China Automated Material Handling (AMH) Market Size, Share, By Type (Automated Storage and Retrieval Systems (ASRS), Automated Guided Vehicles (AGVs), Automated Conveyor & Sorting Systems, Mobile Robots, Others), By End-User (E-commerce & Retail, Manufacturing, Food & Beverage, Automotive, Pharmaceuticals, Logistics & Distribution, Others), China Automated Material Handling (AMH) Market Insights, Industry Trend, Forecasts to 2032

Industry: Automotive & TransportationChina Automated Material Handling (AMH) Market Size Insights Forecasts to 2035

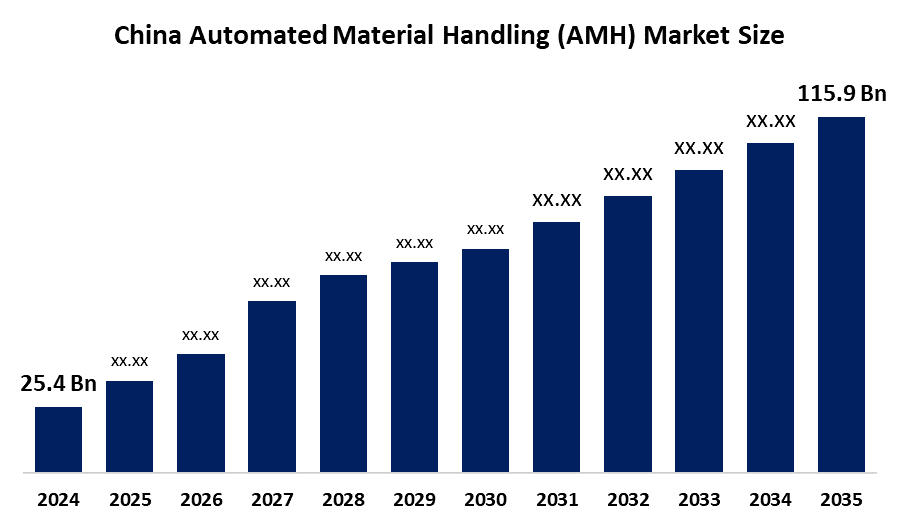

- China Automated Material Handling (AMH) Market Size 2024: USD 25.4 Billion

- China Automated Material Handling (AMH) Market Size 2035: USD 115.9 Billion

- China Automated Material Handling (AMH) Market CAGR 2024: 14.8%

- China Automated Material Handling (AMH) Market Segments: By Type, By End-user.

Get more details on this report -

The China Automated Material Handling Market Size involves sophisticated automation systems and their machinery capable of automating the flow, storage, security and management of materials and products during the manufacturing, warehousing, distribution and logistics operations. The most significant ones are automated guided vehicles (AGV), automated storage and retrieval systems (ASRS), conveyors, sortation systems, robot arms, and software-integrated solutions, and serve the e-commerce, manufacturing, automotive, food and beverage, pharmaceuticals, and logistics industries. These systems promote efficiency in operations, less dependence on labour, minimization of errors and high throughput operations.

The China market is expanding at a rapid rate due to the attention by China government towards Industry 4.0 and smart manufacturing under the Made in China 2025 project, the massive expansion of e-commerce via Alibaba and JD.com, the rise in labour costs, and the necessity to have resilient supply chains. The use of robotics and automation is being propelled by the government through subsidies on robotics and automation, advances in AI, IoT, and mobile robotics.

Market Dynamics of the China Automated Material Handling (AMH) Market:

The driving forces behind this market include explosive e-commerce and online retail growth, labour shortages in manufacturing and logistics, government policies such as Made in China 2025, and support for smart factories and automation, along with fast industrialization and efficient supply chain management in high-volume industries. The AGVs, ASRS, AI-compatible robotics, and the incorporation with systems of warehouse management (WMS) are being made to provide faster and more accurate operations through technological progress.

Some of the challenges include large upfront capital cost to deploy, complexities in integrating with legacy systems, cybersecurity risk in connected systems, lack of skilled workforce to maintain and operate, and the chance of disruptions in the supply chain of imported components.

The future prospects for the market are encouraging, and the range of applications will grow in the field of smart logistics, quick commerce, pharmaceutical cold-chain management, assembly lines in the automotive industry, and food processing. Sustained growth will be supported by increasing investments in robotics, the number of automated warehouses, and supportive policies, as well as the domestic development of AMH equipment.

Market Segmentation

The China automated material handling (AMH) market share is classified into type and end-user.

By Type:

The China automated material handling market is divided by type into automated storage and retrieval systems (ASRS), automated guided vehicles (AGVs), automated conveyor & sorting systems, mobile robots, and others. Among these, the automated guided vehicles (AGVs) segment dominates the market and is anticipated to grow at a remarkable CAGR during the forecast period. AGVs lead the way mainly because of their high flexibility and scalability in dynamic environments of warehouses, as well as their widespread adoption in e-commerce fulfilment centres, manufacturing facilities, and logistics facilities. The prominent status of AGVs is further supported by the dominance of China in the global robotics production industry and the availability of affordable local solutions.

By End-user:

The market is divided by end-user into e-commerce & retail, manufacturing, food & beverage, automotive, pharmaceuticals, logistics & distribution, and others. Among these, the e-commerce & retail segment dominated in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The E-commerce & Retail segment dominates due to massive online shopping volumes, rapid expansion of fulfilment centres, demand for high-speed and accurate order processing, same-day delivery expectations, and heavy investments by major Chinese e-commerce players in automated warehouses to improve efficiency and reduce labour dependency.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China automated material handling (AMH) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Automated Material Handling (AMH) Market:

- Guangzhou Sinorobot Technology Co. Ltd

- Siasun Robot & Automation Co. Ltd.

- Noblelift Intelligent Equipment Co. Ltd.

- Shanghai Triowin Automation Machinery Co. Ltd.

- Shenzhen Casun Intelligent Robot Co.

- Daifuku Co. Ltd.

- SSI Schaefer

Recent Developments in China Automated Material Handling (AMH) Market:

In March 2024, Daifuku launched advanced automated storage and retrieval systems (AS/RS) in China, aimed at high-throughput warehouses and smart manufacturing facilities supporting the e-commerce and automotive sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China automated material handling (AMH) market based on the below-mentioned segments:

China Automated Material Handling (AMH) Market, By Type

- Automated Storage and Retrieval Systems (ASRS)

- Automated Guided Vehicles (AGVs)

- Automated Conveyor & Sorting Systems

- Mobile Robots

- Others

China Automated Material Handling (AMH) Market, By End-user

- E-commerce & Retail

- Manufacturing

- Food & Beverage

- Automotive

- Pharmaceuticals

- Logistics & Distribution

- Others

Frequently Asked Questions (FAQ)

-

1. What is the current size of the China automated material handling (AMH) market?The China AMH market was valued at approximately USD 25.4 billion in 2024.

-

2. What is the projected size of the China AMH market by the end of the forecast period?The market is expected to reach approximately USD 115.9 billion by 2035.

-

3. What is the expected CAGR for the China AMH Market during the forecast period?The market is projected to grow at a CAGR of 14.8% from 2025 to 2035.

Need help to buy this report?