Global Cargo Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Application (Airports, Seaports, Warehouses, Distribution Centers, Manufacturing Plants), By Equipment Type (Cranes, Forklift Trucks, Conveyor Systems, Automated Guided Vehicles (AGVs), Stacker Cranes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Cargo Handling Equipment Market Insights Forecasts to 2033

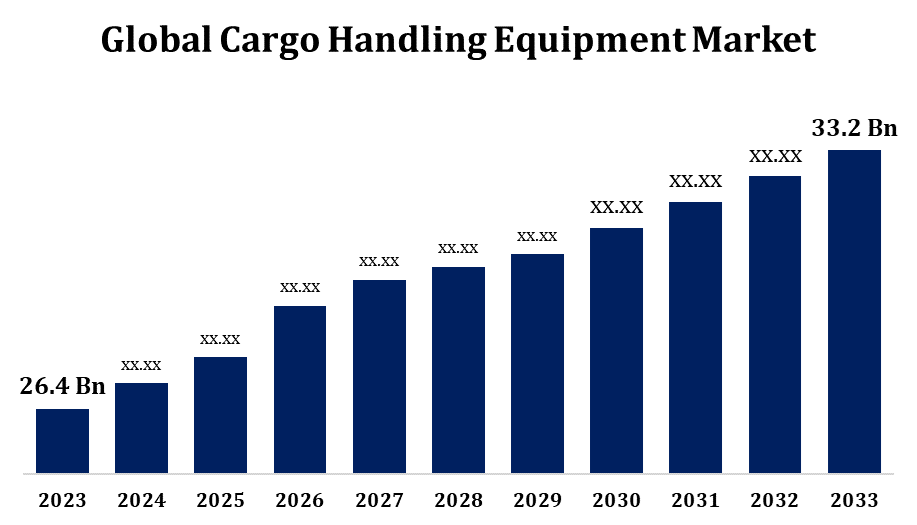

- The Global Cargo Handling Equipment Market Size was valued at USD 26.4 Billion in 2023.

- The Market is Growing at a CAGR of 2.32% from 2023 to 2033.

- The Worldwide Cargo Handling Equipment Market Size is Expected to reach USD 33.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cargo Handling Equipment Market Size is Expected to Reach USD 33.2 Billion By 2033, at a CAGR of 2.32% during the forecast period 2023 to 2033.

The cargo handling equipment market is experiencing steady growth, driven by expanding global trade, rising e-commerce activity, and increasing port infrastructure investments. This market includes a wide range of machinery such as forklifts, cranes, automated guided vehicles (AGVs), and conveyors, essential for loading, unloading, and transporting goods in ports, airports, and warehouses. The demand for electric and hybrid equipment is also rising due to strict emission regulations and the global push for sustainable operations. Technological advancements, including automation and telematics, are enhancing equipment efficiency and operational safety. Key players are focusing on product innovation and strategic partnerships to strengthen their market presence. Asia-Pacific dominates the market due to the presence of major shipping hubs, while North America and Europe are witnessing growth through modernization efforts.

Cargo Handling Equipment Market Value Chain Analysis

The cargo handling equipment market value chain comprises several key stages, beginning with raw material suppliers who provide components such as steel, hydraulics, and electronics. These materials are then utilized by manufacturers to design and assemble various types of cargo handling equipment, including cranes, forklifts, and automated systems. Original Equipment Manufacturers (OEMs) play a central role in integrating technologies and ensuring compliance with safety and environmental standards. Distributors and dealers handle the sales, marketing, and delivery of the equipment to end-users, including ports, airports, warehouses, and logistics firms. Aftermarket services, such as maintenance, repair, and spare parts supply, add value by enhancing equipment longevity and performance. Technology providers also contribute through automation, telematics, and electrification solutions, streamlining operations across the cargo handling ecosystem.

Cargo Handling Equipment Market Opportunity Analysis

The cargo handling equipment market presents significant opportunities driven by global trade expansion, e-commerce growth, and the push for automation and sustainability. Ports and logistics hubs are investing in advanced equipment to enhance efficiency and reduce emissions. The demand for electric and hybrid cargo handling machinery is increasing due to environmental regulations and the need for cost-effective operations. Emerging markets in Asia-Pacific, Africa, and Latin America are investing in port infrastructure, creating opportunities for equipment manufacturers. Technological advancements, such as automation and telematics, are enhancing equipment efficiency and operational safety. Companies focusing on innovation and strategic partnerships are well-positioned to capitalize on these trends. The integration of digital technologies and the development of smart ports further contribute to the market's growth potential.

Global Cargo Handling Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.32% |

| 2033 Value Projection: | USD 33.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Application, By Equipment Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Kalmar (Cargotec Corporation), Hyster-Yale Group, Mitsubishi Heavy Industries Engineering, Ltd., Liebherr Group, Terex Corporation, Zoomlion, Konecranes, CVS Ferrari, Weibang, SANY, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cargo Handling Equipment Market Dynamics

Rising international trade volumes to drive market growth

Rising international trade volumes are a major driver of growth in the cargo handling equipment market. As global commerce expands, there is a growing need for efficient movement of goods through ports, airports, and logistics hubs. This surge in trade activity places higher demand on cargo handling operations, prompting investments in advanced equipment such as cranes, forklifts, container handlers, and automated systems. Additionally, increased containerization and intermodal transport are accelerating the adoption of high-performance machinery to ensure faster turnaround times and reduced operational bottlenecks. To keep pace with trade dynamics, infrastructure upgrades are underway in emerging and developed economies alike.

Restraints & Challenges

High initial investment and maintenance costs pose a significant barrier, especially for small and medium enterprises. The transition to electric and hybrid equipment, while necessary for sustainability, involves costly upgrades and infrastructure development. Additionally, global supply chain disruptions can lead to delays in equipment manufacturing and delivery. Regulatory complexities, including stringent emission norms and safety standards, also increase compliance burdens for manufacturers. Skilled labor shortages and the need for operator training further complicate adoption, particularly with the integration of automation and advanced technologies. Moreover, fluctuating raw material prices and economic uncertainties can impact production costs and profitability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cargo Handling Equipment Market from 2023 to 2033. Major ports across the United States and Canada are upgrading their facilities to improve efficiency and reduce turnaround times, boosting demand for equipment such as cranes, forklifts, and automated systems. The push toward sustainability is also prompting a shift toward electric and hybrid cargo handling equipment. Additionally, the rise of e-commerce and logistics operations has increased the need for efficient cargo movement across distribution centers and terminals. Automation is gaining traction, with ports integrating technologies like automated guided vehicles and remote-controlled systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China and India are at the forefront, driven by robust manufacturing sectors and increasing trade activities. The surge in online retail has led to heightened demand for efficient cargo movement, prompting the adoption of advanced equipment such as automated guided vehicles (AGVs), electric forklifts, and smart cranes. Government initiatives aimed at modernizing logistics and reducing carbon emissions are further accelerating the shift towards eco-friendly and automated solutions.

Segmentation Analysis

Insights by Equipment Type

The Forklift Trucks segment accounted for the largest market share over the forecast period 2023 to 2033. The surge in online retail has heightened the demand for efficient material handling solutions, leading to increased adoption of forklifts in warehouses and distribution centers. Electric forklifts are gaining significant traction due to their zero emissions, reduced noise levels, and lower maintenance requirements, aligning with global sustainability goals. Advancements in battery technology, such as lithium-ion batteries, have further enhanced the performance and appeal of electric forklifts. Additionally, the integration of automation and telematics in forklift operations is improving efficiency and safety.

Insights by Application

The manufacturing plants segment accounted for the largest market share over the forecast period 2023 to 2033. As global manufacturing activities expand, there is a heightened need for advanced equipment to streamline production processes and enhance operational efficiency. Manufacturers are increasingly adopting automated systems, such as automated guided vehicles (AGVs) and robotic arms, to improve precision and reduce labor costs. Additionally, the integration of Internet of Things (IoT) technologies enables real-time monitoring and predictive maintenance, further optimizing equipment performance. This shift towards automation and smart manufacturing is not only boosting productivity but also contributing to sustainability goals by reducing energy consumption and minimizing waste. Overall, the manufacturing plants segment is poised for continued growth, supported by technological advancements and the evolving needs of modern production facilities.

Recent Market Developments

- In September 2023, Konecranes has unveiled a new series of automated container cranes featuring AI-driven predictive maintenance capabilities, designed to improve operational efficiency and minimize downtime at port terminals.

Competitive Landscape

Major players in the market

- Kalmar (Cargotec Corporation)

- Hyster-Yale Group

- Mitsubishi Heavy Industries Engineering, Ltd.

- Liebherr Group

- Terex Corporation

- Zoomlion

- Konecranes

- CVS Ferrari

- Weibang

- SANY

- others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cargo Handling Equipment Market, Equipment Type Analysis

- Cranes

- Forklift Trucks

- Conveyor Systems

- Automated Guided Vehicles (AGVs)

- Stacker Cranes

Cargo Handling Equipment Market, Application Analysis

- Airports

- Seaports

- Warehouses

- Distribution Centers

- Manufacturing Plants

Cargo Handling Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cargo Handling Equipment Market?The Global Cargo Handling Equipment Market Size is Expected to Grow from USD 26.4 Billion in 2023 to USD 33.2 Billion by 2033, at a CAGR of 2.32% during the forecast period 2023-2033.

-

2. Who are the key market players of the Cargo Handling Equipment Market?Some of the key market players of the market are Kalmar (Cargotec Corporation), Hyster-Yale Group, Mitsubishi Heavy Industries Engineering, Ltd., Liebherr Group, Terex Corporation, Zoomlion, Konecranes, CVS Ferrari, Weibang, SANY.

-

3. Which segment holds the largest market share?The manufacturing plants segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?