Global Catering and Food Services Contractor Market Size, Share, and COVID-19 Impact Analysis, By Type (Mobile Food Services, Buffets, Cafeterias, Limited-Service Restaurants and Full-Service Restaurants), By Application (Medical Institutions, Educational Institutions, Commercial Organization and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Catering and Food Services Contractor Market Insights Forecasts to 2035

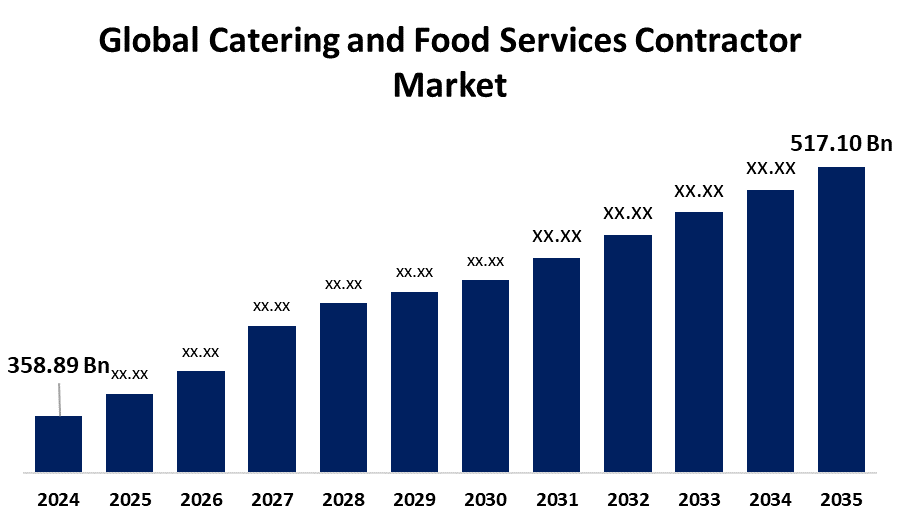

- The Global Catering and Food Services Contractor Market Size Was Estimated at USD 358.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.38% from 2025 to 2035

- The Worldwide Catering and Food Services Contractor Market Size is Expected to Reach USD 517.10 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Catering And Food Services Contractor Market Size was worth around USD 358.89 Billion in 2024 and is predicted to Grow to around USD 517.10 Billion by 2035 with a compound annual growth rate (CAGR) of 3.38% from 2025 to 2035. The catering and food services contractor industry is fueled by increasing demand from institutions, emphasis on employee well-being, urbanization, hospitality and tourism recovery, outsourcing practices, technological developments, and increased consumer awareness of healthy, specialist meal choices.

Market Overview

The catering and food services contractor industry describes the business of companies supplying outsourced food preparation, delivery, and service to different customers, including schools, hospitals, corporate buildings, hotels, and events. The contractors arrange meal planning, food safety, and day-to-day food service operations, usually through multi-year contracts. In addition to this, increased demand for mini buffets also has the potential to fuel growth in the catering and food services contractor market across the world. Mini meals provide convenience since they are placed in disposable trays and can be sent easily to a location of preference. Mini meals are particularly suited for small occasions or where there is limited space. Besides, the simple and trouble-free installation of mini buffets has become a more favorable choice than traditional buffet arrangements. The implementation of technology in catering, including electronic ordering systems, inventory control tools, and real-time data analysis, has immensely enhanced efficiency levels. Such advancements minimize wastage of food, simplify operations, and increase customer satisfaction, enabling catering contractors to be more competitive. The rising application of technology is one of the major contributors to market expansion.

Report Coverage

This research report categorizes the catering and food services contractor market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the catering and food services contractor market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the catering and food services contractor market.

Global Catering and Food Services Contractor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 358.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.38% |

| 2035 Value Projection: | USD 517.10 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Mobile Food Services, Buffets, Cafeterias, Limited-Service Restaurants and Full-Service Restaurants), By Application (Medical Institutions, Educational Institutions, Commercial Organization and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) |

| Companies covered:: | Compass Group, Sodexo, Aramark Corporation, Elior Group, Delaware North, Shanghai Wagas Catering Co., Yum China Holdings Inc, Chefs Culinar Nord GmbH & Co KG, BaxterStorey, Kofler & Kompanie GmbH, Searcys, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Schools, hospitals, and public institutions increasingly hire third-party food contract providers to operate their facilities. These organizations demand predictable, mass-produced meal programs, building dependable demand. With expanding public infrastructure around the world, particularly in developing nations, demand for formal, professional catering services remains strong, driving growth in the market. Further, corporations are becoming concerned about worker health and wellness by providing high-quality food service at work locations. On-site cafeterias and catering are viewed as vehicles for enhancing morale, productivity, and retention. This trend is particularly prevalent in tech centers and large corporate campuses, fueling consistent demand for food service contractors.

Restraining Factors

Catering businesses have high labor, food ingredient, logistics, and health and safety compliance costs. Food price volatility and inflation in wages can reduce profit margins, particularly for fixed-price contracts, restricting scalability and appeal of the business. In addition, the sector tends to experience a lack of skilled staff and high staff turnover. This results in higher recruitment and training expenses and may affect service quality and consistency.

Market Segmentation

The catering and food services contractor market share is classified into type and application.

- The cafeterias segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the catering and food services contractor market is divided into mobile food services, buffets, cafeterias, limited-service restaurants, and full-service restaurants. Among these, the cafeterias segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to cafeteria-style service reduces labor expense and food waste by simplifying menus and self-service models. This increases the efficiency and scalability of operations for catering contractors. The capacity to serve hundreds or thousands of meals per day at a controlled cost makes cafeterias a very profitable and desirable format, particularly in high-volume institutional environments.

- The commercial organization segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the catering and food services contractor market is divided into medical institutions, educational institutions, commercial organizations, and others. Among these, the commercial organization segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to corporate clients tend to require high-end, tailored dining experiences that include themed meals, healthy menus, or branded cafeterias. This provides food service providers with opportunities to upsell value-added services and generate more revenue. Corporate clients are more willing to spend compared to institutional clients with budget limitations.

Regional Segment Analysis of the Catering and Food Services Contractor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the catering and food services contractor market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the catering and food services contractor market over the predicted timeframe. North America houses some of the leading players in the catering and food services industry, such as Compass Group and Aramark. These giants have a firm grip on the market because they have well-developed service networks, a reputable brand name, and the capability to serve diversified industries such as healthcare, education, and business segments. North America is at the forefront of the adoption of innovative technologies in the catering industry, including AI to optimize food service and delivery apps. These technologies enhance service effectiveness, boost customer satisfaction, and optimize operations, making the region a leader in the catering and food services market.

Asia Pacific is expected to grow at a CAGR in the catering and food services contractor market during the forecast period. Asia Pacific is witnessing rapid urbanization, which has created a growing demand for catering services in urban areas. With more individuals shifting to urban areas for work and education, there's a high demand for convenient, quality food services, especially in corporate offices, schools, and hospitals, fueling the region's fast-growing share in the catering market.

Europe is predicted to hold a significant share of the catering and food services contractor market throughout the estimated period. European consumers have a tendency to favor quality, sustainability, and health food products. Catering companies in Europe respond by providing organic, local, and sustainable food catering services. Such consumer behavior enables the sustained demand for high-quality catering services to sustain the region's significant market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the catering and food services contractor market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Compass Group

- Sodexo

- Aramark Corporation

- Elior Group

- Delaware North

- Shanghai Wagas Catering Co.

- Yum China Holdings Inc

- Chefs Culinar Nord GmbH & Co KG

- BaxterStorey

- Kofler & Kompanie GmbH

- Searcys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the catering and food services contractor market based on the below-mentioned segments:

Global Catering and Food Services Contractor Market, By Type

- Mobile Food Services

- Buffets

- Cafeterias

- Limited-Service Restaurants

- Full-Service Restaurants

Global Catering and Food Services Contractor Market, By Application

- Medical Institutions

- Educational Institutions

- Commercial Organization

- Others

Global Catering and Food Services Contractor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the catering and food services contractor market over the forecast period?The global catering and food services contractor market is projected to expand at a CAGR of 3.38% during the forecast period.

-

2. What is the market size of the catering and food services contractor market?The global catering and food services contractor market size is expected to grow from USD 358.89 Billion in 2024 to USD 517.10 Billion by 2035, at a CAGR of 3.38% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the catering and food services contractor market?North America is anticipated to hold the largest share of the catering and food services contractor market over the predicted timeframe.

Need help to buy this report?