Global CBD Food and Beverage Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bakery Products, Chocolate, Cereal Bars, Candies, Beverages, Ice Cream, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal CBD Food and Beverage Market Insights Forecasts to 2035

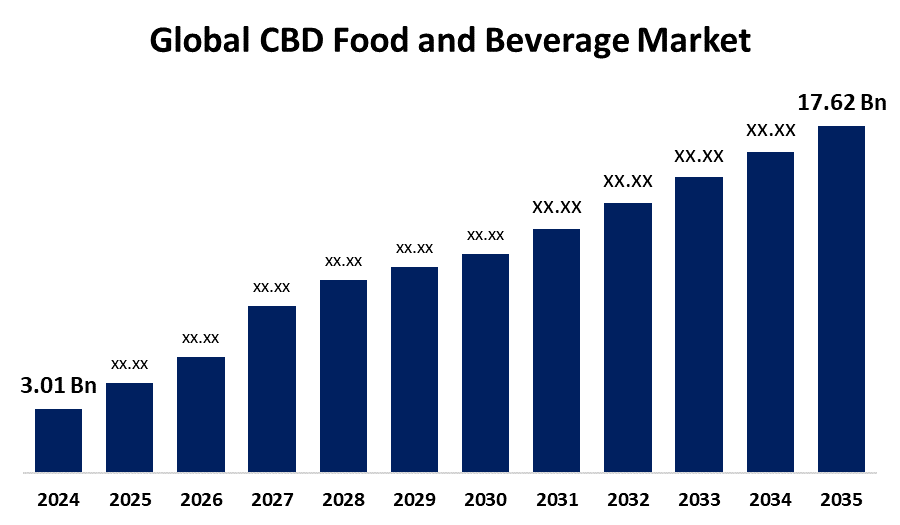

- The Global CBD Food and Beverage Market Size Was Estimated at USD 3.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.43 % from 2025 to 2035

- The Worldwide CBD Food and Beverage Market Size is Expected to Reach USD 17.62 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global CBD Food And Beverage Market Size was worth around USD 3.01 Billion in 2024 and is predicted to Grow to around USD 17.62 Billion by 2035 with a compound annual growth rate (CAGR) of 17.43 % from 2025 and 2035. Increased consumer knowledge, favorable legalization, growing wellness trends, creative product development, and growing demand for natural, functional, and therapeutic consumables all contribute to the important opportunities in the CBD food and beverage market.

Market Overview

The manufacturing, marketing, and distribution of consumable products containing cannabidiol (CBD), a non psychoactive substance mostly obtained from hemp plants, are all included in the CBD food and beverage market. These products include delicacies like chocolates, candies, and baked goods, as well as drinks like teas, coffees, and sparkling waters. Health-conscious customers looking for natural, functional products that support wellbeing, reduce stress, and provide therapeutic advantages through creative plant-based formulations and growing retail channels are the target for CBD food and beverage market.

Growing consumer knowledge of CBD's possible health benefits is one of the main factors driving the CBD food and beverage market. The market is expanding rapidly due to a number of factors, including rising consumer interest in natural and wellness-oriented products, changing laws, the progressive legalization of CBD in different areas, and growing public knowledge of CBD's possible advantages. The market is expected to continue growing as a result of rising consumer interest in natural and wellness focused products.

Report Coverage

This research report categorizes the CBD food and beverage market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the CBD food and beverage market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the CBD food and beverage market.

Global CBD Food and Beverage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.01 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.43 % |

| 2035 Value Projection: | USD 17.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Distribution Channel and By Region |

| Companies covered:: | Medterra CBD, Charlotte’s Web, CV Sciences, Inc., Dixie Brands Inc., Green Roads CBD, HempMeds Brasil, Aurora Cannabis Inc., Phivida Holdings Inc., Elixinol Global Limited, CBD American Shaman, Beverages Trade Network, Canopy Growth Corporation, The Alkaline Water Company Inc., New Age Beverages Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A growing number of health conscious customers are incorporating CBD into their everyday routines as a way to improve their general quality of life due to its adaptability and possible health benefits. Consequently, this is driving the food and beverage business in the CBD. One of the main factors driving the market for foods and beverages infused with CBD is the changing legal environment surrounding the substance. Growing customer interest in wellness and health-focused goods is one of the main drivers of the CBD food and beverage market's expansion. CBD's widespread recognition in many legal jurisdictions across the world and growing public knowledge of its therapeutic benefits are driving this market's rapid expansion.

Restraining Factors

Strict regulatory frameworks, uneven global legalization, a lack of consumer education, difficulties with quality control, and the stigma associated with cannabis-derived products all restrict the market's potential to expand widely and commercially.

Market Segmentation

The CBD food and beverage market share is classified into product type and distribution channel.

- The bakery products segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the CBD food and beverage market is divided into bakery products, chocolate, cereal bars, candies, beverages, ice cream, and others. Among these, the bakery products segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Bakery products owing to its broad appeal and adaptability. Cookies, brownies, and bread that have been infused with CBD provide customers with a comfortable and delightful method to add CBD to their diets. A wide range of customers are drawn to bakery products due to their pleasant flavors and the possible wellness advantages of CBD.

- The specialty stores segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the CBD food and beverage market is divided into supermarkets and hypermarkets, specialty stores, convenience stores, online, and others. Among these, the specialty stores segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Specialty stores serve customers looking for holistic and natural solutions, which is in line with the wellness-conscious appeal of baked products enriched with CBD. Specialty store workers can offer helpful advice and information, which improves the shopping experience for customers.

Regional Segment Analysis of the CBD Food and Beverage Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the CBD food and beverage market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the CBD food and beverage market over the predicted timeframe. North America's strong market environment is a result of its early legalization and acceptance of CBD. High consumer awareness, extensive product availability, and supportive regulatory frameworks are what propel North America. North America is a major contributor to the global CBD food and beverage market because of the presence of well-known brands, a wide retail environment, and an informed customer base that have all contributed to market growth. Customers in the area are becoming more interested in CBD-infused foods and drinks as they research the possible health advantages.

Asia Pacific is expected to grow at a rapid CAGR in the CBD food and beverage market during the forecast period. Consumer interest in CBD-infused foods and drinks is also rising in the Asia Pacific area, especially in nations like China, South Korea, and Australia. Increased health consciousness and the gradual legalization of CBD products are driving the growth of the Asia Pacific market for CBD food & drinks. Consumer interest in CBD infused products is rising in nations like South Korea, Japan, and Australia, especially because of the possible therapeutic advantages.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the CBD food and beverage market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medterra CBD

- Charlotte's Web

- CV Sciences, Inc.

- Dixie Brands Inc.

- Green Roads CBD

- HempMeds Brasil

- Aurora Cannabis Inc.

- Phivida Holdings Inc.

- Elixinol Global Limited

- CBD American Shaman

- Beverages Trade Network

- Canopy Growth Corporation

- The Alkaline Water Company Inc.

- New Age Beverages Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Congress represents the next step for stakeholders in the cannabis business who were waiting for the US Food and Drug Administration (FDA) to establish a regulatory pathway for cannabidiol (CBD) in consumer goods like traditional foods and nutritional supplements. The FDA announced that it has no plans to start a regulation process for CBD and that its current regulatory procedures for foods and dietary supplements are inappropriate for CBD products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the CBD food and beverage market based on the below-mentioned segments:

Global CBD Food and Beverage Market, By Product Type

- Bakery Products

- Chocolate

- Cereal Bars

- Candies

- Beverages

- Ice Cream

- Others

Global CBD Food and Beverage Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Global CBD Food and Beverage Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the CBD food and beverage market over the forecast period?The global CBD food and beverage market is projected to expand at a CAGR of 17.43% during the forecast period.

-

2. What is the market size of the CBD food and beverage market?The global CBD food and beverage market size is expected to grow from USD3.01 billion in 2024 to USD 17.62 billion by 2035, at a CAGR of 17.43 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the CBD food and beverage market?North America is anticipated to hold the largest share of the CBD food and beverage market over the predicted timeframe.

Need help to buy this report?