China Blood Testing Market Size, Share, By Test Type (Vitamin D, Thyroid, AST, Glucose, A1C, Lipid Panel, Testosterone, Covid-19, Cortisol, Creatinine, and Others), By Technology (Manual Blood Testing and Automated Blood Testing), By Sample Type (Venous, Capillary, Plasma, and Other), China Blood Testing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Blood Testing Market Insights Forecasts to 2035

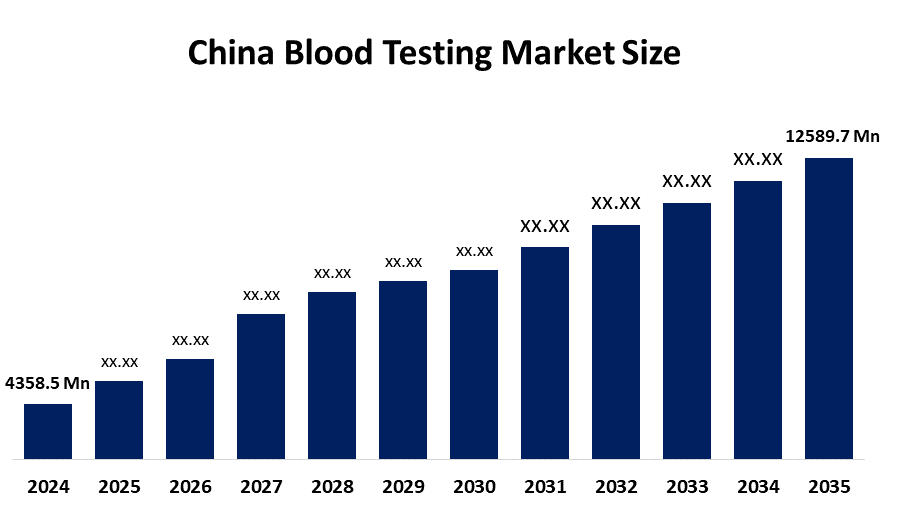

- China Blood Testing Market Size 2024: USD 4358.5 Mn

- China Blood Testing Market Size 2035: USD 12589.7 Mn

- China Blood Testing Market CAGR: 10.12%

- China Blood Testing Market Segments: Test Type, Technology, and Sample Type

Get more details on this report -

The Chinese Blood Testing Market is experiencing a steady expansion, which can be attributed to the increasing supply of chronic and infectious diseases, the rising awareness of preventive healthcare, and the higher healthcare expenditures that create a demand for both regular and specialized blood diagnostics. The blood tests include hematology, biochemistry, immunoassays, and molecular diagnostics, all playing a part in the growth of the in-vitro diagnostics (IVD) market in collaboration with healthcare modernization and early disease detection initiatives.

Government initiatives are putting blood safety first and the diagnostic infrastructure, especially in small cities and rural areas, second, through a plan of investing in laboratory features, applying strict screening practices such as NAT (nucleic acid testing), and making it easier to get advanced diagnostics involved in the public health policy.

Slicing technology is the main factor that prompts growth automation, high-throughput analyzers, next-generation sequencing (NGS), artificial intelligence (AI)-enabled data analysis, and point-of-care testing are all contributing to blood tests being more accurate, quicker, and more widely available. Home-grown creativity coupled with digital integration not only boosts the efficiency of diagnostic procedures but also lessens the dependency on imports, thereby putting the Chinese blood-testing sector in the right spot for developing new innovations and expanding the market size.

Market Dynamics of the China Blood Testing Market:

The primary factors of the China blood testing market are mainly the rapid aging of the population in the country and the increasing number of diseases like diabetes, heart problems, cancer, and liver diseases. The public's growing knowledge about the importance of preventive healthcare and early disease identification has given a tremendous boost to the demand for routine blood tests including glucose, lipid panels, thyroid, and HbA1c tests. Furthermore, new diagnostic technologies like automated analyzers, molecular diagnostics, and chemiluminescence immunoassays are making tests more accurate and quicker hence, are driving up the market. Strong government investments in healthcare infrastructure and new blood safety and quality regulations are also among the factors that accelerate the market growth.

The market is subjected to a number of restrictions. The advanced testing equipment and automation's high initial costs limit the adoption especially in smaller hospitals and rural laboratories, where they can hardly bear such costs. By and large, regional differences in medical facilities, unavailability of skilled laboratory personnel, and the unprofitability caused by the reimbursement limitations are other factors that negatively impact the growth of the market. Additionally, regulatory approval processes that are hard to navigate can postpone the introduction of new blood testing technologies.

Even with these difficulties, the market still presents a great deal of potential. The opening up of healthcare access in tier-II and tier-III cities, the rise of point-of-care testing, and the growing interest in personalized medicine and early diagnosis are all factors that contribute to the very strong potential for growth. Likewise, the state is backing local production, which has reduced the cost of innovation in blood testing technologies and, therefore, made it widely accessible.

China Blood Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,358.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.12% |

| 2035 Value Projection: | USD 12,589.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Test Type, By Technology |

| Companies covered:: | Roche Diagnostics, Abbott Laboratories, Sysmex Corporation, Bio-Rad Laboratories, Inc., BioMérieux SA, Danaher Corporation, Thermo Fisher Scientific, Siemens Healthineers, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

China Blood Testing Market share is classified into test type, technology, and sample type.

By Test Type:

China’s blood testing market is classified by test type into vitamin-D, thyroid, AST, glucose, A1C, lipid panel, testosterone, COVID-19, cortisol, creatinine, and other. Among these, the glucose testing segment held the majority market share in 2024 and is predicted to grow at a remarkable rate in the future. This control is mainly motivated by the large and growing number of diabetes and prediabetes cases in China, routine health screenings becoming more common, and both clinical and home-care settings having a strong demand for regular blood glucose monitoring.

By Technology:

China’s blood testing market is divided by technology into manual blood testing and automated blood testing. Among these, the automated blood testing segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The segment's leading position is ascribed to the extensive use of fully and semi-automated analyzers in hospitals and diagnostic laboratories. This is a result of the demand for quicker turnaround times, more accurate testing, and the capacity to process many samples.

By Sample Type

The Chinese blood testing market is categorised by sample type into venous, capillary, plasma, and other. Among these, the venous segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The major factor behind this dominance is that, among the various sources of blood for tests, venous blood has become the most common and even the best option in laboratories, as it is good for obtaining a larger volume, is the most reliable, and can be used for a great number of assays.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China blood testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Blood Testing Market:

- Roche Diagnostics

- Abbott Laboratories

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- BioMérieux SA

- Danaher Corporation

- Thermo Fisher Scientific

- Siemens Healthineers

- Others

Recent Developments in China's Blood Testing Market:

- In January 2026, BGI Genomics and Roche Diagnostics introduced blood-based Alzheimer’s diagnostic tests, which are less invasive and more accessible early screening options when compared to conventional spinal taps or PET scans.

- In July 2025, the first “saliva-based early pregnancy test kit” was approved for market launch, ushering in a new era of advanced technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China blood testing market based on the following segments:

China Blood Testing Market, By Test Type

- Vitamin D

- Thyroid

- AST

- Glucose

- A1C

- Lipid Panel

- Testosterone

- Covid-19

- Cortisol

- Creatinine

- Others

China Blood Testing Market, By Technology

- Manual Blood Testing

- Automated Blood Testing

China Blood Testing Market, By Sample Type

- Venous

- Capillary

- Plasma

- Other

Frequently Asked Questions (FAQ)

-

1.What is the base year and forecast period for the China Blood Testing Market?The base year for the study is 2024, with historical data covering 2020–2023. The forecast period spans from 2025 to 2035.

-

2.What is the current and projected market size of the China Blood Testing Market?The market was valued at USD 4,358.5 million in 2024 and is projected to reach USD 12,589.7 million by 2035, growing at a CAGR of 10.12% during the forecast period.

-

3.Which test type dominates the China blood testing market?The glucose testing segment dominated the market in 2024, driven by the rising prevalence of diabetes, increasing routine health screenings, and strong demand for continuous glucose monitoring.

-

4.Which technology segment holds the largest market share?Automated blood testing accounted for the largest share in 2024 due to its higher accuracy, faster turnaround times, and widespread adoption in hospitals and diagnostic laboratories.

-

5.What sample type is most commonly used in China?The venous blood sample segment dominated the market in 2024, as it provides reliable results and supports a wide range of diagnostic assays.

Need help to buy this report?