Global Cardboard Box & Container Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product & Service (Corrugated & Solid Fiber Boxes, Folding Paperboard Boxes, and Other), By Major Market (Food, Beverage, & Agricultural Producers, Retail & Whole Trade Sectors, Miscellaneous Manufacturers, paper & Other Product Producers, Chemical, Plastic & Rubber Product producers, and Exports), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Cardboard Box & Container Manufacturing Market Insights Forecasts to 2035

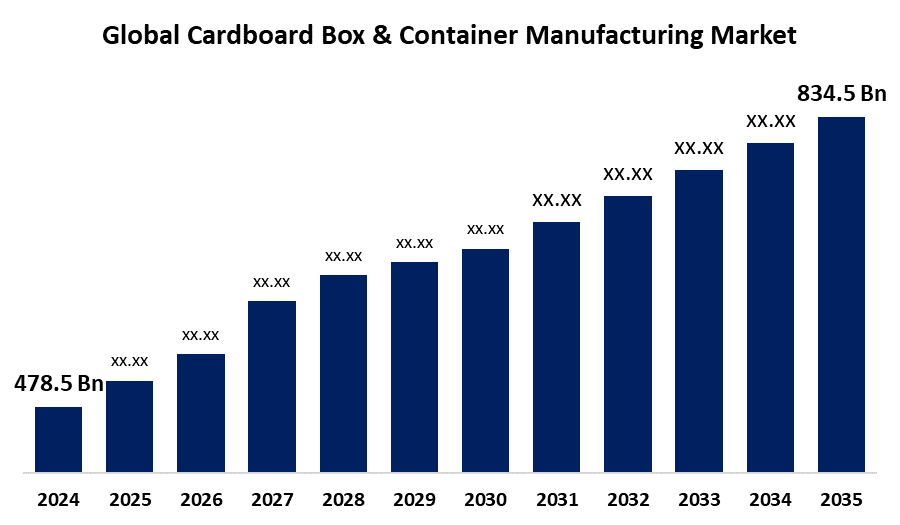

- The Global Cardboard Box & Container Manufacturing Market Size Was Estimated at USD 478.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.19% from 2025 to 2035

- The Worldwide Cardboard Box & Container Manufacturing Market Size is Expected to Reach USD 834.5 Billion by 2035

- Asia Pacific is Expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Global Cardboard Box & Container Manufacturing Market Size was worth around USD 478.5 Billion in 2024 and is predicted to grow to around USD 834.5 Billion by 2035 with a compound annual growth rate (CAGR) of 5.19% from 2025 to 2035. Biodegradability of cardboard boxes & containers and advancement in manufacturing process are driving the global cardboard box & container manufacturing market.

Market Overview

The cardboard box & container manufacturing market refers to the industry that converts paper, paperboard, and recycled corrugated containers into packaging solutions for various industries. Cardboard boxes and containers in the packaging industry are widely used across retail, shipping, and storage sectors. They are made from corrugated board, which is a material consisting of three layers that provide exceptional strength, making the box resistant to pressure, impact, and temperature fluctuations. Further, they are eco-friendly, lightweight & durable, and cost-effective in nature and are Compatible with printing, folding, laminating, and die cutting processes for branding and product differentiation. The manufacturing process of cardboard box & container continues to evolve with the advancements in automation and sustainable materials, and smart packaging technologies. E-commerce and global shipping are driving the need for strong, lightweight, and recyclable packaging solutions, thereby propelling the market demand. Increasing sales of cardboard boxes and containers are driven by the rise of digital platforms for reaching wider audiences. Consumers' increasing demand for packaged goods, especially in the food & beverage industry, manufacturers are providing substantial opportunities in the cardboard box & container manufacturing market.

Report Coverage

This research report categorizes the cardboard box & container manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cardboard box & container manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cardboard box & container manufacturing market.

Cardboard Box and Container Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 478.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.19% |

| 2035 Value Projection: | USD 834.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product & Service, By Major Market, By Region |

| Companies covered:: | Internet Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith, Rengo Co Ltd., Packaging Corporation of America, TGI Packaging Pvt. Ltd., Georgia Pacific LLC, Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing preference for eco-friendly corrugated boxes in the packaging industry due to increasing environmental consciousness and their biodegradability is driving the market demand. Advancements in the manufacturing process of corrugated packaging production, including the integration of automation and robotics, are propelling the market growth. Increasing e-commerce packaging with the adoption of smartphones and an increase in internet activities is positively impacting the market growth. Increasing industrialization and urbanization in emerging economies are driving the demand for container boards, thereby escalating the market.

Restraining Factors

Emergence of substitutes such as glass, metal, and plastic containers is limiting the cardboard box & container manufacturing market. Fluctuations in raw material prices and supply chain disruptions are also challenging the market growth.

Market Segmentation

The cardboard box & container manufacturing market share is classified into product & service and major market.

- The corrugated & solid fiber boxes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product & service, the cardboard box & container manufacturing market is divided into corrugated & solid fiber boxes, folding paperboard boxes, and other. Among these, the corrugated & solid fiber boxes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment includes solid fibreboard boxes, pads, partitions, display items, pallets, single face products, and corrugated sheets. The durability and ability of these boxes to withstand heavier loads for shipping goods are driving the market in the corrugated & solid fiber boxes segment.

- The food, beverage, & agricultural producers segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the major market, the cardboard box & container manufacturing market is divided into food, beverage, & agricultural producers, retail & whole trade sectors, miscellaneous manufacturers, paper & other product producers, chemical, plastic & rubber product producers, and exports. Among these, the food, beverage, & agricultural producers segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cardboard boxes and containers protect food and beverages and aid in extending their shelf life. Food safety, reliability, and efficiency, consumers' increasing demand for packaged goods, and increasing inclination towards eco-friendly packaging are contributing to driving the market demand.

Regional Segment Analysis of the Cardboard Box & Container Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the cardboard box & container manufacturing market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the cardboard box & container manufacturing market over the predicted timeframe. Government initiatives promoting smart manufacturing and industry 4.0 adoption, with the expanding manufacturing sector, are promoting the market of cardboard box & container manufacturing. The expanding e-commerce industry, driving demand for sturdy packaging that offers rigidity with cushioning quality, is promoting the market.

North America is expected to grow at a rapid CAGR in the cardboard box & container manufacturing market during the forecast period. Extensive use of cardboard box and container, along with the growing environmental consciousness, is driving the market. Further, e-commerce activities are contributing to promoting the cardboard box & container manufacturing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cardboard box & container manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Internet Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith

- Rengo Co Ltd.

- Packaging Corporation of America

- TGI Packaging Pvt. Ltd.

- Georgia Pacific LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Oji India Packaging Pvt. Ltd., a subsidiary of Oji Group, inaugurated its fifth facility in the country at Sri City in Andhra Pradesh. The factory would produce corrugated boxes and packaging accessories and employ approximately 300 people in the region. The expansion reinforces the company's commitment to meeting the growing demand for sustainable and high-quality corrugated packaging solutions in South India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cardboard box & container manufacturing market based on the below-mentioned segments:

Global Cardboard Box & Container Manufacturing Market, By Product & Service

- Corrugated & Solid Fiber Boxes

- Folding Paperboard Boxes

- Other

Global Cardboard Box & Container Manufacturing Market, By Major Market

- Food, Beverage, & Agricultural Producers

- Retail & Whole Trade Sectors

- Miscellaneous Manufacturers

- Paper & Other Product Producers

- Chemical, Plastic & Rubber Product producers

- Exports

Global Cardboard Box & Container Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Cardboard Box & Container Manufacturing market over the forecast period?The global Cardboard Box & Container Manufacturing market is projected to expand at a CAGR of 5.19% during the forecast period.

-

2. What is the market size of the Cardboard Box & Container Manufacturing market?The global Cardboard Box & Container Manufacturing market size is expected to grow from USD 478.5 Billion in 2024 to USD 834.5 Billion by 2035, at a CAGR of 5.19% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Cardboard Box & Container Manufacturing market?Asia Pacific is anticipated to hold the largest share of the Cardboard Box & Container Manufacturing market over the predicted timeframe.

-

4. What is the market size of the Global Cardboard Box & Container Manufacturing Market in 2025?The Global Cardboard Box & Container Manufacturing Market size was estimated USD 503.3 billion in 2025.

-

5. Who are the top 10 companies operating in the Global Cardboard Box & Container Manufacturing Market?Key players include Internet Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith, Rengo Co. Ltd., Packaging Corporation of America, TGI Packaging Pvt. Ltd., and Georgia Pacific LLC.

-

6. Can you provide company profiles for the leading Cardboard Box & Container Manufacturing companies?Yes. For example, Internet Paper Company is a provider of sustainable packaging solutions, and the company's major products include containerboard, corrugated packaging, and cellulose fibers. WestRock Company is the global leader in sustainable paper-based packaging, creating solutions from renewable, recyclable materials.

-

7. What are the main drivers of growth in the cardboard box & container manufacturing market?The increasing preference for eco-friendly corrugated boxes, e-commerce expansion, and urbanization & industrialization are major market growth drivers.

-

8. What challenges are limiting the cardboard box & container manufacturing market?Availability of alternative container material and raw material price fluctuation remain key restraints.

-

9. What are the latest trends in the cardboard box & container manufacturing market?Environmental sustainability, use of digital platforms for enhancing sales, and e-commerce expansion are key emerging trends.

-

10. What is the long-term outlook (2025–2035) for the cardboard box & container manufacturing market?The market is expected to remain in a growth phase, with increasing emphasis on environmental sustainability, especially in the food and beverage segments.

Need help to buy this report?