Global Castor Bean Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Castor Beans and Conventional Castor Beans), By Application (Industrial, Pharmaceutical, Cosmetic, Food and Beverage and Others), Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Castor Bean Market Insights Forecasts to 2035

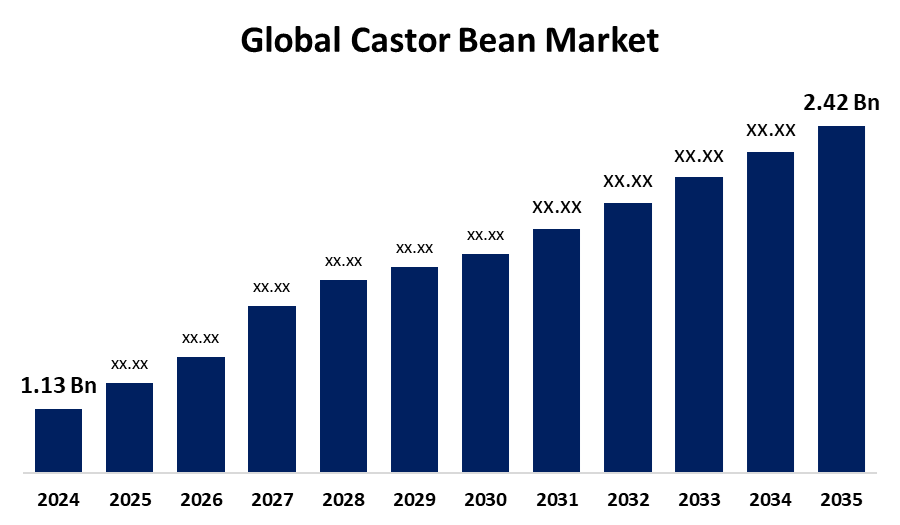

- The Global Castor Bean Market Size Was Estimated at USD 1.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.17% from 2025 to 2035

- The Worldwide Castor Bean Market Size is Expected to Reach USD 2.42 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Castor Bean Market Size was Worth around USD 1.13 Billion in 2024 and is predicted to Grow to around USD 2.42 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 7.17% from 2025 and 2035. The Growth of the Castor Bean Market Size is being fueled by the growing need for biodegradable and sustainable products in sectors like manufacturing, cosmetics, and pharmaceuticals. Castor beans are highly prized for their adaptability; they can be processed into several beneficial derivatives, including ricinoleic acid and castor oil, which makes them appealing to a wide range of industries.

Market Overview

The Castor Bean Market Size refers to the global trade and commercial activity surrounding the cultivation, processing, and distribution of castor beans and their derivatives, primarily castor oil. Castor beans, which are the seeds of the Ricinus communis plant, are prized for their oil content, which finds application in a variety of fields such as bio-based chemicals, industrial manufacturing, cosmetics, pharmaceuticals, and agriculture. Furthermore, castor oil is well known for its medicinal qualities as an efficient laxative and anti-inflammatory. Due mostly to the rising demand for natural and organic healthcare products, its use in the production of ointments, lotions, and pharmaceuticals has been expanding. Additionally, castor oil's moisturizing qualities are being leveraged by the cosmetics industry for skincare and haircare products, which is driving up market demand. Technological developments in the refining and processing of castor beans have also been crucial in the market's expansion. Improved production methods and novel extraction procedures for castor oil derivatives have increased yields and enhanced product quality. The creation of genetically engineered and high-yielding castor bean cultivars has improved production efficiency even more, satisfying the growing demands of the market.

Report Coverage

This research report categorizes the castor bean market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the castor bean market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the castor bean market.

Global Castor Bean Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.13 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.17% |

| 2035 Value Projection: | USD 2.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Gokul Refoils & Solvent Ltd., Jayant Agro-Organics Limited, NK Proteins, Taj Agro Products, Bom Brazil, ITOH Oil Chemicals Co., Ltd., Kanak Castor Products Pvt. Ltd., Adani Wilmar Limited, RPK Agrotech, Hokoku Corporation, Thai Castor Oil Industries Co. Ltd., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Castor oil's healing and moisturizing qualities make it a popular ingredient in cosmetics. Consumer demand for natural ingredients is driving the growth of the worldwide cosmetics and personal care industry, which in turn is driving the market for castor beans. It is preferred in cosmetics, hair care products, and skincare goods. Castor oil's demand is fueled by its many uses in the pharmaceutical business, such as a solvent, laxative, and in drug delivery systems. Castor oil consumption rises due to the expansion of the healthcare industry, especially in emerging regions, which propels the castor bean market. The demand for bio-based, renewable resources like castor oil is also rising as sectors move toward sustainability. The usage of castor oil in coatings, lubricants, and bio-plastics fuels its expansion in industrial sectors and propels the market for castor beans as environmentally friendly substitutes become more popular across a range of industries.

Restraining Factors

Castor beans are extremely reliant on particular weather patterns. Severe weather conditions, such as floods or droughts, can have a detrimental effect on harvests and cause supply instability. Consistent production is severely hampered by this climate change susceptibility, which eventually limits the market's ability to grow and remain stable. Moreover, growing castor beans is a labour-intensive operation that involves a lot of manual labor for planting, harvesting, and processing. Production prices may rise as a result of this reliance on specialized personnel, especially in areas with a shortage of workers. As a result, the high labor demands can restrict the market's growth potential.

Market Segmentation

The castor bean market share is classified into product type, application, and distribution channel.

- The conventional castor beans segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the castor bean market is divided into organic castor beans and conventional castor beans. Among these, the conventional castor beans segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by conventional castor beans are more cost-effective to produce than organic ones. Modern herbicides and fertilizers reduce growing costs, making conventional beans more affordable for farmers and producers. Because of their competitive pricing, which supports their dominant market position, they are the preferred choice for large-scale production.

- The industrial segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the castor bean market is divided into industrial, pharmaceutical, cosmetic, food and beverage, and others. Among these, the industrial segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to its unique chemical properties, Castor oil finds extensive use in industrial applications, including coatings, bio-based polymers, surfactants, and lubricants. It is highly valued because it can withstand high temperatures, serve as a solid base for synthetic materials, and be utilized as a sustainable alternative in a variety of industries. Because of its versatility, the industrial sector of the castor bean market has the highest share.

- The supermarkets/hypermarkets segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the castor bean market is divided into online retail, supermarkets/hypermarkets, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets generally carrying a large selection of castor oil products, meeting a variety of consumer demands from industrial to cosmetic and medical. Because of this variety, customers are more likely to compare options and buy castor oil, which helps explain this segment's substantial market share in the castor bean industry.

Regional Segment Analysis of the Castor Bean Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the castor bean market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the castor bean market over the predicted timeframe. India produces more than 85% of the world's castor beans, due to large-scale farming, cheap labor, and centuries-old agricultural knowledge. Asia Pacific is now the world's top supplier due to this production dominance, which also greatly increases its market share. Its dominance in the castor bean market is strengthened by regional consumption, which supplements export capacity due to the expanding industries in China, India, and Southeast Asia.

North America is expected to grow at a rapid CAGR in the castor bean market during the forecast period. The demand for castor oil is rising in industries including packaging, cosmetics, and automobiles as a result of North America's transition to renewable, environmentally friendly alternatives. This change is being driven by tighter environmental restrictions and consumers' increasing preference for clean-label products. The region's focus on sustainability complements the growing need for castor oil derivatives, which propels market expansion. With well-established companies and cutting-edge processing methods in the US and Canada, North America fosters product diversification and innovation, setting up the market for the quickest development as a result of the growing use of bio-based materials.

Europe is predicted to hold a significant share of the castor bean market throughout the estimated period. Europe has a strong emphasis on sustainability, there is a high demand for renewable and environmentally beneficial resources like castor beans. The market share of castor beans is growing as a result of the region's industries' growing reliance on castor oil derivatives, especially in the bioplastics, pharmaceutical, and cosmetics sectors. Demand for castor oil and its derivatives is being driven by European legislation, such as the EU Green Deal, which encourages the use of bio-based, renewable resources. By fostering an environment conducive to the production and processing of castor beans, these regulations strengthen Europe's commanding market dominance in the sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the castor bean market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gokul Refoils & Solvent Ltd.

- Jayant Agro-Organics Limited

- NK Proteins

- Taj Agro Products

- Bom Brazil

- ITOH Oil Chemicals Co., Ltd.

- Kanak Castor Products Pvt. Ltd.

- Adani Wilmar Limited

- RPK Agrotech

- Hokoku Corporation

- Thai Castor Oil Industries Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Pragati, the first sustainable castor bean program in the world, concluded its eight-year operation in the 2023–2024 season. The initiative has certified over 8,000 farmers, and individual farmer yields have grown dramatically. Its support for women castor farmers leads to better outcomes for families.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the castor bean market based on the below-mentioned segments:

Global Castor Bean Market, By Product Type

- Organic Castor Beans

- Conventional Castor Beans

Global Castor Bean Market, By Application

- Industrial

- Pharmaceutical

- Cosmetic

- Food and Beverage

- Others

Global Castor Bean Market, By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Castor Bean Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the castor bean market over the forecast period?The global castor bean market is projected to expand at a CAGR of 7.17% during the forecast period.

-

2. What is the market size of the castor bean market?The global castor bean market size is expected to grow from USD 1.13 Billion in 2024 to USD 2.42 Billion by 2035, at a CAGR of 7.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the castor bean market?Asia Pacific is anticipated to hold the largest share of the castor bean market over the predicted timeframe.

Need help to buy this report?