Global Carbon Credit Trading Platform Market Size, Share, and COVID-19 Impact Analysis, By Type (Voluntary, Regulated, Others), By System Type (Cap-and-Trade, Baseline and Credit, Others), By End-user (Industrial, Utilities, Energy, Petrochemical, Aviation, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Carbon Credit Trading Platform Market Insights Forecasts to 2033

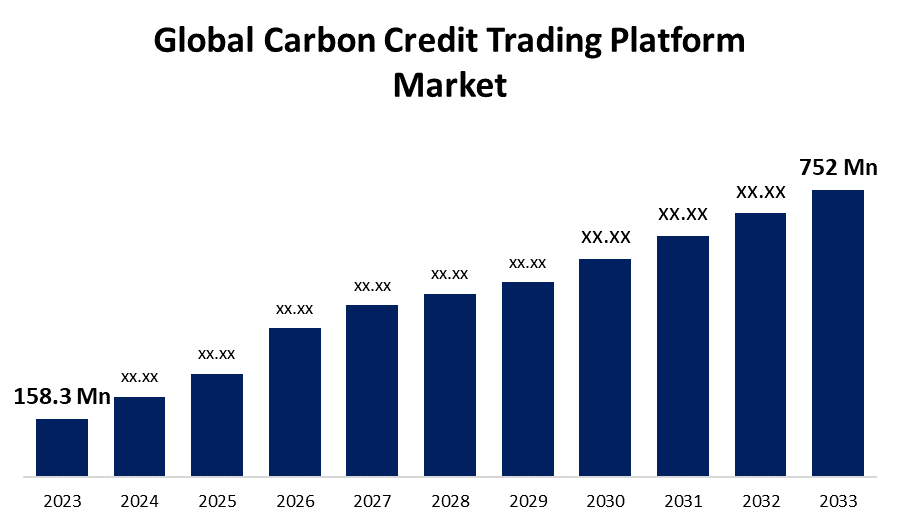

- The Global Carbon Credit Trading Platform Market Size was Valued at USD 158.3 Million in 2023.

- The Market Size is Growing at a CAGR of 16.8% from 2023 to 2033.

- The Worldwide Carbon Credit Trading Platform Market Size is Expected to Reach USD 752 Million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Carbon Credit Trading Platform Market Size is Anticipated to Exceed USD 752 Million by 2033, Growing at a CAGR of 16.8% from 2023 to 2033.

Market Overview

Carbon trading, sometimes referred to as carbon emissions trading, is the use of an exchange to purchase and sell credits that allow companies or other parties to emit a certain amount of carbon dioxide. The global carbon credit trading platform market enables businesses and organizations to reduce their greenhouse gas emissions by facilitating the buying and selling of carbon credits. Its main goals are to combat climate change and reduce greenhouse gas emissions. Furthermore, by allowing the exchange of carbon credits, these platforms encourage funding for international sustainability initiatives and emission reduction projects. In addition, the global carbon credit trading platform market is primarily propelled by the increasing consciousness regarding climate trade and its potential effects on the environment and human welfare. Moreover, a significant contributing element to the growth of the global carbon credit trading platform market is technological improvements. The advent of blockchain technology has brought about a significant transformation in the tracking and selling of carbon credits. Carbon credits must be transparent, safe, and traceable to gain confidence in the global carbon credit trading platform market. Blockchain technology makes sure of all three of these requirements. Furthermore, the range and accessibility of carbon offset projects affect the supply of carbon credits available in the global carbon credit trading platform market. Investments in afforestation, reforestation, renewable energy, and other carbon reduction projects contribute to the growth of the global carbon credit trading platform market by increasing the quantity of credits available.

Report Coverage

This research report categorizes the market for the global carbon credit trading platform market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global carbon credit trading platform market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global carbon credit trading platform market.

Global Carbon Credit Trading Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 158.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.8% |

| 2033 Value Projection: | USD 752 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By System Type, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Climate Impact X, Carbonplace, EEX Group, ClimateTrade, Veridium, AirCarbon Exchange, Nasdaq Inc., Carbon Trade Exchange, IHS Markit, CME Group, Likvidi, BetaCarbon, ShiftCabon and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the global carbon credit trading platform is being driven by government policies and strict environmental restrictions aimed at lowering carbon emissions. Governments throughout the world are putting cap and trade and carbon pricing schemes into place to encourage businesses to lower their emissions. The global community is striving to meet the net zero objectives. Economic transformation is a whole because of climate change. A variety of cutting-edge instruments, such as carbon credits, are needed to navigate the ensuing opportunities and threats. One of the main drivers of the global carbon trading platform market is the anticipated rise in demand for carbon credits in the future years. A large number of businesses are reducing their carbon footprint by committing to sustainability targets. Trading platforms for carbon credits give businesses the chance to buy carbon credits produced by environmentally friendly initiatives to offset their emissions.

Restraining Factors

Throughout the projection period, the rising cost of carbon credits can serve as a market restraint. There is price fluctuation, which causes prices to rise and demand to drive up transaction volumes. Carbon offset project certification and verification procedures can be difficult and expensive. Protracted verification processes and administrative obstacles could deter project developers from engaging in the global carbon credit trading platform markets, so restricting the availability of credits and impeding the expansion of the global carbon credit trading platform market.

Market Segmentation

The Global Carbon Credit Trading Platform Market share is classified into type, system type, and end-user.

- The voluntary segment is expected to hold the largest share of the global carbon credit trading platform market during the forecast period.

Based on the type, the global carbon credit trading platform market is divided into voluntary, regulated, and others. Among these, the voluntary segment is expected to hold the largest share of the global carbon credit trading platform market during the forecast period. This is a result of the voluntary segment's growing importance in limiting global warming. As corporate leaders make ever-more-ambitious commitments to decrease global greenhouse gas (GHG) emissions, a voluntary segment that could assist firms in reducing their emissions is growing.

- The cap-and-trade segment is expected to grow at the fastest pace in the global carbon credit trading platform market during the forecast period.

Based on the system type, the global carbon credit trading platform market is divided into cap-and-trade, baseline and credit, others. Among these, the cap-and-trade segment is expected to grow at the fastest pace in the global carbon credit trading platform market during the forecast period. This is because the market sets the carbon price through the cap-and-trade system, and market innovation and investment decisions are influenced by that price. As a result, it increases demand for the platform used to trade carbon credits. Emissions are given an exchange value under the cap-and-trade system. Businesses that possess emissions credits can profitably sell them, opening up new revenue streams for many industries.

- The utilities segment is expected to hold the greatest share of the global carbon credit trading platform market during the forecast period.

Based on the end-user, the global carbon credit trading platform market is divided into industrial, utilities, energy, petrochemical, aviation, and others. Among these, the utilities segment is expected to hold the greatest share of the global carbon credit trading platform market during the forecast period. The reason behind the growth is the dedication of the utilities segment to decarbonization initiatives in the fight against climate change is driving up demand for carbon credit trading schemes. Utility businesses are significant greenhouse gas emitters; thus, they must lower their carbon footprints and slow down climate change. Utility firms can offset their emissions by buying carbon credits from other businesses that have reduced their emissions through the use of carbon credit trading platforms.

Regional Segment Analysis of the Global Carbon Credit Trading Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global carbon credit trading platform market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global carbon credit trading platform market over the predicted timeframe. North America is the market leader for Carbon Credit Trading Platforms, and the US and Canada have played major roles in establishing this dominance. Interest in carbon credit trading platforms has surged in the US due to the Biden administration's pledge to rejoin the Paris Agreement and the country's growing emphasis on sustainability. To meet carbon neutrality targets, the U.S. has seen an increase in corporate activities and legislative actions, which has increased demand for carbon credits. Similar factors that support the market's dominance in Canada include a strong framework for carbon pricing and the federal government's goal of reaching net-zero emissions by 2050. Both nations have a high emphasis on environmental responsibility, which has fueled the acceptance of carbon credit trading platforms as vital instruments in North America's shift to a low-carbon and more sustainable future.

Asia Pacific is expected to grow at the fastest pace in the global carbon credit trading platform market during the forecast period. The reason behind this is in the Asia Pacific region, the Republic of Korea has the most advanced national emission trading system (ETS). China is looking for an emission trading system (ETS) that can enhance operations, is flexible, compatible with its environment, and has no significant flaws. This aims to improve the coherence and harmonization of national carbon trading systems across Asia, foster regional and global interconnection, and pinpoint workable solutions for their effective design and implementation. As a result, the global carbon credit trading platform market in this area will continue to increase as demand for carbon credits to reduce carbon emissions rises significantly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global carbon credit trading platform along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Climate Impact X

- Carbonplace

- EEX Group

- ClimateTrade

- Veridium

- AirCarbon Exchange

- Nasdaq Inc.

- Carbon Trade Exchange

- IHS Markit

- CME Group

- Likvidi

- BetaCarbon

- ShiftCabon

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, During the formal opening of the Nairobi International Financial Center (NIFC), Aircarbon Exchange (ACX) inked a cooperation agreement with the NSE and the Nairobi International Financial Center (NIFC) to establish a Kenya carbon exchange. Through the cooperation, a carbon ecosystem linked to ACX's global client order book will be established in Kenya, facilitating efficient and transparent transactions between domestic and foreign buyers and sellers.

- In March 2022, A memorandum of understanding (MOU) was inked by CarbonX, a producer of carbon assets, and ACX, a carbon exchange, to collaboratively create a carbon marketplace in Indonesia. Through the cooperation, domestic carbon market developers in Indonesia will have access to ACX's global customer order book. Additionally, the carbon marketplace will enable a swift expansion of the expanding carbon market in Indonesia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Carbon Credit Trading Platform Market based on the below-mentioned segments:

Global Carbon Credit Trading Platform Market, By Type

- Voluntary

- Regulated

- Others

Global Carbon Credit Trading Platform Market, By System Type

- Cap-and-Trade

- Baseline and Credit

- Others

Global Carbon Credit Trading Platform Market, By End-user

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

Global Carbon Credit Trading Platform Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Climate Impact X, Carbonplace, EEX Group, ClimateTrade, Veridium, AirCarbon Exchange, Nasdaq Inc., Carbon Trade Exchange, IHS Markit, CME Group, Likvidi, BetaCarbon, ShiftCabon, and Others.

-

2. What is the size of the global carbon credit trading platform market?The Global Carbon Credit Trading Platform Market is expected to grow from USD 158.3 Million in 2023 to USD 752 Million by 2033, at a CAGR of 16.8% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global carbon credit trading platform market over the predicted timeframe.

Need help to buy this report?