China Bisphenol S Market Size, Share, By Application (Thermal Paper Coating, Epoxy Resins, Dyes & Dye Intermediates, Engineering Plastics & Polymers, And Others), By Sales Channel (Direct Sales And Indirect Sales), And China Bisphenol S Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Bisphenol S Market Insights Forecasts to 2035

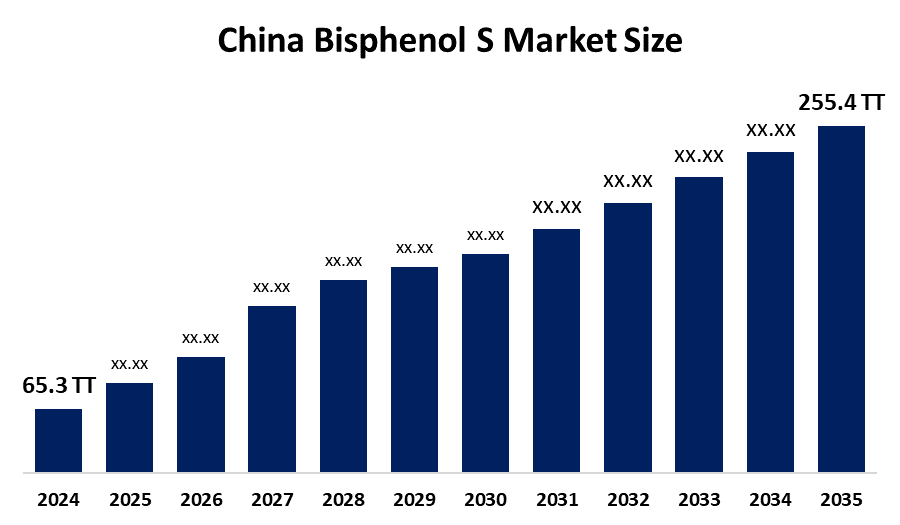

- China Bisphenol S Market 2024: 65.3 Thousand Tonnes

- China Bisphenol S Market Size 2035: 255.4 Thousand Tonnes

- China Bisphenol S Market CAGR 2024: 13.2%

- China Bisphenol S Market Segments: Application and Sales Channel

Get more details on this report -

The Chinese Bisphenol S (BPS) Market encompasses the manufacturing, distributing, and consuming of bisphenol s as an important medium to produce various types of epoxy resin, phenolic resin, polyethersulfone resin, thermal paper, lacquer and many different specialty plastics. The Chinese BPS market has rapidly grown, as China is currently the world's leading producer of chemicals as well as manufacturers using these chemicals in the downstream of the business. In addition to being the world's leading producer of BPS, some of the major producers of BPS are expanding production capacity and increasing their competitive position within China.

The bisphenol s in China is backed by government support, including the Made in China 2025 and related policy frameworks promoting high-value manufacturing and self-sufficiency in advanced materials. The government’s support for high-end chemical materials and electronic chemicals is reflected in increased production and consumption statistics for advanced chemical sectors, where China’s chemical new materials industry’s output and self-sufficiency ratios have steadily risen, with markets such as electronic chemicals achieving self-sufficiency levels above 60% and contributing to the broader chemical sector’s growth.

As technology advances, Chinese bisphenol s providers are now increasingly moving towards automation and greener practices due to the influence of government policies regarding energy efficiency and pollution control. In addition to improved efficiency and environmental compliance, they are able to use digital controls, advanced catalytic methods and refined chemistries to produce quality BPS with greater purity, yield and consistency; while at the same time producing less waste and consuming less energy. New developments related to specialty derivatives of BPS used in the manufacturing of engineered polymers like PES and high performance epoxy resins have created many more possible applications for BPS in high-demand industries.

China Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 65.3 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.2% |

| 2035 Value Projection: | 255.4 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Segments covered: | By Application, By Sales Channel |

| Companies covered:: | Sinopec, Covestro AG, SABIC, Chang Chun Group, Formosa Chemicals & Fibre Corp, Nan Ya Plastics Corporation, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical, Mitsui Chemical Inc., Zibo Shuanghe Chemical Technology Co., Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Bisphenol S Market:

The China bisphenol s market is driven by the strong downstream demand from epoxy and phenolic resin manufacturers, rapid growth of thermal paper and labeling sectors, increasing e-commerce platform, broad industrial base that uses high-performance polymer intermediates, increase in China’s leadership in global chemical production, extensive industrial infrastructure, and expanding applications in engineering plastics and specialty polymers, and ongoing investment in chemical industry modernization, sustainability initiatives, and technological innovation further propel the market growth.

The China bisphenol s market is restrained by the increasing regulatory and environmental scrutiny, potential endocrine-disrupting properties, raising concerns about safety and environmental impact, shifts toward alternative materials, and high compliance costs for producers.

The future of China bisphenol s market is bright and promising, with versatile opportunities emerging from the expansion of applications for high-performance polymers, including advanced composites, aerospace components, and medical devices, offers many opportunities for higher-value derivatives of bisphenol s. The growth of domestic manufacturing of electronic chemicals and specialty resins supports the demand for BPS intermediates and growing global interest in alternatives to bisphenol A (BPA) could help sustain demand for BPS in areas where regulations favor decreased use of BPA. At the same time, technological innovations will help to create a favorable environment for the diversification of markets and new product development.

Market Segmentation

The China bisphenol S market share is classified into application and sales channel.

By Application:

The China bisphenol s market is divided by application into thermal paper coating, epoxy resins, dyes & dye intermediates, engineering plastics & polymers, and others. Among these, the thermal paper coating segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rapid expansion of organized retail, e-commerce, and logistics, used as safer alternative to BPA, superior functionality, and cost effective application all contribute to the thermal paper coating segment's largest share and higher spending on bisphenol s when compared to other application.

By Sales Channel:

The China bisphenol s market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because it provides superior cost control, ensures supply chain stability for crucial downstream applications, and enables direct relationships between manufacturers and large-scale industrial buyers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China bisphenol s market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Bisphenol S Market:

- Sinopec

- Covestro AG

- SABIC

- Chang Chun Group

- Formosa Chemicals & Fibre Corp

- Nan Ya Plastics Corporation

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical

- Mitsui Chemical Inc.

- Zibo Shuanghe Chemical Technology Co., Ltd.

- Others

Recent Developments in China Bisphenol S Market:

In October 2025, Jiangsu Aolunda High Tech Industry Co., Ltd initiated the construction of a new BPS project with a capacity of 12250 tons, to challenge for the spot in the global BPS market, aiming to surpass Ningxia Lejian upon completion expected 2027.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China bisphenol s market based on the below-mentioned segments:

China Bisphenol S Market, By Application

- Thermal Paper Coating

- Epoxy Resins

- Dyes & Dye Intermediates

- Engineering Plastics & Polymers

- Others

China Bisphenol S Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the China bisphenol s market size?A: China bisphenol s market is expected to grow from 65.3 thousand tonnes in 2024 to 255.4 thousand tonnes by 2035, growing at a CAGR of 13.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong downstream demand from epoxy and phenolic resin manufacturers, rapid growth of thermal paper and labeling sectors, increasing e-commerce platform, broad industrial base that uses high-performance polymer intermediates, increase in China’s leadership in global chemical production, extensive industrial infrastructure, and expanding applications in engineering plastics and specialty polymers, and ongoing investment in chemical industry modernization, sustainability initiatives, and technological innovation further propel the market growth.

-

Q: What factors restrain the China bisphenol s market?A: Constraints include the increasing regulatory and environmental scrutiny, potential endocrine-disrupting properties, raising concerns about safety and environmental impact, shifts toward alternative materials, and high compliance costs for producers.

-

Q: How is the market segmented by application?A: The market is segmented into thermal paper coating, epoxy resins, dyes & dye intermediates, engineering plastics & polymers, and others.

-

Q: Who are the key players in the China bisphenol s market?A: Key companies include Sinopec, Covestro AG, SABIC, Chang Chun Group, Formosa Chemicals & Fibre Corp, Nan Ya Plastics Corporation, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical, Mitsui Chemical Inc., Zibo Shuanghe Chemical Technology Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

-

Q: What is the China bisphenol s market size?A: China bisphenol s market is expected to grow from 65.3 thousand tonnes in 2024 to 255.4 thousand tonnes by 2035, growing at a CAGR of 13.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong downstream demand from epoxy and phenolic resin manufacturers, rapid growth of thermal paper and labeling sectors, increasing e-commerce platform, broad industrial base that uses high-performance polymer intermediates, increase in China’s leadership in global chemical production, extensive industrial infrastructure, and expanding applications in engineering plastics and specialty polymers, and ongoing investment in chemical industry modernization, sustainability initiatives, and technological innovation further propel the market growth.

-

Q: What factors restrain the China bisphenol s market?A: Constraints include the increasing regulatory and environmental scrutiny, potential endocrine-disrupting properties, raising concerns about safety and environmental impact, shifts toward alternative materials, and high compliance costs for producers.

-

Q: How is the market segmented by application?A: The market is segmented into thermal paper coating, epoxy resins, dyes & dye intermediates, engineering plastics & polymers, and others.

-

Q: Who are the key players in the China bisphenol s market?A: Key companies include Sinopec, Covestro AG, SABIC, Chang Chun Group, Formosa Chemicals & Fibre Corp, Nan Ya Plastics Corporation, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical, Mitsui Chemical Inc., Zibo Shuanghe Chemical Technology Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?