China Acetone Market Size, Share, By Grade (Technical Grade And Specialty Grade), By Application (Solvents, Methyl Methacrylate, Bisphenol A, And Others), And China Acetone Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsChina Acetone Market Insights Forecasts to 2035

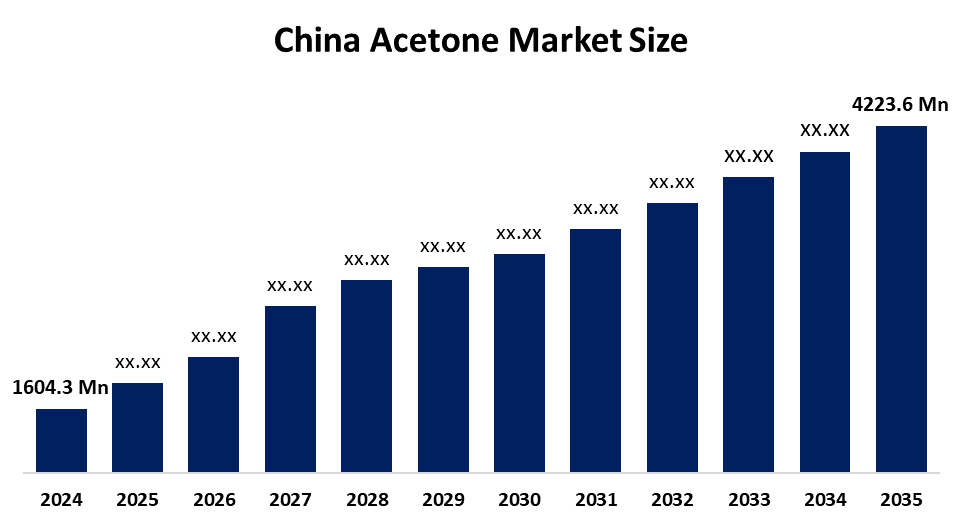

- China Acetone Market Size 2024: USD 1604.3 Million

- China Acetone Market Size 2035: USD 4223.6 Million

- China Acetone Market CAGR 2024: 9.2%

- China Acetone Market Segments: Grade and Application

Get more details on this report -

The China Acetone Market encompasses all of the activities associated with producing, importing, distributing, and consuming acetone, which is a transparent, capricious, and liquid used as an intermediary and solvent in many sectors. Industries such as plastics, pharmaceuticals, adhesives, coatings, cosmetics, and electronic chemicals utilize acetone as their primary component.

The acetone in China is backed by government support, including the 14th Five-Year Plan (2021–2025), which allocated significant funding for chemical industry modernization and advanced manufacturing development including acetone production capacity and derivative industries. Under this framework, authorities like the Ministry of Industry and Information Technology have prioritized strengthening domestic production capabilities

As technology advances, Chinese acetone providers are now using innovative catalytic and processing technologies, while conducting research on producing high purity acetone suitable for use in sensitive applications such as electronics, pharmaceuticals and other high purity chemical intermediates. Innovation is primarily geared towards addressing environmental concerns including lower volatility organic compound emissions. In addition, the trend toward using more sustainable sources of feedstock and purification systems to meet increasing national environmental standards is also on the rise in China.

China Acetone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1604.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.2% |

| 2035 Value Projection: | USD 4223.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Sinopec, Shell Petrochemicals, Wanhua Chemical Group, Formosa Chemicals & Fibre Corp, Longjiang Chemical, Blue Star Harbin, Hengli Petrochemical, LG Chem, INEOS, Mitsui Chemicals Inc., BASF SE, Lyondell Basell Industries, Evonik Industries, Hubei Xingfa Chemicals Group Co., Ltd., Anhui Guangxin |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the China Acetone Market:

The China acetone market is driven by rapid expansion of chemical industries and downstream sectors, China’s large manufacturing base, integrated petrochemical complexes, growing innovations in green chemistry, strong policy support for upgrading industrial infrastructure, global supply chain realignment, China’s cost advantages in production capacity, technological advancements improving yields and energy efficiency further propel the market growth.

The China acetone market is restrained by the complex environmental regulations, high compliance costs, limited invest in pollution control technologies, stringent emissions standards that raise operating expenses, relies on imports for high-purity acetone, and infrastructure gap in domestic technological capabilities for ultra-high-grade acetone.

The future of China acetone market is bright and promising, with versatile opportunities emerging from the continued growth of downstream products providing higher margins and diversification in terms of demand. By investing in high-purity acetone manufacturing technologies, companies can decrease reliance upon importation and enhance access to the global market as a whole. Additionally, the rise of sustainable practices in green chemistry will provide opportunities for companies to adopt eco-friendly manufacturing practices and to produce various derivative products that align with global environmental goals, thereby strengthening China’s competitive position in foreign markets.

Market Segmentation

The China Acetone Market share is classified into grade and application.

By Grade:

The China acetone market is divided by grade into technical grade and specialty grade. Among these, the technical grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High demand for large scale industrial manufacturing, cost effectiveness, rapid industrialization, and high vertical integration favouring the production of technical grade acetone to feed into downstream polymer manufacturing all contribute to the technical grade segment's largest share and higher spending on acetone when compared to other grade.

By Application:

The China acetone market is divided by application into solvents, methyl methacrylate, bisphenol a, and others. Among these, the bisphenol a segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The bisphenol a segment dominates because of massive downstream demand for polycarbonate, rapid expansion of production capacity, increasingly dominance of vertically integrated producers, and essential for producing epoxy resins in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China acetone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Acetone Market:

- Sinopec

- Shell Petrochemicals

- Wanhua Chemical Group

- Formosa Chemicals & Fibre Corp

- Longjiang Chemical

- Blue Star Harbin

- Hengli Petrochemical

- LG Chem

- INEOS

- Mitsui Chemicals Inc.

- BASF SE

- Lyondell Basell Industries

- Evonik Industries

- Hubei Xingfa Chemicals Group Co., Ltd.

- Anhui Guangxin

- Others

Recent Developments in China Acetone Market:

In July 2025, Zhenhai Refining & Chemical commissioned a new large-scale phenol-acetone facility, which significantly boosted production, leading to a record high output of 279,000 tons.

In February 2025, Fuyu Petrochemical commissioned a new 250,000-ton/year phenol-ketone unit. Feedstock processing began in October 2024, with qualified product output achievement.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China acetone market based on the below-mentioned segments:

China Acetone Market, By Grade

- Technical Grade

- Specialty Grade

China Acetone Market, By Application

- Solvents

- Methyl Methacrylate

- Bisphenol A

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the China acetone market size?A: China acetone market is expected to grow from USD 1604.3 million in 2024 to USD 4223.6 million by 2035, growing at a CAGR of 9.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion of chemical industries and downstream sectors, China’s large manufacturing base, integrated petrochemical complexes, growing innovations in green chemistry, strong policy support for upgrading industrial infrastructure, global supply chain realignment, China’s cost advantages in production capacity, technological advancements improving yields and energy efficiency further propel the market growth.

-

Q: What factors restrain the China acetone market?A: Constraints include the complex environmental regulations, high compliance costs, limited invest in pollution control technologies, stringent emissions standards that raise operating expenses, relies on imports for high-purity acetone, and infrastructure gap in domestic technological capabilities for ultra-high-grade acetone.

-

Q: How is the market segmented by grade?A: The market is segmented into technical grade and specialty grade.

-

Q: Who are the key players in the China acetone market?A: Key companies include Sinopec, Shell Petrochemicals, Wanhua Chemical Group, Formosa Chemicals & Fibre Corp, Longjiang Chemical, Blue Star Harbin, Hengli Petrochemical, LG Chem, INEOS, Mitsui Chemicals Inc., BASF SE, Lyondell Basell Industries, Evonik Industries, Hubei Xingfa Chemicals Group Co., Ltd., Anhui Guangxin, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?