China Beef Market Size, Share, By Product Type (Fresh Beef, Frozen Beef, Processed Beef Products, and Others), By Cut Type (Shank, Loin, Brisket, and Others), By Slaughter Method (Kosher, Halal, and Others), and China Beef Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesChina Beef Market Insights Forecasts to 2035

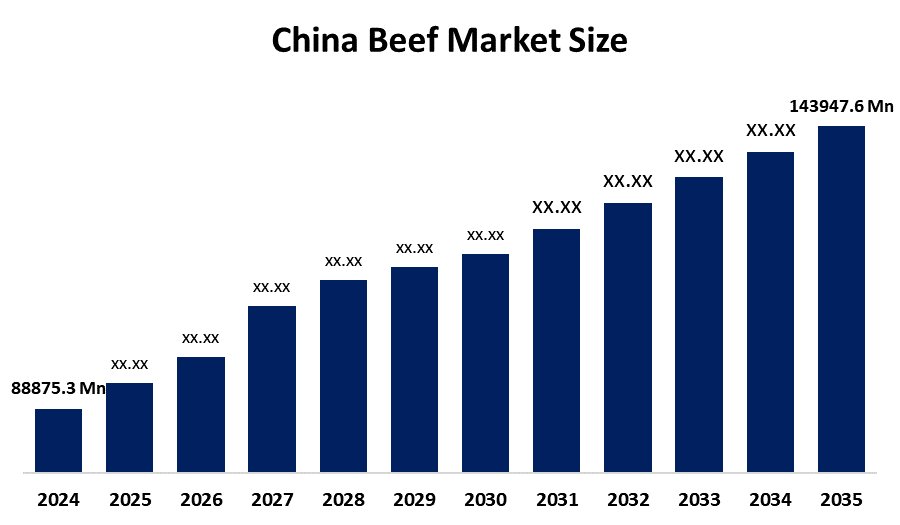

- China Beef Market Size 2024: USD 88875.3 Mn

- China Beef Market Size 2035: USD 143947.6 Mn

- China Beef Market CAGR: 4.48%

- China Beef Market Segments: Product Type, Cut Type, and Slaughter Method

Get more details on this report -

The production, processing, distribution, and consumption of beef products in the fresh, frozen, and processed categories are all included in the beef market. Rising protein demand, shifting dietary habits, and growing preferences for premium and diverse meat products all contribute to this expanding sector of China's meat industry. Beef consumption remains lower than pig but is rising steadily due to urbanization and higher disposable incomes.

The Chinese government has introduced several initiatives to support the beef sector, focusing on stabilizing cattle farming and ensuring food security. These include monetary incentives, financing assistance for livestock farmers, promotion of large-scale cow breeding, and measures to increase the effectiveness of domestic supply. Furthermore, in order to balance domestic production and demand, the government modifies trade laws while tightly regulating beef imports through stringent quality, safety, and traceability criteria.

The market is also changing as a result of technological developments. Improvements in cold-chain logistics, modern slaughtering practices, and meat processing technology have boosted product quality and shelf life. The long-term expansion of the Chinese beef market is being supported by the increased adoption of digital platforms, blockchain-based traceability, and smart farming techniques to increase efficiency, transparency, and consumer trust.

China Beef Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 88875.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.48% |

| 2035 Value Projection: | USD 143947.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type,By Cut Type, By Slaughter Method |

| Companies covered:: | COFCO Group Yurun Group Kerchin Cattle Industry Co., Ltd. Inner Mongolia Prairie Industry Co., Ltd. Shanghai Maling Aquarius Co., Ltd. Shandong Jinluo Group Co., Ltd. Liaoning Wellhope Agri-Tech Co., Ltd. Henan Anlong Meat Products Co., Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Beef Market:

Rising disposable incomes, quick urbanization, and growing consumer demand for premium animal protein are the main factors driving the China beef market. Beef consumption is on the rise as eating patterns shift away from pork, particularly among middle-class and urban people. Fresh and frozen beef is now much more widely available in cities thanks to the growth of contemporary retail formats, e-commerce sites, and cold-chain logistics.

Nonetheless, there are significant limitations on the market. Domestic beef production remains fragmented and generally inefficient, resulting in increased production costs and restricted scalability. Price-conscious consumers are concerned about affordability because beef is typically more expensive than other protein sources. Furthermore, supply chains can be disrupted and market uncertainty created by changes in import regulations, biosecurity threats, and disease outbreaks in exporting nations.

The market offers appealing opportunities in spite of these difficulties. Demand for premium cuts, branded beef, and imported kinds is increasing due to premiumization tendencies. Busy urban lifestyles are in line with the growing demand for processed, ready-to-cook, and value-added beef products. Additionally, it is anticipated that advancements in food safety regulations, traceability, and direct-to-consumer distribution models would open up new growth opportunities and set up the Chinese beef market for consistent, long-term growth.

Market Segmentation

The China beef market share is classified into product type, cut type, and slaughter method.

By Product Type:

On the basis of product type, the China beef market is categorized into fresh beef, frozen beef, processed beef products, and others. Among these, the fresh beef segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. This dominance is driven by traditional cooking methods, growing availability through contemporary retail and cold-chain infrastructure, and a high customer preference for freshness.

By Cut Type:

Based on cut type, the China beef market is divided into shank, loin, brisket, and others. Among these, the brisket segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Due to its widespread use in traditional Chinese dishes, including hotpot, braised dinners, and noodle soups, the brisket segment dominates the Chinese beef industry. Its affordability relative to premium cuts and high demand from restaurants and foodservice companies further support its strong market share and growth.

By Slaughter Method:

The market is classified by the slaughter method into kosher, halal, and others. Among these, the halal segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is attributed to the huge Muslim population, increased demand for certified halal meat, and increasing acceptance of halal products in mainstream retail and foodservice outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China beef market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Beef Market:

- COFCO Group

- Yurun Group

- Kerchin Cattle Industry Co., Ltd.

- Inner Mongolia Prairie Industry Co., Ltd.

- Shanghai Maling Aquarius Co., Ltd.

- Shandong Jinluo Group Co., Ltd.

- Liaoning Wellhope Agri-Tech Co., Ltd.

- Henan Anlong Meat Products Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China beef market based on the following segments:

China Beef Market, By Product Type

- Fresh Beef

- Frozen Beef

- Processed Beef Products

- Others

China Beef Market, By Cut Type

- Shank

- Loin

- Brisket

- Others

China Beef Market, By Slaughter Method

- Kosher

- Halal

- Others

Frequently Asked Questions (FAQ)

-

1. What is the current and projected size of the China beef market?The China beef market was valued at USD 88,875.3 million in 2024 and is expected to reach USD 143,947.6 million by 2035, growing at a CAGR of 4.48% during the forecast period.

-

2. What factors are driving the growth of the China beef market?Key growth drivers include rising disposable incomes, urbanization, increasing demand for premium animal protein, expansion of modern retail and e-commerce channels, and improved cold-chain infrastructure.

-

3. What are the major challenges faced by the China beef market?Challenges include fragmented domestic production, higher production and logistics costs, price sensitivity among consumers, and risks related to import regulations and animal disease outbreaks.

-

4. What opportunities exist in the China beef market?Opportunities lie in premium and branded beef products, ready-to-cook and processed beef, improved traceability, digital platforms, and direct-to-consumer distribution models.

-

5. Who are the key players operating in the China beef market?Major players include COFCO Group, Yurun Group, Kerchin Cattle Industry, Inner Mongolia Prairie Industry, Shanghai Maling Aquarius, Shandong Jinluo Group, Liaoning Wellhope Agri-Tech, and Henan Anlong Meat Products, among others.

Need help to buy this report?