Global Caramel Market Size, Share, and COVID-19 Impact Analysis, By Function (Fillings, Toppings, Inclusions, Colors, Flavors and Others), By Application (Bakery and Confectionery Products, Ice Cream and Desserts, Sauces and Condiments and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Caramel Market Insights Forecasts to 2035

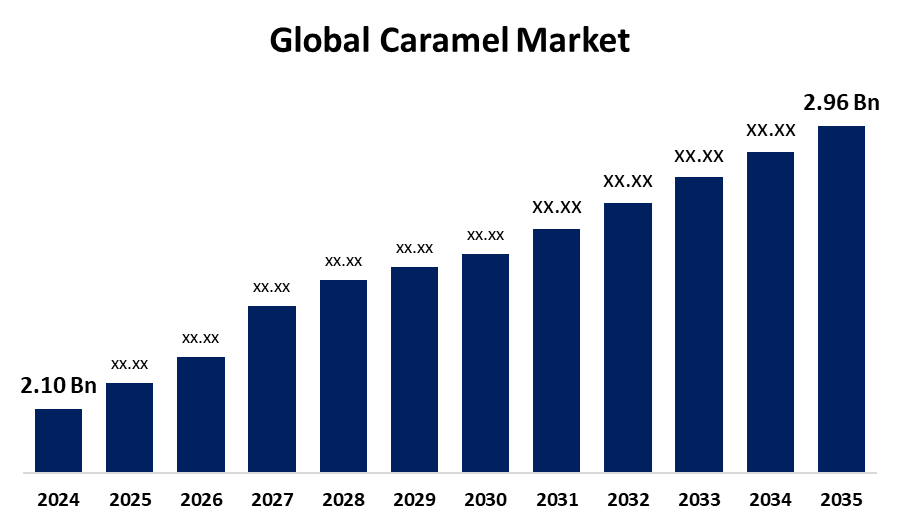

- The Global Caramel Market Size Was Estimated at USD 2.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.17% from 2025 to 2035

- The Worldwide Caramel Market Size is Expected to Reach USD 2.96 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Caramel Market Size was Worth around USD 2.10 Billion in 2024 and is predicted to Grow to around USD 2.96 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 3.17% from 2025 and 2035. Increasing demand for indulgent snacking, rise in processed foods, demand for natural clean-label ingredients, and ongoing flavor innovation such as salted caramel propel the caramel market's growth worldwide by increasing taste, appearance, and consumer acceptance in a variety of food and beverages.

Market Overview

The caramel industry is the worldwide business sector involved in the production, distribution, and sale of caramel and caramel products. Its primary purpose is to improve the sensory attractiveness of foodstuffs such as bakery products, confections, dairy foods, sauces, and drinks. Caramel gives a deep, sweet taste and a desirable brown color that enhances consumer acceptability and product differentiation. The advantages of caramel go beyond flavor and visual appeal; it provides functional benefits like performing as a natural colorant and contributing texture benefits without the addition of artificial ingredients, which meets the emerging trend of clean-label and natural ingredients. Additionally, continuous innovations like salted caramel flavorings, caramel combinations with nuts or chocolate, and reduced-calorie caramel syrups are appealing to new segments of customers and expanding uses. These developments not only add flavor and diversity but also address health-oriented consumers who desire lower-sugar or organic varieties. In general, the caramel industry continues to grow by meeting changing consumer tastes and food technology innovations, positioning it as an essential part of current food production.

Report Coverage

This research report categorizes the caramel market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the caramel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the caramel market.

Global Caramel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.17% |

| 2035 Value Projection: | USD 2.96 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Function, By Application, By Region |

| Companies covered:: | Barry Callebaut Inc., Cargill Inc., Kerry Group PLC, Sensient Technologies Corporation, Puratos Group, Mars Inc., Dallas Caramel Company, Sethness Roquette, The Caramel Candy Company, Cicero Caramel Company, Colorado Caramel Company, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers increasingly prefer indulgent foods and convenient-to-eat products like caramel-filled sweets and desserts. The trend stimulates the use of caramel in bakery and confectionery products. Caramel's intense flavor and smooth texture increase consumer demand, exhibiting robust growth and reinforcing the market globally. In addition, an increase in globally processed foods and drinks stimulates demand for caramel as a flavor and color ingredient. It is used widely in soft drinks, sauces, bakery, and dairy. Its versatility and potential to enhance both flavor and appearance mean that it is increasingly being utilized in various food industries.

Restraining Factors

Heightened realization of the harmful health impacts of excessive sugar intake, including obesity and diabetes, is deterring certain consumers from purchasing products containing caramel. This shift toward low-sugar and sugar-free diets restricts caramel use in some food categories, inhibiting total market expansion. More stringent regulations on food colorants and additives, particularly on caramel color classes with possible contaminants such as 4-MEI, can limit the application of particular caramel forms. Compliance costs and reformulation difficulties may retard market growth and restrict product availability.

Market Segmentation

The caramel market share is classified into function and application.

- The colors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the function, the caramel market is divided into fillings, toppings, inclusions, colors, flavors, and others. Among these, the colors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to caramel color is among the most commonly applied natural colorants in food and beverages. Caramel color contributes an appealing brown hue to foods such as soft drinks, sauces, bakery products, and processed foods, enhancing appearance without affecting taste, and thereby sustaining its high demand in various applications.

- The bakery and confectionery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the caramel market is divided into bakery and confectionery products, ice cream and desserts, sauces and condiments, and others. Among these, the bakery and confectionery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to caramel being a very common ingredient in confectionery and baked products because of its sweet, rich, and buttery taste. It adds taste to cakes, cookies, pastries, and chocolates. It is versatile enough to be applied as a filling, a topping, or a flavoring, hence a staple ingredient in a very wide variety of sweet foods.

Regional Segment Analysis of the Caramel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the caramel market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the caramel market over the predicted timeframe. North America boasts a highly established food processing and manufacturing base. This facilitates the intensive production of various caramel products, ranging from caramel syrups to toppings and fillings. The established industry network facilitates rapid uptake of emerging technologies and product innovations, underpinning consistent caramel demand in food service and retail channels. Major food and beverage brands like Hershey, Mars, Mondelez, and Nestlé USA have operations in the region. These companies constantly innovate and introduce caramel-based products, establishing high market awareness and availability. Their strong distribution networks also provide universal access to caramel products in supermarkets, convenience stores, and food service establishments.

Asia Pacific is expected to grow at a rapid CAGR in the caramel market during the forecast period. Urban life and international media trends are transforming consumption habits in the Asia Pacific. Young consumers increasingly adopt Western-style diets, with preferences for caramel-flavored coffee, pastry, and snacks. International brands expanding into these markets expose consumers to caramel-dense options, raising familiarity and demand. This taste preference transformation drives regional demand for caramel across a variety of food categories.

Europe is predicted to hold a significant share of the caramel market throughout the estimated period. Europe boasts a rich pastry, dessert, and confectionery tradition in which caramel is an indispensable ingredient. France, Belgium, and Germany are renowned for making great caramel-based foods like éclairs, tarts, and toffees. Such deep-rooted tradition guarantees constant demand for caramel in the artisanal and commercial food industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the caramel market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Barry Callebaut Inc.

Cargill Inc.

Kerry Group PLC

Sensient Technologies Corporation

Puratos Group, Mars Inc.

Dallas Caramel Company

Sethness Roquette

The Caramel Candy Company

Cicero Caramel Company

Colorado Caramel Company

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Mars added a new Snickerdoodle flavor to its Twix family in May 2025. The new version has a cinnamon-sugar caramel swirl, providing a nostalgic take on the original Twix mix of milk chocolate, caramel, and biscuit.

- In May 2025, Starbucks introduced the Salted Caramel Mocha Frappuccino as part of its summer menu, available in July. The new item has the deep flavors of mocha and salted caramel topped with cold foam.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the caramel market based on the below-mentioned segments:

Global Caramel Market, By Function

- Fillings

- Toppings

- Inclusions

- Colors

- Flavors

- Others

Global Caramel Market, By Application

- Bakery and Confectionery Products

- Ice Cream and Desserts

- Sauces and Condiments

- Others

Global Caramel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the caramel market over the forecast period?The global caramel market is projected to expand at a CAGR of 3.17% during the forecast period.

-

2. What is the market size of the caramel market?The global caramel market size is expected to grow from USD 2.10 Billion in 2024 to USD 2.96 Billion by 2035, at a CAGR of 3.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the caramel market?North America is anticipated to hold the largest share of the caramel market over the predicted timeframe.

Need help to buy this report?