Global Cattle Feeder Market Size, Share, and COVID-19 Impact Analysis, By Type (Manual and Autonomous), By Animal Type (Mature Ruminants and Young Ruminants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Industry: AgricultureGlobal Cattle Feeder Market Insights Forecasts to 2035

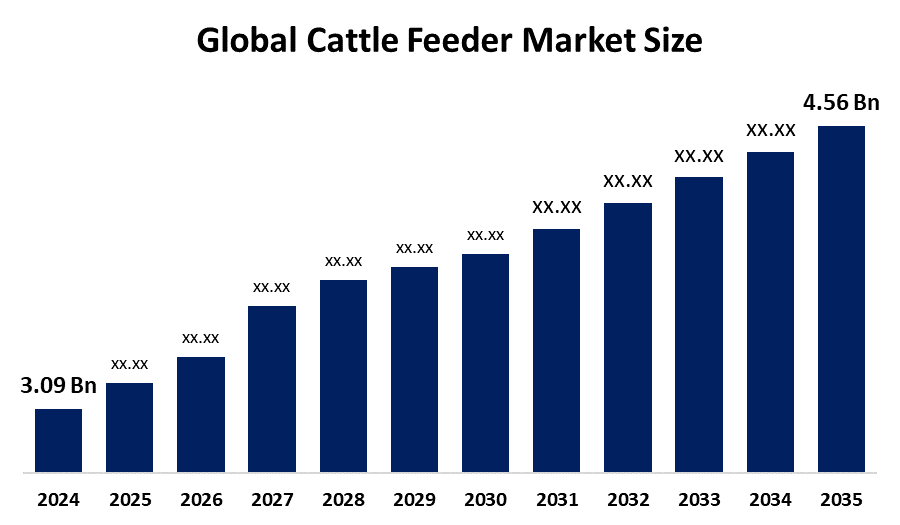

- The Global Cattle Feeder Market Size Was Valued at USD 3.09 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.6 % from 2025 to 2035

- The Worldwide Cattle Feeder Market Size is Expected to Reach USD 4.56 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Cattle Feeder Market Size Was Worth Around USD 3.09 Billion In 2024 And Is Predicted To Grow To Around USD 4.56 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 3.6 % From 2025 To 2035. Growing demand for meat worldwide, the use of automated feeding systems, productivity optimization, advances in feed efficiency, and the expansion of livestock output in developing agricultural economies all present growth opportunities for the cattle feeder market.

Market Overview

The global trading ecosystem for feeder cattle, young, weaned calves (usually 6–12 months old, weighing 600–800 pounds) intended for intense finishing in feedlots or backgrounding on pasture before slaughter is covered by the cattle feeder market. Through futures contracts on markets like the Chicago Mercantile Exchange (CME), where cash-settled products protect against fluctuations in the value of live cattle, this market helps with risk management and price discovery. Products used in dairy farms, feedlots, and livestock production facilities, such as manual, semi-automatic, and fully automated feeders, are included in this market. According to the USDA launched updated WASDE projections, raising 2026 fed steer prices to $236 per cwt, citing tighter cattle supplies, strong demand, higher feeder values, and a projected two percent decline in beef production. For Instance, in October 2025, at VIV Asia 2025, De Heus Vietnam & Asia CEO announced the company’s first Indian feed mill, a $20 million investment producing 250,000 tonnes/year, focusing on dairy, buffalo, and poultry feed. Technological advancements, growing labor costs in industrialized nations, and robust government backing for animal welfare and farming mechanization are anticipated to propel future expansion.

Report Coverage

This research report categorizes the cattle feeder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cattle feeder market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the cattle feeder market.

Global Cattle Feeder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.09 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.6% |

| 2035 Value Projection: | USD 4.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Animal Type, By Regional Analysis |

| Companies covered:: | Ahrens, Alltech, Inc., BASF SE, Bison Industries Inc, Cargill Incorporated, CHS Inc., De Heus Animal Nutrition, ForFarmers N.V., HE SILOS, ILgun, Land O’Lakes, Inc., Manna Pro Products, LLC Farmco, Nutreco N.V., Purina Animal Nutrition, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling the growth of the cattle feeder market is the rising consumption of meat and dairy products worldwide. Additionally, the investment in contemporary cow feeding equipment is being driven by farmers' growing awareness of the necessity of balancing the amount of feed consumed to guarantee that the cost of feeding the cattle is minimized to optimize the yield. Market development is also supported by government programs that encourage sustainable livestock management and better farm infrastructure. By lowering labor expenses, decreasing feed waste, and guaranteeing constant nutritional intake, technological developments in automated and precision feeding systems are also greatly boosting cattle feeder market growth.

Restraining Factors

High initial investment prices, low adoption among small-scale farmers, maintenance challenges, a lack of technical know-how, and economic uncertainty that limit capital expenditure in the livestock and agricultural industries are all factors restricting the cattle feeder market.

Market Segmentation

The Cattle Feeder market share is classified into type and animal type.

- The manual segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the cattle feeder market is divided into manual and autonomous. Among these, the manual segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Traditional, non-automated feeding systems used in livestock management, mostly in small to medium-sized farms, are referred to as the manual cow feeder market sector. Farmers can immediately monitor cow consumption and manage feed quantities with manual feeders because they are usually straightforward to maintain, long-lasting, and basic in design.

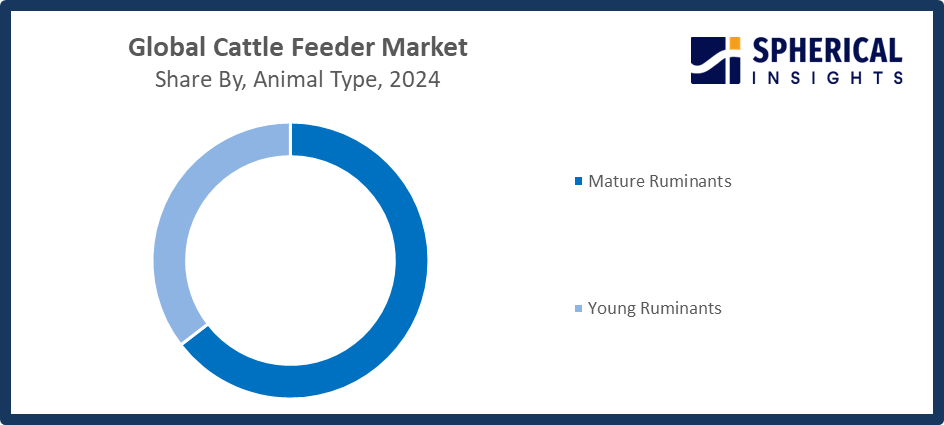

- The mature ruminants segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the animal type, the cattle feeder market is divided into mature ruminants and young ruminants. Among these, the mature ruminants segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Adult cattle, including cows and bulls, reared primarily for milk production, breeding, or beef are referred to as mature ruminants in the cattle feeder market. The need for specialized feeders that improve animal welfare and operational efficiency is fueled by the mature ruminant market, which is still vital to the dairy and meat industries.

Get more details on this report -

Regional Segment Analysis of the Cattle Feeder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the cattle feeder market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the cattle feeder market over the predicted timeframe. With the transition from less conventional cattle rearing to more industrialized and commercialized cow feeding operations, the market ecology is expanding extremely quickly. Government programs to improve agricultural infrastructure and automate tasks also contribute to market expansion. To improve feed and cow nutrition, the governments of China, India, and Vietnam are investing significant sums of money in agrarian reforms and livestock modernization. While another announcement from the ASEAN Agri-Food Summit sets November 25, 2025, as the date for stabilized quotas that could bring in 500,000 new workers annually, another discusses precision feeding technology trials, which would help to strengthen the regional market and result in a significant increase of 18% in the market.

North America is expected to grow at a rapid CAGR in the cattle feeder market during the forecast period. The region's well-established livestock business places a special focus on large-scale operations, efficiency, and precision feeding, especially in the United States and Canada. Particularly in the United States, there is a thriving feedlot industry that is centered in places like Texas, Kansas, and Nebraska, which have adopted technological applications, such as precision feeding and health monitoring equipment. Elevated feeder prices for 2026 were reported in the WASDE report on January 12, 2026, at USD 229/cwt, up USD 1 from previous predictions due to a 2% reduction in production and high demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cattle feeder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ahrens

- Alltech, Inc.

- BASF SE

- Bison Industries Inc

- Cargill Incorporated

- CHS Inc.

- De Heus Animal Nutrition

- ForFarmers N.V.

- HE SILOS

- ILgun

- Land O'Lakes, Inc.

- Manna Pro Products, LLC Farmco

- Nutreco N.V.

- Purina Animal Nutrition

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Mayank Cattle Food Limited launched 'Masino Nuskho', an innovative herbal Ayurvedic postnatal livestock care product, set for market release, advancing its oil and cattle feed industry strategy.

- In August 2025, Eva Group launched Urja Platinum, a premium cattle feed for high-yield dairy cows producing over 25 litres daily, unveiled at Sandila, Hardoi, with government officials and industry stakeholders present.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cattle feeder market based on the below-mentioned segments:

Global Cattle Feeder Market, By Type

- Manual

- Autonomous

Global Cattle Feeder Market, By Animal Type

- Mature Ruminants

- Young Ruminants

Global Cattle Feeder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cattle feeder market over the forecast period?The global cattle feeder market is projected to expand at a CAGR of 3.6% during the forecast period.

-

2. What is the market size of the cattle feeder market?The global cattle feeder market size is expected to grow from USD 3.09 billion in 2024 to USD 4.56 billion by 2035, at a CAGR of 3.6 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cattle feeder market?Asia Pacific is anticipated to hold the largest share of the cattle feeder market over the predicted timeframe.

-

4. Who are the top companies operating in the global cattle feeder market?Ahrens, Alltech, Inc., BASF SE, Bison Industries Inc, Cargill Incorporated, CHS Inc., De Heus Animal Nutrition, ForFarmers N.V., HE SILOS, ILgun, Land O'Lakes, Inc., Manna Pro Products, LLC Farmco, Nutreco N.V., Purina Animal Nutrition, and Others.

-

5. What factors are driving the growth of the cattle feeder market?Growing demand for meat and dairy products worldwide, the use of automated and precision feeding systems, a lack of workers, government assistance, large-scale commercial farms, and growing consciousness of feed efficiency and animal health.

-

6. What are the market trends in the cattle feeder market?Automation and IoT integration in feeders, precision nutrition, sustainable livestock practices, digital monitoring, commercial feedlot growth, growing mechanization, and a growing focus on cutting feed waste and operating expenses.

-

7. What are the main challenges restricting the wider adoption of the cattle feeder market?Wider market penetration is restricted by high initial costs, complicated maintenance, a lack of technical know-how, resistance from small-scale farmers, infrastructure limitations, unstable economic conditions, and sluggish technological acceptance in underdeveloped nations.

Need help to buy this report?