China Bubble Tea Market Size, Share, and COVID-19 Impact Analysis, By Type (Black Tea, Green Tea, Oolong Tea, and White Tea) and By Flavour (Fruit Flavour, Original Flavour, Chocolate Flavour, Coffee Flavour, and Others), and China Bubble Tea Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesChina Bubble Tea Market Insights Forecasts to 2035

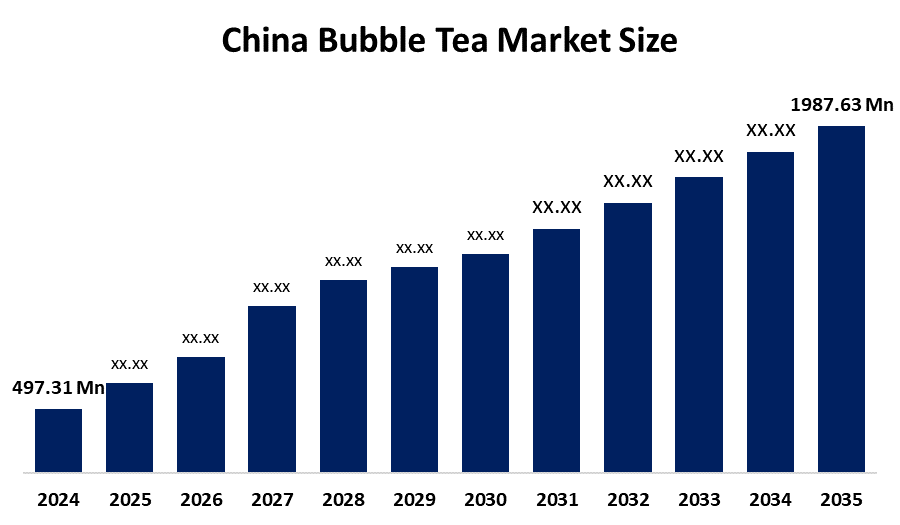

- The China Bubble Tea Market Size Was Estimated at USD 497.31 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.42 % from 2025 to 2035

- The China Bubble Tea Market Size is Expected to Reach USD 1987.63 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The China Bubble Tea Market Size Is Anticipated To Reach USD 1987.63 Million By 2035, Growing At A CAGR Of 13.42% From 2025 To 2035. The market growth is driven by the youth appeal (Gen Z, Millennials), flavour innovation (cheese tea, fruit infusions), customization, strong social media influence and cafe culture, rising disposable incomes and urbanization, and a shift toward healthier or more diverse options (low-sugar, plant-based), all supported by major local chains such as HEYTEA and Mixue.

Market Overview

The China Bubble Tea Market Size defines a rapidly growing sector with the broader beverage industry, encompassing the preparation, sale, and consumption of customizable, milk fruit based teas toppings sold through the extensive franchise chain and the delivery platforms, heavily driven by the youth trends, social media, and local flavour innovation making it a cultural phenomenon beyond just being a drink. It is popular in the Gen Z generation who are seeking trendy customizable visually appealing and the experimental drinks, which are often purchased by the delivery apps. The China bubble tea market is a dynamic retail segment specifically focused on the trendy, personalized tea beverages, acting as a cultural touchstone for young consumer and a massive economic force in the China’s beverages landscape.

China’s bubble tea market size offers the huge future opportunities driven by the young consumers, also with the diverse flavours and the technical development. It has key opportunities in health options, primiumization, digital expansion into the suburbs and the strategic collaboration, despite the challenges from sugar concern and the competition.

Report Coverage

This Research Report Categorises The Market Size for the China bubble tea market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China bubble tea market recent market size developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China bubble tea market.

China Bubble Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1987.63 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 13.42% |

| 2023 Value Projection: | USD 1987.63 Million By 2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Flavour |

| Companies covered:: | Biosense Webster, St. Jude Medical, Boston Scientific, Medtronic, Abbott Laboratories, Siemens Healthineers, Philips Healthcare, and GE Healthcare Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The China’s Bubble Tea Market Size is driven by the youth culture, the extensive customization, the strong franchising, social media trends, innovative flavours, convenient digital ordering, rising incomes, urbanization and a shift towards the healthier life style and also the plant based options all the are supported by a massive tea culture base. The rising disposable incomes and the urban living fuel demand for the premium, and the novel beverages. It is a mix of the cultural trends, smart business trends, smart business models, and the constant flavours innovations that are driving the markets growth in china. It is also driven by driven by supply-chain integration and in-house ingredient sourcing, aggressive price competition by value brands, expansion into lower-tier cities, cross-category fusion with coffee and functional drinks, IP collaborations with entertainment brands, data-driven menu optimization, and overseas brand exposure boosting domestic brand prestige.

Restraining Factors

China's Bubble Tea Market Size is constrained by health concerns (high sugar, preservatives), fierce rivalry and overexpansion, supply chain challenges, economic considerations, and strong alternatives such as coffee, resulting in store closures and a push for healthier, tech-driven options. High sugar content, artificial preservatives, and colours are key deterrents, increasing health concerns such as obesity and heart disease and encouraging consumers to seek healthier alternatives.

Market Segmentation

The China bubble tea market share is classified into by type and by flavour.

- The black tea segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Bubble Tea Market Size is divided by type into black tea, green tea, oolong tea, and white tea. Among these, the black tea segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the powerful, diverse flavour that blends sweetness and toppings, its long cultural roots in Asia, and supposed health benefits such as antioxidants, green tea is fast developing due to rising health consciousness and weight control benefits.

- The fruit flavour segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Bubble Tea Market Size is divided by flavour into fruit flavour, original flavour, chocolate flavour, coffee flavour, and others. Among these, the fruit flavour segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their refreshing taste, perceived nutritional benefit (vitamins), diversity, and strong appeal to younger customers wanting vibrant, customized drinks, with original milk tea being a close second, while the chocolate and coffee segments are fast expanding.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China bubble tea market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xiangpiaopiao

- Lelecha

- Yehitang

- Dakasi

- Chatime Group

- Tiger Sugar

- Hey tea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China bubble tea market based on the below-mentioned segments:

China Bubble Tea Market, By Type

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

China Bubble Tea Market, By Flavour

- Fruit Flavour

- Original Flavour

- Chocolate Flavour

- Coffee Flavour

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China bubble tea market size?Market is expected to grow from USD 497.31 million in 2024 to USD 1987.63 million by 2035, growing at a CAGR of 13.42% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?Market growth is driven by the youth appeal (Gen Z, Millennials), flavour innovation (cheese tea, fruit infusions), customization, strong social media influence and cafe culture, rising disposable incomes and urbanization, and a shift toward healthier or more diverse options (low-sugar, plant-based), all supported by major local chains such as HEYTEA and Mixue.

-

Q: What factors restrain the China bubble tea market?Constraints like include health concerns (high sugar, preservatives), fierce rivalry and overexpansion, supply chain challenges, economic considerations, and strong alternatives such as coffee, resulting in store closures and a push for healthier, tech-driven options.

-

Q: How is the market segmented by type?The market is segmented into black tea, green tea, oolong tea, and white tea.

-

Q: Who are the key players in the China bubble tea market?Key companies include Xiangpiaopiao, Lelecha, Yehitang, Dakasi, Chatime Group, Tiger Sugar, Hey tea, Others.

-

Q: Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?