China Acrylonitrile Butadiene Styrene Market Size, Share, By Type (Opaque, Transparent, And Coloured), By Application (Appliances, Electrical & Electronics, Automotive, Consumer Goods, Construction, And Others), And China Acrylonitrile Butadiene Styrene Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsChina Acrylonitrile Butadiene Styrene Market Insights Forecasts to 2035

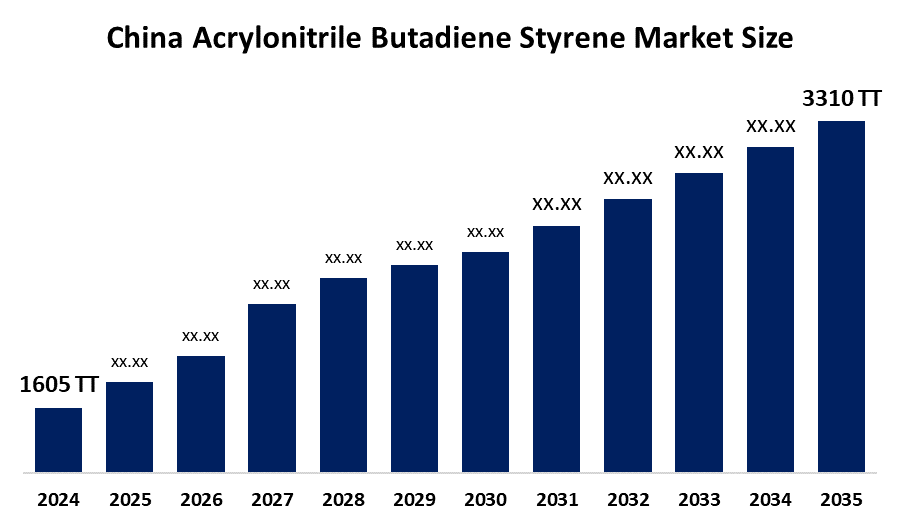

- China Acrylonitrile Butadiene Styrene Market 2024: 1605 Thousand Tonnes

- China Acrylonitrile Butadiene Styrene Market Size 2035: 3310 Thousand Tonnes

- China Acrylonitrile Butadiene Styrene Market CAGR 2024: 6.8%

- China Acrylonitrile Butadiene Styrene Market Segments: Type and Application

Get more details on this report -

The China acrylonitrile butadiene styrene (ABS) encompasses a sector operates on one of the most versatile types of engineering thermoplastic that is produced worldwide, so as a copolymer of acrylonitrile, butadiene, and styrene, ABS combines properties including strength, impact resistance, heat resistance, and ease of manufacture. Uses for ABS exist in many end use sectors including automotive parts, electronics enclosures, consumer goods, built-up materials, and molded components due to its durability, and dimensional stability, as well as being compatible with both injection molding and extrusion processes.

The acrylonitrile butadiene styrene in China is backed by government support, including the Made in China 2025 industrial strategy, a broad policy framework aimed at transforming China from a low-cost manufacturer into a high-value advanced manufacturing powerhouse. By 2027 China is expected to account for approximately 96% of planned ABS capacity growth in the region, reflecting the government’s focus on bolstering domestic polymer production and downstream manufacturing capabilities.

As technology advances, Chinese acrylonitrile butadiene styrene providers are now using advanced reactor technology and control of the two-step polymerization process, to provide greater consistency, increased purity, as well as manufacturer-specific custom grades which meet customer requirements. In addition, modification of the material, blending with various other polymers, and utilizing various additives to improve performance in harsh environments have permitted ABS to be employed in a broad range of applications and employ smart manufacturing processes to reduce waste, improve energy efficiency, and improve quality control at ABS manufacturing facilities.

China Acrylonitrile Butadiene Styrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1605 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.8% |

| 2035 Value Projection: | 3310 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 136 |

| Segments covered: | By Type,By Application |

| Companies covered:: | PetroChina Company Limited, Sinopec, CHIMEI Corporation, LG Chem, Formosa Plastics Group, INEOS Styrolution, Toray Industries, Inc., Kumho Petrochemical, Lotte Chemical Corporation, Trinseo, BASF SE, Techno-UMG Co., Ltd., Jiangsu Sailboat Petrochemical, Tianjin Dagu Chemical Co., Ltd., Sabic,and Other |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Acrylonitrile Butadiene Styrene Market:

The China acrylonitrile butadiene styrene market is driven by the strong domestic demand from automotive, electronics, and consumer goods industries, rising ABS demand for interior and exterior parts, rapid expansion of the electronics sector, high consumption in housings, displays, and electrical components, rapid urbanization, growth in infrastructure projects further stimulate construction materials, technological progress, and the growing preference for lightweight, high-performance materials in manufacturing processes further propel the market growth.

The China acrylonitrile butadiene styrene market is restrained by the volatility in raw material prices, material feedstocks challenges, price instability for ABS resin, fluctuations in crude oil and monomer markets, environmental and regulatory pressures to reduce emissions, and competition from alternative polymers challenges.

The future of China acrylonitrile butadiene styrene market is bright and promising, with versatile opportunities emerging from the expanding market of electric vehicles and next-gen electronics is for high-performing ABS materials with optimal characteristics of lightweight, thermal stability, and aesthetic appeal. A strong base of export-oriented manufacturing represents potential for growth with a continued increase investments into advanced materials research and locally produced capabilities indirectly supported by broader industrial policies will position domestic manufacturers to capture more of the value created by developing niche-specific grades of ABS.

Market Segmentation

The China Acrylonitrile Butadiene Styrene Market share is classified into type and application.

By Type:

The China acrylonitrile butadiene styrene market is divided by type into opaque, transparent, and coloured. Among these, the opaque segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High dominance in key end use industries, favouring high impact resistance, rigidity, and surface gloss, highly suitable for injection molding, and country’s dominant manufacturing technology all contribute to the opaque segment's largest share and higher spending on acrylonitrile butadiene styrene when compared to other type.

By Application:

The China acrylonitrile butadiene styrene market is divided by application into appliances, electrical & electronics, automotive, consumer goods, construction, and others. Among these, the appliances segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The appliances segment dominates because of manufacturing hub dominance, offers high impact resistance and durability, rising domestic demand, rapid urbanization, increasing disposable income, and cost effective solution compared to alternatives in mass production.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China acrylonitrile butadiene styrene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Acrylonitrile Butadiene Styrene Market:

- PetroChina Company Limited

- Sinopec

- CHIMEI Corporation

- LG Chem

- Formosa Plastics Group

- INEOS Styrolution

- Toray Industries, Inc.

- Kumho Petrochemical

- Lotte Chemical Corporation

- Trinseo

- BASF SE

- Techno-UMG Co., Ltd.

- Jiangsu Sailboat Petrochemical

- Tianjin Dagu Chemical Co., Ltd.

- Sabic

- Others

Recent Developments in China Acrylonitrile Butadiene Styrene Market:

In December 2025, LG Chem completed a KRW 150 billion continuous-polymerization upgrade at its Yeosu plant, which serves Chinese demand. The upgrade cuts cycle times by 30% to produce high gloss ABS for electronics.

In November 2025, PetroChina scheduled to begin operations of a massive 600,000 metric tons/year ABS plant in Jilin City, following the startup of upstream styrene monomer facilities in October 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China acrylonitrile butadiene styrene market based on the below-mentioned segments:

China Acrylonitrile Butadiene Styrene Market, By Type

- Opaque

- Transparent

- Coloured

China Acrylonitrile Butadiene Styrene Market, By Application

- Appliances

- Electrical & Electronics

- Automotive

- Consumer Goods

- Construction

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China acrylonitrile butadiene styrene market size?A: China acrylonitrile butadiene styrene market is expected to grow from 1605 thousand tonnes in 2024 to 3310 thousand tonnes by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong domestic demand from automotive, electronics, and consumer goods industries, rising ABS demand for interior and exterior parts, rapid expansion of the electronics sector, high consumption in housings, displays, and electrical components, rapid urbanization, growth in infrastructure projects further stimulate construction materials, technological progress, and the growing preference for lightweight, high-performance materials in manufacturing processes further propel the market growth.

-

Q: What factors restrain the China acrylonitrile butadiene styrene market?A: Constraints include the volatility in raw material prices, material feedstocks challenges, price instability for ABS resin, fluctuations in crude oil and monomer markets, environmental and regulatory pressures to reduce emissions, and competition from alternative polymers challenges.

-

Q: How is the market segmented by type?A: The market is segmented into opaque, transparent, and coloured.

-

Q: Who are the key players in the China acrylonitrile butadiene styrene market?A: Key companies include PetroChina Company Limited, Sinopec, CHIMEI Corporation, LG Chem, Formosa Plastics Group, INEOS Styrolution, Toray Industries, Inc., Kumho Petrochemical, Lotte Chemical Corporation, Trinseo, BASF SE, Techno-UMG Co., Ltd., Jiangsu Sailboat Petrochemical, Tianjin Dagu Chemical Co., Ltd., Sabic, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?