China Automotive Air Filter Market Size, Share, By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Product Type (Air Intake Filters and Cabin Air Filters), China Automotive Air Filter Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationChina Automotive Air Filter Market Insights Forecasts to 2035

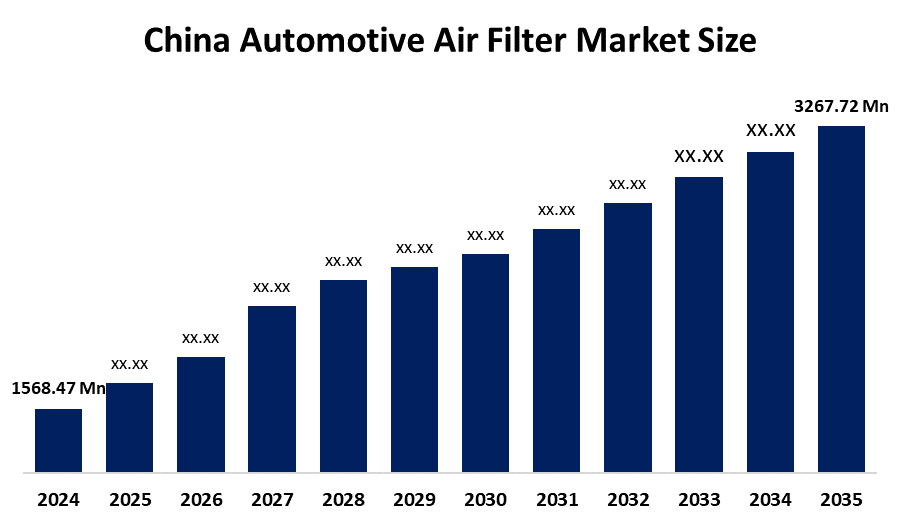

- China Automotive Air Filter Market Size 2024: USD 1568.47 Mn

- China Automotive Air Filter Market Size 2035: USD 3267.72 Mn

- China Automotive Air Filter Market CAGR 2024: 6.9%

- China Automotive Air Filter Market Segments: Vehicle Type and Product Type

Get more details on this report -

The China Automotive Air Filter Market Size refers to the segment covering engine and the cabin air filter for the vehicles in China, which is driven by the massive car production, rising pollution which boosts demand for the air filters, stricter emission rule, and growing consumer focus on the air quality are encompassing the both OEM supply and the after-market sales for the passenger car, commercial vehicle and the two wheelers are using the materials like paper, cotton and advanced Nano fabrics. It is the market for purifying the air in the China’s vast and growing vehicle fleet, which is essential for the engine health, performance, and passenger well-being.

Under the China VI standards, which are on par with or more demanding than Euro VI, China has imposed some of the strictest vehicle emission rules in the world. According to which the government data, and these regulations, which call for significant reductions in NOx and particulate matter, apply to all the new light-duty and heavy-duty vehicles. This encourages the use of high-efficiency engine and cabin air filtration systems by automakers, hence fostering the expansion of the automotive air filter market in China.

China Automotive Air Filter Market Size presents the strong future opportunities driven by the strict emission regulation, rising consumer focus on cabin air quality, booming EV market needs, aftermarket demand for higher vehicle usage, and the tech integration. Despite initial concern about EV shifts impacting traditional engine filters. The key areas include the advanced multi filtration, sensor equipped systems, eco-friendly materials, the OEM partnership and catering to both ICE and New Energy Vehicle.

China Automotive Air Filter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1568.47 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.9% |

| 2035 Value Projection: | USD 3267.72 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Vehicle Type, By Product Type |

| Companies covered:: | Donaldson Company Inc., Dongguan Shenglian Filter Manufacturing Co., Ltd., HEBEI XUE YUAN FILTER CO., LTD, Fonho, XTSKY INDUSTRIAL GROUP LIMITED, FILONG Automotive Group Limited, Guangzhou DC Auto Parts Co., Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Automotive Air Filter Market:

The China Automotive Air Filter Market Size is driven by the massive vehicle production, rising incomes fuelling car purchases and serve urban pollution demanding better engine filtration alongside strict emission rules pushing advanced filter tech for performance and the cleaner air, with the strong aftermarket replacement demands adding consistency in the growth. The key driver includes rapid motorization, health awareness, and a large manufacturing base. Severe air pollution in the cities drives the demand for high-efficiency cabin air filter for the passenger health.

The China Automotive Air Filter Market Size is restrained from the shift towards the electric vehicles, high costs of the advanced filters, fluctuating raw material prices, intense competition, and the potential trade impacts, through the rising pollution drives demand for the cabin filter which is creating a complex market.

The future of China Automotive Air Filter Market Size is bright and growing, driven by its massive vehicle production, the increasing demand of EV adoption and also the demand for advanced cabin filters, rising consumer health awareness, stricter emission norms and the tech integration with the projection pointing to the significant revenue for its growth and the dominance.

The China Automotive Air Filter Market share is classified into vehicle type and product type.

By vehicle Type:

The China Automotive Air Filter Market Size is divided by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, the passenger cars segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Which is driven by China's enormous automobile production, high ownership rates, expanding middle class, and rising need for engine and cabin air filtration for performance and comfort, along with its promising aftermarket

By product type:

The China Automotive Air Filter Market Size is divided by product type into air intake filters and cabin air filters. Among these, the cabin air filters segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Which is driven by growing affluence, greater pollution concerns, higher health standards, and OEM adoption of advanced technology (such HEPA/activated carbon) for cleaner driving conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Automotive Air Filter Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Automotive Air Filter Market:

- Donaldson Company Inc.

- Dongguan Shenglian Filter Manufacturing Co., Ltd.

- HEBEI XUE YUAN FILTER CO., LTD

- Fonho

- XTSKY INDUSTRIAL GROUP LIMITED

- FILONG Automotive Group Limited

- Guangzhou DC Auto Parts Co., Ltd.

- Others

Recent Developments in China Automotive Air Filter Market:

In January 2024, Bosch launched FILTER+pro, a high-efficiency cabin air filter with antimicrobial protection and over 98% PM2.5 filtrations, supporting demand in China’s Automotive Air Filter Market Size for advanced in-vehicle air quality solutions.

In June 2023, UFI Filters supplied its SUPER ADSORBER cathode air filter to Changan’s fuel-cell light vehicle, using activated carbon to absorb gaseous contaminants and protect fuel-cell efficiency and lifespan, highlighting advanced filtration demand in China’s automotive air filter market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China automotive air filter market based on the below-mentioned segments:

China Automotive Air Filter Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

China Automotive Air Filter Market, By Product Type

- Air Intake Filters

- Cabin Air Filters

Frequently Asked Questions (FAQ)

-

What is the China automotive air filter market size?China automotive air filter market is expected to grow from USD 1568.47 million in 2024 to USD 3267.72 million by 2035, growing at a CAGR of 6.9% during the forecast period 2025-2035.

-

China automotive air filter market is expected to grow from USD 1568.47 million in 2024 to USD 3267.72 million by 2035, growing at a CAGR of 6.9% during the forecast period 2025-2035.Market growth is driven by the segment covering engine and the cabin air filter for the vehicles in China, which is driven by the massive car production, rising pollution which boosts demand for the air filters, stricter emission rule, and growing consumer focus on the air quality are encompassing the both OEM supply and the after-market sales for the passenger car, commercial vehicle and the two wheelers are using the materials like paper, cotton and advanced Nano fabrics.

-

What factors restrain the China automotive air filter market?Constraints include from the shift towards the electric vehicles, high costs of the advanced filters, fluctuating raw material prices, intense competition, and the potential trade impacts, through the rising pollution drives demand for the cabin filter which is creating a complex market.

-

How is the market segmented by vehicle type?The market is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles.

-

Who are the key players in the China automotive air filter market?Key companies include Donaldson Company Inc, Dongguan Shenglian Filter Manufacturing Co., Ltd, HEBEI XUE YUAN FILTER CO., LTD, Fonho, XTSKY INDUSTRIAL GROUP, FILONG Automotive Group Limited, Guangzhou DC Auto Parts Co., Ltd, Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?