Global Children’s Electric Toothbrushes Market Size, Share, and COVID-19 Impact Analysis, By Product Analysis (Battery Powered, and Rechargeable) By Age Group (0-3 Years, 3-6 Years, and 6-12 Years), By Technology Analysis (Rotational, and Vibrational), By Distribution Channel Analysis (Offline Stores, and Online Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Electronics, ICT & MediaGlobal Children’s Electric Toothbrushes Market Insights Forecasts to 2035

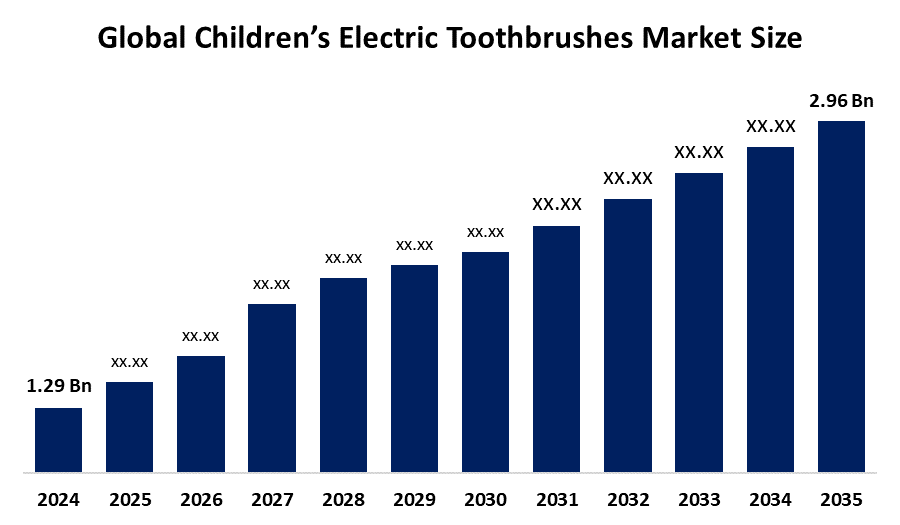

- The Global Children’s Electric Toothbrushes Market Size Was Estimated at USD 1.29 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.84% from 2025 to 2035

- The Worldwide Children’s Electric Toothbrushes Market Size is Expected to Reach USD 2.96 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global children’s electric toothbrushes market size was worth around USD 1.29 billion in 2024 and is predicted to grow to around USD 2.96 billion by 2035 with a compound annual growth rate (CAGR) of 7.84% from 2025 to 2035. The market for children's electric toothbrushes offers opportunities in terms of technical innovation, growing awareness of oral health, increased parental spending on hygiene, growing e-commerce channels, and the desire for age-specific, interactive, and environmentally friendly dental care products.

Market Overview

The market for children's electric toothbrushes includes the section of the global oral care industry that is specifically focused on powered dental hygiene products for children are usually between the ages of two and twelve. With characteristics like soft bristles, compact brush heads, ergonomic handles, and captivating designs with colors, characters, or interactive elements, these products are designed to support regular brushing while meeting the special dental requirements of young consumers. Battery-operated, rechargeable, and smart toothbrushes with features like timers, music, or app connectivity to promote regular brushing practices are among the product varieties available on the children’s electric toothbrushes market. In March 2025, the UK launched its Supervised Toothbrushing Programme for deprived areas, while the U.S. expanded the CMS Oral Health Initiative, highlighting government support for accessible pediatric oral care tools. The rising incidence of dental problems in young children, improvements in electric toothbrush technology, and parents' greater knowledge of oral hygiene for kids are the main factors driving the growth of the children’s electric toothbrushes market. Growing awareness of oral hygiene is one of the main factors driving the children’s electric toothbrushes market.

Report Coverage

This research report categorizes the children’s electric toothbrushes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the children’s electric toothbrushes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the children’s electric toothbrushes market.

Global Children’s Electric Toothbrushes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.29 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 7.84% |

| 024 – 2035 Value Projection: | USD 2.96 Billion |

| Historical Data for: | 2021 - 2024 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Analysis, By Age Group |

| Companies covered:: | Procter & Gamble (Oral-B), Philips Sonicare, Colgate-Palmolive, Panasonic Corporation, FOREO, Brush-Baby, Grush, Quip, Kolibree, Fairywill, Church & Dwight (Arm & Hammer), Xiaomi, And Other Plyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Electric toothbrush technology developments are another important factor propelling the children’s electric toothbrush market. The significance of early dental care for children has been made clear to parents and guardians through oral health campaigns and educational initiatives. The global market for children's electric toothbrushes is expanding significantly as a result of a confluence of behavioral, technological, and demographic reasons. Parents' growing awareness of pediatric oral health is a major contributing element in the children’s electric toothbrushes market. Additionally, more households are adopting high-end dental care products, such as electric toothbrushes, due to urbanization and increased disposable income in developing nations. Accessibility is further made easier by the growth of retail channels and e-commerce platforms.

Restraining Factors

The market for children's electric toothbrushes is restricted by a number of factors, including high product costs, low awareness in rural areas, battery dependence, parental preference for manual brushes, and worries about durability and safety.

Market Segmentation

The children’s electric toothbrushes market share is classified into product analysis, age group, technology analysis, and distribution channel analysis

- The rechargeable segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product analysis, the children’s electric toothbrushes market is divided into battery-powered and rechargeable. Among these, the rechargeable segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The improved durability, long-term cost-effectiveness, and cutting-edge features like integrated timers, pressure sensors, and interactive features that appeal to both parents and kids are contributing factors to the rechargeable market. Due to rising consumer demand for cutting-edge and environmentally friendly dental care products, the rechargeable category is expected to experience a notable CAGR.

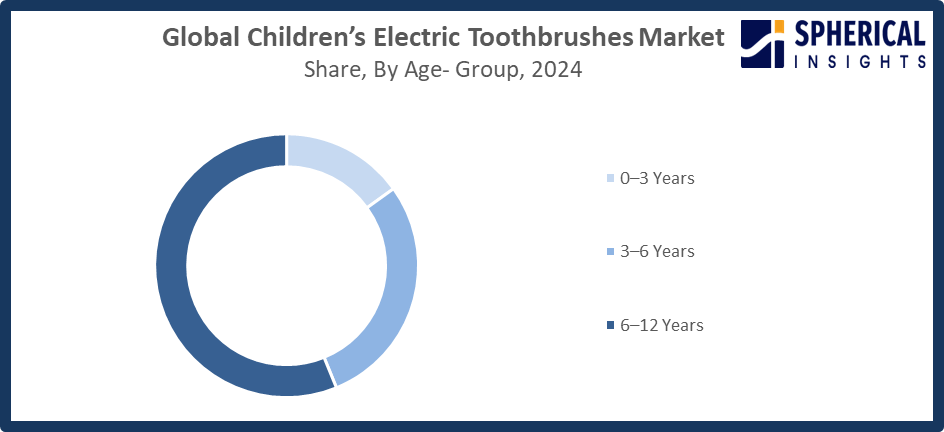

- The 6–12 years segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the age group, the children’s electric toothbrushes market is divided into 0–3 years, 3–6 years, and 6–12 years. Among these, the 6–12 years segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The 6–12 age group is mostly driven by older kids who can use electric toothbrushes efficiently and take advantage of sophisticated features like timers, music, and app connectivity. Demand is further supported by the fact that children in this age range show greater independence in their dental hygiene practices. Parents' growing focus on preventive dental care supports the 6–12 age group.

Get more details on this report -

- The vibrational segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology analysis, the children’s electric toothbrushes market is divided into rotational and vibrational. Among these, the vibrational segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increased desire for mild yet efficient cleaning, improved comfort for younger users, and the accessibility of lightweight, user-friendly designs are what propel the vibrational market. Due to their reduced noise levels and compatibility with kid-friendly interactive elements, vibrational toothbrushes are also commonly used.

- The offline stores segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel analysis, the children’s electric toothbrushes market is divided into offline stores and online stores. Among these, the offline stores segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Strong consumer preferences for physically inspecting things, instant product availability, and the pervasiveness of supermarkets, pharmacies, and specialized retail outlets are all factors contributing to the offline stores segment. Continued retail growth and growing consumer need for dependable, readily available children's dental care goods boost the offline store segment.

Regional Segment Analysis of the Children’s Electric Toothbrushes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the children’s electric toothbrushes market over the predicted timeframe.

North America is anticipated to hold the largest share of the children’s electric toothbrushes market over the predicted timeframe. North America is determined by several economic, demographic, and strategic forces. Due to widespread educational efforts, preventative dentistry programs, and government measures that prioritize early childhood dental care, the region has great parental knowledge of pediatric oral health. Government initiatives support this trend, such as the September 2025 expansion of the U.S. Centers for Medicare & Medicaid Services (CMS) Oral Health Initiative, which incorporates subsidized electric toothbrushes into Head Start programs for low-income families, and the October 2025 launch of Canada's Public Health Agency's "Bright Smiles" campaign, which distributes 500,000 units to indigenous communities in an effort to prevent early childhood caries.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the children’s electric toothbrushes market during the forecast period. Rising disposable incomes, growing urban populations, and growing awareness of pediatric oral health are the main factors driving the Asia Pacific market. Adoption of technology is a major factor in this region. In an effort to reduce dental inequities by 30%, Colgate-Palmolive and the Government of Goa, India, partnered in August 2024 to provide 200,000 schools with subsidized electric toothbrushes and full oral health curricula by 2025. In addition, the September 2025 "Smile Guardians" initiative of China's National Health Commission allots USD 50 million for the distribution of one million smart brushes in rural areas, incorporating them into school hygiene regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the children’s electric toothbrushes market, along with a comparative evaluation primarily based on their types of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procter & Gamble (Oral-B)

- Philips Sonicare

- Colgate-Palmolive

- Panasonic Corporation

- FOREO

- Brush-Baby

- Grush

- Quip

- Kolibree

- Fairywill

- Church & Dwight (Arm & Hammer)

- Xiaomi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Philips Sonicare announced its Philips One for Kids toothbrush, designed to help children aged 3–12 adopt healthier oral care routines through easy operation, engaging colors, and trusted sonic technology.

- In July 2023, STIM Oral Care launched its new “Hoppy Kids” toothbrush for children aged 3–10, aiming to make oral hygiene enjoyable while fostering healthy brushing habits from an early age.

- In January 2022, Oral-B, the global leader in oral care, launched its CES Innovation Award–winning iO10 with iOSense at the 2022 Consumer Electronics Show, introducing advanced digital coaching for enhanced oral health routines.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the children’s electric toothbrushes market based on the below-mentioned segments:

Global Children’s Electric Toothbrushes Market, By Product Analysis

- Battery Powered

- Rechargeable

Global Children’s Electric Toothbrushes Market, By Age Group

- 0–3 Years

- 3–6 Years

- 6–12 Years

Global Children’s Electric Toothbrushes Market, By Technology Analysis

- Rotational

- Vibrational

Global Children’s Electric Toothbrushes Market, By Distribution Channel Analysis

- Offline Stores

- Online Stores

Global Children’s Electric Toothbrushes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the children’s electric toothbrushes market over the forecast period?The global children’s electric toothbrushes market is projected to expand at a CAGR of 7.84% during the forecast period.

-

2. What is the market size of the children’s electric toothbrushes market?The global children’s electric toothbrushes market size is expected to grow from USD 1.29 billion in 2024 to USD 2.96 billion by 2035, at a CAGR of 7.84% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the children’s electric toothbrushes market?North America is anticipated to hold the largest share of the children’s electric toothbrushes market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global children’s electric toothbrushes market?Procter & Gamble (Oral-B), Philips Sonicare, Colgate-Palmolive, Panasonic Corporation, FOREO, Brush-Baby, Grush, Quip, Kolibree, Fairywill, Church & Dwight (Arm & Hammer), Xiaomi, and Others.

-

5. What factors are driving the growth of the children’s electric toothbrushes market?Rising parental awareness of pediatric oral health, technological innovations, increasing disposable income, government initiatives, e-commerce expansion, and demand for engaging, age-specific, and eco-friendly toothbrush solutions drive market growth.

-

6. What are the market trends in the children’s electric toothbrushes market?The market for children's electric toothbrushes is being driven by a number of important trends, including the use of smart, interactive brushes, integration with apps, colorful and playful designs, rechargeable models, sustainability-focused products, and a growing focus on preventive dental care.

Need help to buy this report?