Global Cardiovascular Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Lipid Modifiers, Antithrombotic Agents, Beta Blocking Agents, Vasodilators, and Other drug classes), By Indication (Hypertension, Hyperlipidemia, Coronary artery disease, Arrhythmia, and Other indications), By Route of Administration (Oral, Parenteral, and Other routes of administration), By Distribution Channel (Hospital pharmacies, Online pharmacies, Retail pharmacies, and Other distribution channels), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Cardiovascular Market Insights Forecasts To 2035

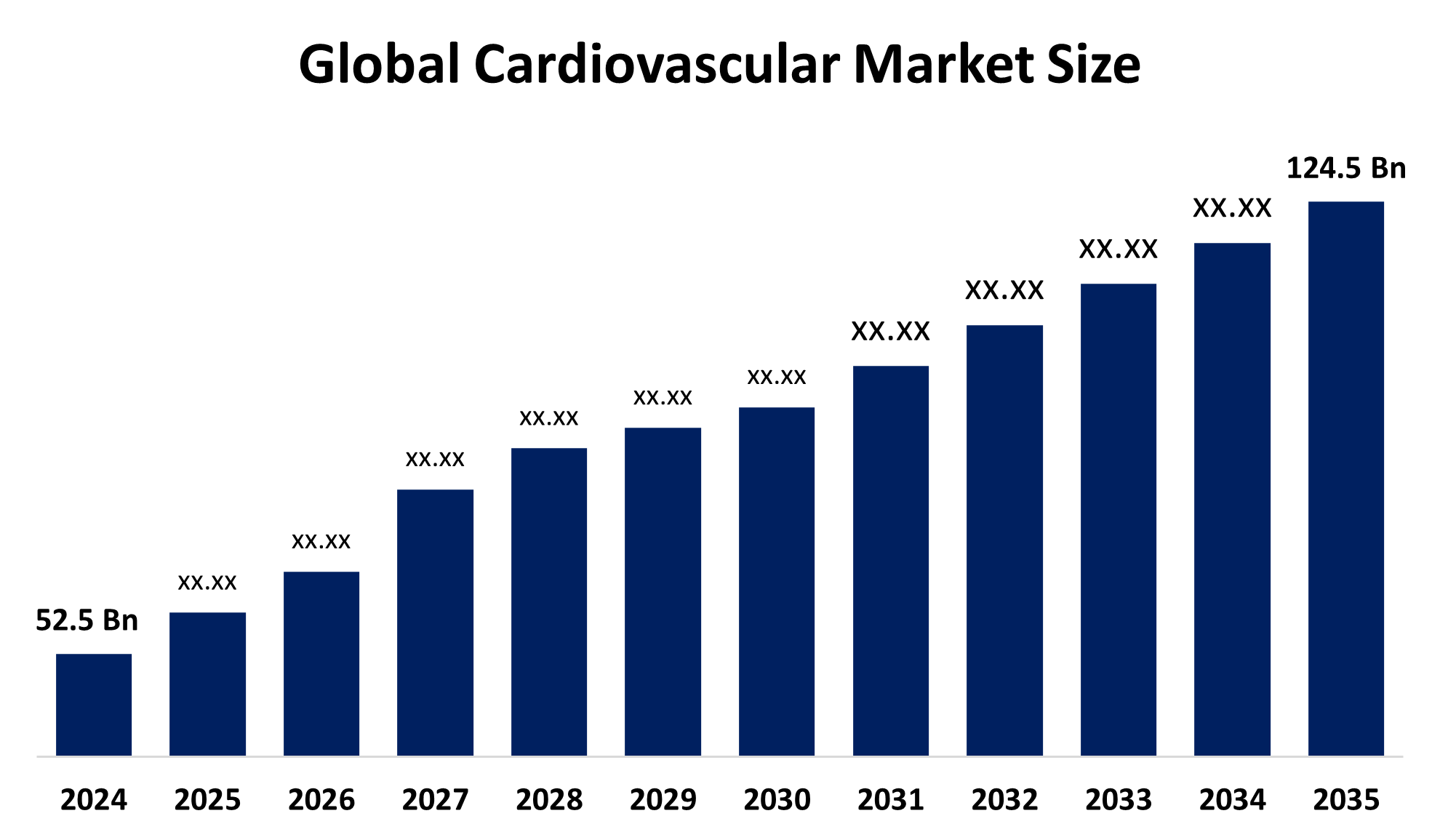

- The Global Cardiovascular Market Size Was Estimated at USD 52.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.17% from 2025 to 2035

- The Worldwide Cardiovascular Market Size is Expected to Reach USD 124.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Cardiovascular Market Size was worth around USD 52.5 Billion in 2024 and is Predicted To Grow to around USD 124.5 Billion by 2035 with a compound annual growth rate (CAGR) of 8.17% from 2025 and 2035. The market for cardiovascular has a number of opportunities to grow due to technological advancements and an increasing need for heart health monitoring devices.

Market Overview

The global industry for cardiovascular encompasses the products, technologies, and services designed for the diagnosis, treatment, and management of cardiovascular diseases. The increasing prevalence of cardiovascular diseases like heart failure, atrial fibrillation-related stroke, heart valve disease or coronary heart disease, along with the medical technology industry’s inclination towards high-quality solutions for safeguarding and promoting cardiovascular health. For instance, MedTech Europe are working in partnership with the patients, governments, and payers for promoting cardiovascular health and driving coordinated action at the European Level. Increasing efforts towards the personalised medicine approach, growing emphasis on disease diagnosis, and an increase in the usage of electrocardiograms are several trends in the global cardiovascular market.

Report Coverage

This research report categorizes the cardiovascular market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cardiovascular market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cardiovascular market.

Global Cardiovascular Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 52.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.17% |

| 2035 Value Projection: | USD 124.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Class, By Indication, By Route of Administration, By Distribution Channel, By Region |

| Companies covered:: | Amgen, AstraZeneca, Baxter, Bayer, Boehringer Ingelheim, Bristol Myers Squibb, Gilead Sciences, Johnson & Johnson, Lupin, Merck, Novartis, Pfizer, Sanofi, Viatris, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of cardiovascular diseases and associated age-related cardiac disorders, with changing lifestyle patterns, especially in urbanized regions, is anticipated to drive the cardiovascular market growth. Cardiovascular disease is the leading cause of death globally, with an estimated 19.8 million people died from CVDs in 2022, especially in low and middle-income countries. The increasing adoption of cardiovascular devices due to modernized healthcare infrastructure and favourable healthcare investment is supporting the market growth. Furthermore, technological innovations like AI-powered diagnostic tools and advanced stent technologies are propelling the cardiovascular market growth.

Restraining Factors

The cardiovascular market is restricted by a strict regulatory approval procedure for ensuring the safety and effectiveness of the cardiovascular medical device. Further, the complications associated with the use of implantable cardiovascular devices are challenging the market growth. The increased availability of substitute treatments and products is hampering the market demand.

Market Segmentation

The cardiovascular market share is classified into drug class, indication, route of administration, and distribution channel.

- The lipid modifiers segment dominated the market in 2024 and is projected to grow at the fastest CAGR during the forecast period.

Based on the drug class, the cardiovascular market is divided into lipid modifiers, antithrombotic agents, beta blocking agents, vasodilators, and other drug classes. Among these, the lipid modifiers segment dominated the market in 2024 and is projected to grow at the fastest CAGR during the forecast period. Lipid modifiers like statins, proprotein convertase subtilisin/kexin type 9 inhibitors, ezetimibe, and other drugs aid in improving lipid abnormalities, such as reducing LDL-C and triglycerides or increasing HDL-C. The increasing awareness about cardiovascular risk management and the adoption of novel lipid-lowering therapies are driving the market in the lipid modifiers segment.

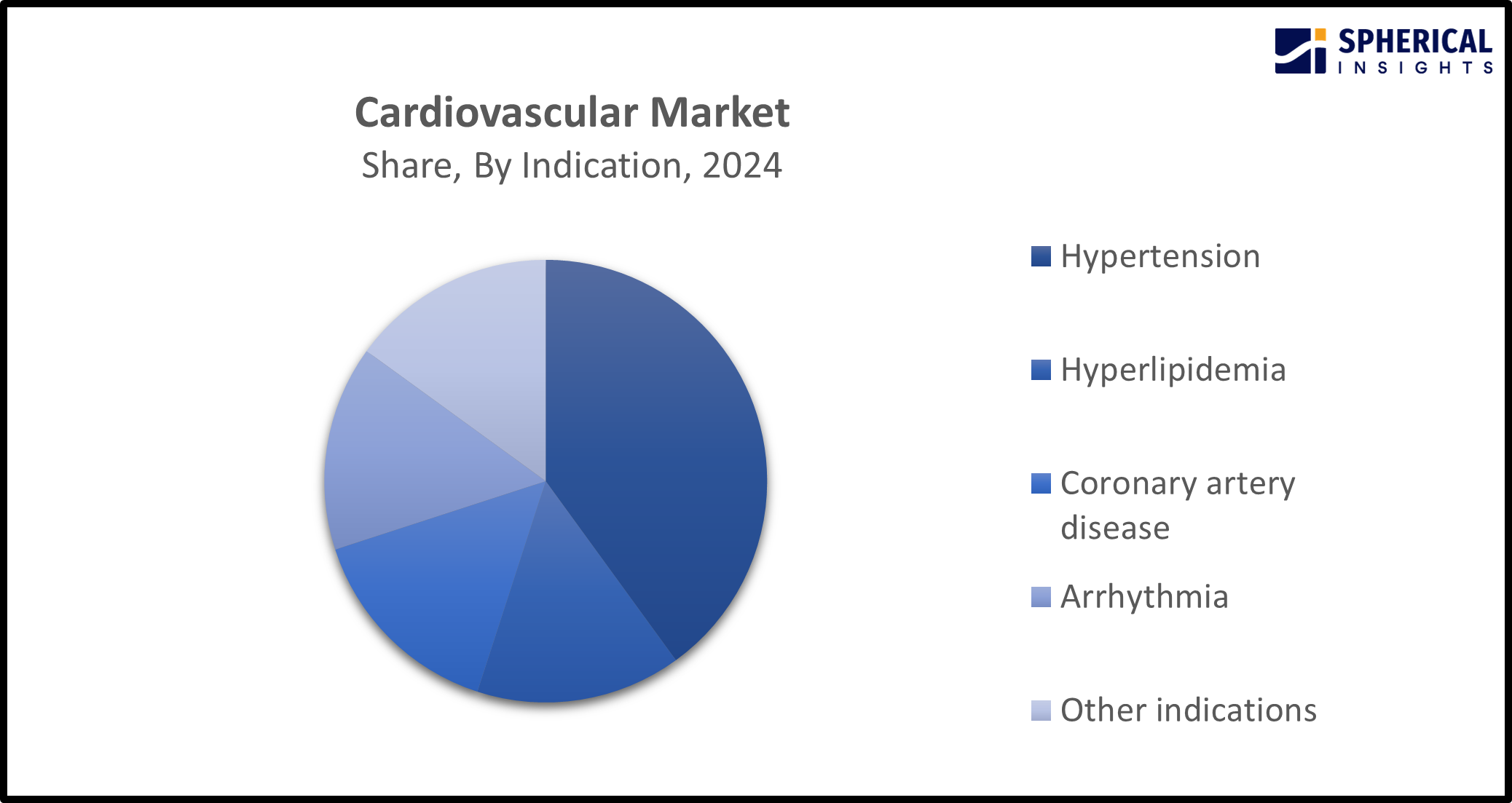

- The hypertension segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the indication, the cardiovascular market is divided into hypertension, hyperlipidemia, coronary artery disease, arrhythmia, and other indications. Among these, the hypertension segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Hypertension is a modifiable risk factor for the development of cardiovascular disease (CVD). The rising adoption of hypertension management solutions, including pharmacological treatments, lifestyle interventions, and diagnostic monitoring for preventing cardiovascular complications, is driving the market.

Get more details on this report -

- The oral segment dominated the cardiovascular market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the cardiovascular market is divided into oral, parenteral, and other routes of administration. Among these, the oral segment dominated the cardiovascular market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The oral route of administration is convenient and indicated for patients who can ingest and tolerate oral medications. For instance, digoxin in combination with diuretics and an ACE inhibitor is used for treating a heart rhythm problem called atrial fibrillation.

- The hospital pharmacies segment dominated the cardiovascular market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the cardiovascular market is divided into hospital pharmacies, online pharmacies, retail pharmacies, and other distribution channels. Among these, the hospital pharmacies segment dominated the cardiovascular market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pharmacists, in collaboration with physicians, manage cardiovascular risk factors and anticoagulation therapy based on patients' specific situations, improving the quality of therapy in the health care system. The ease of availability of rare and commonly used drugs in the hospital pharmacies is driving the market.

Regional Segment Analysis of the Cardiovascular Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cardiovascular market over the predicted timeframe.

North America is anticipated to hold the largest share of the cardiovascular market over the predicted timeframe. The market ecosystem in North America is strong, with both increasing research & development activities and a strong presence of medical device manufacturing. Further, the region's sophisticated technology infrastructure and disposable affluence are promoting market growth for cardiovascular.

Asia Pacific is expected to grow at a rapid CAGR in the cardiovascular market during the forecast period. The Asia Pacific area has a thriving market due to its rapid economic development, rising disposable incomes, and growing technological advancements. The demand for cardiovascular devices has been driven by government initiatives such as Ayushman Bharat and Make in India, thereby promoting market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cardiovascular market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen

- AstraZeneca

- Baxter

- Bayer

- Boehringer Ingelheim

- Bristol Myers Squibb

- Gilead Sciences

- Johnson & Johnson

- Lupin

- Merck

- Novartis

- Pfizer

- Sanofi

- Viatris

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, BDC Laboratories, a leader in cardiovascular device testing solutions, announced a strategic partnership with the newly established Dilawri Cardiovascular Institute (DCI).

- In June 2025, Bayer and the Broad Institute announced that they had extended their research collaboration of 10 years by an additional five years to further advance findings in human genomics research in cardiovascular diseases.

- In March 2025, NVIDIA announced a collaboration with GE HealthCare to advance innovation in autonomous imaging, focused on developing autonomous X-ray technologies and ultrasound applications.

- In February 2025, Novartis agreed to acquire Anthos Therapeutics, Inc., a Boston-based, privately held, clinical-stage biopharmaceutical company with abelacimab, a late-stage medicine in development for the prevention of stroke and systemic embolism in patients with atrial fibrillation.

- In November 2024, Ascendis Pharma A/S announced that it has granted Novo Nordisk A/S an exclusive worldwide license to the TransCon technology platform to develop, manufacture and commercialize Novo Nordisk proprietary products in metabolic diseases (including obesity and type 2 diabetes) and a product-by-product exclusive license in cardiovascular diseases.

- In November 2024, Medera Inc., a clinical-stage biotechnology company focused on targeting difficult-to-treat or incurable cardiovascular diseases using a range of next-generation gene- and cell-based approaches, and The Cardiovascular Disease National Collaborative Enterprise (CADENCE) of Singapore announced the initiation of Asia’s first cardiac gene therapy clinical trial for heart failure in Singapore.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cardiovascular market based on the below-mentioned segments:

Global Cardiovascular Market, By Drug Class

- Lipid Modifiers

- Antithrombotic Agents

- Beta Blocking Agents

- Vasodilators

- Other drug classes

Global Cardiovascular Market, By Indication

- Hypertension

- Hyperlipidemia

- Coronary artery disease

- Arrhythmia

- Other indications

Global Cardiovascular Market, By Route of Administration

- Oral

- Parenteral

- Other routes of administration

Global Cardiovascular Market, By Distribution Channel

- Hospital pharmacies

- Online pharmacies

- Retail pharmacies

- Other distribution channels

Global Cardiovascular Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cardiovascular market over the forecast period?The global cardiovascular market is projected to expand at a CAGR of 8.17% during the forecast period.

-

2. What is the market size of the cardiovascular market?The global cardiovascular market size is expected to grow from USD 52.5 Billion in 2024 to USD 124.5 Billion by 2035, at a CAGR of 8.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cardiovascular market?North America is anticipated to hold the largest share of the cardiovascular market over the predicted timeframe.

-

4. Who are the top companies operating in the Global Cardiovascular Market?Key players include Amgen, AstraZeneca, Baxter, Bayer, Boehringer Ingelheim, Bristol-Myers Squibb, Gilead Sciences, Johnson & Johnson, Lupin, Merck, Novartis, Pfizer, Sanofi, and Viatris.

-

5. Can you provide company profiles for the leading Cardiovascular manufacturers?Yes. For example, Amgen is a biotechnology company that focuses on discovering, developing, manufacturing, and delivering innovative medicines, with an increased focus on products in therapy areas including heart diseases. AstraZeneca is a global, science-led biopharmaceutical company, focused on the discovery, development and commercialization of innovative medicines and improving access to them.

-

6. What are the main drivers of growth in the cardiovascular market?The growing prevalence of cardiovascular conditions, technological advancements, and favourable government policies are major market growth drivers of the cardiovascular market.

-

7. What challenges are limiting the Cardiovascular market?Stringent regulatory requirements and availability of treatment substitutes remain key restraints in the cardiovascular market.

Need help to buy this report?