China Air Conditioner Market Size, Share, By Product Type (Splits, VRFs, Chillers, Windows, Rooftop, and Others), By Technology (Inverter, Non- Inverter, Smart AC, and Others), By End User (Residential, Commercial, Industrial, and Others), and China Air Conditioner Market Industry Trend, Forecasts to 2035

Industry: Consumer GoodsChina Air Conditioner Market Insights Forecasts to 2035

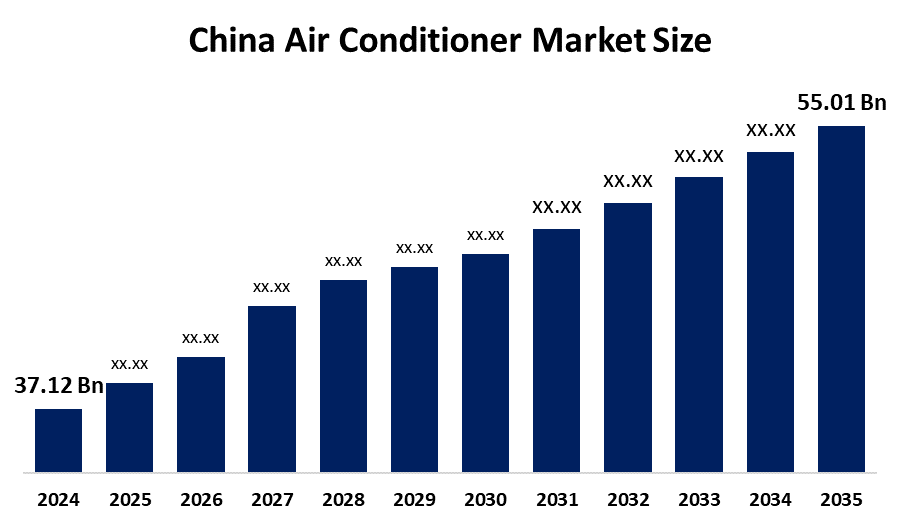

- China Air Conditioner Market Size 2024: USD 37.12 Billion

- China Air Conditioner Market Size 2035: USD 55.01 Billion

- China Air Conditioner Market CAGR 2024: 3.64%

- China Air Conditioner Market Segments: Product Type, Technology, and End User.

Get more details on this report -

The China Air Conditioner Market involves manufacturing, selling, and using cooling equipment in residential, office, shopping, and factory settings. The market comprises split air conditioners, window air conditioners, portable air conditioners, and large central air conditioning systems. The increasing summer temperatures, rising number of people with higher incomes, urbanization, and regulations promoting energy-efficient products force manufacturers to provide smarter and more efficient air conditioners. The China air conditioner market is steadily expanding due to increasing urbanization, rising middle class incomes, and warmer summers. New residential and commercial developments are adding to the demand. Consumers are also increasingly adopting energy-saving and smart air conditioners. Government initiatives to make air conditioners more energy-efficient and promote green buildings are adding to the demand for new units.

Government support is a constant factor in the Chinese air conditioner market. The government is promoting energy-saving standards, green building standards, and subsidy policies to encourage consumers to replace their old air conditioners with new ones of high energy efficiency. Carbon reduction and peak policies are also promoting the development of inverter and eco friendly technology in the industry.

The major trends in the China air conditioner market include a fast shift towards inverters and energy saving models, an increasing demand for smart connected air conditioners, and an increasing popularity of heat pump air conditioners. Consumers are preferring noiseless and compact models for apartments. The demand for replacement sales is increasing in large cities, while first-time sales are increasing in lower-tier cities.

China Air Conditioner Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.64% |

| 2035 Value Projection: | USD 55.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By End User |

| Companies covered:: | Gree Electric Appliances Inc, Midea Group Co LTD, Haier Smart Home Co Ltd, Hisense Group Co Ltd, AUX Group, Chigo Holding Co Ltd, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Air Conditioner Market:

The China air conditioner market is fueled by the fast pace of urbanization, increased middle-class purchasing power, and steady residential construction. The rising temperatures and increased duration of heatwaves are making air conditioning less of a luxury item and more of a necessity. Commercial growth in the form of shopping malls, offices, and hotels is also a steady source of demand. Upgrades from old air conditioners to energy efficient inverter air conditioners for electricity savings are also on the rise.

The China air conditioner market is challenged by restraints from various factors. Less activity in the real estate sector and consumers' prudent spending habits lower new demand, while competition reduces profit margins. Increasing production costs because of energy and environmental regulations, market saturation in the major cities, and raw material and supply chain variability also limit growth.

The Chinese market for air conditioners has bright opportunities, as many families are planning to buy air conditioners for the first time in smaller cities and rural areas. The urban population is upgrading to intelligent, noiseless, and energy-saving models, which is creating a replacement market. The movement for a low-carbon lifestyle is encouraging the use of heat pumps and energy-efficient models. The increasing number of data centres, shopping malls, and modern offices is increasing the demand for commercial air conditioners. Additional functionalities such as air purification and health-centric cooling are becoming key differentiators.

Market Segmentation

The China air conditioner market share is classified into product type, technology, and end user.

By Product Type:

The China air conditioner market is divided by product type into splits, vrfs, chillers, windows, rooftop, and others. Among these, the split air conditioner segment dominated the share in 2024 and is expected to grow at a strong CAGR during the forecast period. The dominance of split air conditioners is driven by their suitability for apartment living, widespread affordability, and ease of installation. They are more energy efficient and quieter than window units, making them appealing for urban households. Rising middle class incomes encourage upgrades to inverter models, and government efficiency regulations further push consumers to replace older, less efficient systems with modern split ACs.

By Technology:

The China air conditioner market is divided by technology into inverter, non- inverter, smart ac, and others. Among these, the smart air conditioner segment is the fastest growing segment during the forecast period. The smart ac segment is growing rapidly because it offers convenience, energy savings, and remote control through apps or voice assistants. Consumers in urban areas prefer these connected, tech-enabled units for smarter temperature management, integration with home automation, and better efficiency, making them more appealing than traditional or non-smart air conditioners.

By End User:

The China air conditioner market is divided by end user into residential, commercial, industrial, and others. Among these, the residential segment is projected to hold the largest share during the forecast period. The residential segment leads because rising urbanization and the expansion of apartment and housing developments are increasing household demand. Growing disposable incomes allow more families to purchase or upgrade to energy-efficient and smart ACs. Additionally, hotter summers and changing lifestyles make air conditioning a necessity in homes, while government incentives for energy-efficient appliances further encourage residential adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China air conditioner market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Air Conditioner Market:

- Gree Electric Appliances Inc

- Midea Group Co LTD

- Haier Smart Home Co Ltd

- Hisense Group Co Ltd

- AUX Group

- Chigo Holding Co Ltd

- Others

Recent Developments in China Air Conditioner Market:

In August 2025, Tcl launched the freshin fresh air conditioner series with smart health and energy-saving features, targeting next-generation consumers and setting benchmarks for intelligent, efficient, and convenient home cooling solutions.

In May 2025, Haier introduced its first ai automotive air conditioner in Guangzhou, expanding its product line beyond homes into vehicles, integrating intelligent climate control and health-focused features for modern mobility environments.

In March 2025, Xiaomi showcased progress at its smart home appliance factory in Wuhan, preparing large-scale production of smart air conditioners to compete with established brands and expand its presence in intelligent home cooling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China air conditioner market based on the below-mentioned segments:

China Air Conditioner Market, By Product Type

- Splits

- Vrfs

- Chillers

- Windows

- Rooftop

- Others.

China Air Conditioner Market, By Technology

- Inverter

- Non- Inverter

- Smart Ac

- Others

China Air Conditioner Market, By End User

- Residential

- Commercial

- Industrial

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the size of the China air conditioner market?A: China air conditioner market is expected to grow from USD 37.12 billion in 2024 to USD 55.01 billion by 2035, growing at a CAGR of 3.64% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the China air conditioner market?A: The key growth drivers of the China air conditioner market include rapid urbanization, rising disposable incomes, and increased residential construction, which boost household demand. Hotter summers and changing lifestyles make cooling essential, while government incentives for energy efficient appliances encourage upgrades. Rising adoption of smart and inverter ACs, along with commercial expansion in offices, malls, and hotels, further fuels market growth.

-

Q: What factors restrain the China air conditioner market?A: The China air conditioner market is restrained by market saturation in major cities, limiting first-time purchases. Intense competition among manufacturers pressures profit margins. High production costs due to energy efficiency regulations, fluctuating raw material prices, and supply chain disruptions also challenge growth. Slower real estate activity and tightening consumer spending in some regions further reduce demand, particularly for premium or replacement units.

-

Q: Who are the key players in the China air conditioner market?A: Key companies include gree electric appliances inc, midea group co ltd, haier smart home co ltd, hisense group co ltd, aux group, chigo holding co ltd, tcl technology group corporation, kelon electrical holdings hisense kelon, chunlan group, shanghai hitachi electrical appliances (JV), and others.

-

Q: Who are the target audiences for China air conditioner market?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?