Global Cardiac Imaging Software Market Size, Share, and COVID-19 Impact Analysis, By Modality (Computed Tomography, Magnetic Resonance Imaging, Ultrasound Imaging, X-Ray Imaging, and Others), By End-User (Hospitals, Diagnostics Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Cardiac Imaging Software Market Size Insights Forecasts to 2035

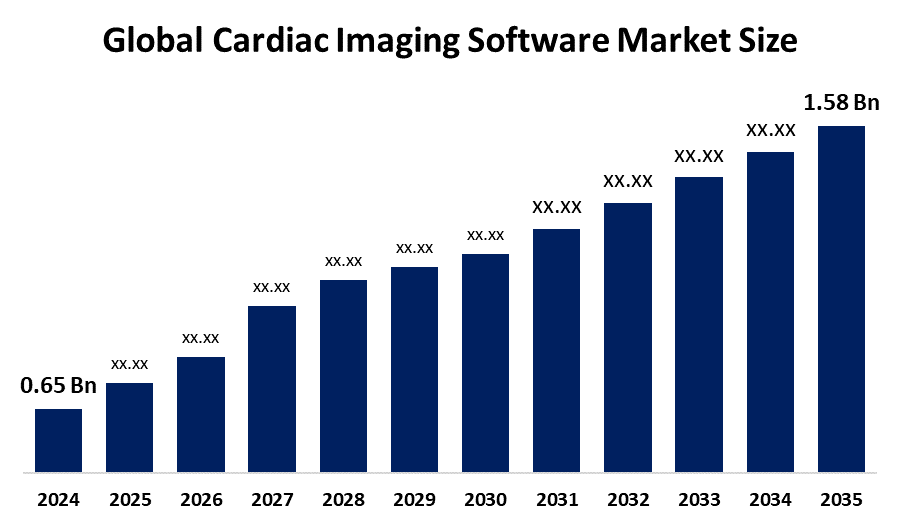

- The Global Cardiac Imaging Software Market Size Was Estimated at USD 0.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.41% from 2025 to 2035

- The Worldwide Cardiac Imaging Software Market Size is Expected to Reach USD 1.58 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Cardiac Imaging Software Market Size was worth around USD 0.65 Billion in 2024 and is predicted to Grow to around USD 1.58 Billion by 2035 with a compound annual growth rate (CAGR) of 8.41% from 2025 and 2035. The market for cardiac imaging software has a number of opportunities to grow due to the growing prevalence of cardiovascular disease, AI integration in diagnostics, and the shift to cloud-based and integrated systems.

Market Overview

The global cardiac imaging software market is focused on software solutions for analyzing heart and blood vessel images from sources such as CT, MRI, and ultrasound. Cardiac imaging software refers to the specialized digital tools designed for visualizing, analyzing, and interpreting images of the heart. The tool is essential for diagnosing cardiovascular conditions, planning treatments, and monitoring patient progress. Cardiac imaging software modalities, including MRI, CT, or ECG, enable clinicians to detect abnormalities like blockages, structural defects, or tissue damage with greater precision. Furthermore, the incorporation of AI, machine learning, and cloud computing leads to the improvement in accuracy, reducing analysis time and facilitating remote consultations, which ultimately makes cardiac care more efficient and effective.

Innovation and market expansion are anticipated to grow as a result of major players' expanding partnerships between major companies and diagnostic centres. The growing prevalence of cardiovascular diseases, along with an increasing need for early, accurate diagnosis, is driving a huge surge in the global cardiac imaging software market. For instance, in June 2023, Royal Philips has teamed up with BIOTRONIK to expand the range of cardiovascular devices available for Philips SymphonySuite customers.

Report Coverage

This research report categorizes the cardiac imaging software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cardiac imaging software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cardiac imaging software market.

Global Cardiac Imaging Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.65 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.41% |

| 2035 Value Projection: | USD 1.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Modality, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Koninklijke Philips N.V, Siemens Healthineers AG, GE HealthCare, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Holdings Corporation, NeoSoft LLC, Tempus AI Inc. (Arteys), Pie Medical Imaging B.V. (Esaote group), Medis Medical Imaging Systems B.V., Circle Cardiovascular Imaging Inc., SymphonyAI, Arterys, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The essential role of cardiac imaging software for cardiovascular disease management, including early diagnosis, monitoring, and treatment planning, is driving the market demand. Cardiovascular diseases are the leading cause of death worldwide, taking an estimated 19.8 million lives each year, representing approximately 32% of all global deaths. Technological advancements, including the development of improved algorithms, along with the integration of AI, ML, DL, and VR applications, are contributing to propel market growth.

Restraining Factors

The cardiac imaging software market is limited by factors such as compatibility and cost issues, data security concerns, and the need for skilled professionals. Furthermore, strict regulatory approval and uncertainty in reimbursement policies are hindering market growth.

Market Segmentation

The cardiac imaging software market share is classified into modality and end-user.

- The magnetic resonance imaging segment dominated the cardiac imaging market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the modality, the cardiac imaging software market is divided into computed tomography, magnetic resonance imaging, ultrasound imaging, X-ray imaging, and others. Among these, the magnetic resonance imaging segment dominated the cardiac imaging market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Cardiac magnetic resonance imaging is used for non-invasive assessment of the cardiovascular system in conditions like CHD, cardiomyopathies and valvular heart disease. Development of innovative solutions like real-time imaging and motion correction for boosting image quality and patient comfort is driving the market growth.

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the cardiac imaging software market is divided into hospitals, diagnostics centers, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cardiac imaging software is used in hospitals for diagnosis and managing cardiovascular diseases by converting raw material images from modalities such as MRI, CT, and ultrasound into visualized, quantified data. An increasing integration of advanced technologies, along with a trend towards strategic alliances, is promoting the market in the hospitals segment.

Regional Segment Analysis of the Cardiac Imaging Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cardiac imaging software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cardiac imaging software market over the predicted timeframe. The market ecosystem in North America is strong, due to the presence of cutting-edge startups like Eko Health and AliveCor that focus on digital health and AI technology company. The market is further driven by the region's increasing prevalence of cardiovascular diseases, healthcare infrastructure, and investment in healthcare IT for supporting digital health tools. Additionally, an increasing partnerships and collaborations for developing customized software technologies are contributing to promoting market growth.

Asia Pacific is expected to grow at a rapid CAGR in the cardiac imaging software market during the forecast period. The Asia Pacific area has a thriving market for cardiac imaging software due to its rapid industrialization, urbanization, and awareness about cardiovascular diseases. Ongoing advancements in cardiac imaging technologies like CT scans, MRI, and echocardiography are contributing to propel market growth. For instance, in September 2024, Amrita Hospital Kochi, introduced Kerala’s first AI-enabled imaging technology for advanced cardiac care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cardiac imaging software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Koninklijke Philips N.V

- Siemens Healthineers AG

- GE HealthCare

- CANON MEDICAL SYSTEMS CORPORATION

- FUJIFILM Holdings Corporation

- NeoSoft LLC

- Tempus AI Inc. (Arteys)

- Pie Medical Imaging B.V. (Esaote group)

- Medis Medical Imaging Systems B.V.

- Circle Cardiovascular Imaging Inc.

- SymphonyAI

- Arterys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, China’s National Medical Products Administration (NMPA) released an announcement on optimizing whole life cycle regulation to support innovative development of high-end medical devices.

- In March 2025, NVIDIA announced a collaboration with GE HealthCare to advance innovation in autonomous imaging, focused on developing autonomous X-ray technologies and ultrasound applications.

- In December 2024, Terumo Health Outcomes (THO) and Medis Medical Imaging announced a strategic partnership to enhance cardiovascular care through the utilization of both ePRISM, Terumo’s proprietary clinical decision support platform and Medis’ Quantitative Flow Ratio (QFR) technology, a non-invasive software solution designed to assess angiography-derived coronary physiology.

- In October 2024, HeartFocus, the revolutionary AI-enabled heart echo software by data-driven medtech company, DESKi, announced the launch of the HeartFocus Education app in partnership with Butterfly Network, Inc., a digital health company transforming care with portable, semiconductor-based ultrasound technology and intuitive software.

- In August 2024, Skanray, a leading global MedTech R&D and Manufacturing company specialising in diagnostic imaging, critical care and surgery/OT solutions, chose Tata Elxsi as a strategic partner for advanced surgical imaging core technology and software platform development.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cardiac imaging software market based on the below-mentioned segments:

Global Cardiac Imaging Software Market, By Modality

- Computed Tomography

- Magnetic Resonance Imaging

- Ultrasound Imaging

- X-Ray Imaging

- Others

Global Cardiac Imaging Software Market, By End-User

- Hospitals

- Diagnostics Centers

- Others

Global Cardiac Imaging Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cardiac imaging software market over the forecast period?The global cardiac imaging software market is projected to expand at a CAGR of 8.41% during the forecast period.

-

2. What is the market size of the cardiac imaging software market?The global cardiac imaging software market size is expected to grow from USD 0.65 Billion in 2024 to USD 1.58 Billion by 2035, at a CAGR of 8.41% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cardiac imaging software market?North America is anticipated to hold the largest share of the cardiac imaging software market over the predicted timeframe.

-

4. Who are the top companies operating in the Global Cardiac Imaging Software Market?Key players include Koninklijke Philips N.V, Siemens Healthineers AG, GE HealthCare, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Holdings Corporation, NeoSoft LLC, Tempus AI Inc. (Arteys), Pie Medical Imaging B.V. (Esaote group), Medis Medical Imaging Systems B.V., Circle Cardiovascular Imaging Inc., SymphonyAI, and Arterys.

-

5. Can you provide company profiles for the leading cardiac imaging software manufacturers?Yes. For example, Koninklijke Philips N.V. is a diversified technology company that develops and manufactures medical systems and consumer electronics products, in the areas of precision diagnosis, image-guided therapy, monitoring, enterprise informatics, sleep and respiratory care, and personal health. Siemens Healthineers AG (Siemens Healthineers), a subsidiary of Siemens AG, is a medical technology company that designs, develops, produces, and distributes diagnostic and therapeutic products, including imaging systems, in vitro diagnostics, and advanced therapies.

-

6. What are the main drivers of growth in the cardiac imaging software market?The growing prevalence of cardiovascular disease, AI integration in diagnostics, and the shift to cloud-based and integrated systems are major market growth drivers of the Cardiac Imaging Software market.

-

7. What challenges are limiting the cardiac imaging software market?Data security concerns and uncertainty in reimbursement policies, as well as compatibility & cost issues, remain key restraints in the cardiac imaging software market.

Need help to buy this report?