China Baby Diapers Market Size, Share, By Product (Disposable, Cloth, Training Nappies, Swim Pants, and Others), By Age Group (Newborns, Infants, and Toddlers), and China Baby Diapers Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsChina Baby Diapers Market Size Insights Forecasts to 2035

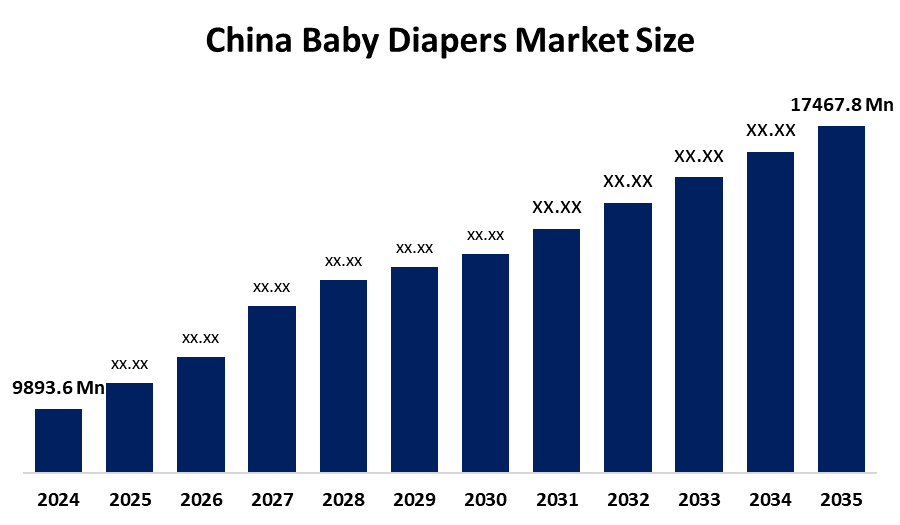

- China Baby Diapers Market Size 2024: USD 9893.6 Mn

- China Baby Diapers Market Size 2035: USD 17467.8 Mn

- China Baby Diapers Market CAGR: 5.3%

- China Baby Diapers Market Segments: Product and Age Group

Get more details on this report -

The market for baby diapers in China includes both disposable and specialty diapers that are made to absorb and contain the pee and faces of infants. Driven by urbanization, rising disposable incomes, and shifting parenting tastes that favor practical, high-quality hygiene solutions for babies, it is one of the biggest divisions of China's infant care business. Despite fluctuating birth rates, the nation's massive demographic base maintains significant demand. Health-conscious parents are drawn to high-end diapers with exceptional absorbency, skin-friendly materials, and unique features. Distribution and customer reach are significantly influenced by e-commerce channels, particularly live commerce and social media.

The market for infant diapers is indirectly supported by China's governmental environment. By increasing fertility and parental spending capacity, the three-child policy and associated family assistance programs (such as longer maternity leave and childcare subsidies) hope to increase demand for baby care products. In order to safeguard customers and improve industry reputation, regulatory initiatives concentrate on product safety and quality requirements, including chemical rules and required certifications. Additionally, there are incentives to support waste reduction, environmental practices, and local manufacture in the diaper industry.

A key component of market expansion is innovation. Super-absorbent polymers (SAP), breathable and pH-balanced linings, and designs that enhance comfort and leak protection are examples of cutting-edge materials that manufacturers invest in. Eco-friendly and biodegradable materials as well as the early uptake of smart diapers with moisture sensors connected to apps which appeal to tech-savvy parents and environmental objectives are examples of emerging trends.

Market Dynamics of the China Baby Diapers Market:

Numerous important development factors are driving the baby diaper industry in China. Demand for premium diapers is increased as a result of parents choosing them due to rising disposable incomes and growing middle-class purchasing power. Convenient disposable diapers are more appealing than conventional options due to urbanization and hectic lifestyles, particularly among dual-income families, which raises adoption rates. Diaper use has increased due to parents' willingness to pay more for features like better absorbency and skin protection, as well as increased awareness of newborn hygiene, health, and comfort. Additionally, distribution reach and brand visibility across regions have been reinforced via e-commerce and live-streaming sales channels.

The market faces difficulties despite robust demand drivers. Consumer scrutiny and regulatory pressure have increased due to environmental concerns regarding the disposal of non-biodegradable diapers and their contribution to landfills. Furthermore, even while policies aim to promote higher fertility, China's dropping birth rate restricts long-term market expansion and caps overall demand potential.

There are noteworthy avenues for further development. Eco-friendly and biodegradable diaper options are a rapidly growing market and appeal to people who care about the environment. Lower-tier cities and unexplored rural markets offer substantial potential for penetration as awareness grows and logistics get better. In a competitive industry, investing in premiumization, product innovation (like smart diapers), and digital marketing techniques can help firms stand out from the competition and capture value.

Market Segmentation

The China baby diapers market share is classified into product and age group.

By Product

The market is categorized by product into disposable, cloth, training nappies, swim pants, and others. Among these, the disposal segment held the majority market share in 2024 and is predicted to grow at a remarkable rate. Fueled by China's growing urbanization, a growing number of working parents, ease of use, high absorbency, and the country's extensive supply of high-quality, environmentally friendly disposable diaper goods.

By Age Group

This market is divided by age group into newborns, infants, and toddlers. Among these, the infants segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. High frequency of diaper use, prolonged diaper use, growing knowledge of child cleanliness, and expanding demand in China for high-quality, skin-friendly, and highly absorbent diaper products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China baby diapers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Baby Diapers Market:

- Fujian Hengan International Group Co., Ltd.

- Chiaus (Fujian) Industrial Development Co., Ltd.

- DaddyBaby

- Dongguan Tianzheng Diaper Co., Ltd.

- Guangzhou BBG Sanitary Commodity Limited

- Fujian Golden Hygienic Products Co., Ltd

- Wehoo Hygiene Products Co., Ltd.

- Procter & Gamble Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China baby diaper market based on the following segments:

China Baby Diapers Market, By Product

- Disposable

- Cloth

- Training Nappies

- Swim Pants

- Others

China Baby Diapers Market, By Age Group

- New-borns

- Infant

- Toddlers

Frequently Asked Questions (FAQ)

-

1. What is the projected market size of the China baby diapers market by 2035?The market is expected to reach USD 17,467.8 million by 2035, growing from USD 9,893.6 million in 2024.

-

2. What is the expected CAGR during the forecast period?The China Baby Diapers Market is projected to grow at a CAGR of 5.3% during 2025 to 2035.

-

3. Which product segment dominates the China baby diapers market?The disposable diapers segment held the largest market share in 2024 due to convenience, high absorbency, and strong demand from working parents in urban areas.

-

4. Which age group accounts for the highest China baby diapers market share?The infants segment dominated the market in 2024, driven by high diaper usage frequency and growing demand for skin-friendly, premium products.

Need help to buy this report?