China Biodegradable Polymer Market Size, Share, By Type (Starch-Based Plastics, Polylactic Acid, Polyhydroxy Alkanoates, Polyesters, And Cellulose Derivatives), By End User (Agriculture, Textile, Consumer Goods, Packaging, And Healthcare), And China Biodegradable Polymer Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Biodegradable Polymer Market Insights Forecasts to 2035

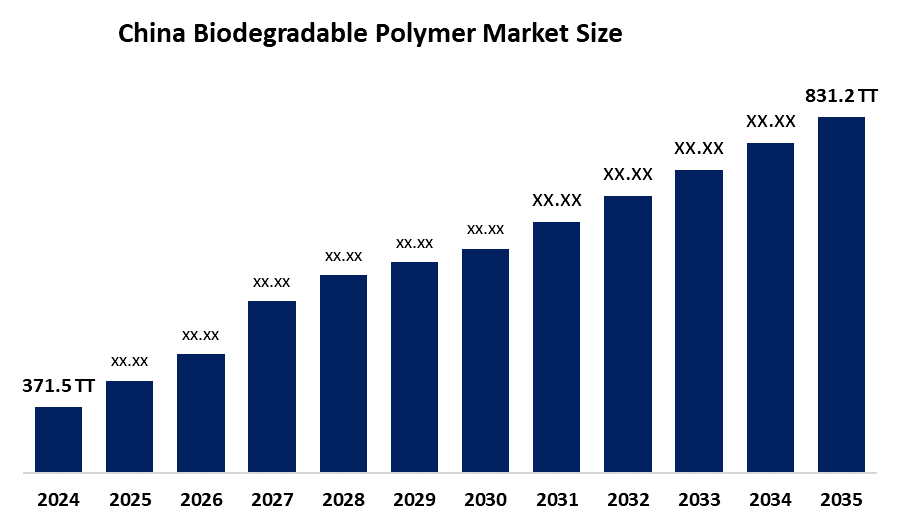

- China Biodegradable Polymer Market 2024: 371.5 Thousand Tonnes

- China Biodegradable Polymer Market Size 2035: 831.2 Thousand Tonnes

- China Biodegradable Polymer Market CAGR 2024: 7.6%

- China Biodegradable Polymer Market Segments: Type and End User

Get more details on this report -

The China biodegradable polymer market encompasses all economic and commercial activity related to the production and sale of biologically-based polymers that are capable of decomposing naturally via biological processes to form water, carbon dioxide, and biomass. It represents an alternative to traditional petroleum-derived plastics that is a more sustainable option for the environment. Biodegradable polymers include polylactic acid (PLA), polyhydroxy alkanoates (PHA), and polybutylene adipate terephthalate (PBAT). Biodegradable polymers are being utilized in a variety of applications including packaging, agriculture, consumer products, and medical or healthcare-related products because they exhibit a significantly lower overall impact on the environment than conventional plastics.

The biodegradable polymer in China are backed by government support, including the National Development and Reform Commission’s (NDRC) plastic pollution control measures, which phase out certain single-use plastics in major cities and actively promote biodegradable alternatives. The Ministry of Agriculture reports that China consumes approximately 2.6 million tonnes of agricultural plastic films annually, indicating a large potential market for biodegradable alternatives in agriculture alone.

As technology advances, Chinese biodegradable polymer providers are now using high-performance PLA, PHA, and PBAT formulations through research and development to improve mechanical properties. Mechanisms of producing these materials include improved performance from biopolymers as well as from changing production methods through fermentation and catalysis so that production costs can be lower while increasing available feedstocks. Some current research projects are investigating the use of marine-carbon sources as alternative biodegradable precursors for producing some of these biodegradable polymers, which would further enhance China’s industrial competitiveness in the biodegradable polymer manufacturing industry.

Market Dynamics of the China Biodegradable Polymer Market:

The China biodegradable polymer market is driven by the stringent environmental policies aimed at reducing plastic pollution, rising consumer and corporate demand for sustainable products, push for circular economy practices within China’s manufacturing base, rapid growth in e-commerce, packaging, and agriculture increased demand for biodegradable polymers, and supportive government regulations.

The China biodegradable polymer market is restrained by the structural overcapacity, production capacity creating pressure on pricing and utilization rates, higher production costs, slower adoption of technological advances among few manufacturers, and complex regulations.

The future of China biodegradable polymer market is bright and promising, with versatile opportunities emerging from the biobased materials such as biodegradable films, packages and other consumer products, instead of using conventional plastic materials. As manufacturers develop efficient ways to manufacture these materials and governments develop supportive policies, and as there is a larger number of export opportunities available, this all creates opportunity for the China biopolymer industry to gain larger by concentrated shares in both the regional and global markets of sustainable materials. As the world's environmental priorities continue to grow, developing new biodegradable types of biopolymers and their uses will lead to new commercial opportunities via the creation of new biopolymers for use outside traditional packaging and other uses.

China Biodegradable Polymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 371.5 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.6% |

| 2035 Value Projection: | 831.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Kingfa Sci. & Tech. Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., Shenzhen Esun Industrial Co., Ltd., China BBCA Group, Yangzhou Huitong New Material Co., Ltd., Shandong Intco Recycling Resources Co., Ltd., BASF SE, TotalEnergies Corbion PLA, Novamont S.p.A., Mitsubishi Chemical Group, Tianan Biologic Materials Co., Ltd., Zhejiang Huafon Biomaterials Co., Ltd., Danimer Scientific, Toray Industries, Inc., Henan Jindan Lactic Acid Technology Co., Ltd., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China Biodegradable Polymer Market share is classified into type and end user.

By Type:

The China biodegradable polymer market is divided by type into starch-based plastics, polylactic acid, polyhydroxy alkanoates, polyesters, and cellulose derivatives. Among these, the starch-based plastics segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Low operational costs, abundant raw material availability, strong government support through plastic bans and incentives, and widely adopted in packaging and agriculture all contribute to the starch-based plastics segment's largest share and higher spending on biodegradable polymer when compared to other type.

By End User:

The India alkoxylates market is divided by end user into agriculture, textile, consumer goods, packaging, and healthcare. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because stringent government bans on single-use plastics, rising environmental awareness, eco-friendly alternatives, and high consumption in e-commerce and food services with flexible packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China biodegradable polymer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Biodegradable Polymer Market:

- Kingfa Sci. & Tech. Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Shenzhen Esun Industrial Co., Ltd.

- China BBCA Group

- Yangzhou Huitong New Material Co., Ltd.

- Shandong Intco Recycling Resources Co., Ltd.

- BASF SE

- TotalEnergies Corbion PLA

- Novamont S.p.A.

- Mitsubishi Chemical Group

- Tianan Biologic Materials Co., Ltd.

- Zhejiang Huafon Biomaterials Co., Ltd.

- Danimer Scientific

- Toray Industries, Inc.

- Henan Jindan Lactic Acid Technology Co., Ltd.

- Others

Recent Developments in China Biodegradable Polymer Market:

In April 2025, Kingfa Sci. & Tech. Co., Ltd., at Chinaplas 2025, highlighted its development of a broad range of biodegradable materials, including modified PLA, PBS, PBAT, and TPU. Their focus is on 100% low-carbon, eco-friendly filters materials and optimizing biodegradable polymers for better processing.

In November 2024, Sinopec commissioned a 60,000-ton-per-year PBAT complex in Hainan. This facility was notable for being integrated with sugarcane-ethanol-based BDO (1, 4 Butanediol), which provides a 15% reduction in feedstock consumption, targeting domestic mulch film and ASEAN markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China biodegradable polymer market based on the below-mentioned segments:

China Biodegradable Polymer Market, By Type

- Starch-Based Plastics

- Polylactic Acid

- Polyhydroxy Alkanoates

- Polyesters

- Cellulose Derivatives

China Biodegradable Polymer Market, By End User

- Agriculture

- Textile

- Consumer Goods

- Packaging

- Healthcare

Frequently Asked Questions (FAQ)

-

Q: What is the China biodegradable polymer market size?A: China biodegradable polymer market is expected to grow from 371.5 thousand tonnes in 2024 to 831.2 thousand tonnes by 2035, growing at a CAGR of 7.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the stringent environmental policies aimed at reducing plastic pollution, rising consumer and corporate demand for sustainable products, push for circular economy practices within China’s manufacturing base, rapid growth in e-commerce, packaging, and agriculture increased demand for biodegradable polymers, and supportive government regulations.

-

Q: What factors restrain the China biodegradable polymer market?A: Constraints include the structural overcapacity, production capacity creating pressure on pricing and utilization rates, higher production costs, slower adoption of technological advances among few manufacturers, and complex regulations.

-

Q: How is the market segmented by type?A: The market is segmented into starch-based plastics, polylactic acid, polyhydroxy alkanoates, polyesters, and cellulose derivatives.

-

Q: Who are the key players in the China biodegradable polymer market?A: Key companies include Kingfa Sci. & Tech. Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., Shenzhen Esun Industrial Co., Ltd., China BBCA Group, Yangzhou Huitong New Material Co., Ltd., Shandong Intco Recycling Resources Co., Ltd., BASF SE, TotalEnergies Corbion PLA, Novamont S.p.A., Mitsubishi Chemical Group, Tianan Biologic Materials Co., Ltd., Zhejiang Huafon Biomaterials Co., Ltd., Danimer Scientific, Toray Industries, Inc., Henan Jindan Lactic Acid Technology Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?