Global Carbonated Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flavored and Unflavored), By Packaging (Bottles, Cans and Others), By Distribution Channel (Supermarkets/hypermarkets, Convenience stores, Online retailers and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Carbonated Bottled Water Market Insights Forecasts to 2035

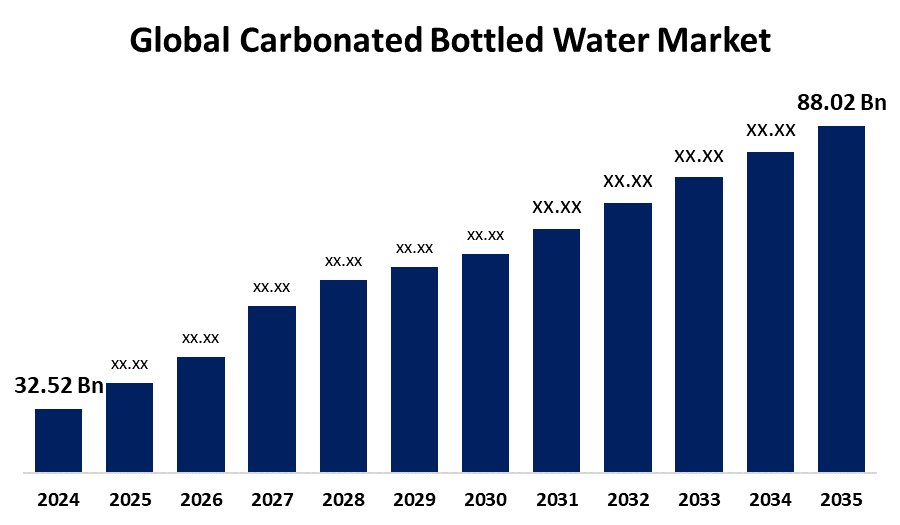

- The Global Carbonated Bottled Water Market Size Was Estimated at USD 32.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.47% from 2025 to 2035

- The Worldwide Carbonated Bottled Water Market Size is Expected to Reach USD 88.02 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Carbonated Bottled Water Market Size was worth around USD 32.52 Billion in 2024 and is predicted to Grow to around USD 88.02 Billion by 2035 with a compound annual growth rate (CAGR) of 9.47% from 2025 and 2035. Growing health consciousness, the desire for low-calorie and sugar-free beverages, urbanization, increased availability through retail and e-commerce, and successful branding that positions sparkling water as a hip and healthful substitute for sodas are the main factors propelling the market for carbonated bottled water.

Market Overview

The carbonated bottled water market refers to the industry focused on producing, distributing, and selling bottled water that has been carbonated with dissolved carbon dioxide, creating bubbles. Carbonated bottled water is a desirable option because it offers the effervescent feeling of soda without the extra sugar, calories, or chemical components. More people are choosing carbonated water as an alternative to sugary drinks as they become more conscious of the health hazards they pose, including diabetes and obesity. Furthermore, the market for carbonated bottled water is expanding due to the growing desire for sugar-free, low-calorie beverages and an increased emphasis on staying hydrated. Healthy beverages that offer refreshment without the extra sugars and calories of sodas are becoming more and more popular among consumers. Packaging innovations, including portable formats and environmentally friendly bottles, have increased the product's popularity. Another important aspect is the trend toward premiumization, which is driving market expansion as more consumers are prepared to spend more for flavored or high-quality carbonated water. Sustainable packaging has increased in response to environmental worries over single-use plastic bottles, following worldwide sustainability trends. These elements, in addition to a variety of marketing techniques and distribution methods, are setting up the market for carbonated bottled water for significant expansion in the upcoming years.

Report Coverage

This research report categorizes the carbonated bottled water market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the carbonated bottled water market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the carbonated bottled water market.

Global Carbonated Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 32.52 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.47% |

| 2035 Value Projection: | USD 88.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type (Flavored and Unflavored), By Packaging (Bottles, Cans and Others), By Distribution Channel (Supermarkets/hypermarkets, Convenience stores, Online retailers and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) |

| Companies covered:: | Nestle Waters, The Coca-Cola Company, Keurig Dr Pepper Inc, Gerolsteiner Brunnen GmbH & Co., Sanpellegrino S.p.A, Perrier, VOSS of Norway ASA, PepsiCo, Danone S.A., gerolsteiner brunnen gmbh & co. kg, LaCroix Beverages, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As consumers become more health-conscious, there's a shift from sugary beverages to healthier alternatives. The fizzy feeling of soft drinks without the added sugar, calories, or artificial additives is provided by carbonated bottled water. This makes it a well-liked option for people who want to consume less sugar, control their weight, and stay hydrated while still having a tasty, refreshing beverage. Furthermore, popular brands' powerful branding and successful marketing techniques have established carbonated bottled water as a stylish and health-conscious option. Sparkling water has drawn a lot of consumer attention due to influencer marketing, environmentally friendly packaging, and a lifestyle emphasis. The market for carbonated bottled water is expanding due to these marketing initiatives, which are also fostering strong brand loyalty.

Restraining Factors

Carbonated bottled water is frequently more expensive than ordinary bottled water because of the additional carbonation procedures and packaging needs. Customers may choose less expensive hydration options in markets when prices are tight. Profit margins and pricing strategies may also be impacted by rising production and shipping costs, particularly for glass or metal packaging. Additionally, flavored water, energy drinks, kombucha, non-carbonated bottled water, and functional beverages are fierce rivals to the market for carbonated bottled water. It is more difficult for plain or mildly flavored carbonated water to stand out in a competitive market since many consumers choose beverages with extra health advantages like vitamins, electrolytes, or probiotics.

Market Segmentation

The carbonated bottled water market share is classified into product type, packaging, and distribution channel.

- The unflavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the carbonated bottled water market is divided into flavored and unflavored. Among these, the unflavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to many consumers prefer unflavored carbonated water because of its natural flavor and ease of use. It provides the fizz of soda without the use of artificial chemicals, sweeteners, or additional sugars. Unflavored carbonated water is a mainstay of healthy living choices since it appeals to people who are trying to save calories while still enjoying a refreshing beverage.

- The bottles segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the packaging, the carbonated bottled water market is divided into bottles, cans, and others. Among these, the bottles segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by plastic bottles are portable and perfect for consumption while on the go. Travelers, exercise lovers, and people with hectic schedules would all benefit from this portability. Plastic is more convenient than heavier alternatives like glass, which increases its appeal and sales in the market for carbonated bottled water.

- The supermarkets/hypermarkets segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the distribution channel, the carbonated bottled water market is divided into supermarkets/hypermarkets, convenience stores, online retailers, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets providing a wide range of carbonated bottled water brands, tastes, and packaging options in one location, which is responsible for the increase. This wide range appeals to a range of consumer budgets and tastes. These retail formats are a major distribution route because they allow customers to compare products side by side, which encourages them to buy more.

Regional Segment Analysis of the Carbonated Bottled Water Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

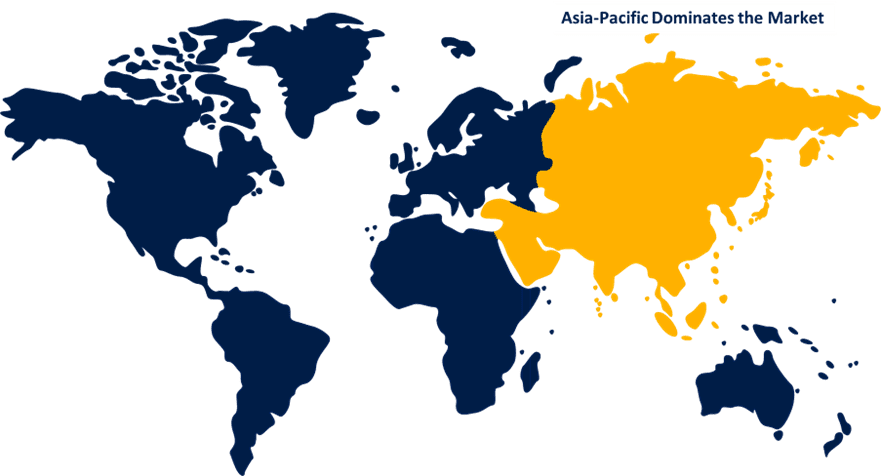

Asia Pacific is anticipated to hold the largest share of the carbonated bottled water market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the carbonated bottled water market over the predicted timeframe. The health advantages of carbonated bottled water over sugary soft drinks are becoming more widely recognized in the Asia-Pacific area. Carbonated water is in high demand as a natural, pleasant beverage option because consumers are moving toward healthier options that encourage hydration without extra calories or artificial additives. In response to the rising demand for sparkling bottled water, global brands such as Perrier, Schweppes, and San Pellegrino have expanded their market share in Asia-Pacific. By utilizing successful marketing techniques and forming alliances with regional distributors, these companies have increased the accessibility and appeal of carbonated bottled water in the area, thereby increasing their market share.

North America is expected to grow at a rapid CAGR in the carbonated bottled water market during the forecast period. As consumers in North America place a greater emphasis on their health, sugary drinks are being replaced with low-calorie, healthier options like carbonated bottled water. The demand for carbonated bottled water as a healthier hydration choice is being driven by rising awareness of the health hazards associated with sugary drinks, such as obesity and diabetes.

Europe is predicted to hold a significant share of the carbonated bottled water market throughout the estimated period. The industry for carbonated bottled water is well-established in Europe, with top brands including Vichy Catalan, Perrier, and San Pellegrino. Europe is a major player in the global carbonated water market due to these companies' strong retail presence and long history of customer devotion. Consistent demand is reinforced by their reputation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the carbonated bottled water market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle Waters

- The Coca-Cola Company

- Keurig Dr Pepper Inc

- Gerolsteiner Brunnen GmbH & Co.

- Sanpellegrino S.p.A

- Perrier

- VOSS of Norway ASA

- PepsiCo

- Danone S.A.

- gerolsteiner brunnen gmbh & co. kg

- LaCroix Beverages

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, in collaboration with Waterloo Sparkling Water, celebrity chef Guy Fieri unveiled the 'Flavortown' collection, which includes three new flavors: Spiced Mango Sorbet, Lemon Italian Ice, and Huckleberry Cobbler. Made with pure, non-GMO ingredients, these sugar-free, calorie-free sparkling waters are sold in major stores around the country.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the carbonated bottled water market based on the below-mentioned segments:

Global Carbonated Bottled Water Market, By Product Type

- Flavored

- Unflavored

Global Carbonated Bottled Water Market, By Packaging

- Bottles

- Cans

- Others

Global Carbonated Bottled Water Market, By Distribution Channel

- Supermarkets/hypermarkets

- Convenience stores

- Online retailers

- Others

Global Carbonated Bottled Water Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the carbonated bottled water market over the forecast period?The global carbonated bottled water market is projected to expand at a CAGR of 9.47% during the forecast period.

-

2. What is the market size of the carbonated bottled water market?The global carbonated bottled water market size is expected to grow from USD 32.52 Billion in 2024 to USD 88.02 Billion by 2035, at a CAGR of 9.47% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the carbonated bottled water market?Asia Pacific is anticipated to hold the largest share of the carbonated bottled water market over the predicted timeframe.

Need help to buy this report?