and 2060 carbon neutrality targets, the Chinese government aggressively encourages CCS. National energy and climate roadmaps incorporate CCS, along with finance for research, industry pilots, and legislative support for demonstration projects. CCS hubs, carbon utilization initiatives, and integration with China's carbon emissions trading system (ETS) are all supported by government-backed businesses and regional authorities to boost project profitability.

Reducing costs and increasing efficiency are the main goals of technological advancement. Next-generation collection methods (solvent-based, membrane, and adsorption systems), enhanced CO2 transport infrastructure, and safe geological storage monitoring are examples of advancements. Commercial feasibility and scalability are further improved by integrating CCS with carbon utilization and enhanced oil recovery (EOR) technologies.

Market Dynamics of the China Carbon Capture Storage Market:

China's strong commitment to reaching carbon peaking by 2030 and carbon neutrality by 2060 is the main factor driving the country's carbon capture storage sector. The need to use CCS as a transitional decarbonisation solution has grown due to rapid industrialization and a large reliance on coal-based power generation, especially in difficult-to-abate industries like power, cement, steel, and chemicals. Adoption is further accelerated by government support in the form of pilot projects, participation from state-owned enterprises, and integration of CCS into national energy and climate initiatives. Additionally, enterprises are encouraged to invest in emission-reduction technology like CCS by growing corporate ESG commitments and the expansion of China's carbon emissions trading system (ETS).

The market faces some obstacles despite considerable policy support. Widespread deployment is hampered by high capital and operating costs, complicated infrastructure requirements, and a lack of commercial-scale initiatives. Investment decisions are additionally slowed by uncertainties over liability frameworks, regulatory clarity, and long-term storage safety. Furthermore, CCS projects frequently call for close coordination throughout the collection, transport, and storage phases, which lengthens project schedules and increases project complexity.

Industrial CCS hubs, deployment close to major emission clusters, and integration with enhanced oil recovery (EOR) have significant growth prospects. Large-scale commercialization and sustained market expansion in China are anticipated to be made possible by technological developments that lower capture costs as well as more public-private partnerships and international cooperation.

Market Segmentation

The China carbon capture storage market share is classified into application and technology.

By Application:

On the basis of application, the China carbon capture storage market is categorized into power generation, cement, oil and gas, metal production, and others. Among these, the power generation segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. China's strong reliance on coal-fired power plants and the pressing need to cut carbon emissions while maintaining energy security are the main factors driving the power generating segment's dominance. Thermal power plants are increasingly using CCS technologies to collect massive amounts of CO2 at the source, making this sector a major focus of national decarbonisation plans.

By Technology:

Based on technology, the China carbon capture storage market is divided into post combustion, industrial process, oxy-combustion, and pre-combustion. Among these, the post-combustion segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is attributed to the fact that post-combustion technology can be easily integrated with current industrial and power generation facilities, especially coal-fired power plants, without requiring significant modifications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China carbon capture storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Carbon Capture Storage Market:

- Sinopec Limited

- China Datang Corporation

- Baowu Steel Group

- Longyuan Power Group

- State Power Investment Corporation (SPIC)

- China National Petroleum Corporation (CNPC)

- Siemens Energy

- Shell

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China carbon capture storage market based on the following segments:

China Carbon Capture Storage Market, By Application

- Power generation

- Cement

- Oil and Gas

- Metal Production

- Others

China Carbon Capture Storage Market, By Technology

- Post Combustion

- Industrial Process

- Oxy-combustion

- Pre-combustion

Frequently Asked Questions (FAQ)

-

1. What is the projected market size of the China carbon capture storage market by 2035?The China carbon capture storage market is projected to reach USD 623.6 million by 2035, growing from USD 316.5 million in 2024.

-

2. What is the expected CAGR of the China carbon capture storage market during the forecast period?The market is expected to grow at a CAGR of 6.36% during the forecast period 2025–2035.

-

3. Which application segment dominated the China carbon capture storage market in 2024?The power generation segment dominated the market in 2024 due to China’s heavy reliance on coal-fired power plants and increasing adoption of CCS technologies to reduce carbon emissions while ensuring energy security.

-

4. Which technology held the largest market share in the China carbon capture storage market in 2024?The post-combustion technology segment accounted for the largest market share in 2024, owing to its ease of integration with existing industrial and power generation infrastructure without major modifications.

Need help to buy this report?