Global Certificate Authority Market Size, Share, and COVID-19 Impact Analysis, By Component (Certificate Type And Services), By Enterprise Size (SMEs and Large Enterprises), By Certificate Validation Type (Domain Validation, Organization Validation, and Extended Validation), By Vertical (BFSI, Retail and E-commerce, Government and Defense, Healthcare, IT and Telecom, Travel and Hospitality, Education, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Certificate Authority Market Insights Forecasts to 2033

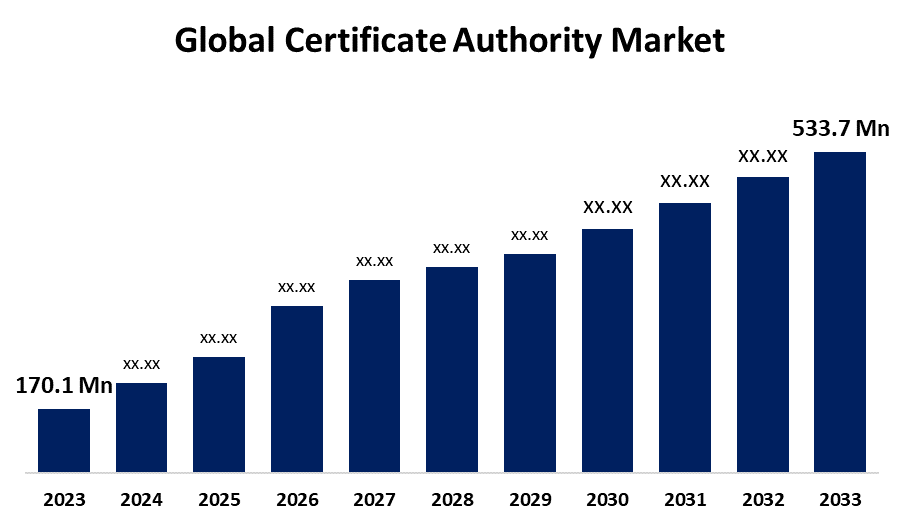

- The Global Certificate Authority Market Size Was Estimated at USD 170.1 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 12.11% from 2023 to 2033

- The Worldwide Certificate Authority Market Size is Expected to Reach USD 533.7 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Certificate Authority Market Size is Anticipated to Exceed USD 533.7 Million by 2033, Growing at a CAGR of 12.11% from 2023 to 2033. The market Growth is rising due to trusted certificate authorities play a vital role in defending against phishing by ensuring secure, encrypted communications. Their SSL/TLS certificates help verify website authenticity and protect users from data breaches and fraud.

Market Overview

The certificate authority market refers to a reliable third-party company in charge of digital certificate management, validation, and issuance. These certificates allow encrypted, secure communications over the internet using protocols like TLS/SSL and verify the identification of websites, people, or organizations.

Under India's IT Act of 2000, the CCA is the highest regulatory authority in charge of approving and monitoring certifying authorities (CAs) that grant certifications for digital signatures. To build confidence throughout India's Public Key Infrastructure (PKI), it runs the root certifying authority of India (RCAI), which digitally signs and verifies the public keys of certified public accountants. Along with ensuring adherence to cryptographic standards and promoting the use of secure digital signatures in e-Government and e-Commerce, the CCA also keeps an inventory of digital certificates.

Technology for certificate authorities is developing quickly to meet new security requirements. The use of shorter 90-day TLS lifecycles for increased security, the move toward post-quantum cryptography to future-proof encryption against quantum attacks, and the pervasive automation using ACME protocols to expedite certificate issuance and renewal are some major themes. Furthermore, machine identity management is becoming increasingly important, especially in Internet of Things contexts where millions of connected devices are protected and authenticated by secure digital certificates. Verified digital identities are becoming increasingly important in online trust ecosystems, as evidenced by the growth of technologies like the EUDI Wallet and compliance with international rules like eIDAS 2.0.

The CGInO is a renowned designation reserved solely for government organizations that demonstrate a dedication to continual innovation and long-term strategic advancement. It is provided following a third-party assessment by recognized providers and assessors.

The increasing third-party use in certification authorities and the rise of the government's innovation toward the certificate authority, expansion of the market growth.

Report Coverage

This research report categorizes the certificate authority market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the certificate authority market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the certificate authority market.

Global Certificate Authority Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 170.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.11% |

| 2033 Value Projection: | USD 533.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Enterprise Size, By Certificate, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | ACTALIS S.p.A., WISeKey International Holding Ltd, Asseco Data Systems S.A., SSL.com, DigiCert, Inc, Sectigo Limited, Entrust Corporation, Newfold Digital Inc., GlobalSign, Network Solutions, LLC, GoDaddy Operating Company, LLC, GoDaddy, Entrust, Camerfirma, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The certificate authority market is experiencing rapid growth, driven by the rise in HTTP phishing attacks, highlighting how crucial it is to use trustworthy certificate authorities and authentic SSL/TLS certificates to provide secure and dependable communication channels. To avoid and mitigate the risk of phishing attacks and protect users and companies from possible data breaches and financial losses, certificate authorities are crucial. Certificate authorities are crucial to this process because they offer the SSL/TLS certificates that allow users and websites to communicate securely and encryptedly. False websites that mimic real websites are commonly used in phishing attacks. By obtaining SSL/TLS certificates from reliable certificate authorities, legitimate websites can demonstrate their legitimacy and encrypt the communication route, making it more difficult for hackers to intercept or alter private information.

Restraining Factors

The market growth is hindered by the although self-signed certificates lack public trust validation, they can improve internal network security. They frequently result in browser alerts, confusing users, and sometimes making them suspicious. They could leave systems vulnerable to dangers like spoofing or abuse if not handled carefully. Businesses should balance the advantages against usability issues and security considerations.

Market Segmentation

The global certificate authority market is classified into component, enterprise size, certificate validation type, and vertical.

- The service segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the estimated period.

Based on the component, the certificate authority market is categorized into certificate type and services. Among these, the service segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the estimated period. The segmental growth can be attributed to the digital certificates to be used and managed effectively; certificate authority services are necessary. By industry best practices, they assist enterprises in integrating and implementing secure PKI solutions. To preserve certificate integrity and trust, these services also provide continuous assistance. Because digital security is so complicated, cooperation amongst many stakeholders is essential. The expansion of these services is still being driven by the growing need for uniform security frameworks.

- The segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the enterprise size, the certificate authority market is divided into SMEs and large enterprises. Among these, the segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. The segmental growth can be expanded to the demand for digital certificates issued by CAs has increased as a result of large organizations implementing digital transformation projects to upgrade their operations and adjust to changing customer expectations. By offering scalable, adaptable solutions that are suited to the unique needs of enterprise clients, CAs are advancing their products to meet the security issues that big businesses face.

- The domain validation segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the projected period.

Based on the certificate validation type, the certificate authority market is categorized into domain validation, organization validation, and extended validation. Among these, the domain validation segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the projected period. The segmental growth can be propagated to the domain validation certificates are now easier and faster to administer through technological improvements. Deployment is streamlined by automation using DCV techniques, which cut down on delays and manual labor. Axians and Sectigo are two partnerships that demonstrate the trend toward proactive certificate management. These developments assist companies in strengthening security, preventing interruptions, and bolstering expansion plans.

- The retail and e-commerce segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the estimated period.

Based on the vertical, the certificate authority market is classified into BFSI, retail and e-commerce, government and defense, healthcare, it and telecom, travel and hospitality, education, and others. Among these, the retail and e-commerce segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the estimated period. The segmental growth can be expanded to show visual clues that differentiate authentic websites from fake ones, such as the padlock icon or the organization's verified name. Certificate authorities offer SSL/TLS certificates that aid in preventing these nefarious behaviors. Retail and e-commerce companies may safeguard their clients against phishing scams, foster trust, and uphold the integrity of their brands by putting SSL/TLS certificates in place.

Regional Segment Analysis of the Certificate Authority Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the certificate authority market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the certificate authority market over the predicted timeframe. The regional growth can be attributed to its advanced infrastructure and strong economy. The region’s digital transformation across key sectors increases demand for secure communications. Growth in cloud, IoT, and mobile technologies further drives the need for trusted digital certificates. Rising cyber threats reinforce the importance of a certificate authority in safeguarding data and systems.

Asia Pacific is expected to grow at the fastest CAGR of the certificate authority market during the forecast period. In these regions, the demand for safe online transactions has increased due to Asia Pacific's developing e-commerce and digital payment environment. Digital certificates are being quickly adopted by businesses to protect customer data and foster confidence. Digitally changing industries like finance and logistics are also affected by this change. The region's dedication to innovation and cybersecurity is further demonstrated by collaborations like Visa's Accelerator Program.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the certificate authority market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACTALIS S.p.A.

- WISeKey International Holding Ltd

- Asseco Data Systems S.A.

- SSL.com

- DigiCert, Inc

- Sectigo Limited

- Entrust Corporation

- Newfold Digital Inc.

- GlobalSign

- Network Solutions, LLC

- GoDaddy Operating Company, LLC

- GoDaddy

- Entrust

- Camerfirma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, GMO GlobalSign, Inc., a specialist in identity security, digital signing, and IoT solutions, established a strategic agreement with airSlate to improve company productivity and automation solutions by expanding the variety of sophisticated electronic signatures, notably in Europe and Latin America. The agreement, which integrates GMO GlobalSign's sophisticated electronic signatures with SignNow, intends to improve users' security, compliance, and authentication procedures, particularly in highly regulated industries like financial services and public administration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the certificate authority market based on the below-mentioned segments:

Global Certificate Authority Market, By Component

- Certificate Type

- Services

Global Certificate Authority Market, By Enterprise Size

- SMEs

- Large Enterprises

Global Certificate Authority Market, By Certificate Validation Type

- Domain Validation

- Organization Validation

- Extended Validation

Global Certificate Authority Market, By Vertical

- BFSI

- Retail and E-commerce

- Government and Defense

- Healthcare

- IT and Telecom

- Travel and Hospitality

- Education

- Others

Global Certificate Authority Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the certificate authority market over the forecast period?The certificate authority market is projected to expand at a CAGR of 12.11% during the forecast period

-

2. What is the market size of the certificate authority market?The Global Certificate Authority Market Size is expected to grow from USD 170.1 Million in 2023 to USD 533.7 Million by 2033, at a CAGR of 12.11% during the forecast period 2023-2033

-

3. Which region holds the largest share of the certificate authority market?North America is anticipated to hold the largest share of the certificate authority market over the predicted timeframe.

Need help to buy this report?